United Airlines Q3 Earnings Review: More Than Just Sector Tailwinds

Jetlinerimages

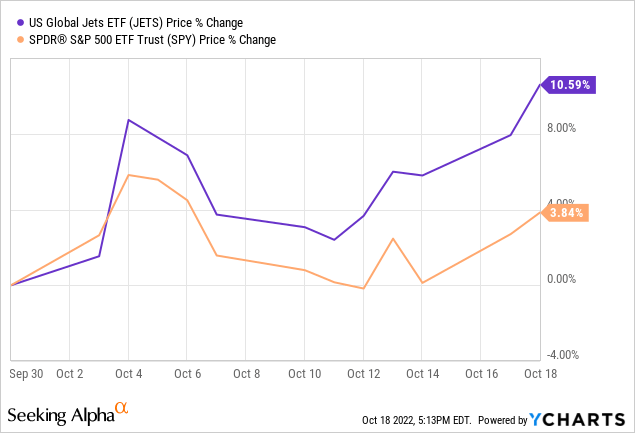

If there has been an early winner in the current Q3 earnings season, it is probably the airline space (JETS). Since the start of October, US-based air carrier stocks have roared back to life (see chart below), after about 18 months of pitiful market performance. Following United Airlines’ (NASDAQ:UAL) most recent mic-dropper, the sector should climb even further.

The Q3 headline numbers were inspiring: United’s revenue and adjusted EPS beats of $140 million and 53 cents, respectively, were among the three widest delivered in the past 20 quarters. But what impressed me the most laid hidden under the hood. The company’s excellent Q3 results seem to reflect more than mere industry-wide tailwinds, but also the company’s strong execution.

United Airlines: Blue skies

After peer Delta Air Lines (DAL) wowed analysts and investors late last week by delivering total revenues and unit revenues that surpassed pre-pandemic levels, United showed that the rising tide (or air currents) might be lifting all boats (or planes). Sky-high demand for air travel services and consumers’ willingness to pay what it takes to return to “normal life” after the COVID-19 crisis were key tailwinds in Q3.

United delivered passenger revenue per available seat mile (a measure of monetization of the existing capacity) that grew by more than 23% over pre-pandemic levels. Despite the rising costs to travelers, load factor (an occupancy metric) climbed 120 basis points above pre-COVID days to an astonishing 87.3% — picture packed aircraft with passengers paying up a hefty sum for their seats.

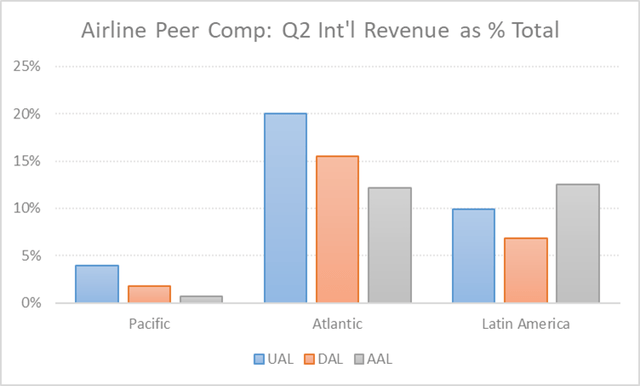

International travel restrictions, lockdowns in parts of the world, and remote work were key themes in the pandemic recovery period through only a few months ago. As a result, airlines that flew predominantly domestic routes seemed better positioned to ride the early innings of the rebound in air travel. The opposite seems to be true now, with United reporting some of the best operating metrics (e.g., capacity, per-unit revenues, occupancy) in its EMEA and Latin America routes.

For reference — and in part justifying my cautious bullishness towards UAL — the Chicago-based carrier is the most international of the three US legacy players, at over one-third of total revenues in Q2, as the chart below depicts (note: United’s Atlantic bucket includes EMEA and India).

DM Martins Research, data from airlines’ investor relations pages

The great news above could be merely a function of the broad recovery in air travel at large. But to United’s credit, the company did a great job (1) managing the sector-wide capacity constraints by delivering available seat mile decline of 9.8% vs. 2019 that was better than the 11% guidance, and (2) CASM-ex (a unit measure of operating costs that excludes certain items, like fuel) increase of 14.5% that fell short of the 16% to 17% expected. I believe UAL’s post-market rally of 7% to be largely a reflection of these couple of factors for which the management team deserves to take credit.

United Airlines will hold its earnings call on Wednesday, October 19, starting at 8:30 a.m. EST.

Cautious bull

I maintain my view that the airline space is a tricky one in which to invest today. At a high level, betting on such a procyclical sector is most appropriate during the early stage of recovery in economic activity. Instead, what I see happening today is a long overdue rebound in travel demand that could still be severely dented, should inflation and rapidly rising interest rates lead to something that resembles a recession next year.

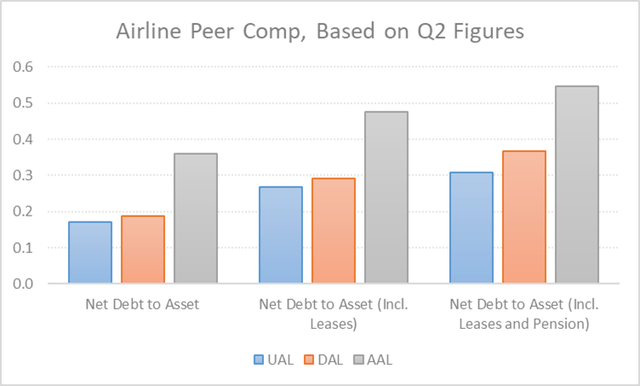

DM Martins Research, data from companies’ investor relations pages

Still, were I to pick winners and losers in the airline industry to place a long-short bet, for example, I would probably favor UAL alongside DAL in the legacy US airline subgroup. I like the company’s exposure to international markets, as discussed above, as well as a net debt position that looks very appealing (see chart above). It does not hurt that the stock remains deeply discounted relative to the pre-pandemic period: down 58% since the end of 2019.