Why Did Electra Battery Materials Stock Price Suddenly Dropped

Geber86/E+ via Getty Images

The stock in free-fall

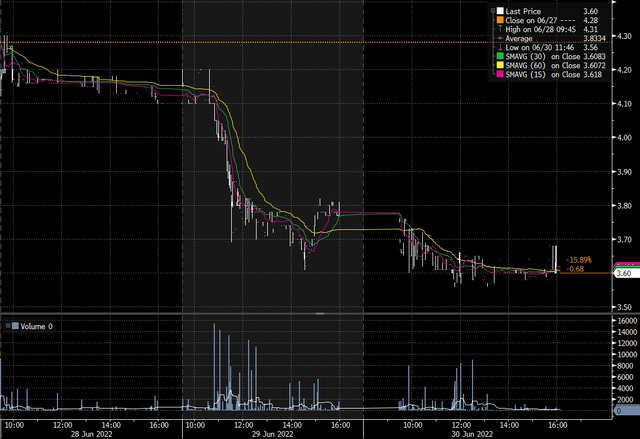

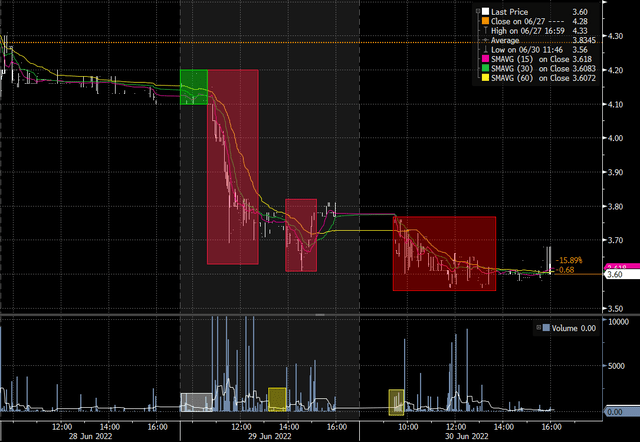

On the morning of June 29, 2022, Electra Battery Materials (NASDAQ:ELBM) opened up from the previous day’s close. Suddenly, the price began to crash. In two days, the stock lost around 15% of its value. What happened?

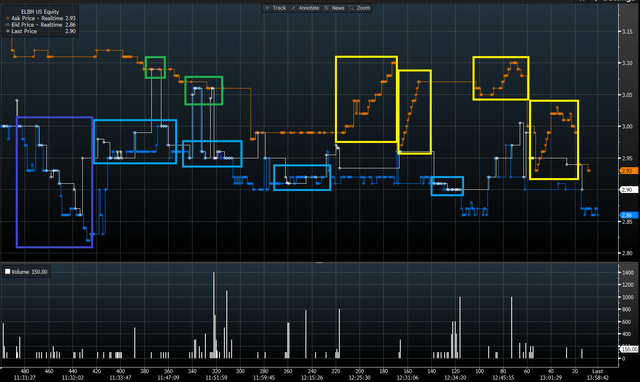

ELBM melts under selling pressure on June 29, 2022 (Bloomberg)

The event that began around 10:45 A.M. on June 29 is not due to market-moving news so don’t panic. It’s someone liquidating a relatively large position. Public information on the fundamentals show they are fine.

The last company news were good news, and none have come out since my last article.

The company is considering building a second refinery, its leadership team is strengthening, and despite supply-chain disruptions, the company is moving briskly along towards commercial operations debuting by the end of the year. Latest drilling revealed additional and highly promising cobalt deposits in the Idaho mining property. I argued this strengthens the company’s prospects and corresponds to the company’s vertically-integrated strategy. In that same article, I question the change in valuation of Electra that would result from ten-year Treasurys yielding an extra 100 basis points. I still think Electra is a Buy! Buy! Buy! because it remains the North American industry leader for a supply of low-carbon, traceable critical minerals. As the world’s economic and political order is quickly shifting, the case for a domestic supply of the 21st century’s strategic minerals has only strengthened. These changes have also increased fleet utilization and revenues for maritime shipping.

So what happened to the stock?

The daily traded volume in the company’s shares is fairly small. So when a computer program sold 150,000 Canadian shares in the morning, it put such heavy pressure that the American shares (even less liquid) followed, and the short-circuit breakers were engaged – SEC Short Sale Rule 201 was put into effect at 11:32A.M. (UTC-4) Rule 201, the so-called “uptick rule” requires that short sales be done at a price higher than the last trade.

