ZIM Integrated Shipping: Rough Seas, But Still On Course (NYSE:ZIM)

bfk92

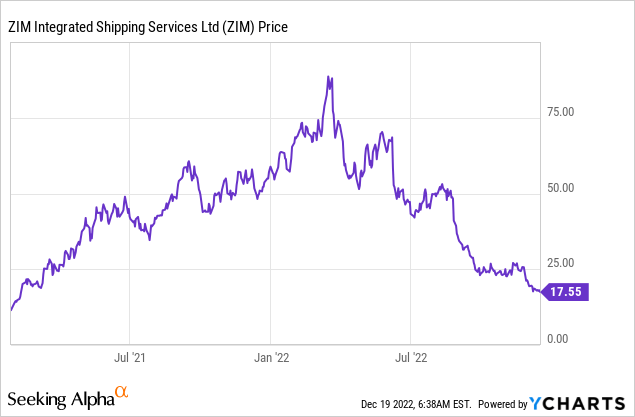

ZIM Integrated Shipping (NYSE:ZIM) is a global shipping company, which was founded back in 1945, perfectly timing the end of World War 2. Since that point, the company has continually reinvented itself and had its IPO in 2021, again perfectly timing the “reopening” of the economy and the boom in shipping. ZIM benefited from rising freight costs, and its stock price exploded upwards by approximately 600% to its highs in March 2022. However, since that point, the stock price has “capsized” and it is now 79% from its all-time high. This has mainly been driven by a “normalization” in shipping rates globally. But the company has still continued to produce strong financial results, surpassing analyst expectations in the third quarter. In this post, I’m going to break down the recent financials, and give a new update on port congestion globally, let’s set sail.

Financials and Shipping Prices

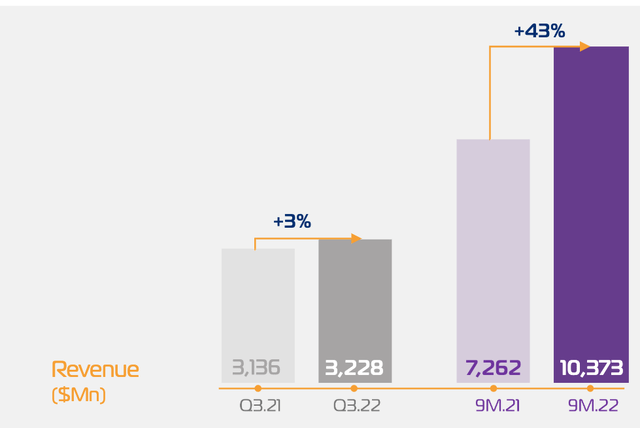

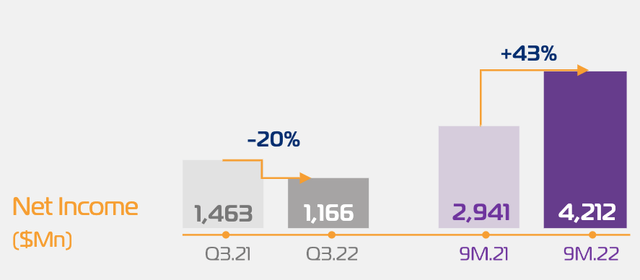

ZIM Integrated Shipping reported solid financial results for the third quarter of 2022. Revenue was $3.23 billion, which surpassed analyst consensus estimates by $21.86 million, despite only increasing by 3% year over year. The slow growth was a worrying sign for investors and partly ensued the sell-off in the stock. However, a positive metric is in the trailing 9 months, revenue is still up by 43% year over year with $10.4 billion reported.

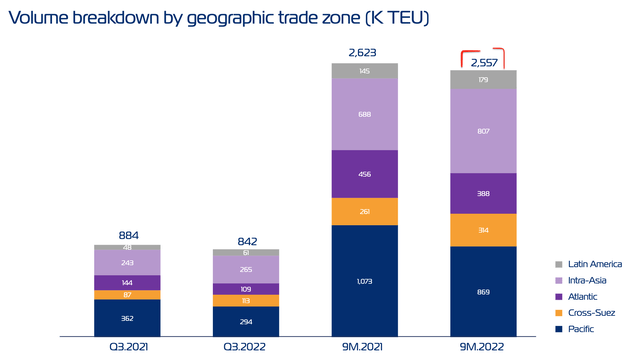

The slow revenue growth in the third quarter was mainly driven by slightly lower demand for shipping and substantially low freight costs. On the chart below you can see total Volume went from 2623 K TEU in 2021 to 2,557 K TEU in the trailing 9 months of 2022, down 2.5% year over year.

