BYD: The Difficult Road To Internationalization (OTCMKTS:BYDDF)

DarthArt/iStock Editorial via Getty Images

In my last article in July, I demonstrated the reasons why BYD (OTCPK:BYDDF) was not a good investment, despite being against most of the market views (I am glad to be the only Seeking Alpha author who is bearish on BYD at the moment). While I deem my previous argument thorough, I would like to go deeper on some of the points I raised previously. Such an exploration is meaningful considering that BYD now is trying to sell a story of its internationalization to investors. In this article, I will elaborate why BYD is unlikely to become internationally successful as well as why its poor margin is unlikely to make a turnaround. So please consider the current piece an elaboration or support for my July article.

How will BYD become a success in the Chinese market?

Before we dive into the discussion of the odds of BYD’s internationalization, it is necessary to review how BYD will become successful in the domestic market. To make the case, I will base my analysis on several of its key models.

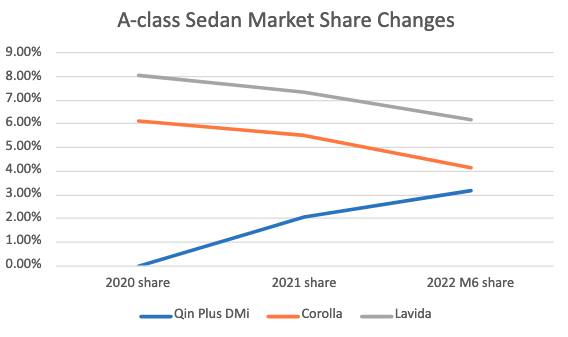

Qin Plus DMi

As one of the largest segments in terms of volume, the compact sedan market in China was long dominated by Sylphy, Corolla and Bora. However, things began to change when the Chinese government initiated a new round of EV subsidy in 2020. Launched in 2021 and equipped with DMi—the latest hybrid technology of BYD, Qin Plus DMi is believed to beat the above-mentioned rivals on account of its better fuel economy. More importantly, as a PHEV model, it receives subsidies including exemption of vehicle purchase tax (10% of car price before tax) and free car plate (worth from CNY 10k to CNY 100k in 6 major cities). Compared with Corolla, Qin Plus DMi has an aggressive pricing – starting from CNY 111k, cheaper than the Corolla entry trim by CNY 17k. Simply put, the effect price of Qin Plus DMi could be 20% lower than Corolla. Such a price advantage is deemed decisive, in my view, as customers in this segment are highly price sensitive. As a result, Qin Plus DMi has been eating into the market share of Corolla and Bora fast.

Qin Plus DMi is eating shares of Corrola and Lavida (Image created by author with data from carsalesbase)

Song Plus DMi

As another backbone of BYD, Song Plus DMi generally presents the same story as Qin Plus DMi, except that it is in the compact SUV segment. Competing with Song Plus DMi, rivals are either ICE models which naturally are not competitive in terms of subsidy or fuel economy or PHEV models but are about 70% more expensive (CR-V hybrid for example). Literally, Song Plus D has no major rivals.

Yuan Plus

This is an interesting model as it is a BEV, considering BYD generally has less edge in BEV area. Positioned a bit downmarket than Song Plus DMi, Yuan Plus has a strong value proposition, which makes ICE rivals (mainly Kia Sportage, Mazda CX-4 and Honda CR-V) suffer. A major threat could be the Aion Y, which is a BEV model with similar price but is not equally competitive due to a weaker brand and horsepower.

Dolphin

This model is unique in BYD’s lineup as it is the only one model to crack the small car segment. While Dolphin is priced slightly higher than its main ICE rivals (Yaris, Fit and Polo), it has been eroding their market share because it is cheaper to own (as a BEV).

Han EV/Tang DMi

An executive BEV sedan of BYD to take on Accord and Passat, Han EV is doing a good job due to its bigger size, EV subsidies, and the growing acceptance for local brands. I want to emphasize the last reason here: as clients in this segment are generally wealthier, they tend to give more weightage to brands in their purchase decision-making. To them, BYD is now a badge that is worth paying CNY 200k or more. Interestingly, Han EV also outsold Han DMi, which means many clients buy Han EV as a secondary car in the family for short-distance trips (usually the first ICE car is for long-distance trip).

