Trick-Or-Treaters Will Bag Less Loot As Halloween Candy Prices Eat Into Sales Volumes

solarseven/iStock via Getty Images

After months of scary headlines on rattled supply chains and possessed prices, US consumers are ready to bury the gloomy news and ring in the holiday season, starting with Halloween.

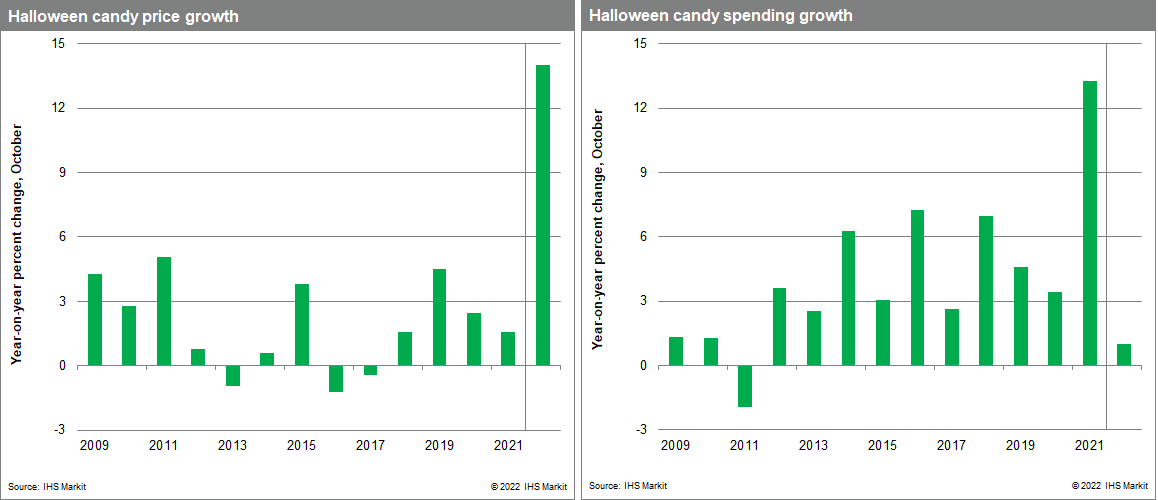

The National Retail Federation expects spirits to be high this All-Hallows’ Eve, with a share of families celebrating back to pre-pandemic levels. Homeowners will be keen to deck out all the new homes purchased over the last two years with ghoulish goods and goodies. Just as with house prices they should beware-y of BOO-ming candy prices that are estimated to be up 14% from last year!

Children, however, are not easily scared, and parents are still expected to spend $3.2 billion on candy this Halloween – a record amount, which works out to about $25 per household.

The dollar doesn’t go as far as it used to, and that’s especially true for candy. A dollar spent this Halloween will get you 12% fewer candies than last year as inflation stalks shoppers this season. The faint-hearted are best advised to use old decorations and DIY their costumes to leave enough in the bank to satisfy the sweet-toothed gremlins at home.

IHS Markit

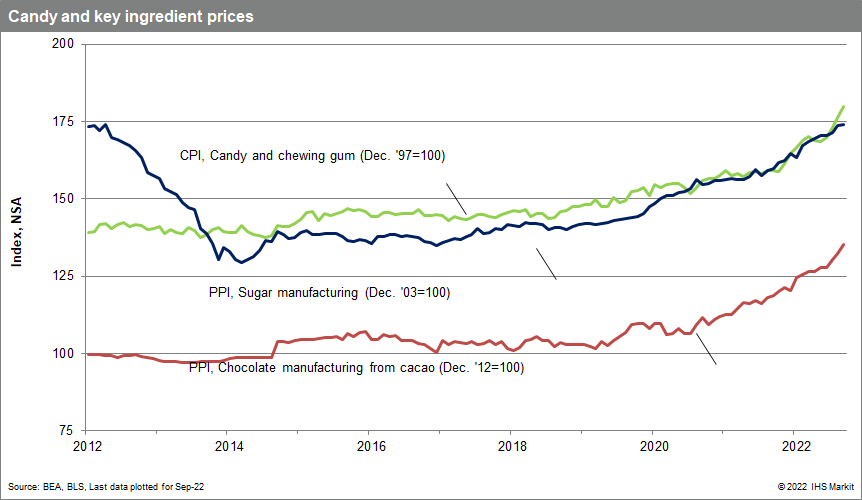

Candymakers aren’t sleeping well at night, either, as input prices have surged over the last year: chocolate and sugar have seen price increases of 14% and 9%, respectively, over the last 12 months.

BEA, BLS

Growth in retail sales has also been slowing in recent months, and retailers are betting that this holiday season, starting with Halloween, will help them break the curse. Compared with last year, when lines at California ports were at their longest, supply chains won’t haunt us this season and retailers should have plenty of candy.

Retail inventory levels, overall, are at record highs, in part because retailers haven’t been able to keep up with the shifting consumer preferences. As of August, inventory levels are at $551 billion, up from $464 billion last October. Consumers can look forward to saving more on the TVs, exercise bikes, and furnishings hovering around warehouses, even if it costs a bit more to conjure up ghosts and ghouls on the front porch this season.

Discounts won’t be the only treat consumers get this year. Average hourly earnings are up 5.0% from a year ago and real income growth is expected to return this quarter. Households also are using some of the $2.4 trillion in “excess savings” accumulated over the course of the pandemic to keep up their spending.

As the specter of recession looms large, retailers will be keeping a keen eye on candy sales to gauge the health of consumer demand going into the 2022 holiday season. While 2022 won’t top the record set in 2021 for quantity purchased, we still expect a 1% y/y increase in spending, bringing the total spent to a new record of $3.2 billion this October.