U.K. Bond Market: Insights From The Recent Downturn

G0d4ather

By Paulina Lichwa-Garcia

The past few weeks have been extraordinary as U.K. politics and financial markets entangled, resulting in GBP-denominated debt becoming both shaken and stirred.

Gilts, bonds issued by the U.K. government, were hit particularly hard on the back of collateral calls in the liability-driven investment pension crisis. Gilts saw their yields reach multi-year highs, especially in the long duration segment.

As Rishi Sunak took over as Prime Minister at the end of October, some calm returned, after the bond vigilantes’ spell. While the new government focuses on sending a message of stability, for the GBP bond market, there is more of an afterthought to look at. Gilts’ reputation as safe-haven instruments has been hurt, but for the British pound sterling bond market, questions arise about what potential opportunities are out there for fixed income investors and how they compare to other markets.

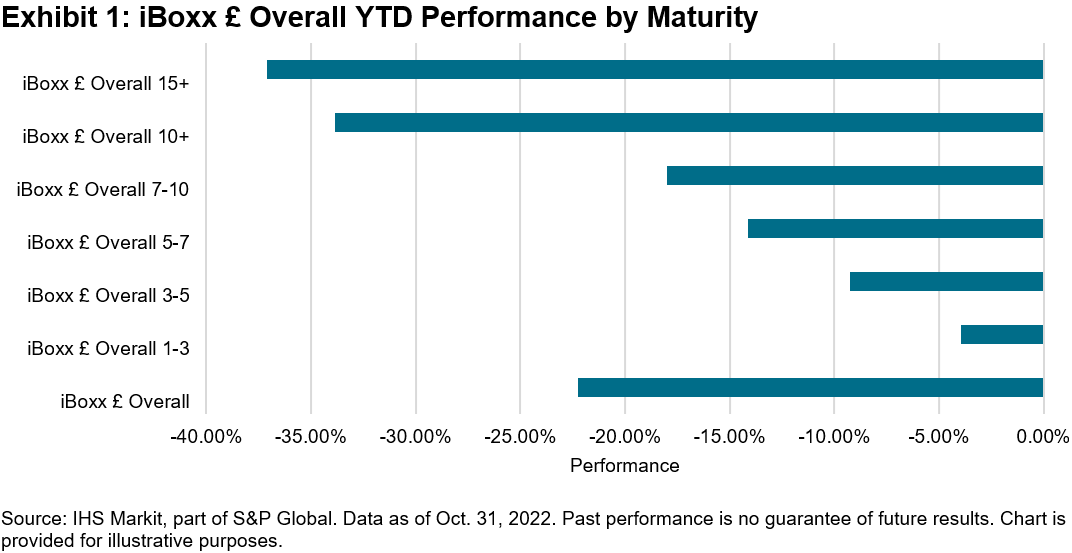

Taking a step back and looking at the broad fixed income category, the global bond market has been having a tough year. The longer duration segment, which has been hit hard in the recent volatile market environment in the U.K. and globally, has seen the biggest losses due to rising interest rates. Exhibit 1 shows the YTD performance of the iBoxx £ Overall in different maturity buckets since the start of the year.

