Volkswagen Or Tesla: Which Stock Is More Attractive?

Justin Sullivan/Getty Images News

Investment Thesis

- I rate Volkswagen AG (OTCPK:VLKAF) (OTCPK:VWAGY) as a buy: the company has a very attractive valuation and is investing heavily in the E-Mobility sector. In 2021, the company was already the market leader for electric vehicles in Europe, achieving a market share of 25%.

- I rate Tesla, Inc. (NASDAQ:TSLA) as a hold: although the company has shown strong growth in recent years, the low Expected Return according to my DCF Model, the current valuation, and high risk factors all combine to make it a hold.

- According to the HQC Scorecard, Volkswagen scores 68 out of 100 points, which is an attractive rating in terms of risk and reward for the German automobile manufacturer. The company shows very strong results in the categories of Valuation, Expected Return and Economic Moat.

- Tesla scores 57 out of 100 points according to the same Scorecard. This is a moderately attractive scoring in terms of risk and reward. Tesla achieves very attractive ratings in the categories of Growth (100 out of 100), Innovation (100 out of 100) and Profitability (90 out of 100), but is unattractive in terms of Expected Return and very unattractive in terms of Valuation.

Volkswagen and Tesla’s Competitive Positions

Volkswagen offers a wide range of cars, with a number of brands in its product portfolio such as Seat, VW, Audi, Porsche, Bentley and Lamborghini. Tesla’s product portfolio consists of high-performance fully electric vehicles as well as solar energy generation systems and energy storage products.

Volkswagen is currently investing heavily in the E-Mobility sector. The company’s Automotive Division’s total Research & Development costs amounted to €15.6 billion in fiscal year 2021, 12.2% higher than the previous year. Volkswagen’s Research & Development Ratio (calculated by the company’s total R&D costs divided by the company’s revenue) was 7.6% in 2021. Tesla spent a total of $2.593 billion in Research & Development in 2021, resulting in a Research & Development Ratio of 5%.

In 2021, Volkswagen was already the market leader for electric vehicles in Europe with a market share of 25%. In the U.S., Volkswagen was second with a market share of around 7.5%. According to Volkswagen, the company’s market share for electric vehicles is already twice as high as for vehicles with combustion engines. This number demonstrates that the company is completely on track with its E-Mobility strategy “NEW AUTO.” Volkswagen is also building a new €2 billion factory in which it plans to bring autonomous driving to the volume segment. In 2021, Tesla delivered a total of 936,222 vehicles. In the same year, the company had a market share of 14.4% in the category of plug-in electric cars, making Tesla the global leader in this category in terms of market share.

In terms of brand value, Tesla is clearly ahead of Volkswagen in my opinion. This is expressed in particular by the growth of Tesla’s brand value. With a brand value of $46,010 billion, Tesla is ranked 28th on the list of the most valuable brands in the world as according to Brand Finance. In comparison to the previous year, Tesla’s brand value increased by 44%. Volkswagen however, is ranked at position 33 (with a brand value of $41,046M). The company’s brand value decreased by 13% in comparison to the year before. Another important difference that distinguishes Tesla and Volkswagen is the fact that Elon Musk was able to build a fan base of loyal Tesla customers, which once again underlines Tesla’s high brand value.

The Valuation of Volkswagen and Tesla

Discounted Cash Flow (DCF)-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Volkswagen and Tesla. The method calculates a fair value of $471 for Volkswagen and a fair value of $569 for Tesla. At the current stock price, this results in an upside of 145% for Volkswagen and a downside of 22.7 for Tesla.

According to Seeking Alpha, Volkswagen’s Average Revenue Growth Rate (FWD) of the last 5 years is 3.56% while Tesla’s is 42.61%. I will make more conservative assumptions for both companies. Therefore, I assume a Revenue Growth Rate and EBIT Growth Rate of 3% for Volkswagen over the next 5 years and a Revenue Growth Rate and EBIT Growth Rate of 15% for Tesla over the same period. The GDP Growth Rate of the United States is about 3% per year on average. Therefore, I assume a Perpetual Growth Rate of 3% for Volkswagen. Due to Tesla’s strong growth rates in the past as well as its strong brand image, I expect the company to be able to grow above the GDP Growth Rate in the future. Therefore, I assume a Perpetual Growth Rate of 5% for Tesla.

I have used Volkswagen’s current discount rate (WACC) of 6.84% and Tesla’s current discount rate (WACC) of 8.25%. Furthermore, I calculate with an EV/EBITDA Multiple of 6.1x for Volkswagen and an EV/EBITDA Multiple of 59.4x for Tesla. Both are the companies’ latest twelve months EV/EBITDA’s.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Volkswagen |

