The Untold Truth About Rental Investments

Feverpitched

Rental properties are some of the popular investments of individual investors and I understand why. The basic idea is very compelling:

You buy a property with the bank’s money. You let your tenant pay off your mortgage. And now you own a property free and clear that will generate cash flow for decades to come – all while the property also appreciates in value.

It can be a great way to use other people’s money to build your own wealth.

However, where I take issue with rental properties is that they are often presented as being “passive, safe, and highly rewarding” investments.

This idea is heavily pushed by brokers who want to earn a commission, as well as YouTubers and bloggers who, of course, are trying to sell you a course for rental investing.

But the reality is very different.

I would argue that in most cases, rental properties are actually very poor investments. They are very risky, require a lot of work, and the returns are mediocre at best.

And it is not as if I didn’t give it a good shot:

-

I come from a family of real estate entrepreneurs that put practically all their wealth into properties.

-

I have been studying real estate investments since I was a small kid, going from one property to another with my father.

-

I went to university to study finance with a specialization in commercial real estate.

-

I eventually went to work in private equity real estate.

-

And finally, I even bought rental properties myself.

So, if someone should be investing in rental properties, then it is me.

I was once convinced that the best way to compound wealth is to buy rental properties, but today, I think that it is one of the worst. I stopped working in private equity real estate, giving up the potential to earn a good salary, and decided to become a real estate investment trust (“REIT”) analyst instead, because I view it as a much better way of investing in real estate for the vast majority of people.

Below, I first tell the untold truth about rental properties concerning their risk and return prospects, and finally, I explain why I now invest most of my wealth into REITs instead of rentals.

Risk: perception vs. reality

Investors perceive rental properties as being safe investments based on a simple idea: we will always need a roof over our heads. After all, even in a recession, people still need a home to stay in. They are more likely to cut down on costs elsewhere. The rent gets paid first.

But here is why this perception of safety is wrong.

You are essentially making a large investment in a concentrated, capex-heavy, private, illiquid asset with limited income diversification, and high leverage.

If a rental property was a stock, it would be perceived to be extremely risky and its value would change 10s of percentage points every day.

Most often, people will buy a property with 80 or even 90% leverage. If you are 90% leveraged, this means that a 5% drop in the value of the property results in a 50% drop in your equity. That’s what you see in the stock market. It is the equity value that’s traded, not the asset value.

What could cause a 5% drop in value?

The market could, of course, just correct as interest rates go up or we go into a recession. This appears to be happening today, and it happened back in 2008-2009 and pushed thousands of rental investors into bankruptcy.

But beyond that, there are lots of property-specific issues that could cause its value to drop and a lot of these things are out of hand.

A water leak could cause significant damage that your insurance won’t cover for reasons x, y, or z. Believe me, they are good at finding reasons to not pay.

Your tenant may stop paying rent, refuse to move out, sue you for x, y, or z, and even if you win, he may then take revenge by trashing your property and never pay up for it.

Or maybe it is just that the street where your property is located becomes less desirable due to growing crime, homelessness, a school being shut down, or whatever else.

Again, you are making a highly leveraged, highly concentrated investment in an illiquid, capex-heavy asset with no income diversification. So, all it takes is one negative surprise and your investment could turn into a nightmare. It is very risky.

And by the way, you are also putting your personal liability on the line for all of this. You are personally signing on the loans and your tenants will sue you personally if something goes wrong. At least with stocks, you enjoy limited liability and can only lose what you invest. With rentals, you can lose a lot more than that. (PS: An LLC does not perfectly cover you from liability issues. That’s a myth.)

Returns: perception vs. reality

Okay, so rental properties are risky investments.

But at least you are getting high returns… right?

A lot of people believe that rental properties are highly rewarding and this is largely because they are highly leveraged. And to be fair, yes, rental properties can be very rewarding.

But the reality is still very different.

Most rental investors overstate and miscalculate their returns because of three main reasons:

1) They only look at returns during good years, not over a full cycle.

Naturally, if you are highly leveraged, your returns will look fantastic when prices are going up and you are earning steady rental income.

But markets move in cycles, and high leverage is a killer when the market goes south. As we noted earlier, just a small move downward will kill your returns if you are highly leveraged.

Therefore, it is key to look at returns over a full cycle when assessing the returns of highly leveraged investments.

2) They underestimate the big costs.

Rental properties are capex-heavy investments. During a regular year, you may just have the usual property expenses, a bit of maintenance, and that’s it. Most rental investors will properly account for that in their return calculations.

But then once in a while, you will be hit with a larger expense and that’s typically not properly factored into their return calculations. This could be a leaking roof that costs you 5 years of rental income to fix. Or worse, it could be a tenant that stops paying rent and sues you for developing asthma due to the mold in your property that you weren’t even aware of. It could cause years of returns going into legal fees just to defend yourself.

It is hard to account for these major expenses and from my experience, most investors don’t do it properly. If they did, they would notice their returns go down significantly.

3) Most importantly, your time has value.

This is the most important and misunderstood element of rental investing.

It is not passive. It is not like buying a stock and then looking back at it once in a while to check that your thesis is playing out.

If you want to earn decent returns in rental investing, you will need to put in a lot of work:

-

Studying different markets and sub-markets.

-

Getting to know what’s fair value and what’s not.

-

Looking for the right property and meeting with brokers.

-

Negotiating, negotiating, and then negotiating a bit more.

-

Getting financing and closing on the property.

-

Deciding what to repair, interviewing contractors, and getting bids.

-

Monitoring the repair works and complaining about things not being done properly. Getting another round of repairs…

-

Marketing the property to find a good tenant.

