Star Bulk Carrier: Still A Stellar Dividend Ship Through 2024 (SBLK)

xefstock

Investment Thesis

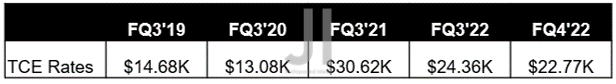

SBLK TCE Rates

Seeking Alpha

It is no wonder that Star Bulk Carriers Corp.’s (NASDAQ:NASDAQ:SBLK) recent FQ3’22 earnings call is met with mixed feelings, due to the quarter’s lower TCE rates of $24.36K against the original guidance of $29K. Assuming a similar impact, we may see its FQ4’22 results further impacted, since only 66% are covered at TCE rates of $22.77K. The quarterly dividend cut to $1.20 was not welcomed by many investors as well, partly attributed to the increased dry docking expenses of -$9.8M in the last quarter, compared to -$5.12M in FQ3’21, though notably improved from -$10.44M in FQ2’22.Combined with the normalization of the Baltic Dry Index, SBLK may face more temporary headwinds indeed.

However, we are not overly concerned, since these are natural calibration events from hyper-pandemic levels. Furthermore, SBLK continues to boast an excellent 20.85% dividend yield by FY2024, based on current stock prices. Otherwise, a tremendous yield of 24.17% for those who had loaded up at recent rock-bottom levels, against its 4Y average yield of 5.51% and sector median of 1.66%. Investors should simply ignore the noise, hold on through the volatility, and enjoy these golden dividends indeed.

The whole market is also trading rather optimistically, due to the upbeat October CPI triggering 80.6% of analysts predicting a 50 basis points hike by the Feds’ upcoming meeting in December. Assuming the early pivot, we would easily see SBLK sustainably recover ahead, as with the S&P 500 Index. Otherwise, another October retest by 14 December, though we are a little more positive, since China may reopen earlier than expected, boosting the imports of iron ore by H1’23, significantly aided by the elevated coal demand from the EU countries through the difficult winter ahead.

SBLK Displays Excellent Operating Efficiencies, Returning Much Value To Shareholders

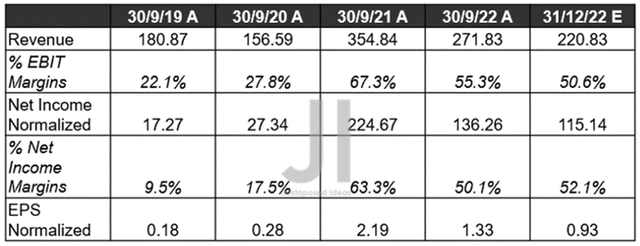

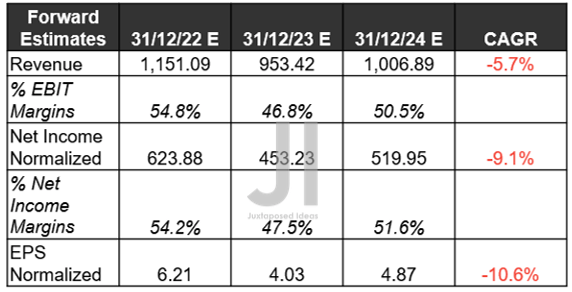

SBLK Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

In its recent FQ3’22 earnings call, SBLK reported the expected YoY and QoQ declines in the top and bottom line growth, due to the normalization of TCE rates. Thereby, naturally impacting its performance across the board, with analysts left relatively pessimistic about its FQ4’22 performance, with a further -18.76% QoQ decline in revenues and -30.07% decline in EPS.

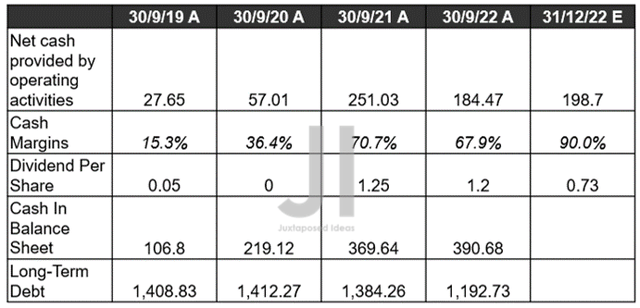

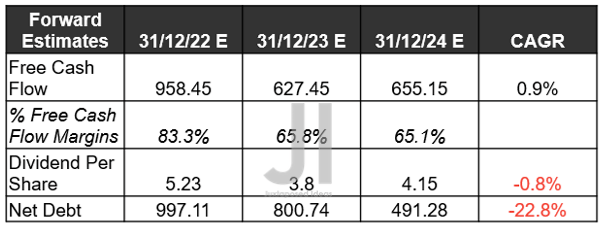

SBLK Cash In Balance Sheet, Cash From Operations (in million $) %, Dividends, and Debt

Naturally, this will impact SBLK’s net cash from operating activities, which inadvertently reduces its dividend payouts by -39.16% QoQ to $0.73 in FQ4’22.