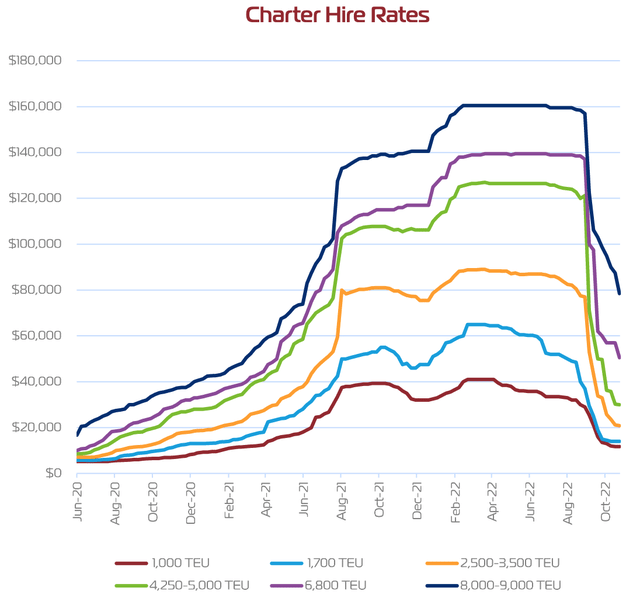

Declining freight costs were the real issue for ZIM Integrated Shipping. Charter Rates were decimated from $160,000 per 8,000-9,000 TEU (container) in the summer of 2022, to just $80,000 by October 2022. As ZIM operates with a “Charted in Capacity” model it tends to generate extra revenue from rising rates (such as in 2021), but also feels the pain when Charter rates fall.

Charter Hire Rates (Clarksons Platou)

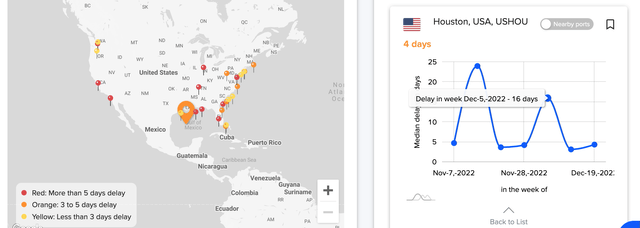

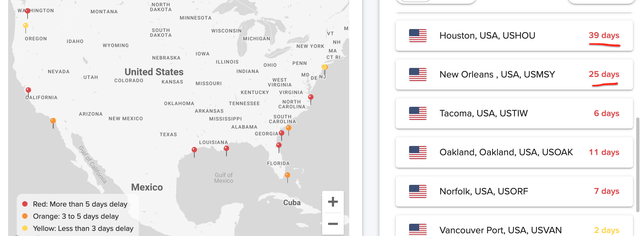

The primary reason the cost of shipping spiked in 2021 and then has fallen in 2022, was due to supply and demand. However, this was not due to a lack of ships but more a lack of “effective ships” as ports were congested which left ships out of action for a substantial period of time. For example, in a previous post in October 2022, I highlighted that U.S. ports still had significant delays embedded. For example, on the below map from October, you can see ports such as Houston and New Orleans had delays of 39 days and 25 days respectively, which is simply eye-watering.

Port Congestion USA (GoComet October 2022)

If we analyze the port congestion at the time of writing (19th December), we can see the delay has reduced significantly. With just 4 days delay reported for Houston which is down from the 16 days in early December (see chart on the right below). Keep in mind, this is during the busy holiday season.

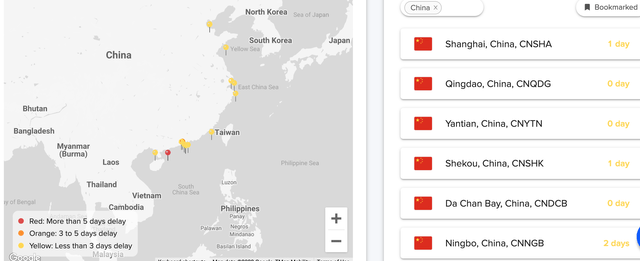

Ports in China have also shown a significant reduction in delays with between 1 day and 2 days delay reported.

Bringing all these factors together, I expect spot freights to continue to fall in the fourth quarter of 2022, albeit at a much lower rate due to holiday freight shipping demand. In 2023, management is also forecasting a “challenging business environment” due to falling freight rates and a risk of oversupply.

Evolving Business Model and Cost Structure

A huge positive for ZIM Integrated shipping is the company is evolving its operations to be much more efficient. For instance, the company has 46 newbuild ships in production with 28 of those ships powered by Liquified Natural Gas [LNG]. This is a big deal, as LNG is more efficient than traditional fuels, which is expected to lower ZIM’s operating costs. In addition, ZIM has secured its LNG supply over the next decade in a major deal with energy giant Shell. This could give the company a competitive advantage, as the energy crisis in Europe has meant a “land grab” is happening for fuels of all types, especially LNG. In addition, LNG is extremely environmentally friendly and creates 20% less greenhouse gas emissions than traditional fuels. Therefore it would not surprise me if ZIM’s stock is favored by ESG funds over its competitors, which could result in a stock price boost.

ZIM has also entered into a major partnership with Maersk Line and MSC, the two largest shipping companies in the world. This will enable the business to act more flexibly without an overreliance on its own capacity. The company also aims to increase its car-carrying capacity for Asia exports, which could be a key growth part of its “global niche” strategy.

