The Winter Of Our Discontent For Stocks

gguy44/iStock via Getty Images

A Holiday Humbug to You

This time of year, it is rather difficult to engage in a rebuttal of the bullish argument being made for the economy, and the markets. After all, this is a time of bullish sentiment when Santa Claus rallies are bandied about, and analysts of Wall Street firms are paraded on financial media to give their latest calls for a new S&P price target for the new year, that of course usually promises ever higher equity prices. This, of course, goes with the theme of the rest of the season. This is a time of celebration, vacation, and a look ahead to a new year, and a new start for many.

But this December, I cannot share in what I perceive to be pollyannish outlooks that consume most on Wall Street, calling for new highs in equities and that the US will avoid recession.

Call me Ebenezer Scrooge if you must, but I bring a big and resounding humbug to you. What is worse, is that I am not alone in my view. Many are feeling this sense that things are not good out there, and they are getting worse.

Consumers hit by the ravages of inflation, are seeing their dollar not go as far as it used to. Stores continue to be hit with supply chain issues that lead to lost sales as a result of products not being in stock. Workers, already hit with wages that are rising slower than the cost of goods and services, are now being hit with layoffs, a trend that unfortunately is likely to worsen as we move through 2023.

Corporate America is starting to realize things aren’t so good out there either, with 86% of CEOs stating they expect a recession in the next 12 months. They are putting their expectations into action, beginning to cut their labor force, pull back on spending, and prepare for what Jamie Dimon, CEO of JPMorgan Chase called the impending “hurricane.”

Big bank CEOs have stated they are seeing revolving debt balances build, and growth in spending slow, a counterpoint to the “the consumer is strong” argument we hear all too often from Wall Street. This is shaping up to be, in the words of Shakespeare, the winter of our discontent.

Even the rare voice on Wall Street is feeling that all is not well. Mike Wilson of Morgan Stanley recently said the earnings drop-off in 2023 could rival 2008.

“US equities are set for their worst year since the global financial crisis, and, according to Morgan Stanley strategist Michael Wilson, corporate profits are about to meet the same fate. A looming earnings recession “by itself could be similar to what transpired in 2008/2009,” said Wilson. That could spark a new stock-market low that’s “much worse than what most investors are expecting,” he wrote in a note. “Our advice – don’t assume the market is pricing this kind of outcome until it actually happens,” Wilson said. The strategist – a stalwart equities bear who called this year’s slump – said that although inflation has started easing from historic highs, recent signs of weakening in the US economy were worrying.”

Popular Delusions and Unpopular Realities

In the 1841 classic Extraordinary Popular Delusions and the Madness of Crowds, author Charles Mackay presents the psychology of crowds in a manner that has stood the test of time.

” In reading the history of nations, we find that… whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first…Money, again, has often been a cause of the delusion of multitudes. Sober nations have all at once become desperate gamblers and risked almost their existence upon the turn of a piece of paper… Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

It offers investors lessons down to our present day of how things get out of hand, as investors speculate wildly on asset prices, and then inevitably come back to reality in a collapse with severe consequences to the wealth of investors and nations.

“At last, however, the more prudent began to see that this folly could not last for ever… It was seen that somebody must lose fearfully in the end. As this conviction spread, prices fell, and never rose again.” – Charles Mackay

We already witnessed the popular delusions that sent asset prices to all-time highs in this cycle. “Real Estate never goes down,” “We need to buy this house at any price,” “T.I.N.A., there is no alternative [to stocks],” “Don’t Fight the Fed,” and my favorite, “Stocks always go up.” All of these are the artifacts of a period of excess. All heard before in one form or another, and all destined to be repeated in future periods of excess, in their new and convincing forms for the time.

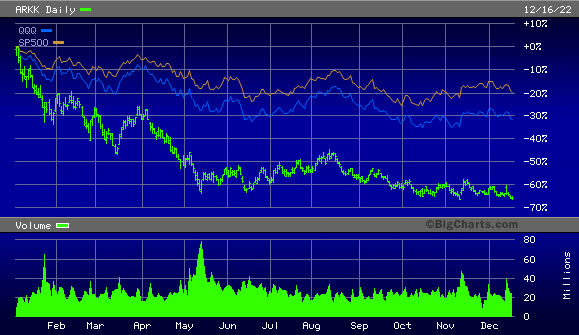

We saw many stocks trading at prices they had no business being valued at, and yet, there seemed to be no limit to the price that could be assigned to them. The ARK Innovation Fund (ARKK), Bitcoin, NFTs, FANG, and other speculative objects, had their prices justified as revolutionary artifacts of a new digital future with limitless possibilities. The exact same arguments we had heard in past periods, like the 2000 tech bubble, and other periods of excess.

