Toast: Solid Growth Prospects But Competition Is Growing (NYSE:TOST)

ShutterOK

Cloud-based restaurant management software company Toast (NYSE:TOST) has been growing at a robust pace; for the fiscal year ended December 2021, revenues soared 107% YoY to 1.7 billion, and GPV jumped 124% YoY to USD 57 billion. Toast was used in approximately 57,000 restaurant locations by the end of the year.

The momentum continued in 2022. For the quarter ended June 2022, total locations soared 40% YoY to approximately 68,000, and revenues jumped 58% YoY to USD 657 million. Overall profitability improved during the quarter with net losses falling to USD 54 million compared with USD 135 million the same quarter a year earlier. Prospects for the coming year appear to be robust with management raising their full-year revenue guidance, with full-year revenues expected to be in the range of USD 2.62 billion to USD 2.66 billion (from USD 2.5 billion to USD 2.55 billion previously).

Longer term, there is reason to be optimistic about Toast’s prospects with the company poised to benefit from several tailwinds.

Restaurant location growth and higher product adoption among existing customers

The pandemic accelerated restaurant adoption of new technologies notably in the areas of omnichannel ordering, delivery, and rewards among others, a trend that has benefited cloud POS providers such as Toast and Olo (OLO). Post pandemic, there are several factors to support continued adoption going forward including persistently declining restaurant profitability (restaurant margins have been declining for years), labor shortages and rising inflation which should drive restaurants to invest in technology enhancements to cut costs, increase operational efficiency and improve customer experience. Moreover, restaurant cloud POS market penetration has surpassed 20% in the U.S. (a critical figure according to the Diffusion of Innovation Theory, that turns a new technology from a novel innovation used by a few early adopters to a more ubiquitous technology with broader acceptance).

With just about 50% of America’s 800,000 or so restaurants expected to have adopted cloud POS in 2022, that leaves an untapped market of thousands more restaurant locations. Toast, with 68,000 locations, has a market share of about 7% of U.S. restaurant locations, and further gains could be possible with the company actively expanding its product offering through a combination of acquisitions and R&D to strengthen its value proposition and market positioning. Toast management for instance highlighted in their latest earnings call that their win rate was higher when making quotations with Sling than without (Sling is an employee management solution they acquired in July 2022, the addition of made Toast’s platform more attractive amid a tight labor market).

The company has been acquisitive lately (apart from Sling, Toast acquired restaurant inventory management solution provider xtraCHEF in 2021) and they have been actively investing in R&D in areas including product innovation (20% of their R&D budget is invested in medium and longer term growth initiatives) and product development (such as developing platform stability and scalability to support “hundreds of thousands of restaurants in the coming years”). Although a climate of rising interest rates may dampen their appetite for further acquisitions, their relatively low leverage (their total debt to equity is about 8%) leaves them with some flexibility to make acquisitions if required.

|

Toast |

Fiserv |

Lightspeed |

Block |

Olo |

|

|

Total debt to equity % |

8.00% |

67.30% |

1.74% |

31.28% |

2.77% |

|

Quick ratio |

2.73 |

0.32 |

5.28 |

1.16 |

9.54 |

Moreover, an expanding portfolio of software solutions and upselling efforts to increase adoption of their full suite of products to existing customers can also drive top line growth and profits as well; Toast noted that the number of Toast locations using four or more core products on top of Toast’s integrated point of sale reached 59% in December 2021, up from approximately 48% as of December 31, 2020 and approximately 37% as of December 31, 2019.

Enterprise customers and international ambitions

Toast is aiming to capture a share of enterprise customers. The segment has its share of strong rivals, from established players such as Oracle (ORCL) and NCR (NCR) to newer players such as Olo (who has an early mover advantage over Toast with years of experience serving enterprise customers and boasts 500 restaurant brand customers and 79,000 restaurant locations using their platform). Toast however does have the advantage of a relatively wider product offering (from POS, and payroll to inventory management and capital) versus Olo whose solutions are largely centered around online ordering which may help Toast gain some traction in the enterprise segment.

Another area of focus in Toast’s growth strategy is international expansion (no material revenue was earned outside the United States in 2021). While international growth presents a significant market opportunity (the global restaurant management software market is expected to grow at double-digit rates over the coming years), the company has limited operating experience overseas and their efforts are at very early stages and thus, it remains to be seen how successful this effort would be.

Risks

Near term risk from restaurant closures and bankruptcies. The majority of Toast’s customer base comprises SMBs who are more vulnerable to macro headwinds and rising interest rates, which could result in significant churn for Toast while any consumer cutbacks to restaurant spending could affect payments GMV and thereby impact financial technology solutions revenue which accounted for 82% of the company’s revenues in 2021). An inflation report by data analytics firm First Insight revealed that dining out topped consumers’ list of inflation-related spending cuts.

Longer term, competitive risks could dampen Toast’s growth prospects. The SMB cloud restaurant management space is already crowded with rivals including Touchbistro, Lightspeed (LSPD), and Global Payments’ (GPN) Vital to name just a few. Meanwhile, new entrants are ramping up their presence in the segment; enterprise restaurant SaaS company Olo is increasingly pursuing SMBs, while Fiserv (FISV)-owned SMB-focused restaurant management software provider Clover is doubling down on the restaurant space with its acquisition of SMB-focused digital storefront solutions provider BentoBox last year. Clover has now fully integrated BentoBox into its own platform, a move that increases its value proposition and potentially market share as well. With Fiserv’s resources at its disposal (Fiserv is profitable while Toast as well as other competitors such as Lightspeed and Olo are not), Clover could emerge as a very formidable competitor on Toast’s turf, limiting Toast’s growth prospects. Fiserv also has the lowest little short interest among major restaurant management SaaS players, suggestive of the company’s competitive strength and prospects, particularly amid a climate of rising interest rates.

| TTM | |||||

|

Revenue growth YoY % |

86.15% |

10.27% |

147% |

2.24% |

27.40% |

|

Net margin % |

-14.95% |

11.92% |

-56.06% |

-3.00% |

-22.06% |

|

Return on equity % |

-47.70% |

6.46% |

-12.53% |

-5.10% |

-5.70% |

|

Short interest |

4.13% |

1.87% |

5.09% |

5.47% |

15.89% |

More formidable threats could surface from deep-pocketed horizontal cloud giants Microsoft (MSFT), Google (GOOGL), and Salesforce (CRM) who are increasingly launching their own industry-focused versions of cloud products to counter market share erosion from vertical SaaS companies.

Summary

Toast is on a solid growth path and is well placed to benefit from the industry’s long-term growth. Location growth and higher revenue per location from continuous cross-selling could drive further growth in the foreseeable future while its enterprise segment and international expansion ambitions could propel longer term growth. Competition, however, is intensifying in what is already a crowded market which can limit growth prospects.

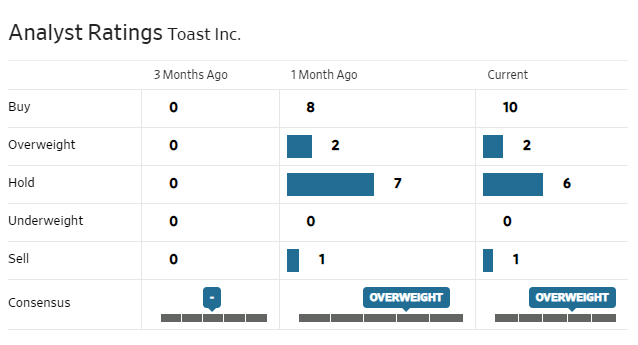

Analysts are mostly neutral on the stock.

WSJ

Source: WSJ