Wereldhave: 4-6% 2023 Direct Result Growth Offset 2024 Tax Headwinds

Larry_Reynolds

Investment Thesis

Wereldhave (OTCPK:WRDEF) has had a rollercoaster year, with a strong H1 2022 rise of some 50% (including the dividend) reversing in recent months, with the stock largely flat YTD taking the dividend into account.

While the COVID-19 recovery drove the stock early in the year, attention has recently shifted to rising rates and plans to change the REIT regime in the Netherlands starting in January 2024. While changes to the tax status are still uncertain and exact impact, if any, is up in the year, the company estimates the impact at around 5% of direct result earnings for 2022.

That said, despite higher interest rates the company is still confident in its 4-6% direct result growth for 2023, leading to my current assessment that 2024 earnings will be flat relative to 2022, before higher rates or residential gains are factored in.

All in all, with a market-implied cap rate of around 8.6% and residential gains (1.6-1.85 EUR/share) yet to be booked (which will likely be negated by debt refinancing at higher rates), the company looks in a good position to maintain the 1.1 EUR/share dividend going into 2024, with a healthy yield of 9% and a conservative sub 70% payout ratio.

What’s more, if investors do not like the tax uncertainty which will persist throughout 2023, they may opt for the company’s Belgian subsidiary -Wereldhave Belgium – which trades at a only slightly slower 8.3% market-implied cap rate. I think Wereldhave Belgium will achieve a net result from core activities of 5.15-5.2 EUR/share in 2023, some 6% higher than 2022. The only issue with Wereldhave Belgium is that there is no specific breakdown for residential gains relating only to Wereldhave Belgium, and residential gains are the main differentiating factor going for Wereldhave at the moment.

Company Overview

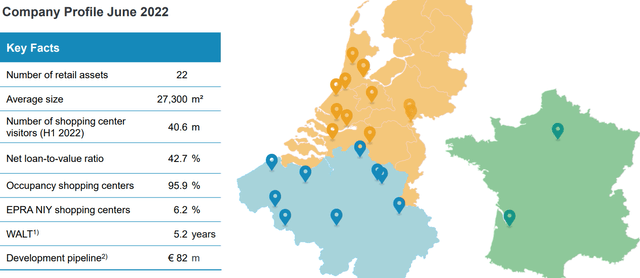

Wereldhave will deliver 3 transformation projects until the end of 2022. The company operates 11 shopping centers in the Netherlands, ten centers and offices in Belgium (through a 64.5% stake in Wereldhave Belgium), and 2 centers in France:

Wereldhave H1 2022 Results Presentation

Q3 2022 Operational Overview

Wereldhave delivered a direct result of 0.43 EUR/share in Q3 2022, implying a 1.72 EUR/share annual run-rate, some 6% higher than the midpoint of its 2022 guidance.

Rent indexation and higher occupancy (up 0.8% Q/Q to 95.5%) drove the net initial yield used for valuation marginally higher at 6.3% (up 0.1% Q/Q). I think a key concern for 2023, aside from the tax situation, will be whether after the traditionally strong Q4 we see a slide in occupancy thanks to higher bankruptcies, worsening economic situation and inability of some tenants to keep up with 100% inflation-indexed rents.

The main thing missing from the Q3 trading update was any booking of residential gains which are set to start from 2022. Given that after 2023 they may be subject to extra taxes, the company may want to frontload gains if possible, though unlikely given the nature of residential construction.

After the recent refinancing, the company more than doubled the group’s weighted average term of the undrawn revolving credit facilities, totaling € 385m, to 4.5 years.

Market-implied Net Initial Yield Valuation

Due to the rise in interest rates, the value of debt on companies’ financial statements has generally gone down, resulting in higher EPRA Net Disposal Value (NDV) than would otherwise be the case. Case in point, Unibail-Rodamco (OTCPK:UNBLF) reported in H1 2022 a 35.83 EUR per share positive impact on EPRA NDV from the fair value adjustment of fixed interest rate debt. In essence, the reported 152.9 EUR/share in EPRA NDV would have been around 117 EUR/share without the adjustment.

For Wereldhave, the effect in H1 2022 amount to 0.36 EUR/share, hence I will adjust the NDV from 22.78 to 22.42 EUR/share. With that in mind, to calculate the market-implied net initial yield, I will take the EPRA NDV which stood at 22.42 EUR/share in Q3 2022:

Market-implied net initial yield = Valuation net initial yield / Division factor where:

Division factor = Price/NDV Ratio * ( 1 – Loan-to-value ratio) + Loan-to-value ratio

and use the Q3 2022 parameters, namely:

1. EPRA NDV = 22.42 EUR

2. Loan-to-value = 42.4%

3. Valuation net initial yield = 6.3%

4. Price at the time of writing = 12 EUR

You get a P/NDV Ratio of 12 / 22.42 = 0.54, a division factor of 0.73 (0.54 * (1-0.424) + 0.424 ) and a market-implied net initial yield of roughly 8.6%.

I estimate Wereldhave Belgium currently offers a market-implied yield of circa 8.3% while largest peers Klepierre (OTCPK:KLPEF) and Unibail-Rodamco-Westfield are in the 6.7% range.

Investor Takeaway

Wereldhave offers a decent margin of safety relative to Klepierre, and absent a worse than expected 5% impact on earnings, should see a recovery in the share price once there is clarity on the tax front.

Wereldhave Belgium remains an excellent option for anyone worried about the tax situation in the Netherlands and is ideally suited for a higher rates environment thanks to its conservative 28.5% Loan-to-value ratio.

Personally, I will probably stick with Wereldhave largely due to the ability to write options opportunistically and the chance for a larger upside if there is no tax change.

Thank you for reading.