Splunk Is Starting To Look Very Attractive (NASDAQ:SPLK)

David Tran

Introduction

2022 has not been the year for numerous fast-growing technology stocks. With high inflation, the Federal Reserve has been aggressively raising interest rates with an expectation to continue to be aggressive for the coming few months. Thus, companies like Splunk (NASDAQ:SPLK) have been hammered with net losses, high valuation, and fast growth. However, I believe Splunk is a buy with the fundamentals surrounding Splunk continuing to build. Business momentum continues to be strong, the company’s operational efficiencies are improving, and the valuation has fallen to unreasonable levels. Therefore, I believe Splunk is a buy as Splunk is expecting to reach profitability and a potential valuation expansion in the coming quarters.

Strong Business Momentum

Not only is the market in which Splunk operates in is expected to be fast-growing for the coming years, but Splunk is also finally nearing an end to its cloud-based business transition bringing strong business momentum.

Splunk identifies itself as a security and observability platform that allows its customers to leverage visualization, machine learning, collaboration, scalability, and log management into their business. With continued digitalization, Splunk’s service is becoming more valuable, which is shown in both the dollar-based net retention rate of 129% and the company’s TAM of $100 billion, according to the management team.

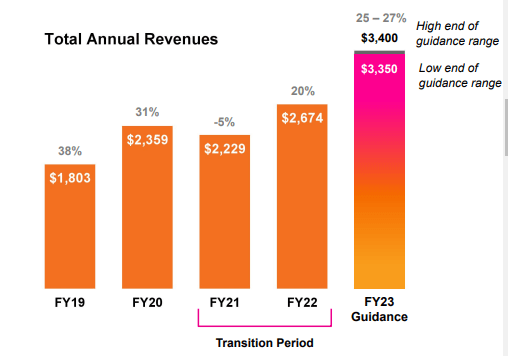

Further, building on top of the strong underlying trend, Splunk’s transition to becoming a cloud-focused business has been successful. During Splunk’s transition to a cloud-focused company, the growth rates and margins have been temporarily lowered as the nature of the new business model takes smaller chunks of consistent payments instead of one large single payment to increase predictability, cross-selling, and long-term value of the customers.

Splunk

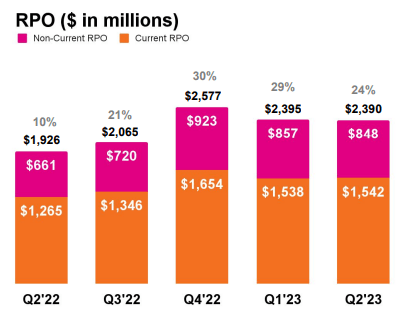

As the picture above shows, Splunk’s revenue growth is improving as the company’s transition is ending, fueled by cloud business growth CAGR of 74%. Therefore, with the transition period end in sight, Splunk’s growth fueled by the cloud business and strong industry underlying trend is expected to be robust going forward, and the strong booking momentum shown below supports my thesis.

Splunk

Operational Efficiency

Splunk has been unprofitable in past years, but by continually increasing its operational efficiency through scale, the company is expected to be profitable starting in 2023.

First, through scale, Splunk’s cloud gross margins have improved from 60.7% in 2022Q2 to 69.3% in 2023Q2 raising the total gross margin from 75.1% to 78.5%. The growth and improvement in margins have brought the company’s free cash flow to $216 million during 2023Q2 from negative $80 million in 2022Q2. Thus, the company is expecting an 8% annual non-GAAP operating margin in comparison to a negative 8% annual non-GAAP operating margin in the previous year. As a result, analysts are expecting $1.1 eps in the fiscal period ending in 2023 and $1.93 eps in the fiscal period ending in 2024.

I think these numbers are significant. For the past 2 years during Splunk’s transition to a more profitable and opportunistic cloud-based platform, the company’s annual operating margins have been negative. The inflection from negative to positive earnings not only signals stronger future bottom-line growth but also a potential for valuation expansion. The current macroeconomic conditions are making investors more stringent upon companies that are unprofitable despite their strong growth and fundamentals; therefore, with Splunk achieving this profitability, the company has the potential to receive valuation multiple expansion.

Valuation

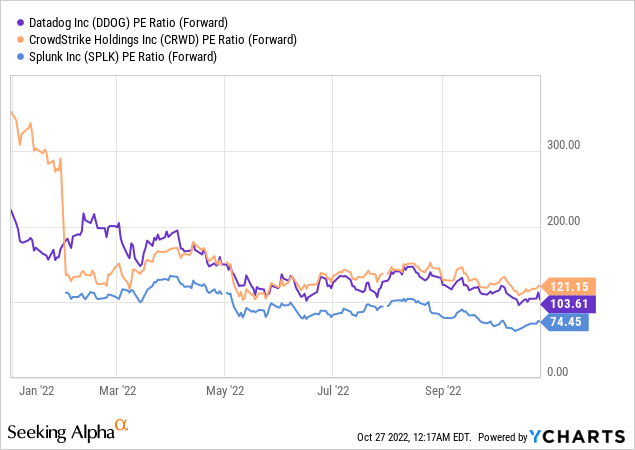

Splunk currently has a market capitalization of about $12.85 billion with a forward price-to-earnings ratio of about 75. While this number may seem high, especially given the current market conditions, I would like to argue otherwise. As the chart below shows, Splunk currently has the lowest valuation multiple in comparison to its nearest peers, Datadog (DDOG) and CrowdStrike(CRWD). Datadog is also a cloud-based security and observability platform while CrowdStrike is a cloud-based cybersecurity company. I believe the reason why these companies have higher valuations despite providing a similar cloud-based service is that they were expecting profitability before Splunk. Thus, given that Splunk is expected to be profitable while showing strong growth in the coming quarters, I believe Splunk can also receive higher valuation multiples in the market.

Further, the expected future earnings of all three of these companies are additional reasons why I think Splunk is undervalued. CrowdStrike’s expected 2025 price-to-earnings ratio is about 57 and Datadog’s expected 2025 price-to-earnings ratio is about 58. On the other hand, Splunk’s expected 2025 price-to-earnings ratio is about 25, less than half of its closest peers. Thus, I strongly believe that continued strong growth and profitability will create an opportunity for Splunk’s valuation multiple to increase in the coming quarters.

Risk to Thesis: Balance Sheet

The biggest risk to my bullish thesis is Splunk’s weak balance sheet. The company has about $750 million in cash and cash equivalents with long-term debt of about $3.87 billion. The total assets stand at about $5.2 billion compared to total liabilities of about $5.9 billion creating a stockholder deficit of about $700 million.

Splunk’s free cash flow for the first two quarters in the current fiscal year was about $113 million, and the company is expecting the full-year free cash flow to be at least $400 million showing accelerating growth. The company’s balance sheet is not in a great position; however, given the operational improvements and future profitability expectations in the coming quarters, I believe the balance sheet does not pose a significant threat to Splunk’s future growth and its potential valuation multiple expansion.

Summary

Splunk has gone through about 2 years of a transition period where the company’s growth outlook and profitability outlook has been uncertain leading to relatively lower valuation multiples compared to its nearest competitors. However, the company is changing as it is nearing the end of its transition period. The growth momentum through the cloud business is starting to be more apparent as the operational scale is creating efficiencies and positive free cash flow. Thus, Splunk may start receiving higher valuation multiples similar to its nearest competitors. Therefore, I believe Splunk is a buy.