What Is An RRSP? Definition, Explanation, And Example

franckreporter

Canadian Investors: Did you know that Seeking Alpha now offers research, news, and financial data on Canadian Tickers? Search for your favorite company here.

What is an RRSP?

An RRSP, which stands for Registered Retirement Savings Plan, is a type of tax-deferred account available to residents of Canada. It has some similarities to IRA accounts available in the United States. Contributions are tax-deferred in the sense that no tax is due on the funds until the time of withdrawal.

What is the main purpose on an RRSP?

RRSP’s are designed to be used by Canadians to save for their retirement. To make these savings plans attractive, funds contributed to RRSP’s are tax-deductable, meaning account owners save on taxes for the year they make contributions. As account owners reach or approach retirement, they can withdraw funds from their RRSP to supplement their income.

Who can open an RRSP?

RRSPs can be opened for any Canadian residents 71 years of age or younger. Even those younger than the age of majority can hold RRSPs, and contribute to them so long as they have earned income. Non-citizens can also open and invest in RRSP accounts, so long as they qualify as a Canadian resident.

How Does An RRSP work?

An RRSP helps Canadians save for retirement, by allowing them to make tax-deferred contributions, and earn tax-deferred investment growth during their employment years. Residents of Canada can set up an RRSP account through a bank, brokerage, or mutual fund provider.

Once an account is open, Canadians can make deposits into their RRSP up to a specific limit. There is no set annual maximum deposit to an RRSP; instead, Canadian workers accrue contribution room based on their reported income in their tax filings. This contribution room can accumulate over time, even if that specific individual doesn’t own an RRSP account.

Deposits made into RRSP accounts can be invested into a variety of securities, including stocks, bonds, mutual funds, exchange-traded funds, guaranteed certificates of deposit, and other qualified investment choices. All investments within an RRSP can grow tax-free, regardless of whether that income is in the form of interest, dividends, or capital gains.

Later in life, typically when the account owner is semi-retired or has stopped working altogether, RRSP withdrawals will be made to supplement income. All withdrawal amounts are added to taxable income in the year the withdrawals were made.

RRSP accounts must be converted to a Registered Retirement Income Fund (RRIF) before the end of the year during which the account owner turns 71. At that point, tax-deferred contributions are no longer allowed, and Canadian tax laws require minimum annual withdrawals from RRIF accounts.

Important: Although all RRSP accounts must be converted to a RRIF by December 31 of the year the account owner turns 71, the conversion can occur much earlier than that. An RRSP-to-RRIF conversion can occur as early as age 55.

RRSP Contribution Deadline For 2022

The deadline for Canada residents to contribute to their RRSP for the 2022 tax year is March 1, 2023. The Government of Canada allows Canadians 2 months beyond the end of the year to make RRSP contributions that could qualify for tax deductions.

Deposits made to RRSP accounts after March 1, 2023, will be eligible for deduction in the 2023 tax year.

How much can investors contribute to an RRSP?

RRSP contribution amounts are limited to the maximum contribution room that a Canadian has remaining. Contribution room is accumulated at 18% of earned income from all years prior to the current year. Contribution room may also be affected by pension adjustments, for those employees with an employer-sponsored pension plan.

How Is RRSP contribution room calculated?

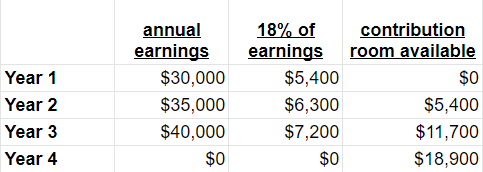

Please see the below example illustrating how RRSP contribution room is created and adjusted over time.

Example:

Gord, a young Canadian, just secured his first job at age 18. He starts work on January 1, during a year we’ll refer to as ‘Year 1’. Gord earns $30,000, $35,000, and $40,000 over his first 3 years of work. Let’s assume that Gord quits his job after 3 years, and enrolls in university. How much RRSP contribution room will he accrue?

It’s important to remember that RRSP contribution room is not available for use during the year it was earned; that amount is only available for use in the following tax year.

If Gord doesn’t make any RRSP contributions during this period, he will have $18,900 of allowable contribution room.

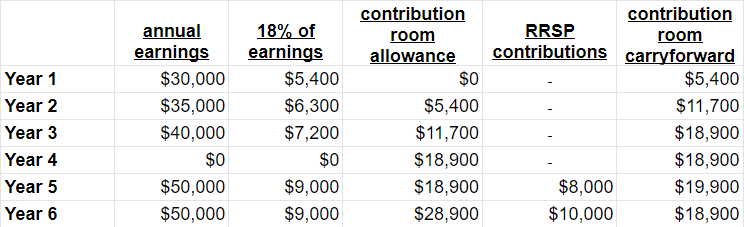

Let’s expand this example and assume Gord flunked at university, and returned to his previous job but at a salary of $50,000. Let’s also assume that he makes RRSP contributions of $8,000 and $10,000 in these 2 next years. Here is how his accumulated contribution room would look, by year.