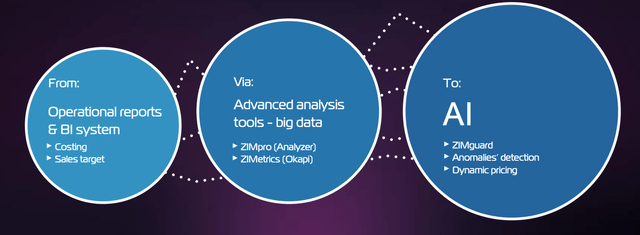

ZIM is extremely forward-thinking for a legacy shipping company. The business has made a series of venture capital-style investments into analytics tools and even Artificial Intelligence [AI], which is expected to help it better predict pricing dynamics. The AI industry is forecasted to reach $1.394 billion by 2029 and we have recently seen a surge in viral AI products such as ChatGPT.

Earnings and Balance Sheet

Back to the financials, ZIM reported $1.166 billion in net income which declined by 20% year over year. This was as a result of the aforementioned issue with declining shipping rates. However, it should be noted net income has still increased by 43% year over year to $4.212 billion. ZIM’s Earnings per share also beat analyst estimates by $0.13 with $9.66 reported in Q3,22.

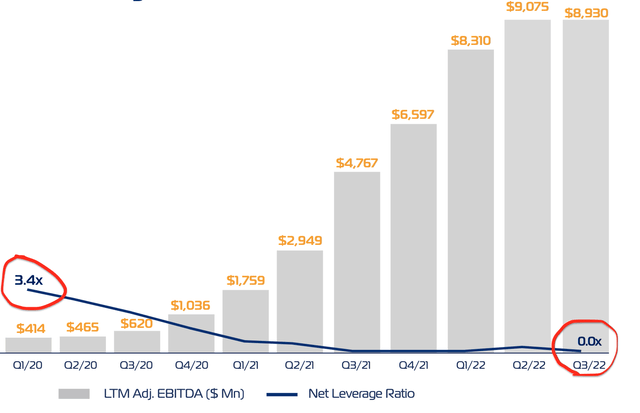

A strong positive for ZIM is management utilized its excess cash flow well to reduce its net leverage ratio from 3.4x in 2020, to virtually zero by Q3,22.

Leverage Reduction (Q3,22 report)

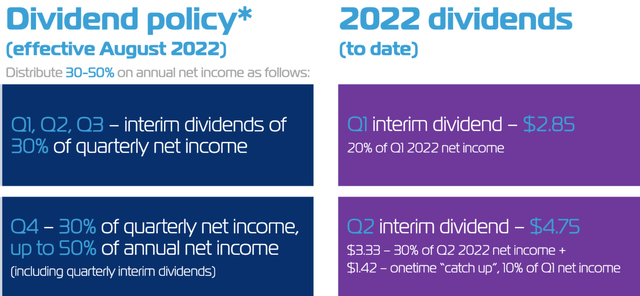

Let us also not forget that ZIM has a strong balance sheet with $4.44 billion in cash, cash equivalents and marketable securities. In addition, the company offers a dividend between 30% and 50% of net income, which is outstanding. I expect this to be ~30% in the fourth quarter, which would be the same as the third quarter, due to the weakening environment.

ZIM dividend Policy (ZIM integrated Shipping)

Valuation?

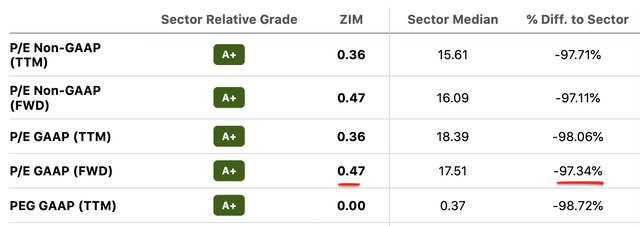

ZIM is trading at a low forward P/E ratio of just 0.47, which is substantially cheaper than historical levels of between a PE = 1.7 and 2.1.

ZIM Integrated Shipping also trades at a lower P/E ratio than industry peers. For example, Navios Maritime Partners L.P. (NMM) which trades at a P/E Ratio = 1.3 and Golden Ocean Group (GOGL) trades at a P/E Ratio = 4.38.

Risks

Declining Shipping Rates/Recession

As port congestion eases, shipping rates are expected to decline further which will continue to impact ZIM negatively. In addition, many analysts have forecasted a recession which will likely impact freight volume. Thus it was no surprise to see analysts at Citigroup have downgraded the stock to a neutral or “high risk” investment. However, a positive is Citigroup still has a high price target of $51.50 per share, which still represents an upside of ~193% from its $17 share price at the time of writing.

Dividend Withholding Tax

As ZIM Integrated shipping is based in Israel, a “withholding tax” of between 25% and 30% is taken on dividends. A positive is the company has reported ways of possibly reducing this tax through various methods, you can read more about it here and I suggest seeking independent tax advice for details.

Final Thoughts

ZIM Integrated is poised to grow its position as a “global niche carrier”. Its forthcoming LNG fleet should improve its operational efficiency. The company is facing a series of headwinds from declining freight rates, but its debt levels are substantially lower. The cyclical freight industry is known for its boom-bust dynamics, we are currently going through the latter, but when the next boom arrives, ZIM will be poised to benefit.