Tesla |

|

|

Company Ticker |

VLKAF |

TSLA |

|

Revenue Growth Rate for the next 5 years |

3% |

15% |

|

EBIT Growth Rate for the next 5 Years |

3% |

15% |

|

Tax Rate |

23.3% |

11% |

|

Discount Rate (WACC) |

6.84% |

8.25% |

|

Perpetual Growth Rate |

3% |

5% |

|

EV/EBITDA Multiple |

6.1x |

59.4x |

|

Transaction Date |

30.06.2022 |

30.06.2022 |

|

Fiscal Year End |

31.12.2022 |

31.12.2022 |

|

Current Price / Share |

$192.36 |

$737.12 |

|

Shares Outstanding |

501 |

1,036 |

|

Debt |

$233,914 |

$7,025 |

|

Cash |

$33,597 |

$17,505 |

|

Capex |

$12,127 |

$6,926 |

Source: The Author

Based on the above assumptions, I calculated the following results (in $ millions except per share items):

Market Value vs. Intrinsic Value

|

Volkswagen |

Tesla |

|

|

Market Value |

$192.36 |

$737.12 |

|

Upside |

145% |

-22.7% |

|

Intrinsic Value |

$471.21 |

$569.65 |

Source: The Author

Relative Valuation Models

Volkswagen’s and Tesla’s P/E (FWD) Ratio

Volkswagen’s P/E Ratio is currently 3.01, which is 74.98% below the sector median (12.01). This provides us with an additional indicator that the company is currently undervalued.

Tesla’s P/E Ratio is currently 69.74, being 480% above the sector median (12.01). This is further evidence that Tesla is currently overvalued.

Volkswagen’s and Tesla’s Free Cash Flow Yield

Taking into consideration Volkswagen’s free cash flow per share (TTM) of $44.73 and its current share price of $192.36, the company has a free cash flow yield (TTM) of 23.25%. Tesla’s latest twelve months free cash flow yield is 0.9%. These numbers are additional indicators for the currently more appealing valuation of Volkswagen compared to Tesla.

Financial Overview: Volkswagen vs. Tesla

|

Volkswagen |

Tesla |

|

|

Industry |

Automobile Manufacturers |

Automobile Manufacturers |

|

Market Cap |

86.62B |

763.94B |

|

Revenue |

277.21B |

62.19B |

|

Revenue Growth 5 Year (CAGR) |

2.40% |

48.72% |

|

EBITDA |

39.51B |

12.70B |

|

EBIT Margin |

9.43% |

15.49% |

|

ROE |

12.77% |

28.26% |

|

P/E GAAP (FWD) |

3.01 |

69.74 |

|

Free Cash Flow Yield (TTM) |

23.25% |

0.9% |

|

Dividend Yield (FWD) |

4.08% |

– |

|

Research & Development Ratio in 2021 |

7.6% |

5% |

Source: Seeking Alpha

The High-Quality Company (HQC) Scorecard

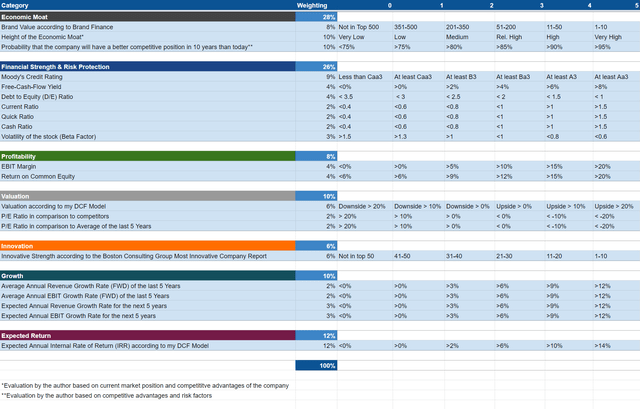

“The aim of the HQC Scorecard I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description about how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every item that is rated.”

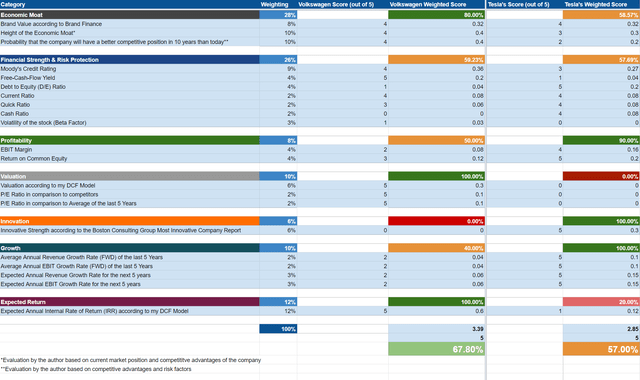

Volkswagen and Tesla According to the HQC Scorecard

According to the HQC Scorecard I have developed, the overall score of Volkswagen is 68 out of 100 points. This means that Volkswagen can currently be classified as an attractive long-term investment in terms of risk and reward. Tesla’s overall score is 57 out of 100 points. This scoring indicates a moderately attractive rating for Tesla in terms of risk and reward. Volkswagen is rated as very attractive in terms of Valuation, Expected Return (both 100 out of 100 points) and Economic Moat (80 out of 100).

Tesla is rated as very attractive in the categories of Growth, Innovation and Profitability. However, the company is rated as very unattractive in terms of Valuation and unattractive in terms of Expected Return (as according to my DCF Model).