For Tang DMi, the analysis for Han EV is mostly applicable, except that Tang DMi outsold its sister model Tang EV.

In summary, all the products analysis above reveals that BYD has been successful in the domestic market because of aggressive pricing (undercutting rivals badly), subsidies (bring down effective price significantly), the brand being cheaper to own (better fuel economy), and the growing acceptance of local brands (for Han and Tang series). Unlike customers of Han and Tang, the target customers of Qin, Song and Yuan are deemed highly price-sensitive, whose decision making is driven by value instead of brand.

The road to internationalization

Is BYD able to build a world empire as many bulls believe? The likelihood exists but is significantly limited. I will examine the point market by market.

Australia

Dominated by Japanese and Korean brands, Australia is a market with low EV adoption. BYD is likely to gain some share for its SUV models, albeit to a limited extent, due to the weakness in its brand name and the poor Aussie-Sino relationship.

Southeast Asia

Another market dominated by Japanese brands. SEA market has low EV adoption due to lack of charging infrastructure and relatively weak policy incentives. Downmarket models such as Song Plus DMi, Qin Plus DMi and Yuan Plus should have their roles here.

America

The Inflation Reduction Act extends the $7,500 tax credit for new EV purchases but only models whose key components are manufactured locally or in countries that have an FTA with the United States are eligible. This requirement simply rules out the possibility of BYD entering the US market.

Europe

As the second largest EV market, Europe is vital for BYD’s international expansion. However, tapping into this market is deemed challenging given the strong presence of local OEMs from Germany, France, Italy, and Sweden. In addition, customers in the region have strong preference for European brands, so the home market effect tailwind BYD enjoys in China will become headwind in the European market. In this regard, while Volkswagen’s position in China is under threat from the heavy competition posed by BYD, the company is considered much more secure in Europe. In my view, the direct competitors for BYD are not tier 1 OEMs but Korean brands who are equally well-prepared for the EV battle.

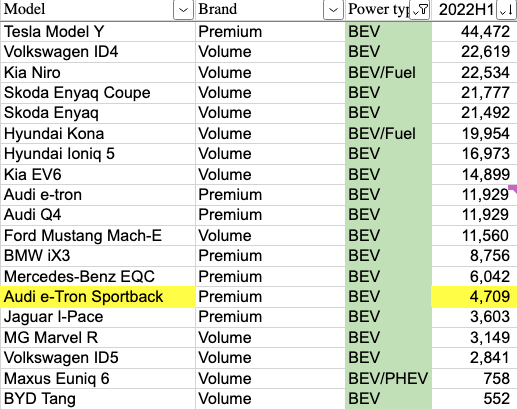

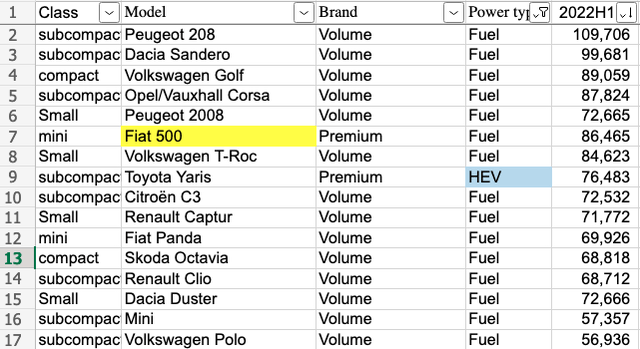

While some of BYD’s models are likely to survive in this highly competitive market, some are not. In my opinion, models that are likely to fail are Han EV and Tang DMi because they stand little chances facing strong rivals such as Hyundai Ioniq 5 and Kia EV6; the Qin sedan can be eliminated too because European customers have strong preference for hatchbacks instead of sedans in this class. The remaining models – namely Song, Yuan and Dolphin – should have their market, but again their prospects are constrained by brand recognition and LFP batteries (which are impacted by the cold weather in Europe).

BYD’s models marginalized by rivals of Hydundai and Kia (carsalesbase)

small and subcompact hatchbacks dominated Eupore market (carsalesbase)

Can BYD improve its margin?

