The Next Commodity Market Driver

Torsten Asmus

By Blu Putnam

Broad-based commodity bull markets in recent decades have typically had a major demand driver. Will supply constraints drive the next bull market?

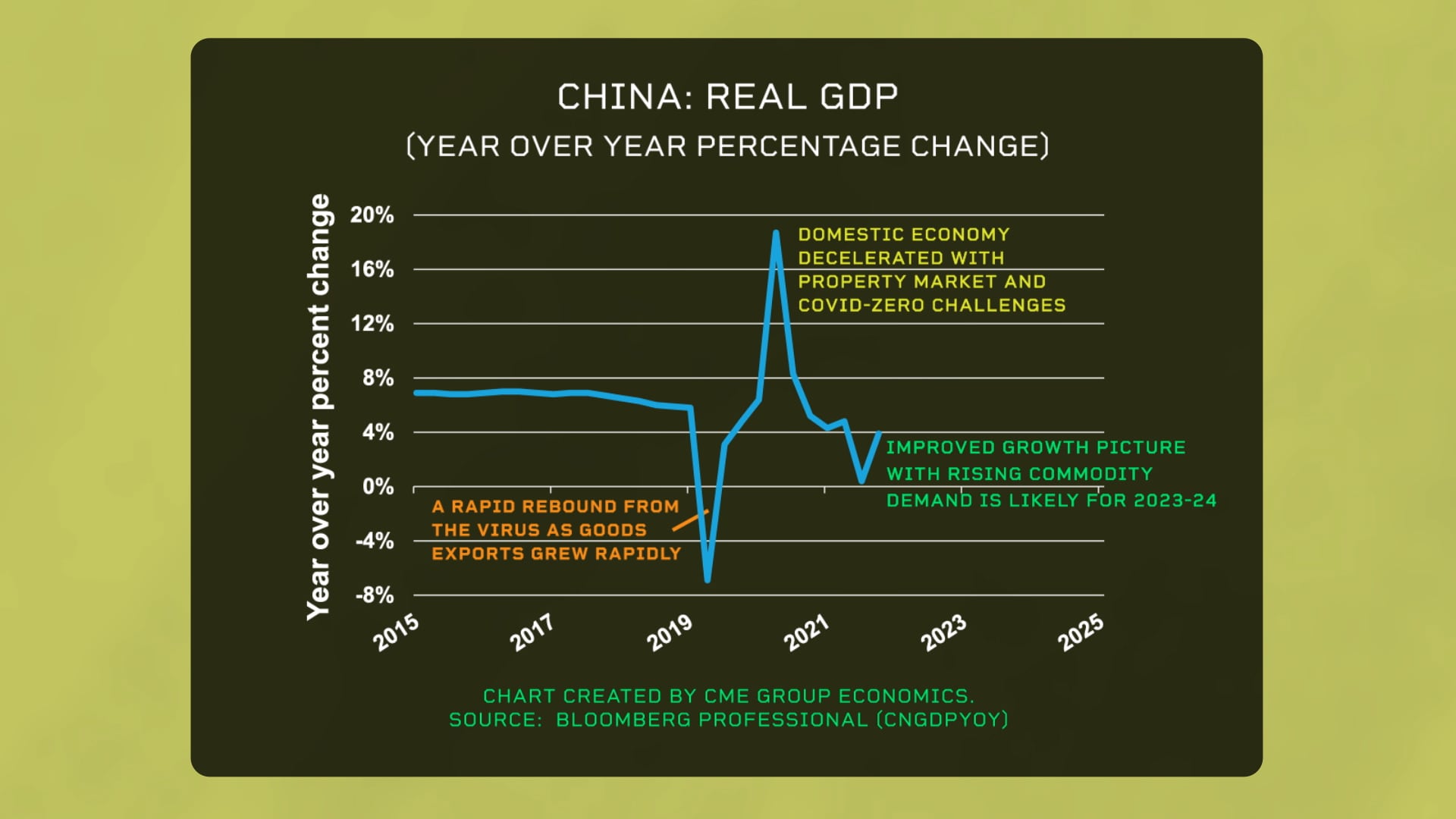

Looking at the last few commodity bull markets is informative. In the 1970s, the driver was a weak U.S. dollar. In the early 2000s, it was the strong growth of China. More recently, the pandemic stimulus followed by the Russia-Ukraine War shock was the demand driver. But commodities faded in the second half of 2022 as they sought new leadership.

In the short term, the recovery of China from its COVID-zero policy has been a focus. Over the long run though, China, as well as Japan, Europe and North America, face severe demand headwinds from their aging populations, low fertility rates, and lack of growth in their labor forces. With potential growth in real GDP constrained by demographics, we are turning our attention to supply constraints.

Over the longer term, the growth in the supply of commodities, from energy to industrial metals to agriculture, is likely to be quite subdued, possibly even stagnant, due to three factors.

First, energy companies are reluctant to invest as much as they once did in fossil fuels. Investment in alternatives continues to grow, yet not necessarily enough to offset expected demand. Second, across all commodities, geopolitical risks seem elevated, and financing is scarcer than it once was due to the reemergence of positive real interest rates (that is, rates adjusted for inflation). Finally, it takes many years from investment to production, so adjustment to even small increases in demand can impact prices.

Stagnant supply growth, even in the face of only modest demand growth, could be the next driver in commodities.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.