Twilio Stock: Absolute Disaster (NYSE:TWLO)

AegeanBlue/E+ via Getty Images

This market has been extremely unforgiving to stocks of companies that have little to no earnings. Innovative tech, cloud, and software as a service type stocks have seen their valuations erode from sky high valuations, to valuations that are still stretched, even with some of these stocks down 50, 60, 70% or more in some cases. It has been an absolute disaster. But the market was not entirely incorrect here. Take today’s case of Twilio (NYSE:TWLO) – a once darling of tech investors a year or so ago. The company has been in strong growth mode, no doubt. But it still loses money. And now the pace of growth is slowing. The Street is dumping shares heavily. Given short interest is very low here, it suggests the selling is institutional money managers who are getting hurt badly, taking retail investors with them. On top of that, we will see some strong tax-loss selling into the year-end, and TWLO and similar stocks are prime candidates for tax-loss harvesting. Folks, it is not good. We think you have to avoid the stock for the next quarter or two until the dust settles, interest rate hikes stop, and the company can demonstrate that it can improve both its efficiency and regain the strong level of growth it was once accustomed to. Let us discuss.

Headline results were actually strong

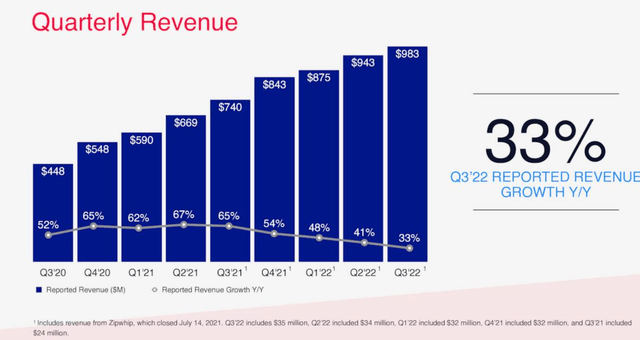

So the recently reported Q3 earnings were actually better than expected and largely exceeded consensus estimates. That was some good news for sure. The company is still growing revenues tremendously; however, the pace of growth is slowing and that is a negative. However, with the immense collapse in shares before earnings, this reduction in sales growth was largely priced in. Still, the growth is quite strong. It is not all horrible news on the past earnings, but the future is murky now. Revenue growth is stalling.

The revenue came in at $983.0 million, up 33% year-over-year, including $34.8 million of contribution from the Zipwhip addition. Further, organic revenue grew 32% year-over-year. That was solid.

Expenses are still an issue

The company is spending money to make money. That is how it works for all of these companies. But constantly losing money in a rising rate environment is a massive problem because any future need for debt or debt refinancing is becoming extremely expensive. That is why all of these innovative growth names did so well during the pandemic; rates were at zero. So these companies need to be wise with their use of debt and cash, and work toward profitability. The thing is, this company was on a path to profitability and was looking to be EPS positive next year. Tough to see it happening now.

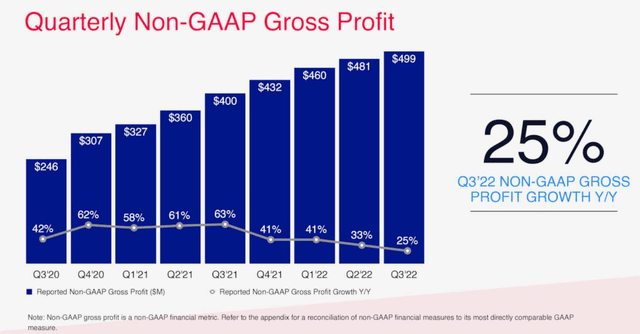

Cost of revenue was up 39% to $521 million. Gross profit was up though to $462 million, but the margin was down from 49% to 47%. Total gross profit percentage continues to fall on an adjusted basis too.

Research costs were up to $284 million from $210 million last year. Sales and marketing spiked to $329 million from $264 million. General expenses also rose about 10% to $135 million while there were also restructuring costs and impairment charges, leading to operating expenses of $919 million. Folks, operating loss doubled from a year ago. Loss from operations was $457.0 versus $232.3 million a year ago. Sadly, adjusted operational loss was $35.1 million, whereas a year ago there was adjusted operational income of $8.2 million

However, while these expenses are all up from last year, the company is working (slowly) to reduce the percentage of dollars going to operating expenses. They have reduced adjusted operating expense as a percent of revenue from approximately 57% in Q4 2017 to approximately 51% in Q3 2022. That is a hidden positive, but efficiency needs to be the name of the game moving forward in our opinion.

Net losses not as bad as expected, but losing money

Putting it together, there was a net loss per share of $2.63 based on 183.7 million weighted average shares vs. a loss of $1.26 based on 177.2 million weighted average shares a year ago. That is another issue, more shares being issued. Harder to reach profitability per share with dilution. It is common in this space for a lot of stock-based compensation as well as share issuance to raise money. Adjusted loss per share was $0.27, beating consensus by $0.08.

The outlook sparked a collapse

So not only has revenue growth come into question, but the outlook going forward was a disaster. This comes despite Twilio having more than 280,000 active customer accounts to end the quarter compared to 250,000 a year ago. But why such a catastrophic set of losses? Like many companies, they are facing big short-term headwinds. We think the long-term opportunity remains strong, but we have to let the selling be completed. There could be sizable more downside if institutions are unwinding. Couple that with tax-loss harvesting now, and you can see how pressure can remain.

The guidance is horrific. Revenue for Q4 is $995-$1.005 billion, which is growth of just 18-19%, way below expectations for about $1.07 per share. The company still sees losses from operations of $10 million at the midpoint (many had expected possible operating income for Q4). A loss per share of $0.06-$0.11 is now forecast, which is not has horrific as it seems as consensus was for losses of $0.11. Keep in mind that stock-based compensation will continue. In the conference call, management noted that they want to reduce this compensation to 15-20% of revenue. That is still disgustingly high. Profitability will elude the company long-term in our opinion. But, management is starting to get it. They also are looking over the next “three to five years out, expect sales and marketing to come down by 300 to 600 basis points and both R&D and G&A to gain some modest efficiencies.”

So the guidance was terrible, and then analysts piled on. There was just a ton of downgrades and target cuts. That added fuel to the fire.

Final thoughts

This is a very toxic stock right now. Sure, the company itself is growing. But the stock is now about 90% off its all-time high. That is wild, and it can get worse, since despite the growth and Q3 beat, many key metrics are weakening right before our eyes. Management’s forecast show revenue growth is stalling. Margins are a concern. Expenses are high. Dilution is a concern. It appears institutions are unwinding, while tax loss harvesting is all but guaranteed the next few weeks. The company has about $1 billion in debt, and $600 million in cash. If the company can get to growing free cash flow, the high rate environment is not as massive as a risk as it may seem, but right now, management has a lot of work to do to regain the Street’s confidence. Avoid the stock.