-

Interviewing tenants…

-

Setting up a company and a bank account for the property.

-

Getting the right insurance.

-

Collecting rental income and paying all property expenses.

-

Doing some more repairs…

-

Etc.

You get the point. It is a huge amount of work. It is much closer to running a real business than simply making a passive investment. Even if you outsourced the management (which comes with its own issues), you would still need to put in a lot of work just to get to owning the property.

All this work has value. You could have put all this time into something else that’s productive, like your main career.

If your main job earns you $30 per hour, and you put 5 hours of work per week on your rental property on average in the year (including all the work to buy the property), that’s $600 per month.

Is your property even earning $600 per month of net operating income after all expenses?

As you can see here, often investors are not buying themselves an investment, they are simply buying themselves another job.

The management is extremely inefficient because you have no scale, lack resources, and aren’t a professional. The only reason why you can make sense of it is that you assume that your time and work are free, which makes no sense whatsoever.

And I won’t go into how buying a rental property will negatively affect your career, which is your primary source of wealth. It will cause you to lose a lot of flexibility, energy, and time, which is all taken away from your career, reducing the odds of you getting that promotion and pay hike. You won’t be able to act on as many opportunities and these indirect opportunity costs are very significant.

A better alternative: REIT investing

These days, I do nearly all of my real estate investing via REITs (VNQ).

REITs are publicly listed real estate investment vehicles.

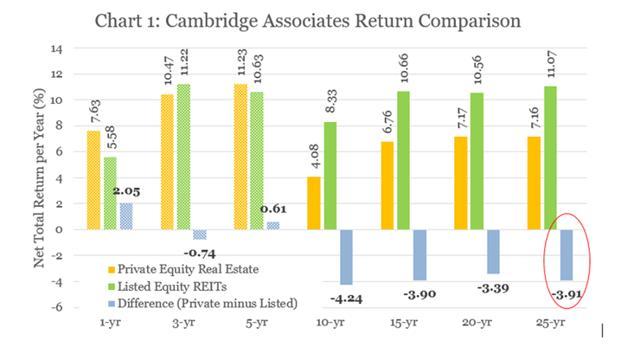

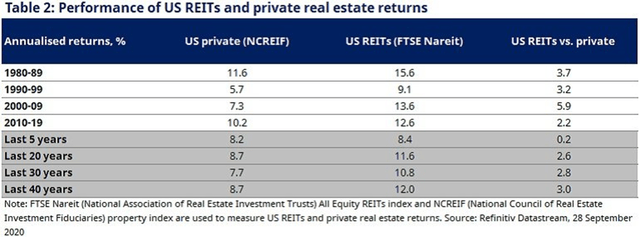

By investing in them, you get exposure to rental properties, but your risk-to-reward is much better. Several studies have demonstrated that REITs are more rewarding than rental properties. The outperformance is 2-4% per year depending on the study:

How can REITs offer so much better risk-to-reward to rental properties?

The risks are lower because you get:

-

Diversification

-

Liquidity

-

Professional management

-

Limited liability

-

Lower leverage in most cases

-

REITs have better access to capital

-

Large scale provides staying power

-

Etc.

And the reward is higher because REITs enjoy:

-

Significant economies of scale

-

Access to cheaper capital

-

Better bargaining power with tenants

-

Skip transaction costs via sale and leasebacks

-

Develop their own assets to earn higher yields

-

Enter real estate-related businesses for extra profits

-

Own Class A properties that experience faster rent growth

-

Lower debt results in higher returns over a full cycle

-

Access to the best talent

-

Etc.

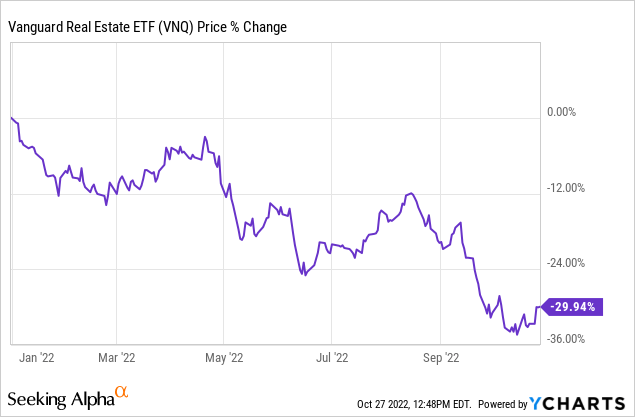

And the risk-to-reward is particularly strong today because REITs are heavily discounted relative to rental properties.

REITs (VNQ) are down heavily in 2022 and now trade at steep discounts to their net asset value:

Even the largest and highest quality REITs like AvalonBay (AVB) and Prologis (PLD) now trade at a 30% discount to NAV.

This has even gotten the attention of the biggest private equity real estate investment firms in the world, which are now targeting REITs instead of private properties.

Here is what Blackstone (BX) said earlier this year:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” John Gray, COO of Blackstone.

And just like Blackstone, Brookfield Asset Management Inc. (BAM) has also been buying REITs left and right.

Put simply, REITs offer you the opportunity to buy real estate at a steep discount to fair value with the added benefits of being a lot safer and completely passive. So why would you want to buy rentals? You would pay a premium to earn lower returns with more risk and a lot more effort.

Bottom line

Rental properties, like all investments, can be rewarding.

But overall, I think that they are some of the worst investments that you can make when you factor in all the risks, and all the work, and properly calculate the returns, taking into account all expenses, the value of your time, and the value of all missed opportunities.

This is particularly true today since you could be buying REITs to gain similar exposure, but at a much lower price, and enjoy superior returns with less risk.

That’s what I am doing.