Taiwan Semiconductor Stock: Buy The Pullback (NYSE:TSM)

PonyWang

We are bullish on the Taiwanese Semiconductor Manufacturing Company (NYSE:TSM). We love businesses with a singular focus. In TSM’s case, it is a pure-play foundry business. TSM is considered the manufacturer of choice for leading semiconductor companies worldwide. We don’t believe the geopolitical tensions change that TSMC is the best-positioned chipmaker in the semiconductor industry, with a roughly 53% market share of the global foundry market. TSMC controls the chips-to-order foundry market for some of the world’s most crucial semiconductor companies- Nvidia (NVDA), Advanced Micro Devices (AMD), Broadcom (AVGO), and Apple (AAPL). Even under the current macroeconomic environment, we believe TSMC is well-positioned to grow for several years. With TSMC opening fabs in Arizona, the company is taking steps to de-risk from geopolitical tensions in Asia. We believe TSMC is cheap at current levels and recommend investors buy the stock.

Still the face of pure-play foundry

Global digitalization is underway now more than ever, which translates to more demand for semiconductor chips, especially those made by TSMC. TSMC is the world’s largest contract manufacturer of semiconductor chips required to power our phones, cars, and refrigerators, among all other aspects of daily life. Hence, we don’t see demand for the chip-maker weakening meaningfully. However, TSMC is not immune to semiconductor cycles. TSMC reported a 47.9% Y/Y increase in revenues in its latest quarter, despite the semiconductor industry slowdown.

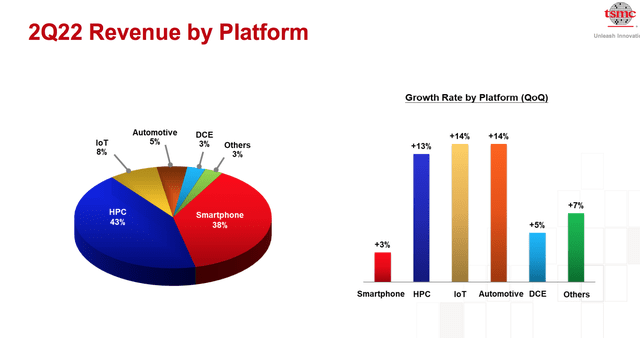

Weakening consumer demand has been the central theme for 2022, and TSMC is not immune to market volatility. TSMC is specifically exposed to the decline in PC and smartphone demand. The following graph from the company’s 3Q22 earnings outlines TSMC’s revenue by platform.

Global PC shipments have declined 19.5% over the past year, and PCs are forecasted to decline again in 2022. Smartphone shipments are also forecasted to drop by 6.5% in 2022.

Despite current macroeconomic headwinds, TSMC reported revenue and gross margins ahead of estimates last week, leading the stock to rally after its results last week. TSMC stock is still down around 37% YTD. We attribute TSMC stock fall to weakening consumer demand within the industry at large. We believe the stock pullback creates an attractive entry point to invest in the world’s leading chipmaker.

Raising ASP as it makes smaller and smaller chips

TSMC has a massive advantage with its process technology, as it allows the company to manufacture chips cost-efficiently with the highest transistor density with high quality/yield. With shrinking transistor sizes, the costs of manufacturing advanced process nodes are increasing. 3nm process node chips are more complex to manufacture, and TSMC is raising the prices for these newer chips. TSMC raising ASP for advanced process nodes will benefit the company in the future. We expect the higher ASP will make the company more resilient to market downturns as it provides more cushion to weather storms. AAPL has already contracted TSMC to produce the 3nm chip tech next year. We’re optimistic that TSMC will increasingly gain shares on advanced process nodes going forward.

Regional concentration is an issue for now

More than half the global made-to-order chip foundry capacity is concentrated in Taiwan, which is increasingly becoming an issue as the “tech wars” between the US and China unfold. Geopolitical concerns about China potentially invading the Island are intensifying, specifically, after US House Speaker Nancy Pelosi visited Taiwan this August. Regional concentration is an issue, but we believe it is only an issue for now.

We believe the regional concentration is easing as TSMC cooperates with the US’s CHIPS Act and plans to bring chip-making to US soil. TSMC has announced that its foundry business will expand and manufacture 5nm chips in Arizona. The company has already invested $12B in building its Arizona-based fabs. We believe TSMC is taking the necessary steps to dilute its regional concentration going forward.

Too valuable to invade: global silicon shield

Media and financial pundits are hyping concerns over the possible Chinese invasion of Taiwan with a lot of “what if China invades?” talk. We believe TSMC is too valuable to China for it to invade the Island anytime soon. China still consumes the bulk of the global chip supply, with 36% estimated to come from Taiwan in 2021. We believe Taiwan’s chip-making value provides it with a global silicon shield that will deter any invasion in the intermediate term.

Valuation

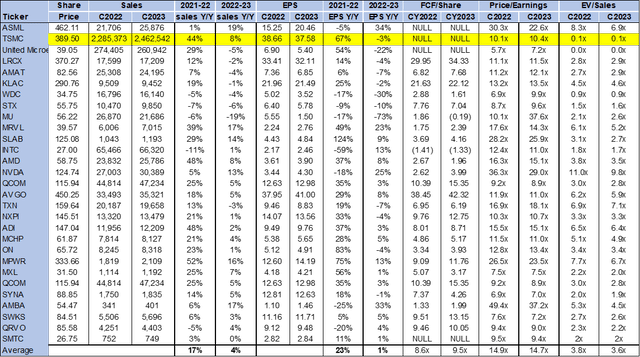

TSMC stock is relatively cheap, trading at 10.4x C2023 EPS of $37.58 on the P/E basis compared to the group average of 14.7x. The stock is trading at 0.1x EV/C2023 sales versus the peer group average of 3.6x. The following chart illustrates the semiconductor peer group valuation.

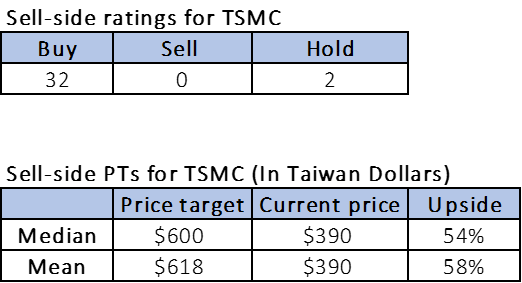

Word on Wall Street

Wall Street is overwhelmingly buy-rated on the stock, and we agree with that sentiment. Of the 34 analysts covering the stock, 32 are buy-rated, and the remaining are hold-rated. TSMC is trading at around $390. The median price target is $600, and the mean price target is $618, with a potential upside of 54-58%. The following chart indicates TSMC sell-side ratings and price targets:

Refinitiv

What to do with the stock

The current macroeconomic and demand environment has caused the stock to drop, but we believe the chip-making industry is still growing. For F3Q22, TSMC reported revenue growth and beat estimates, and we don’t expect the company’s growth to slow down as it remains the best-positioned foundry player with a solid customer base. We believe the stock pullback and the depressed valuation create an attractive entry point to invest in the foundry industry, and recommend investors buy at current levels.