Stratasys Stock: Cathie Wood Sells Large Stake (NASDAQ:SSYS)

Grafner/iStock via Getty Images

Back in May, shares of 3D printing firm Stratasys (NASDAQ:SSYS) jumped after the company’s Q1 earnings report. Revenues and earnings beat estimates, while full year revenue guidance was above expectations. Since then, shares have mostly traded sideways, but the stock saw tremendous volume on Tuesday as one if its biggest supporters hit the sell button.

ETF firm ARK Invest has been one of the company’s largest holders for some time. As of last week, the ETF firm owned almost 6.8 million shares of Stratasys, which was more than 10.2% of the total number of outstanding shares. The relationship is even stronger when you consider that Nikko Asset Management, a firm that mirrors the ARK portfolio, owned another 4.2 million shares at the end of Q1 2022 according to NASDAQ data.

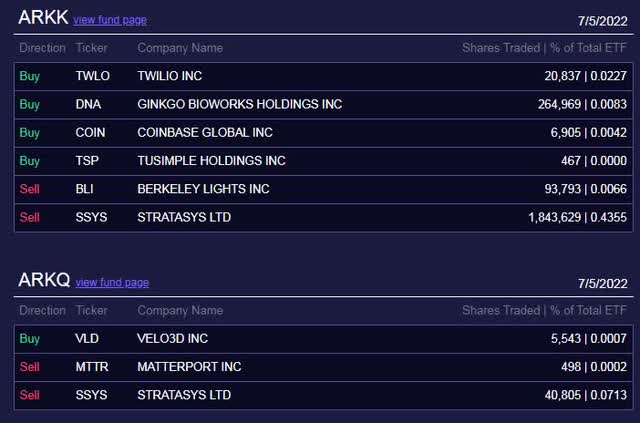

A majority of ARK Invest’s position in Stratasys is held in the flagship ARK Innovation ETF (ARKK), as one might expect, but there are three other funds that hold it as well. The other active ETF that holds it is the ARK Autonomous Technology & Robotics ETF (ARKQ). The other two are some of Ark’s index based ETFs, the 3D Printing ETF (PRNT), and the ARK Israel Innovative Technology ETF (IZRL), which don’t actively trade positions. The following graphic shows a section of the ARK Invest Daily Trades E-mail from Tuesday.

ARKK & ARKQ July 5th Trades (ARK Invest Daily E-mail)

It was back in mid-April when Stratasys showed up in the daily ARKK section for purchases. Cathie Wood and her team bought about 77,000 shares, which seemingly came mostly in the $21 to $22 range. Tuesday’s sale was obviously a much larger position amount, representing more than a third of the total holding by ARKK. Stratasys entered Tuesday as the 25th largest holding of 34 in ARKK, but that number may come down a few spots in the coming days, especially if there are further sales. The name has a higher weight in the two index ETFs, but those will only sell if index weightings change.

What really caught my attention here was the sheer size of Tuesday’s sales. The total amount of shares sold by ARK Invest, approaching 1.9 million, was itself more than any total volume day the stock had seen since last November, according to Yahoo Finance historical data. Total daily volume of more than 3.2 million shares was more than four times the three-month daily average. Another significant item to think about is that Cathie Wood and her team sold almost 3% of the company’s entire outstanding share count on Tuesday alone.

I’m guessing the sales on Tuesday were because the ARK Invest team doesn’t see too much upside in the name as compared to some of its other holdings. The average price target on the street currently is under $25. While that implies a little more than 30% upside from Tuesday’s close, other names in the ARKK ETF have average targets that imply a lot more upside from current levels. The ARK Invest team has not publicly released its SSYS model, but we know from recent model releases that other holdings like Tesla (TSLA) and Zoom (ZM) are currently forecast by Cathie Wood’s firm to rise at least 550% from here by 2026.

When it comes to current estimates, Stratasys is expected to see revenue growth in the low teens (percentage wise) this year and a little less than 10% next year. That doesn’t seem to be the massive growth story that Cathie Wood usually invests in, even if her own projections seem to be a lot more optimistic than the street. I will also point out that Tuesday’s sale happened at a very interesting point for the stock. As the chart below shows, shares closed just above their 50-day moving average, a key technical level the name hasn’t been able to hold for a number of months now.

Stratasys 6-Month Performance (Yahoo! Finance)

In the end, Cathie Wood and her team sold a large part of their stake in Stratasys on Tuesday. If this is the start of a complete exit for either the flagship fund or perhaps even both active ETFs, it would represent a meaningful part of the company’s outstanding shares, especially when counting the mirror strategy at Nikko. The sale represented a huge amount of volume for the 3D printing company, and with the stock right at a key technical level, it will be interesting to see what happens if more sales come in the following days.