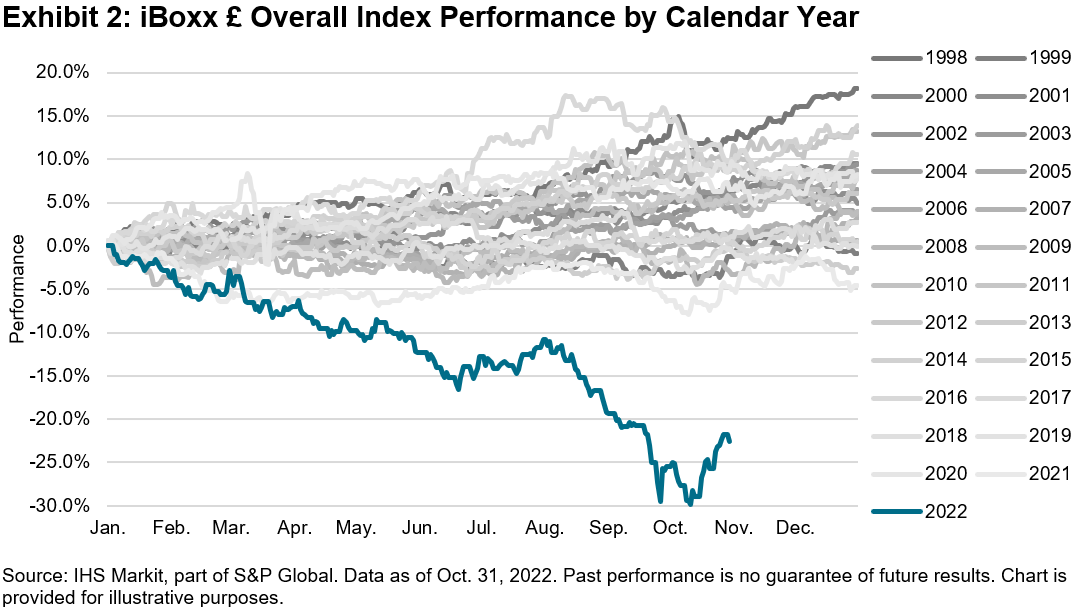

Exhibit 2 shows the daily YTD return of the broader GBP debt market over more than 20 years. The performance in 2022 clearly stands out even before the political and financial volatility in October.

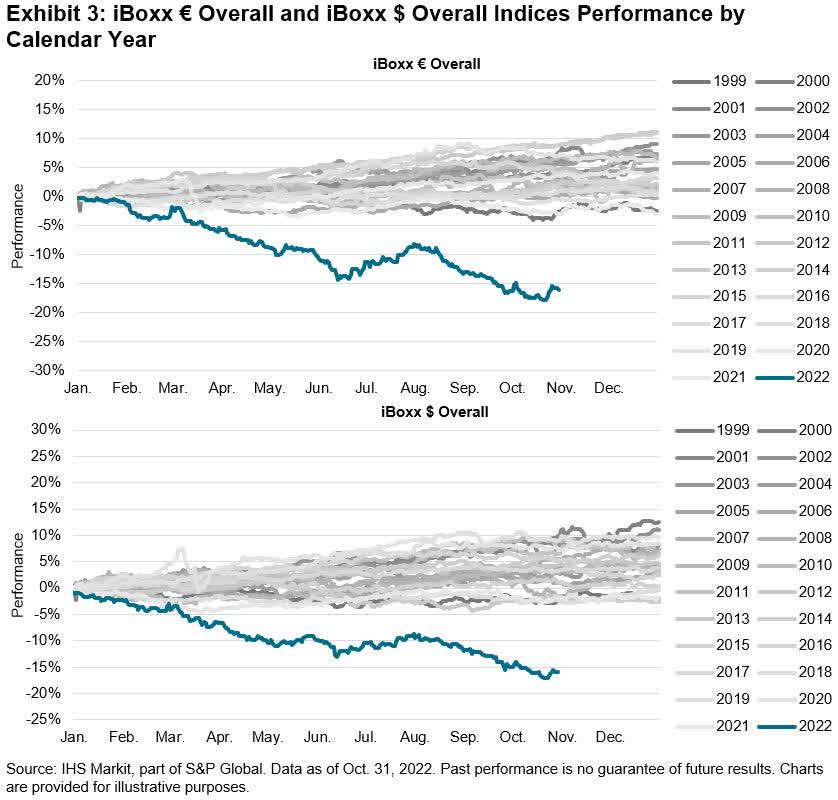

We compared these results with the EUR- and USD-denominated debt markets, and they followed a similar trend. The difference, of course, is in the magnitude of these slumps. While iBoxx £ Overall YTD returns were at their lowest in mid-October, at -29.81% on Oct. 12, 2022, the iBoxx $ Overall declined about 16%, while the iBoxx € Overall shed about 17% over the same period. The energy crisis and hard-to-tame inflation have been key contributors to these declines, as central banks around the world have embarked on hiking interest rates.

