S&P Global: Premium Compounder With A Nearly Unassailable Moat (NYSE:SPGI)

gorodenkoff Company Presentation

I believe S&P Global (NYSE:SPGI) is among the best businesses in the market. The company operates several business lines with nearly unassailable moats, including credit rating, financial indexing, and commodity price reporting. With the acquisition of IHS Markit last year, the company is in position to improve margins and should see operating metrics improve into this year on the back of a recovery in debt issuance. The company’s revenue streams are overwhelmingly recurring at this point, and with shrewd cost management and relatively fixed expenses in a majority of the business lines, the company is set to drive predictable earnings and cash flows well into the future.

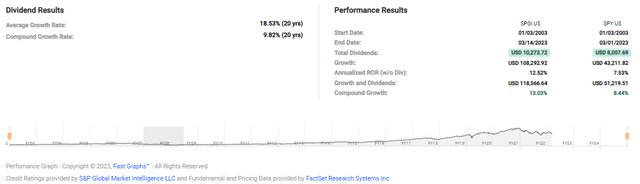

S&P is among a core group of GDP-plus companies with pricing power that tend to compound away at a higher rate than the overall market. The company has easily outperformed its S&P 500 index over the past 2 decades, most notably since 2013 following the spin-off of its McGraw-Hill division which resulted in significant subsequent operating margin improvements.

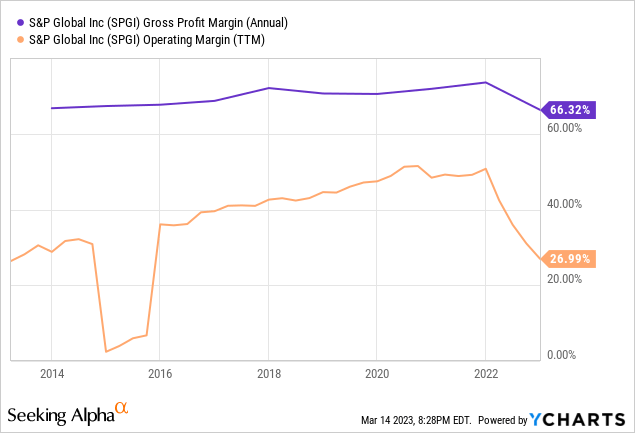

On the margin front, S&P has consistently expanded operating margins over time since 2013, with shrewd expense management and predictable pricing increases across its business lines. Specifically, S&P has increased its credit rating price at around a 3-4% CAGR, which has been easily accepted by customers who need to get their debt rated and don’t have many places to do it. The business relationships built by S&P as well as the other major credit rating agencies represent a barrier to entry that allows for these pricing increases. Regulators, bond aggregators, and banks all rely on credit ratings from these companies and are unlikely to trust an incoming company for a similar service. Additionally, across borders, it is difficult to compare debt without a central rater.

With the acquisition of IHS Markit, the company meaningfully bolstered its recurring revenues, diversified its business lines, and ultimately crimped margins. In general, large acquisitions like this one are often value destructive for shareholders. That remains to be seen here, but I do see the diversification as positive for S&P. The most cyclical of the company’s business lines remains debt rating as evidenced by recent results. Synergies appear to be decent at least in integrating overall corporate support structures, and S&P has shown itself to be effective in managing costs and driving margin improvements. The opportunity is there for them to materially improve IHS Markit margins while continuing to shed business lines in an effort to streamline the portfolio.

In the most recent quarter, revenues declined 3% in constant currency due to a revenue decline of 26% in debt issuance. Excluding the pain in that segment, revenues grew 6% overall for the company. Operating margins were impacted by the IHS Markit acquisition, but contracted an additional 160 bps on the ratings revenue decline. Adjusting for that, the company would have expanded margins by 200 bps. With that, management held expenses flat YOY, and drove $276M in synergies in 2022 from integrating the company’s software infrastructure with IHS Markit.

The growth story from here writes itself. Debt issuance is cyclical, and projected to rebound into the end of the year. It’s possible it takes longer, and will likely be tied to the overall rate environment. Management discussed the $11.1T in debt maturing in the next 5 years, with a heavy weighting to 2027-2029, which should drive substantial refinancing volume as most companies don’t hold their debt to maturity. Adding that to S&P’s normal periodic price increases and the growth of its indexing business, and you’re looking at a long-term average revenue growth rate in the mid-to-high single digits. S&P Capital IQ has a somewhat smaller moat from competition than the rest of the core franchise, but has managed decent results historically.

