Vacasa: Long-Term Bull Thesis Holds, Faces Near-Term Headwinds (NASDAQ:VCSA)

courtneyk

Description

I believe Vacasa (NASDAQ:VCSA) is still worth a lot more than it is today, as I have mentioned in my initial post. That said, I would caution investors that VCSA could face a period of “winter” as no incremental investors are likely to purchase the stock until VCSA shows improvement in executions. Vacations have proven to be in high demand again as people are eager to go places. Long term, VCSA’s rental management platform is still well positioned in the market, as vacation rentals are becoming more popular than hotels, and demand for home rental bookings has been increasing across its various multichannel distribution channels

3Q22 Review

At a high level, my thesis on travel recovery was correct, and VCSA is riding on it. The sharp drop in stock price after earnings, I believe, is due to an EBITDA miss caused by operational cost headwinds (more below).

In its 3Q22 earnings report, VCSA management focused on a number of key themes:

- In the third quarter of 2022, bookings and revenue both surpassed projections, marking a successful close to the summer season.

- Bookings slowed down in October, and it’s now expected that supply growth will slow down by the end of the year 2022.

- The company says that the poor performance and comments on adjusted EBITDA are due to poor use of the new CRM system and the need to shift the property growth strategy back toward individual properties.

In general, I believe that the key investor debate in the online travel and shared accommodation sub-sectors will continue to focus on a combination of consumer demand and supply growth over the next 6–12 months. I believe that for VCSA, executing on supply growth and driving operational efficiencies will be crucial to regaining creditability with the markets.

In the long run, I still think that VCSA has a solid growth path because alternative accommodations are becoming more popular with consumers and getting a bigger share of the market, which is a long-term trend in the travel industry.

EBITDA miss was badly received by the market

Even though VCSA beat the consensus on revenue by 5%, it did not meet expectations for 3Q adjusted EBITDA by 22%. Also, even at the high end, the 4Q Adj. EBITDA loss forecast of $65-75 million was much lower than the consensus estimate of $37 million.

Notably, VCSA is addressing issues with operational efficiency across its entire cost structure. The S&M team’s performance has dropped since the implementation of the new CRM system. Although management is optimistic that these challenges have been mitigated and that productivity has returned to pre-technology levels, the future of productivity enhancements remains unclear. As a result of weaker-than-anticipated supply growth, looming macro headwinds, and operational difficulties in achieving desired salesforce efficiency metrics, the rate and certainty of future S&M cost leverage have slowed. Furthermore, both near- and long-term profitability estimates are currently under pressure because sales force efficiency is a crucial factor in achieving VCSA’s long-term Adj. EBITDA target of 18–22%.

Also, VCSA’s overexpansion of its support and operations teams hurt the company’s ability to leverage its fixed costs during the quarter. Even though progress has been made to right-size the organization and change how VCSA approaches and manages its support organization, it is hard to say when these cost headwinds will be completely fixed. I also think that it will be harder to reach these goals in 2023 because of the high decremental margins that are likely to come with falling ADRs. Even though the macro environment is tough and the company is facing operational headwinds, management has said again that they expect to be profitable in terms of adjusted EBITDA in 2023. This shows that the company has some faith in its ability to get its cost structure right as we move through next year.

Valuation

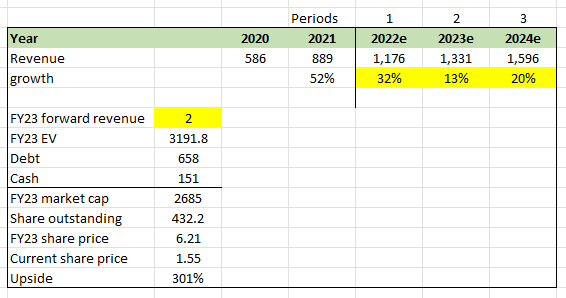

Despite the unfavorable short-term operational headwinds, I believe VCSA is worth much more than it is today. My model has been updated to reflect the general consensus of lower expectations for the coming years:

- Revenue growth will slow from the high 20s to the mid-to-low 20s in FY23 and FY24. While I believe the strength of the travel recovery may exceed this, I am using consensus estimates to reflect what the market believes.

- I continue to believe that VCSA should trade at a higher multiple than it does today, given its expected growth, strong industry tailwinds, and where peers such as Airbnb, Bookings, and Expedia (EXPE) trade. However, as long as VCSA can maintain its growth trajectory, we don’t need a strong inflection in multiples to make good returns here. As a result, I assumed VCSA could return to 2x, where it was a few weeks ago.

Own estimates

Summary

VCSA is currently undervalued at its current share price as of this writing. Overall, I believe VCSA will continue to be a leading provider of vacation rentals and will benefit from secular tailwinds. And, as we move through FY23, the new CEO, Rob Greyber, is making changes in leadership that may result in improved demand and operations.