Margin can be improved through either cost reduction (efficiency) or price increase. Can BYD achieve at least one of them?

Let’s discuss about BYD’s efficiency first. In my previous article, I explained why BYD’s margin is thin:

“BYD is famous for its establishment of a closed-loop, self-supplied system (analysts like to call it the vertical integrated system). Although such a system ensures stability of supply and production, it is at the expense of long-term operation efficiency and cost control…”

Specialization leads to efficiency. Great companies like Apple (AAPL), Toyota (TM) and Tesla (TSLA) are good at leveraging resources of vast suppliers in order to focus on a key area. For example, AAPL relies on Hon Hai for hardware assembly, TM relies on Aisin for powertrain components, and TSLA relies on Panasonic (OTCPK:PCRFY) and CATL for batteries supplies. However, this is not the case for BYD. While being a genius in engineering and technology as claimed by of Charlie Munger, Wang Chuanfu is a man with vast interests (or obsessed with self-sufficient supply system, depending on a different perspective) who is unlikely to focus on one field. At his command, BYD tried the photovoltaic business in 2009, the skytrain business in 2016, and musk manufacturing in 2020, all of which added little to shareholder value. For its EV business, as long as BYD keeps making every auto part except glass and tire as Wang Chuanfu once said, the efficiency of BYD will continued to be capped at a low level.

Can BYD raise the price? In my opinion, it is unlikely. Since Qin, Song and Yuan, which are backbones of BYD’s product line, are appealing to customers who are highly price sensitive, any increase of price could be fatal, unless BYD is willing to sacrifice market share.

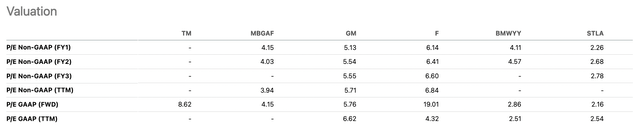

Valuation

How much is BYD worth? Based on my estimation, in 2030 BYD will sell around 6 million cars worldwide, of which 5.3 million will be in the local market. This is a generous number as it means BYD will capture over 25% market share in China. I am assuming net profit per car to be CNY5,000, which is fair given: 1) the margin analysis above; and 2) this number is below CNY 2,300 in FY2021 after adjusting for the government grants and subsidies (I doubt such grants will still exist in 2030). Applying a reasonable PE ratio of 25x (again, this is generous as major automakers currently have only single-digit PE multiples on average), the terminal value is around CNY750 billion. Discounting at a 10% required rate of return annually, the fair value of BYD is around CNY350 billion. As the current market cap is around CNY500 billion, BYD is overvalued by 44%. I therefore believe a Sell is warranted.

Automakers generally have low PE ratios (Seeking Alpha)

Risks

The upside risks consist of stronger-than-expected sales of current models, success of new models, surprises in China’s EV subsidies or zero-COVID policy, and unexpected surge in oil price.

- A stronger-than-expected sales of current models, which are presumably Qin, Song and Han, will change the expected growth of BYD that might invalidate my model;

- The article only covers analysis of BYD’s current models, so new models that may become available and prove successful in the future will jeopardize my assumptions;

- The conclusion drawn from my analysis is based on the assumptions that the current EV subsidy regime and COVID control policy in China will not be significantly altered. Thus, should China boost EV subsidies or ease zero-COVID policy unexpectedly, my conclusion might not hold; and

- If the oil price continues to surge, the EV adoption is likely to accelerate so that BYD will be significantly benefited.

Conclusion

In summary, BYD’s success in China can be attributed to aggressive pricing, innovative products, and government subsidy. Its killer models face no or few meaningful rivals in the local market. However, such a success is not easily transferable worldwide given weak brand recognition, protectionism (United States), strong presence of rivals (Europe), customer preference (Europe), and geopolitical tensions (Australia). In addition, BYD’s margin is expected to be capped at a low level because of Wang Chuanfu’s obsession with self-sufficient supply system (which leads to lack of focus) and the price-sensitive customers BYD appeals to. Based on my estimation, the current market cap of BYD is overvalued by 44% despite recent large selloff.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!