Water Scarcity In Latin America: Operational Challenges

Joa_Souza/iStock via Getty Images

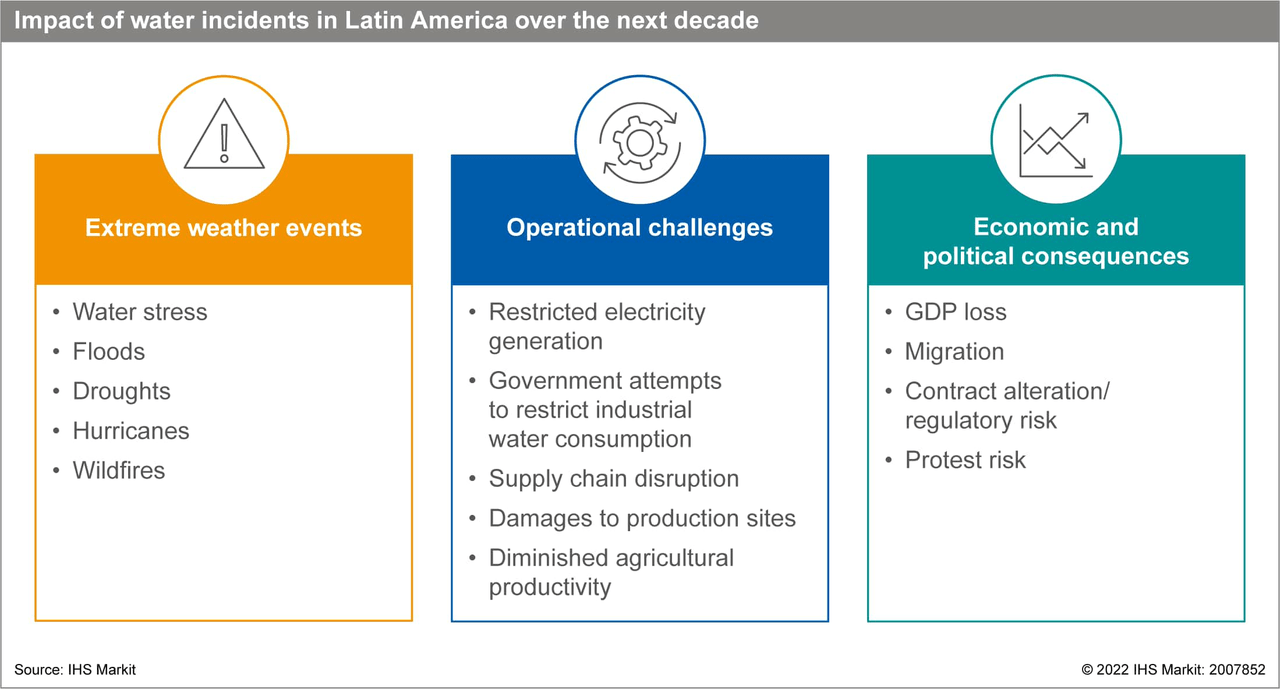

Extreme weather events such as water stress, floods, and droughts have led to additional operational challenges in Latin America.

Restricted electricity generation, supply chain disruption, damages to production sites, and agricultural losses will continue generating detrimental economic and political effects. These include reduced income levels, increased migration, and rising contract alteration and protest risks.

Water scarcity in Latin America is likely to intensify supply chain and operational disruptions, regulatory risks, and economic losses for businesses during the next five years.

Energy

Latin America’s vulnerability to extreme weather events poses risks for electricity generation, increasing production costs and the likelihood of shortages.

Hydropower is the main source of electricity generation in the region and comprises 45% of Latin America’s electricity production. Low water levels due to changing rainfall patterns with prolonged dry periods increase the need for alternative energy sources and are likely to result in significantly higher electricity prices for businesses. In Brazil, hydropower accounts for 65% of the electricity matrix. Reservoir levels in 2021 hit their lowest in over 20 years, with a state of emergency imposed in five Brazilian states.