This HQC Scorecard rating for Volkswagen strengthens my belief that the company can currently be considered as an appealing investment, particularly because of its very attractive Valuation, Expected Rate of Return (as according to my DCF Model) and Economic Moat. Tesla’s scoring reinforces my belief that the company is currently a hold. This is mostly due to its low scoring in terms of Valuation and Expected Rate of Return.

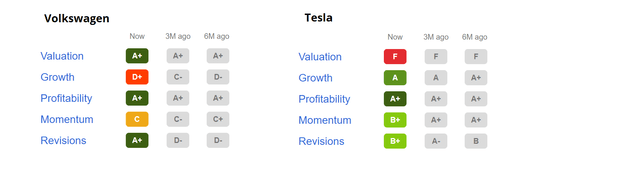

Volkswagen and Tesla According to Seeking Alpha’s Factor Grades

According to Seeking Alpha’s Factor Grades, Volkswagen is rated with an A+ in terms of Valuation. Tesla, however, is rated with an F in terms of Valuation. For Growth Volkswagen gets a D+, while Tesla gets an A. In terms of Profitability both companies are rated with an A+. In the graphic below you will find the overview of the Seeking Alpha Factor Grades for both Volkswagen and Tesla:

Source: Seeking Alpha Factor Grades

The results of the Seeking Alpha Factor Grades are yet another indicator that Volkswagen can be considered as much more attractive in terms of Valuation as compared to Tesla; however, in terms of Growth, Tesla is far ahead of Volkswagen.

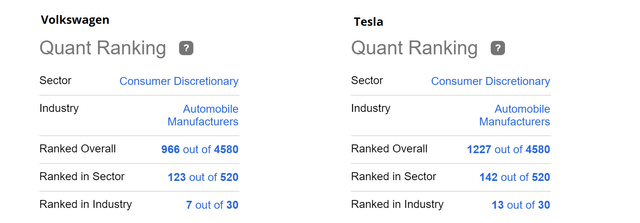

Volkswagen and Tesla According to Seeking Alpha’s Quant Ranking

The results of the Seeking Alpha Quant Rating also show us the more attractive positioning of Volkswagen in each ranking as compared to Tesla. The Overall Ranking of Volkswagen is 966 while Tesla’s is 1227 (out of 4580). In its sector Volkswagen is ranked on position 123 while Tesla is ranked at 142 (out of 520). Within the industry Volkswagen is ranked 7th and Tesla 13th (out of 30).

Risks

One of the risk factors that both Volkswagen and Tesla have in common is the fact that the automotive market is highly competitive, particularly the market for electric car-vehicles. Proof of this is the fact that a significant and growing number of both already established and new automobile manufacturers have entered the market for electric car vehicles, as well as other alternative fuel vehicles and the market for self-driving technology.

But when it comes to risk, there is a clear difference between investing in Volkswagen and investing in Tesla in my opinion. While Volkswagen has a very low P/E (FWD) Ratio of 3 and the current valuation of the company’s share is not linked to high growth expectations of the company, the case is clearly different for Tesla. Due to Tesla’s high P/E (FWD) Ratio of 70, the share price could fall significantly at any time if the company is unable to meet the high growth expectations in the future.

An additional risk factor when investing in Tesla is the fact that the company is highly dependent on the services of its CEO Elon Musk. In the case that Elon Musk had to leave the company, this could have immense consequences on its brand image, ability to innovate, the brand loyalty of its customers and finally on Tesla’s revenue and profit margins.

Taking into consideration the risk factors mentioned above, I see much less risk from investing in Volkswagen than investing in Tesla. These factors also contribute to my buy rating on the Volkswagen stock and my hold rating on the Tesla stock.

The Bottom Line

My Discounted Cash Flow Model indicates that Volkswagen is currently undervalued with an upside of 145%. The DCF Model calculates a fair value of $471 for Volkswagen. For Tesla, the same model calculates a fair value of $570, resulting in a downside of 22.7%.

According to the HQC Scorecard, Volkswagen scores 68 out of 100 points. The HQC Scorecard shows us that Volkswagen can be classified as attractive in terms of risk and reward. It can also be highlighted that Volkswagen is rated as very attractive in the categories of Valuation, Expected Return (as according to my DCF Model) and Economic Moat. Tesla, however, is rated with 57 out of 100 points, showing a moderately attractive scoring in terms of risk and reward according to the HQC Scorecard. In the categories of Valuation and Expected Return, Tesla is rated with significantly lower scores in comparison to Volkswagen. The Seeking Alpha Factor Grades also show Volkswagen to have better scoring in terms of Valuation in comparison to Tesla, although Tesla scores significantly higher in terms of Growth.

In my opinion, Volkswagen is currently a buy. The company’s very attractive valuation and the upside potential of the stock strengthens my opinion of a buy rating for the German car manufacturer.

At the same time, I rate Tesla as a hold. This is particularly due to the company’s high valuation and the low expected rate of return as according to my DCF Model. Furthermore, the company’s high P/E Ratio shows that the share price could drop significantly at any time if the growth expectations of the company are not fulfilled in the future. For this reason, I would only invest a small proportion of an investment portfolio into Tesla when deciding to invest in the company.

Thank you for reading and I would appreciate any feedback on this analysis!