The big open question is IHS Markit. Management appears to be ahead on its integration efforts, but margins will be the name of the game going forward. The company operates Carfax, an index business with credit derivatives and fixed income which S&P should know well, IHS Resources for the oil and gas market, and IHS Financial Services, which provides independent valuation services. I wouldn’t be surprised to see S&P pare down some of these offerings if they aren’t able to expand margins. Carfax is a very interesting business, and IHS Resources has a substantial moat with the quantity of its oil exploration data. However, based on management commentary, the company is heavily committed to its “green” image and may not hold onto that asset over the long-run. My suspicion is based off the significant portfolio shifts S&P has executed over the years. Since 2013, when McGraw-Hill was spun out, the company has tweaked the company a substantial number of times with small tuck-in acquisitions and divestitures. Most recently, they sold Engineering Solutions to KKR (KKR). If operating margins don’t rebound all the way to historical averages, it was still likely worth the merger if only to diversify away from the ratings revenue somewhat. Management projects around 77% of revenues are recurring now, which puts S&P in an incredible position to compound away well into the future.

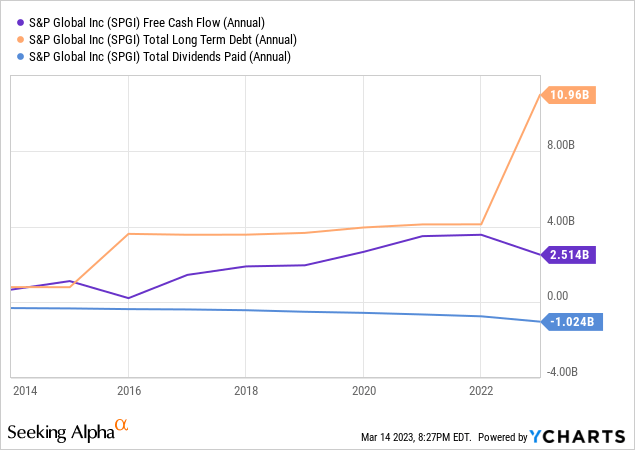

The company took on some debt in the merger, but it’s well covered by cash flows and the company’s recurring revenue stream gives them the ability to predict cash flows reasonably well. The dividend is also well covered.

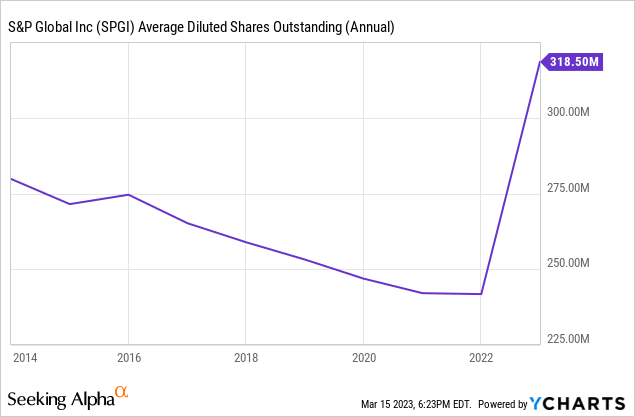

Outside of the merger bump, the company was putting in work cannibalizing the share float. As they get IHS Markit integrated, I’d expect that to continue. It’s good to see the float was relatively untouched in 2021 considering the company was bid up to extraordinary share prices.