This had the effect of drying up liquidity in the US, since short-sellers would only be able to take a position by ‘asking’ for a price and waiting for a buyer to come along. This resulted in lower liquidity in the Canadian market, which slowed down the seller. This gave time for buyers to shore up their bids and which cushioned the price decline.

Rule 201 slows down FX Arb and liquidity dries up

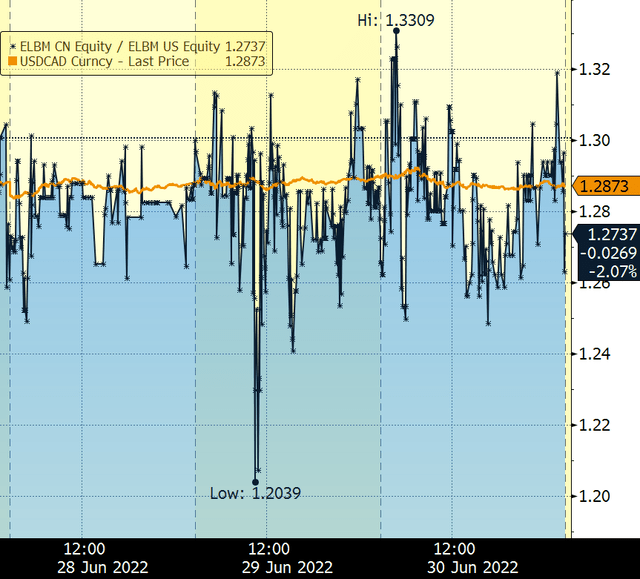

Electra Battery Materials’ shares are traded in the US and in Canada. Since shares in either market are equivalent claims on the company’s equity, they have the same intrinsic value. Since they have the same value but are traded in different currencies, an exchange rate for the currencies is implied by them. If this implied exchange rate deviates from the spot exchange rate (the one prevailing in the vast currency market), then there are opportunities to arbitrage the two exchange rates by simultaneously buying and selling the cross-listed shares, and exchanging the currencies. In this specific case, there are arbitrage opportunities when the ratio of the ELBM:CA and ELBM:US share prices deviates significantly from the Canadian dollar to US dollar (USD/CAD) exchange rate.

This arbitrage operation is important for the shares to be worth the same on both the Canadian and American markets.

Although created to stop speculative short-selling in an attempt to avoid a disorderly market, by putting in effect Rule 201, the SEC disrupted the foreign-exchange arbitrage operation. This explains why liquidity dried up in the US market, since only those who already owned US shares of Electra Battery Materials could ‘ask’ for a price and wait for a buyer to come along – which almost none did, because of the selling pressure up North. Rule 201 is meant to stop speculative bears from taking liquidity which would be better and more fairly used by investors seeking to exit their long positions. The problem is that arbitrageurs who hold no inventory would also be short-sellers if they were to take liquidity at the ‘bid’.

USD/CAD exchange rate implied by cross-listed ELBM shares and compared to the spot exchange rate (Bloomberg)

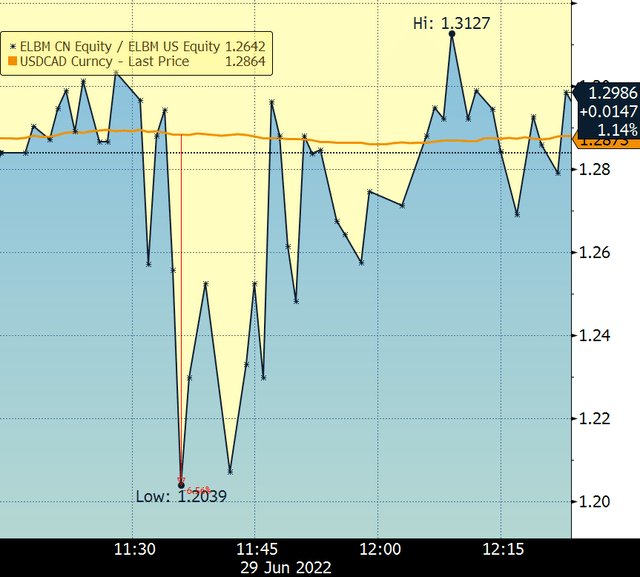

The circuit breaker was engaged at 11:32 and liquidity quickly dried up in the US while the Canadian shares continued to be heavily sold. This resulted in a very rapid deterioration of the implied exchange rate, reaching a maximal deviation of about 6.5% in just four minutes.