Popular delusions have given way to unpopular realities. We are seeing the beginning stages of a collapse. A collapse I believe was so inevitable and predictable, yet whose timing remains uncertain. This condition was built on easy money, 0% interest rate policy, and quantitative easing which sought to push investors out on the risk curve, to stimulate the economy after the 2008 financial crisis.

Maybe a policy of good intention at the start, this can be debated, but the Fed was still buying mortgage-backed securities when unemployment was at all-time lows, housing prices were increasing at 20% per year, and the stock market was surging, with the S&P 500 gaining nearly 100% from 2019-2021, Nasdaq did even better gaining nearly 163% in this short period of time.

“The hard lesson of zero interest rates… was that as long as investors had the speculative bit in their teeth, no amount of speculation was too much, no matter how extreme from a historical perspective. I suspect that as this bubble unwinds, the hard lesson for others will be that as long as investors remain risk-averse, no amount of Fed easing will support the market – it certainly didn’t during the bulk of the 2000-2002 and 2007-2009 collapses. Indeed, even during the recent bubble, none of the net gains of the S&P 500 accrued in periods when market internals were unfavorable… Valuations always matter, but the immediacy of their consequences depends on market internals. Once extreme valuations are joined by unfavorable internals, the trap door swings wide open. ” – John Hussman, Ph.D

This year, we have begun to see the sobering of financial markets, as Bitcoin is down 75% from its high, ARK Innovation fund is down 60%, Nasdaq has fallen 30%, and the S&P 500 is down 20%. History provides a guide for investors as we move through this period. The market has certainly begun to erase some of the excess returns we saw in the speculative period, but markets have much further to go, in my view.

Bigcharts.marketwatch.com

Conclusion

“After all, you only find out who is swimming naked when the tide goes out.” – Warren Buffett, 2001 Berkshire Hathaway Annual Report

While opinions in the market are varied pertaining to the direction of equity markets, the prevailing opinion is that the U.S. will avoid recession as the Fed accomplishes a soft landing. I believe this ignores a tremendous amount of data in the economy, and financial markets that are pointing to a hard landing and deep recession. Take for example the inverted yield curve. Currently, the 2yr/10yr spread is sitting at -0.69% and the 3mo/10yr at -0.83%, the bond market is telling us all is not well.

The contrarian points made in support of the soft-landing crowd, such as strong employment, consumer spending, etc. are either backward-looking data in the case of spending or lagging data in the case of unemployment. In addition, the market is still trading north of 18x forward earnings even though the Fed has raised rates by nearly 500Bps. The mathematics tells us, the market has a long way to fall before it catches up to the reasonable fundamentals. This is especially true in tech stocks, where we have seen the tech-heavy Nasdaq fall 30% this year, but still carry a multiple north of 22x. This is going to be painful for investors, and it could last far longer than most expect. The Japanese market hit a high in 1989 and still today, 33 years later, has not recovered the high. Is the Japanese example a foreshadowing for US investors in this cycle? The answer is, we do not know, but it could be, as a recent article in the Financial Times articulated:

“Boaz Weinstein, whose New York-based Saba Capital was one of the world’s top-performing hedge funds in the market turmoil of 2020, said that the unwinding of central banks’ vast stimulus programmes in an effort to combat high inflation could lead to “doldrum” markets for a prolonged period. “I’m very pessimistic. There isn’t a rainbow at the end of all this,” Weinstein told the Financial Times. “[Quantitative tightening] is going to be a real headwind for investors.” “There’s no reason that this difficult [economic] period will only last two to three quarters [and] . . . no reason to think we’ll have a soft landing or a shallow recession,” he added…Developed markets, he said, “could certainly” follow the pattern of the Nikkei 225, which is still about 30 percent below its all-time high reached in 1989. “That changed the psychology about whether being a stockholder is such a prized” status, he added.”

I believe a market collapse is approaching, and investors should remain cautious as they seek to deploy capital on beaten-down equities. Many of these stocks are still too expensive, even after large declines in their prices. In such, an environment, I believe investors would be wise to take advantage of the enhanced rates being paid on cash, and fixed income securities to ride out the approaching hurricane.