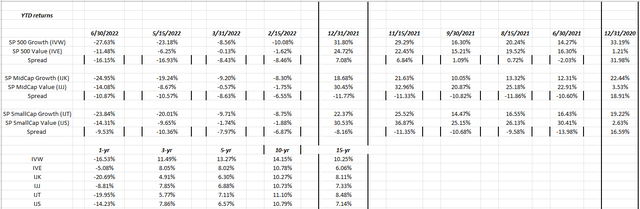

Style Box Update: Growth Across All Market Caps Remains Out Of Favor

Looking at style-box returns YTD, value is offering a little less downside, as growth continues to give up some of its outperformance the last 5 years.

The issue this year is finding any kind of positive return, outside of the energy sector.

What’s a little more interesting is that between May 15 ’22 and June 30 ’22, value deteriorated more than growth on a percentage basis probably due to the collapse in energy and crude oil in June ’22.

The only other stat worth noting is the 3 and 5-year large cap growth annualized returns (bottom of spreadsheet) remain about 500 bps higher than the rest of the style box returns for those time periods, meaning l/c growth probably or could have more underperformance ahead relative to mid and small cap growth and all of value.

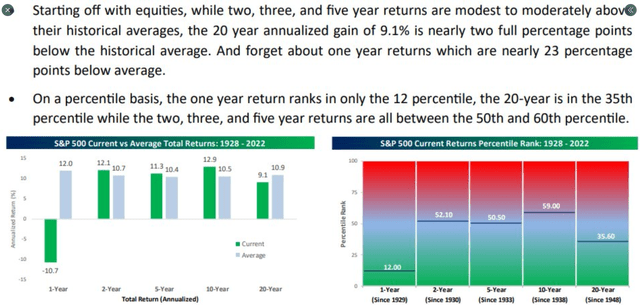

Finally, Bespoke table from the 4th of July weekend shows that annualized returns are now back to “normal” or slightly below normal, for the long run.

Summary / conclusion: It looks like some of the charts of the “mega-cap 8” as Ed Yardeni refers to them are starting to base after a brutal 6 months start to 2022, but much depends on 2nd quarter earnings from the group.

Across the rest of the style boxes, value held up well into mid-June ’22 when weakness in energy and commodities took the value style lower.

What puzzles me is the financial sector: a value sector to some extent, it has found no bid at all over the last 6 months, even after CCAR gave a green light to dividends and share repurchases. Q2 ’22 will see tough compares for all the major financial stocks like banks and brokers, but those compares will ease as we move into the back half of 2022.

It’s a difficult market: nothing is really “trending” except the US dollar (UUP) which generates a K-1, and can’t be bought for clients.

With Q2 ’22 earnings starting next week, it could be a “stock-selection” market for the 2nd half of 2022.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.