Why Occidental Petroleum Won’t Get Bought For $90+ (NYSE:OXY)

Brandon Bell/Getty Images News

Occidental Petroleum (NYSE:OXY) has become one of Warren Buffett’s (BRK.A) (BRK.B) largest investments. The company has a market capitalization of just over $50 billion and a roughly $35 billion stack of obligations including roughly $25 billion in debt and $10 billion in preferred equity. The company has come a long way from the depths of COVID-19 when it was forced to issue shares instead of pay interest on its capital.

Berkshire Hathaway History

Berkshire Hathaway has had a troubled history with energy investments. The company received Occidental Petroleum stock as the company struggled to pay its dividends on Berkshire Hathaway’s preferred stock. It then sold that stock. However, since then the company has changed its plans and started to build up a substantial stake.

The company recently purchased another 9.6 million shares at roughly $55 / share versus a current stock price of roughly $57 / share and a 52-week high of almost $75 / share. Berkshire Hathaway slowed down its purchases to almost a standstill as the company hit its 52-week highs showing a clear line on what it considers fair value.

The company now owns ~16% of Occidental’s common stock. Options to repurchase additional stock from the company’s support of the Anadarko Petroleum acquisition could be exercised for $5 billion and take the company’s stake towards 25%, making it by far the largest owner and giving it a substantial stake.

The company’s continued investments here have convinced shareholders to raise their price targets towards $90+ per share.

Occidental Petroleum Cash Flow Targets

Occidental Petroleum, after years of struggle, is finally rolling in the cash, and you can bet they’re not going to miss the opportunity to clean up the company.

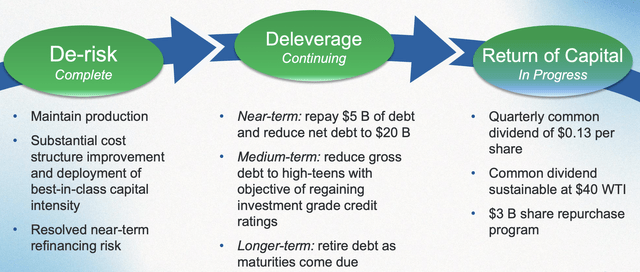

Occidental Petroleum Targets – Occidental Petroleum Investor Presentation

The company is planning to maintain production and focus on maintenance capital spending for now, while resolving any refinancing risks. It’s done with that stage. Now the company is looking to get net debt all the way down to $20 billion, with another $5 billion reduction, which should put it solidly in the investment grade space.

The company, at current cash flow levels, should be able to pull that off in just a few quarters. Past that, it can comfortably afford to continue retiring debt as it comes due. The company has a recently increased dividend of almost 1% which is payable at oil prices more than $60 / barrel below current prices, and has announced a buyback for ~6% of its stock.

Occidental Petroleum Earnings Breakdown

Financially, the company’s earnings have been stronger than ever and we expect that to continue.

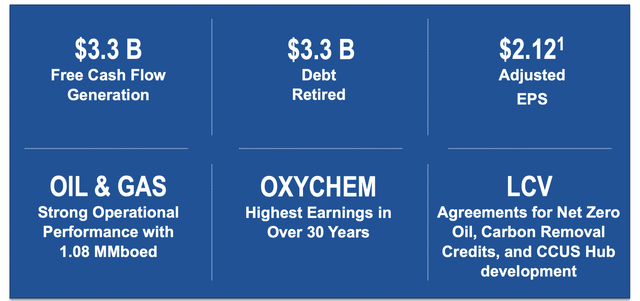

Occidental Petroleum Earnings – Occidental Petroleum Investor Presentation

In 1Q 2022 alone, the company saw $3.3 billion in FCF generation and retired a matching amount of debt, with a mid-single-digit EPS. The company’s production has remained high with continued efficiency improvements and its downstream business has continued to improve incredibly well. We expect margins to continue to improve at a constant oil price.

These strong margins from across the stack will support continued shareholder returns.

Occidental Petroleum Financial Picture

Financially, Occidental Petroleum has the ability to generate rewards from numerous avenues. The company’s annualized FCF is roughly $12 billion, giving the company a FCF yield of roughly 25%. The company can hit its debt target roughly in just 2 quarters of this cash flow, saving it hundreds of millions of dollars in annual cash flow.

Unfortunately, despite the company’s higher average interest rate on its debt of roughly 5-6%, rising interest rates and a tougher market mean that we think the company will be unable to significantly improve its rates from refinancing. However, the company does have a respectable share buyback and will have numerous levers to improve its financials after that.

The company’s dividend costs the company only $500 million annualized, meaning after the next 2-3 quarters, if prices remain high, we expect the company to have numerous other avenues for shareholder returns. That helps make the company a valuable investment.

Our View

There’s no denying that Occidental Petroleum is a cash flow giant. However, last week’s purchase was Berkshire Hathaway’s first in Occidental Petroleum since roughly May 12 when the company’s stock was at $59.22 / share. The company’s pace of investments rapidly slowed down after Mar 16 when the company had 136 million out of 152 million current shares.

At that point, the company’s share price was just under $53 / share. The company’s 90-day volume remains roughly 35 million shares a day, which is fairly substantial at ~3-4% of its overall stock. It seems like Berkshire Hathaway has determined a fair price for the company’s stock is at less than $60 / share.

At the company’s current stake size, we think the chance of it exiting completely is low, and the chance of it expanding its position is much higher. We can see it going up as high as $75 / share for an offer for the entire company; however, we feel anywhere near $90 is incredibly unlikely. At less than $50-60 / share, we can see the company adding to its position.

As a result, we recommend investors invest with a $75 price target in mind versus a $90 target that analysts have.

Conclusion

Analysts are raising their price targets on Occidental Petroleum towards $90+ per share; however, we feel that’s way too expensive. The company is a cash flow giant and rapidly improving its cash flow; however, there’s still risk to its ability to drive returns if the market drops significantly. More so, there’s still $10 billion of 8% preferred equity that can’t be redeemed easily.

The max that Berkshire Hathaway is willing to invest at seems to be almost $60 / share. We can see the company moving towards $75 / share for a full acquisition of the company. Regardless, the company is a cash flow giant and we do expect Berkshire Hathaway to buy it, just nowhere near a price target of $90 / share.