Video Interview: Energy, Geopolitics And The Transition

Hiroshi Watanabe/DigitalVision via Getty Images

The Fed’s energy conference offered information and analysis in one place that would be otherwise hard to obtain. Seeking Alpha’s Michael Hopkins interviews Jennifer Warren about her attendance at the conference. She engaged with experts and executives at the conference, posing a number of questions to them. (Video link follows with commentary and analysis.)

Michael Hopkins Interview Jennifer Warren about the Fed’s conference findings (Jennifer Warren, Concept Elemental)

Video Interview: New Energy Landscape: Afterthoughts from the Fed’s Energy Event in Houston, Nov 2022

The following is a quick trip around the video interview’s content.

In oil markets:

We’re in a new paradigm with producing and consuming nations. The U.S. is an energy powerhouse and policymakers play a role. The idea that: “We would like it to be one way, but really it’s the other way,” resonated for some participants.

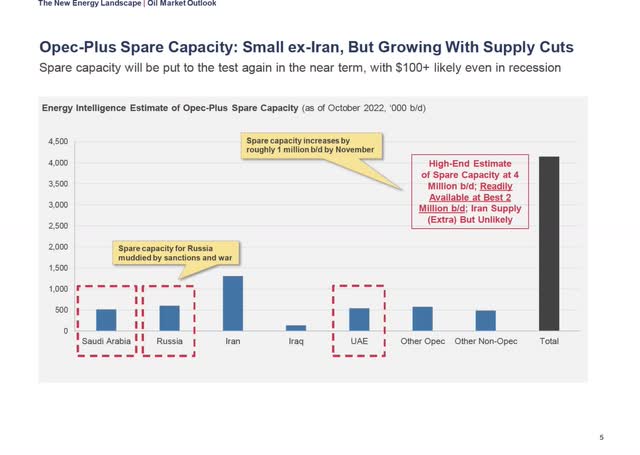

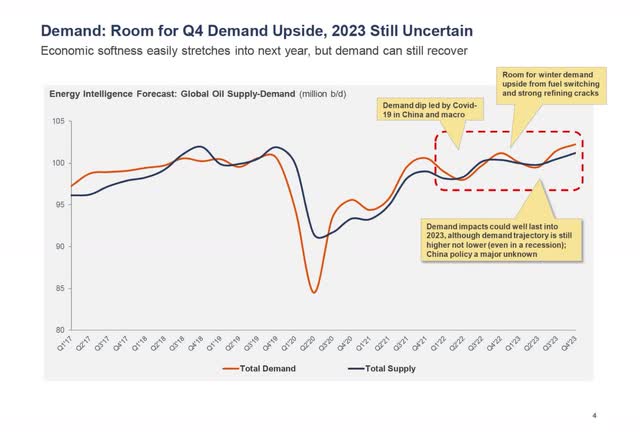

A lack of spare capacity is a key factor in oil market tightness, resulting from underinvestment of the last many years, pandemic-effects, and geopolitical turbulence.

Changing oil paradigm (Transversal Consulting, Wald)

Oil spare capacity (Energy Intelligence, Rajendran)

Oil market tightness (Energy Intelligence, Rajendran)

In natural gas…

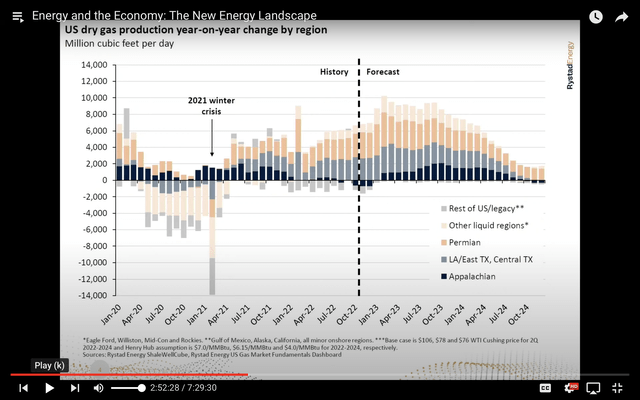

Natural gas production grows. And LNG is a proxy for this. In the U.S., the Haynesville and Permian basins have picked up some of the slack in the market owing to Appalachia’s takeaway capacity issues.

Gas basins (Rystad, Allen)

In the Energy Transition and Low-Carbon Quests

Battery power was cited as a poster child for some of the challenges. Generally, commodity prices are high, also for minerals; and many of these markets are opaque with poor governance. It doesn’t mean we don’t try to effect change, but we need “humility” with our direction, a directly quoted thought.

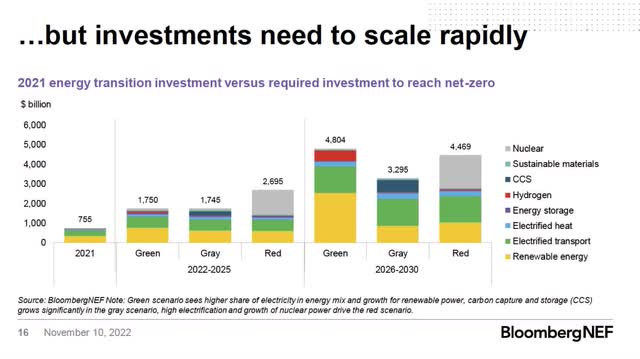

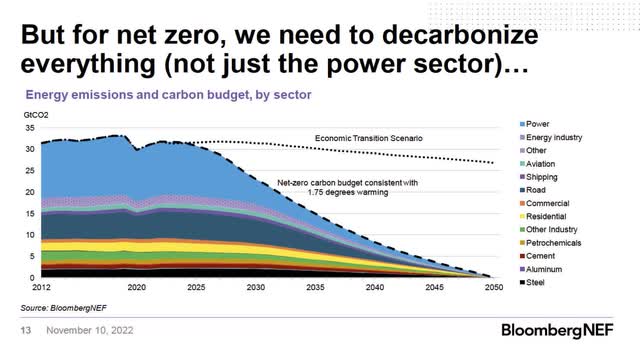

Investments needed for the energy transition (BloombergNEF, Sethia)

The decarbonization quest is a heavy lift. Net zero is a challenging idea and maybe not the best goal. Pathways to transition – rather than a hard and fast goal are thought to offer brighter prospects. We need the economy to stay intact while we look in a better direction. The range of investment needed to fund the transition as it is put forth in some camps would cost $2 – 6 trillion per annum for some number of decades.

How much decarbonization is needed (BloombergNEF, Sethia)

The conference video is available until roughly December 9th.

The following stocks or funds were mentioned as examples and as reference points: (AMZA), (XOP), (NYSEARCA:XLE), (NYSEARCA:UNG), (USO), (SHEL), (XOM), (CVX),(NASDAQ:ICLN), (TELL), (COP), (JPM), (BHP), (PXE), (PXD), (EOG), (DVN), (OXY), (CRC),(BP), (OTCPK:EDRVF)

Global Energy Dynamics: Video Interview (Link)

Interview with Jay Hatfield, AMZA (Jennifer Warren, Concept Elemental)