As we can see, Gord had $18,900 in accumulated RRSP contribution room after Year 3, and in Year 4 that amount didn’t increase because he was at university and earned no income. In Year 5, Gord opened an RRSP and deposited $8,000. In Year 6, he deposited another $10,000 into his RRSP. Note how in Year 5 his contribution room carried foward to the next year rose by $1,000, and in Year 6 it dropped by $1,000. This is because in Year 5 Gord contributed $1,000 less than the $9,000 of room he earned from working that year, and in Year 6 it was the opposite; Gord contributed $1,000 more than the $9,000 of room he accumulated.

Important Note: The Government of Canada does set an upside $ maximum in earned contribution room. For 2023, the maximum contribution that can be earned by any individual is $31,560. This yearly maximum changes annually and is posted here.

Tax Deductions

A Registered Retirement Savings Plan is a tax-deferred savings plan that’s available to Canadian residents. When RRSP contributions are made, the plan sponsor will email the account owner with a tax receipt for the contribution. This amount can then be deducted to reduce the level of net earnings reported in this individual’s tax return.

Important: Not all eligible RRSP contributions need to be used as tax deductions in the year of contribution. A given individual may, for example, have $20,000 of RRSP contribution room, make $10,000 in deposits to an RRSP, but decide to only claim $6,000 as a deduction in that year. This would leave that individual with $4,000 of contributions to deduct in the following year, even if they make no new RRSP deposits.

Any RRSP account withdrawals, on the other hand, serve to increase the amount of taxable income in the year of the withdrawal.

Benefits of investing in an RRSP

The benefits of investing in RRSPs are essentially three-fold:

- tax deferral of income

- tax-deferred investment growth

- tax mitigation

The core benefit of RRSPs is the ability to earn tax deductions on contribution amounts, deferring taxes payable until the time of withdrawal. If an individual with a 40% marginal tax rate contributes $20,000 to their RRSP, they will reduce their income tax bill by $8,000 that year. If they withdraw that $20,000 twenty years later, they will pay the $8,000 tax at that point (assuming they are in the same tax bracket).

Capital invested in an RRSP can also grow tax-free. If a $20,000 stock investment within an RRSP earns $1,000 of dividends, that amount is also not taxable. Had that $1,000 of dividends been earned in a non-registered account, the owner would have been required to report $1,000 of dividend income on their tax return.

The third common benefit to RRSP investing is a where the account owner is situated in a lower tax bracket at the time of withdrawals from an RRSP. If that individual deposits $20,000 into their RRSP when their tax rate is 40%, they’re avoiding $8,000 in tax. If they withdraw $20,000 when their tax rate is only 30%, the tax they would pay is only $6,000. This individual would not only have deferred their tax bill but reduced it.

What is the difference between an RRSP and a Spousal RRSP?

Individuals who are married, or in a common-law relationship in Canada, are allowed to make Spousal RRSP contributions. Here, the RRSP contribution is made not into one’s own RRSP, but their partner’s RRSP. The individual who makes the contribution is afforded the tax deduction, while their spouse will pay tax on the withdrawn funds whenever that occurs.

A Spousal RRSP is particularly advantageous to people whose spouse is either in a much higher tax bracket or much lower tax bracket than they are. To minimize combined tax payable, the partner who is in a higher tax bracket contributes to the RRSP of their lower-taxed spouse or partner.

How is an RRSP different than a TSFA

Both Registered Retirement Savings Plans (RRSP) and Tax-Free Savings Accounts ((TSFA) are made eligible to Canadians. The primary difference between these is the fact that RRSP monies are taxed upon withdrawal, whereas funds deposited to a TSFA have already been subject to taxation. In other words, after-tax funds are used to contribute to a TSFA, as opposed to pre-tax funds for an RRSP.

The other main difference is how contribution limits are calculated. For an RRSP, contribution room is earned at a rate of 18% of an individual’s earned income, whereas for a TSFA, the Canadian Government sets an annual maximum $ contribution (which can be carried forward, however).

Bottom Line

Canadian residents are entitled to open a Registered Retirement Savings Plan, which is a tax-deferred account that functions similarly to an IRA in the United States. RRSPs allow for tax deferral, tax-deferred investment growth, and in many cases also tax mitigation.

Seeking Alpha announced and introduced Canadian stock ticker pages to our platform in 2022. Use the search bar to find updated research, news, data, and charts on Canadian companies.