More frequent extreme weather events in the region are highly likely to lead to a trend of rising corporate electricity costs in the five-year outlook.

Manufacturing

Water shortages are worsening operational disruption, protests, and contract revision risks for companies in the manufacturing sector.

Mexico experienced some of the most severe water shortages on record during 2022 because of low rainfall, population growth, and warmer temperatures in its north and northeastern states. The north of Mexico is particularly vulnerable to increased water stress and drought risk, and relies on the manufacturing sector for up to 40% of GDP.

Given shortages in Nuevo León state in July, particularly affecting Monterrey, the federal government intervened by initially requesting that industrial and manufacturing firms voluntarily return water to the main system and then by allowing the government to exercise temporary control over existing water rights to redistribute them for public use as necessary.

Agribusiness

Droughts and flooding events worsen the risk of lower crop yields and higher food prices.

The weather extremes experienced during the 2021-22 crop season severely affected several major agribusiness-producing countries in Latin America. Argentina, the third-biggest global soybean and maize producer, experienced USD2.9 billion in total losses within its agribusiness sector. As drought remains an issue in Argentina, an estimated 15% of wheat production will be lost with significant delays to maize planting for the current season.

Brazil’s agricultural sector experienced USD9 billion in losses in 2021 because of drought. As extreme weather events become more accentuated in the five-year outlook, crop yields are likely to become increasingly unreliable, leading to food shortages and lower agricultural revenues.

Supply chain

Water disputes are likely to increase disruption to road cargo, damaging supply chains.

Disputes over water usage between communities and state governments, such as the recent protests in Mexico’s Tamaulipas state demanding the transfer of water from Nuevo León state, are likely to increase disruption to road cargo.

Protests in 2020 over the federal Mexican government’s decision to relocate water flows from La Boquilla dam to comply with international obligations for water transfer led to USD700 million in losses following road blockades during more than a one-month period. Further protests and roadblocks due to water concerns disrupting operations are likely, particularly in northern Mexico, where water stress is more acute, and through which more than 80% of US-bound exports are transported by land.