However, we must also highlight SBLK’s highly competent management team in debt refinancing during these uncertain economic conditions, by extending the average maturity of outstanding facilities from 3.6 to 4.5 years. These efforts have saved the company $4.9M in annual interest expenses against the $48.75M of interest expenses reported in the LTM. Therefore, it is no wonder that SBLK remains well poised for the worsening macroeconomics, with $390.68M of cash and equivalents on its balance sheet.

SBLK Projected Revenue, Net Income (in million $) %, EBIT %, and EPS

S&P Capital IQ

On the other hand, market analysts expect these normalized TCE rates of approximately $21K to hold through FY2023, due to the rising inflation and Fed’s continuous hike. SBLK investors may, unfortunately, see a YoY revenue fall of -17.17%, net income of -27.35%, and EPS of -35.10% then.

Nonetheless, we must also highlight that SBLK’s TCE rates of $21K remain an excellent increase of 43.05% from FQ3’19 levels of $14.68K. Thereby, triggering tremendous expansions in the company’s EBIT and net income margins to 46.8% and 47.5%, respectively, compared to pre-pandemic levels of 18.9% and 4% in FY2019. Combined with its excellent operating efficiency, we would likely see still see an excellent EPS of $4.03 in FY2023, compared to $0.26 in FY2019.

SBLK Projected FCF (in million $) %, Dividends, and Debt

S&P Capital IQ

Furthermore, SBLK’s projected FCF margins remain robust at 65.8% in FY2023, with the company expected to disburse $3.80 in annual dividends, indicating an impressive 19.09% yield against 0.42% in FY2019. Its net debt situation is also expected to improve over the next two years as the company deftly weighs balance sheet growth and debt refinancing.

In the meantime, we encourage you to read our previous article on SBLK, which would help you better understand its position and market opportunities.

- Star Bulk Carriers: The Market’s Panic Will Give Us A $15 Gift

- Star Bulk Carriers: Brilliant Execution, But Uncertainty Looms

So, Is SBLK Stock A Buy, Sell, or Hold?

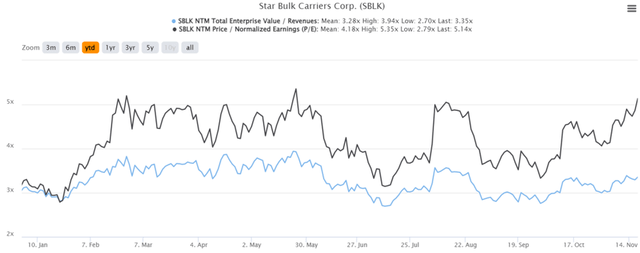

SBLK YTD EV/Revenue and P/E Valuations

SBLK is currently trading at an EV/NTM Revenue of 3.35x and NTM P/E of 5.14x, higher than its YTD mean of 3.28x and 4.18x, respectively. However, investors must note that the stock is notably trading way below its pre-pandemic mean EV/Revenue of 4.09x and P/E of 11.82x between FY2016 and FY2019. Thereby, highlighting its dirt-cheap valuations, due to the obvious improvements in its FCF generation and dividend yields ahead.

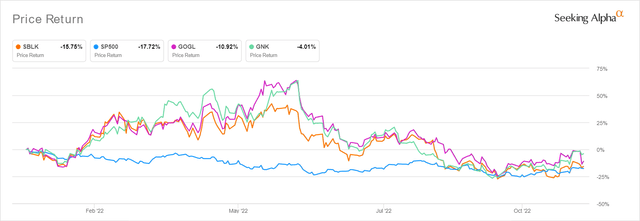

SBLK YTD Stock Price

The SBLK stock is also trading very attractively at $19.90, down -41.45% from its 52 weeks high of $33.99. Consensus estimates are still very bullish about its prospects, due to their price target of $30.50 and a 53.27% upside from current prices. Despite the notable 14.23% recovery from recent rock-bottom levels in late October, we reiterate the stock as a speculative buy.

Though dividends will obviously be cut moderately ahead, no one should complain about those stellar yields, due to the uncertain Fed hikes through 2023. Other than oil/gas stocks with fluctuating dividends, one would be hard-pressed to find another cyclical industry that yields similarly rich short-term returns as shipping stocks or REITs.

In addition, SBLK offers relatively higher (though also more volatile) dividend yields of 20.85% by FY2024, compared to other dry bulk peers, such as Golden Ocean Group Limited (GOGL) at 13.97% and Genco Shipping & Trading Limited (NYSE:GNK) at 17.73%. Therefore, investors with higher risk tolerance and keener eye for short-term returns should not shun SBLK despite the potential volatility.