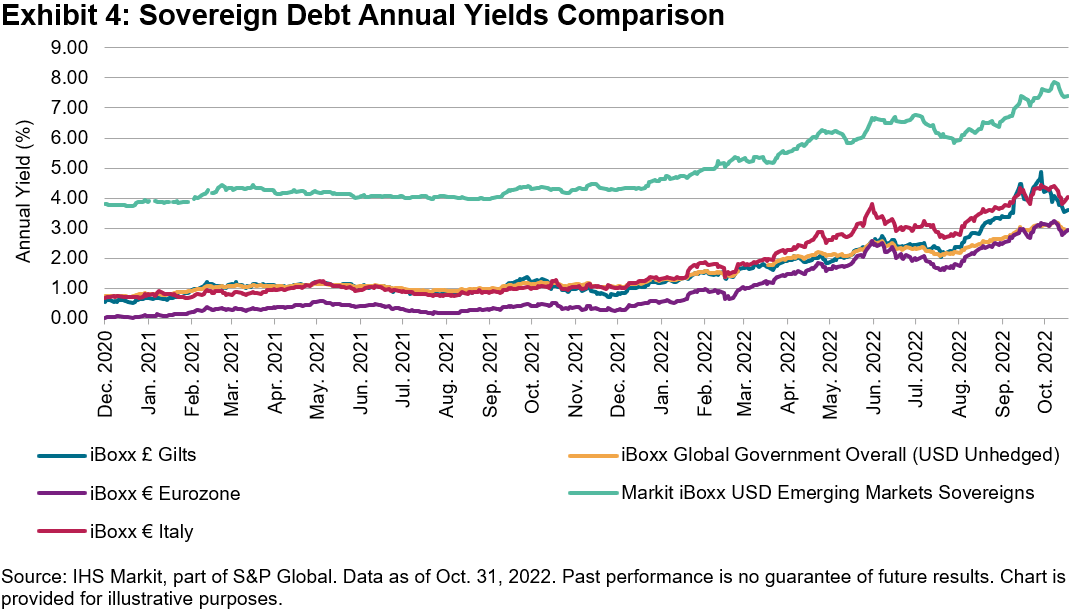

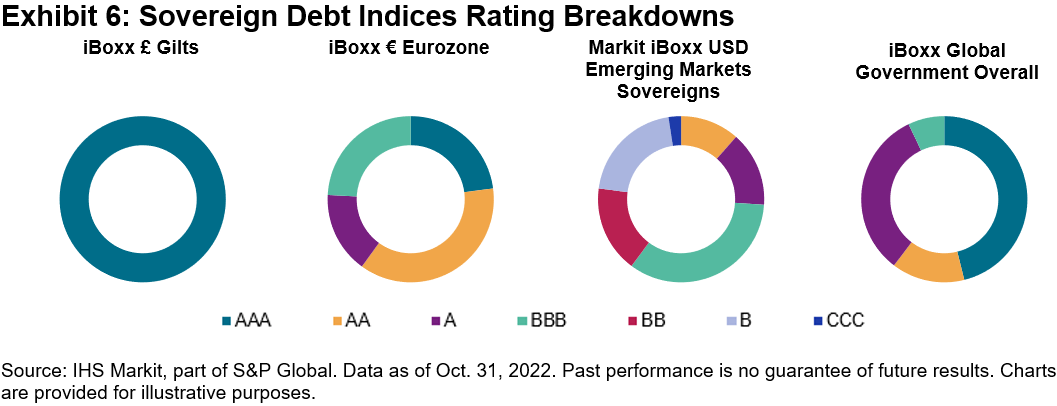

The annual yields on the iBoxx £ Gilts spiked considerably amid the post-mini budget crisis, compared to the iBoxx Global Government Index, a basket of debt from developed markets. At their peak, U.K. gilt yields also outpaced those of Italy’s bond market, which posted multi-year highs after the country’s September elections. Amid the rally, the U.K.’s cost of debt narrowed its spread considerably even compared to emerging market yields on Oct. 12, 2022. Exhibits 5 and 6 are reminders of the respective duration and credit quality of these indices.

The past weeks have seen the GBP bond market move into new territories. As the shockwaves of these events are being digested, the fixed income market will no doubt stay vigilant of signs of cracks in other bond markets, as well as potential opportunities brought on by this market rout.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.