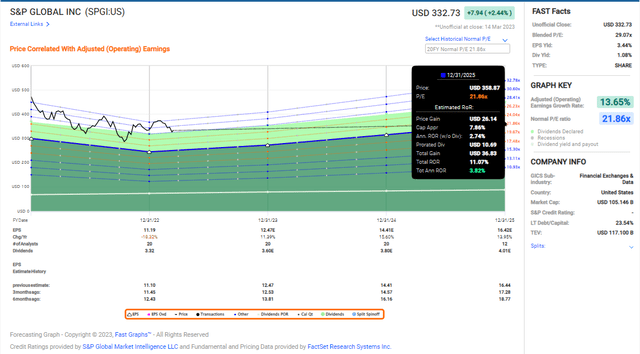

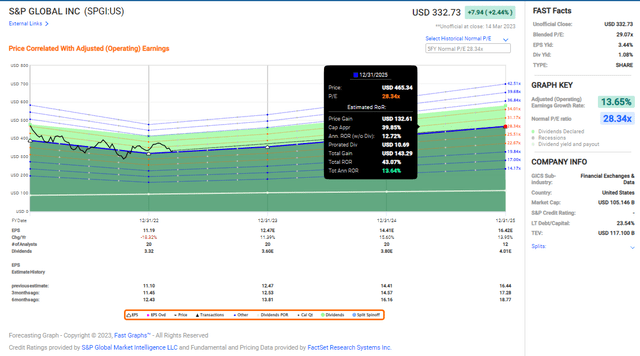

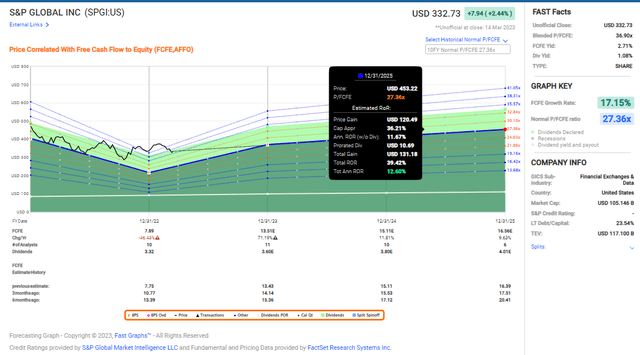

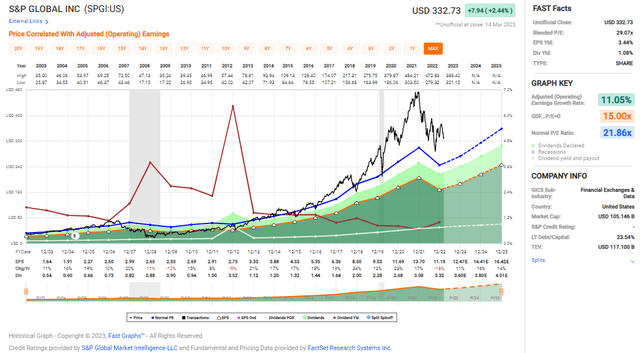

FAST Graphs

Looking at the long-term earnings growth, S&P has trundled along at 11% over the long-term, with much faster earnings growth since the divestiture in 2013. The company will be reliant on operating margin expansion in IHS Markit to drive earnings growth similar to the 2013-2021 period again, but low double-digits does seem very possible with some share buybacks.

Based on earnings projections, and a return to the average long-term valuation, an investment today would only yield around 4%.

However, I think S&P trades at a well-deserved premium to the market multiple today, and will maintain that well into the future. Based on its more recent average valuation of around 28X earnings, an investment today could yield closer to 14% annualized.

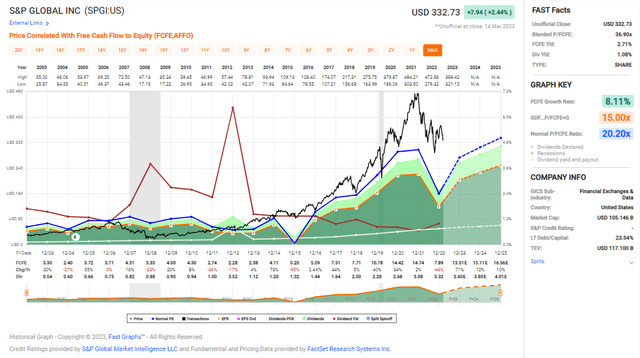

Free cash flows have grown somewhat more slowly over the long-term than earnings. They dipped significantly in the most recent year, but I’d anticipate a return to form from here. The company’s expense management has been solid, the capital outlays aren’t significant, and S&P should be in a good spot to compound cash on the back of its recurring business model.

Based on analyst estimates for FCF growth and a 28X FCF multiple (just shy of a 4% FCF yield), an investment today could yield around 12% annualized total returns.

S&P is a boring business, well entrenched in the markets it operates. The company’s moats are nearly unmatched (of course, Moody’s (MCO) is an obvious contender as well as the other ratings agencies). The IHS Markit acquisition is a bit of a curveball for modeling the future, but the company’s track record has been solid in driving margin improvement. The growth story writes itself from here, but we will have to see if the company executes on it. I think today represents a decent value for S&P on a bounce back in metrics, and it’s one of the best compounders in the market.