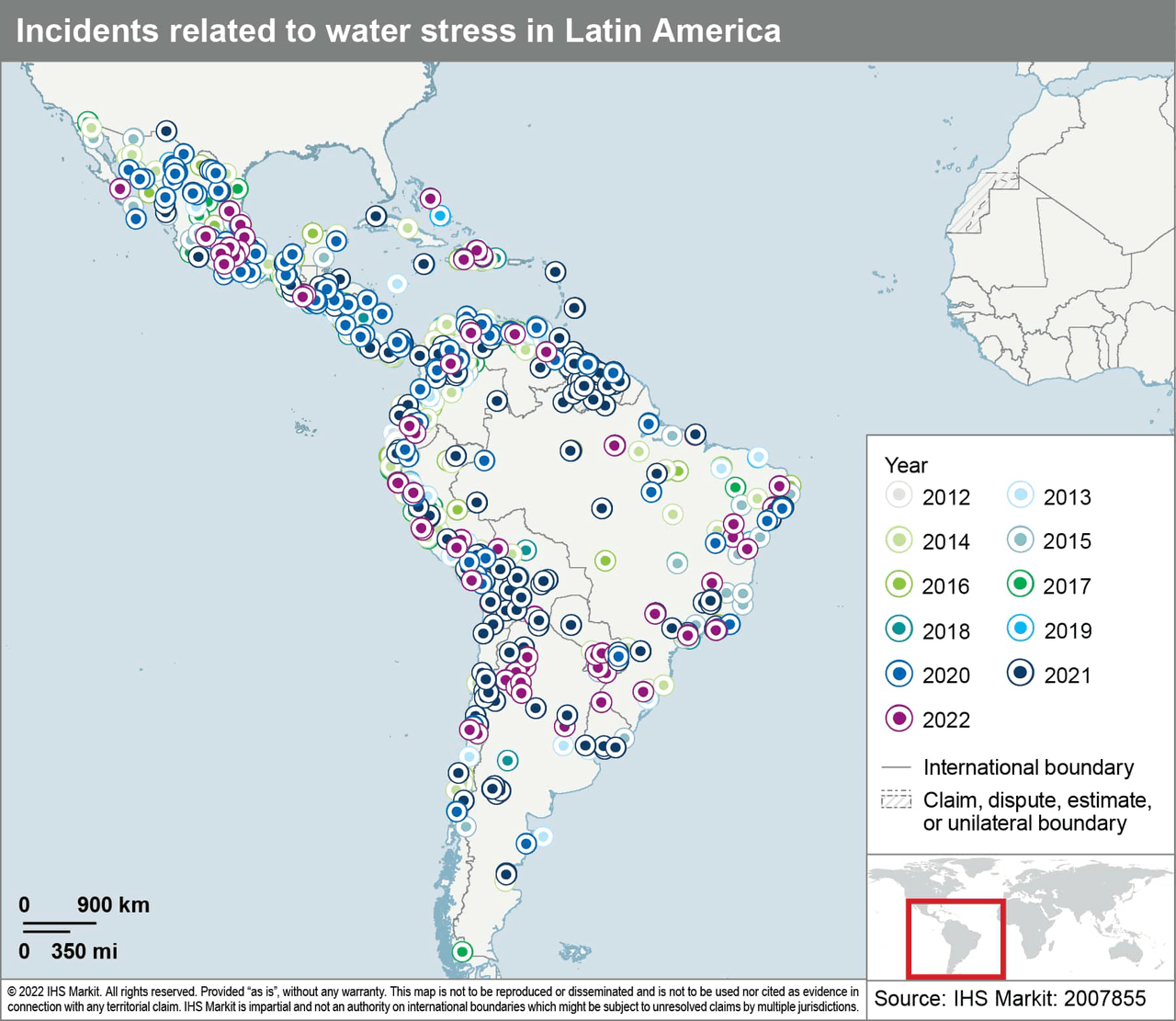

Our Economics and Country risk open-source intelligence collection system data are highlighted in the infographic below.

Changes in water levels will affect global supply chains relying on rivers and canals to move cargo.

Rising temperatures and changing precipitation patterns are likely to reduce water critical levels in rivers and canals used for transportation by significant amounts of vessels, impacting supply chains at both the local and global levels in the five-year-outlook.

Disruption derived from temporary weight restrictions is likely to become increasingly common. More severe or longer lasting droughts worsen the risk of temporary bans on cargo. Such measures would lead to delays and higher costs.

Mining/extractives

Water stress will drive environmental activism, increasing protest and legal challenges for extractive companies.

In Colombia, concerns about water usage and contamination have been a main driver behind the new left-wing Gustavo Petro administration’s proposal to implement a national ban on fracking. A bill was submitted in August to ban fracking as part of the government’s broader agenda to accelerate Colombia’s energy transition away from fossil fuels. The bill, slated to be discussed in Congress soon, proposes the cancellation of existing fracking contracts.

One reason for the firmer stance on fracking is the environmental concern about high volumes of water use and potential contamination of surrounding aquifers, with local communities holding frequent protests against fracking pilot projects in Puerto Wilches during 2022.

In Chile, after growing pushback against mining projects, companies have increased the use of seawater to manage water use better to maintain relationships with communities and limit operational disruption caused by rationing, with eight mining-related desalination plants already in operation.

Water scarcity is likely to be an ongoing constraint to Latin America’s contribution to meet global energy transition targets.

Although the region is well positioned to become a key supplier of critical minerals such as lithium for batteries for electric vehicles, having around 60% of global lithium reserves, the intensive use of water to extract lithium will continue to be an issue in the five-year outlook. Protests over water usage related to lithium extraction have already occurred in Argentina’s Jujuy region and in Chile’s Atacama region.

As global demand for lithium continues growing, expansion of existing or new projects in the region, particularly in arid locations already facing water stress, are likely to face increased opposition from local communities.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.