Enovix: Higher Density 3D Silicon Batteries Stand To Power Technologies Of Tomorrow (ENVX)

Lan Zhang/E+ via Getty Images

Enovix (NASDAQ:ENVX) wants its safer and higher-density batteries to power the next generation of consumer technology with everything from smartphones, to laptops, and wearables in play. The Californian company also thinks its 3D silicon batteries will eventually make their way into electric vehicles and is aiming to do this by 2025. BrakeFlow, a safer iteration of the technology behind this push, increases the tolerance of its lithium-ion battery cells to abuse. This has created a new layer of safety that stands to materially reduce the propensity of batteries to thermal expansion and combustion when internally shorted.

Enovix has built and now stands to scale and ride demand for its 100% active silicon anode batteries to help facilitate technologies of the future from artificial intelligence and 5G to augmented reality. These will all require greater battery density to realize their full potential. The company is in the very early stages of this commercialization journey with inaugural revenue being realized recently at its last earnings quarter. This was a key milestone for a company that has been working since its founding in 2007 to make a modern and more advanced battery. Critically, the bull case centres on two factors.

Higher Density Batteries With Enhanced Safety And Cycle Life

The first is that Enovix’s enhanced 3D battery architecture will win out in the interim versus new battery materials in the race to power the next generation of technology. Solid-state batteries are the rage with a number of companies like QuantumScape (QS) and Solid Power (SLDP) on track to release their solid-state batteries for the EV market by the middle of this decade. Enovix is essentially generating revenue now and does not come with the inherently speculative risk of its peers. This has attached a certainty to its shares which means they trade far above their $10 SPAC reference price in contrast to QuantumScape and Solid Power.

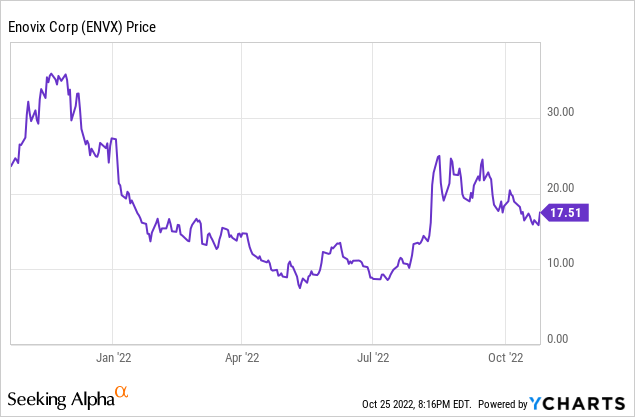

The common shares rallied hard from July lows on the back of fiscal 2022 second quarter results that showed the company’s go to market strategy and broader production and commercial delivery roadmap was on track with the first deliveries from its Fab-1 facility in Fremont, California made to multiple customers and distributors.

The second factor is that whilst there are dozens of startups chasing new chemistries for enhanced battery profiles, lithium-ion battery cells are still largely unchanged from the turn of the new millennium. That’s because there really isn’t a better material. Lithium is the lightest metal and has the best electrochemical potential with the largest energy density compared to weight. Hence, whilst the material does face competition from other materials in other use cases like utility-scale battery storage, small and high power demand applications will require the greatest energy density. Enovix builds on this with an enhanced architecture that encases its batteries in stainless steel and manufactures them with a stacking process. Flow batteries, flywheels, and sodium-ion batteries can’t be attached to a laptop. Enovix bills itself as an evolution of the dominant lithium-ion battery chemistry.

Batteries will become strategically important components for OEMs. The company stated during its earnings call that momentum from Fab-1 is already making waves and has helped the company garner strong interest. To be clear here, management stated during their last earnings call that they completed discussions with three mega-cap technology companies, firms with a market cap above $200 billion. Two of these companies stated that Enovix has the most advanced battery they’ve tested. The third stated that they will aim to quickly roll out the 3D silicon battery across their product portfolio. Management should be able to provide more clarity on these customers in future quarters as they set themselves up to radically ramp up the production and deliveries of their batteries.

Powering Technologies Of Tomorrow

Enovix looks to have achieved something spectacular with its new battery architecture and now faces a substantial growth opportunity ahead. Comments from potential customers are encouraging and no doubt help to justify the strong level of bullish enthusiasm on the shares. Indeed, the company’s partner on the U.S. Army program to build wearable battery cells for soldiers stated that Enovix was the only next-gen high energy density battery to pass its nail penetration test.

Batteries are the fundamental building blocks of modernity powering devices that enable trillions of dollars in GDP and Enovix now stands to more fully contribute to this economic engine. There is a risk that shares pull back on further stock market malaise from economic weakness, but the long-term bull case is strong. Enovix will start generating money years before more solid-state batteries are expected to reach the market and there are no clear competitors to its 3D silicon batteries. I might very well take a position if the shares were to retrace further.