USD/CAD exchange rate implied by cross-listed ELBM shares and compared to the spot exchange rate (Bloomberg)

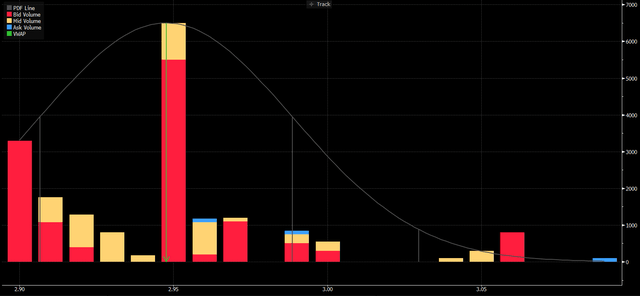

A few more trades were made, possibly between arbitrageurs with US share inventory or exiting bulls, and investors with bids in the book, substantially around round-number levels like US$2.95, US$2.90, etc.

ELBM:US Volume transacted at price between 11:33 and 13:57 (UTC-4) on 29/06/2022. Volume in the ‘ask’ is due to buyer-initiated transactions; volume in the bid is from seller-initiated transactions (Bloomberg)

Eventually this liquidity dried up and for about 54 minutes, the US market stopped trading until someone – who was not a short-seller – sold 150 shares at 13:57 for US$2.90 each.

An even closer look at the transactions of ELBM:US shows that the bid collapsed shortly before Rule 201 came into effect. The collapse of bids is highlighted in the purple rectangle below. Once the uptick rule came into effect, the bid was able to replenish itself, even as sellers kept taking liquidity. A few eager buyers came in and took a bit of volume at the ask (green rectangles below) but as illustrated in figure above, only a very small proportion of the transacted volume during the period of 11:33 and 13:57 was initiated by buyers; the red bars are seller-initiated transactions. The figure below confirms that sellers found buyers at round number levels, highlighted in blue rectangles. We can also see the ask-side was unsure of the spread to offer, as highlighted in the yellow rectangles. This is the behaviour of a market participant feeling out the demand from buyers and attempting to avoid selling at a price too close to the bid, in case the trade goes wrong – which means the price increasing. This should bring comfort to bulls caught flat-footed in the stock. That is why the yellow boxes show the asking prices (i.e.: those for buyers) rising mechanically. If the selling pressure came from public information material to the company, the ask would be much firmer. As it was, the ask was a reluctant seller, hoping to make a buck without having strong downside views. Encouragingly, the bid was quite firm. This should also bring comfort to bulls.

Bid, Ask, and Trade prices in top panel for ELBM US, with transacted volume in the bottom panel (Bloomberg)

The seller takes a breather

Noticing that liquidity is drying up, the selling program in Canada relents. The volume during this period drops, as illustrated in the yellow rectangle in the figure below.

ELBM price and volume in Canada (CAD) (Bloomberg)

Once the spread the offer was asking for began coming down in the US market, some buyers were tempted and purchased. This likely brought in more buyers, filling the bid-side of the book; selling pressure was sustained until about three quarters of an hour before the day’s close.

It didn’t end on June 29

The next day, the selling program tested the market soon after the open, as can be seen in the mechanically-increasing volume highlighted in yellow. Satisfied to have found probable liquidity, it began selling again, which it did until about 13:00 (UTC-4) on June 30, 2022.

Will it continue?

It’s possible that this seller will continue to liquidate the position. If I were to attempt to divine the seller’s motivations, I expect they are based either on portfolio rebalancing needs or due to private information. I favour the former hypothesis because of the rapidity of the sale – so quick it triggered the Rule 201 in the US market – and the timing as an end-of-month and end-of-quarter date.

Friday, July 1, is a national holiday in Canada (Canada Day) and Monday, July 4, is a national holiday in the US (Independence Day). During these holidays, the Canadian and then American markets will be closed. This will result in lower overall liquidity and trading volumes until Tuesday, July 5. A well-programmed selling program would recognize the lower liquidity environment and wait, if it can, for willing buyers to return. This means that it’s possible for sustained selling to return after the holidays, especially if Rule 201 is not in effect. However, I believe it is unlikely – or at least unwise to dump Electra’s shares on the available information. In fact, I believe that you can get some bargain shares at the moment while the company is doing well and the prices are depressed.

I don’t expect someone has superior private information – but if we see an insider file in the next few days and before the second quarter financial statements, now expected for July 11 – run!