Simon Property: Cheaply Valued For The Long Run (NYSE:SPG)

MarsBars

Sometimes I wish I can get in a time machine, or at least be able to tell my former self about what stocks to buy. That’s just wishful thinking, of course, and I’m sure many other stock investors have had that fantasy.

Given that’s impossible, the next best thing is to look at current values and the future. In other words, buying above average companies at below average prices may lead to market-beating returns in the future.

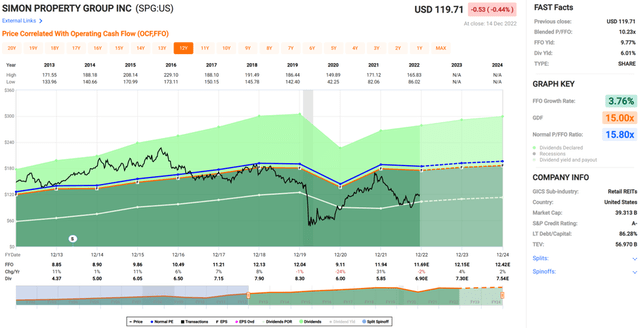

This brings me to Simon Property Group (NYSE:SPG), which has given investors a 19% total return since I last visited the stock near the end of October, far surpassing the 4% return of the S&P 500 (SPY) over the same time period. However, SPG remains highly undervalued despite the recent rally, and in this article, I highlight why the stock remains a bargain for potentially strong returns.

Why SPG?

Simon Property Group is an S&P 100 company and is the largest retail-focused REIT in the U.S. It owns over 200 properties, about half of which are primarily Class A U.S. Malls with the rest comprising of Premium Outlets and International/Mills/Lifestyle Centers. In addition, SPG owns an 80% interest in Taubman, which carries a premier portfolio of malls and outlet centers across the U.S.

SPG has carried many headline risks, including talk of a retail apocalypse in recent years. However, many of these concerns proved to be overblown coming out of the pandemic, as consumers have a newfound appreciation for in-person shopping experiences, especially at high quality locations.

In fact, there was recently an excellent article in the Wall Street Journal, that highlighted the pitfalls of a “frictionless” economy. The article noted that when it’s too easy to purchase goods, whether through the click of a button online or by other means, the consumer is losing everyday opportunities to engage with other human beings. This, in turn, can naturally lead to feelings of social isolation and loneliness. That’s perhaps one of the key reasons why companies with brick-and-mortar retail exposure like Simon Property have surged over the past year and half.

This is reflected by very strong sales per square foot at Simon’s malls and outlet properties, which reached another record in its third quarter, at $749 per square foot, representing a 14% YoY increase. Moreover, SPG was able to achieve this with a low occupancy cost of 12%, a level that it hasn’t seen since 2015.

In addition, NOI grew by 5.5% YoY during the first nine months of the year. This was driven by robust demand for its properties, with occupancy improving by 170 basis points YoY to 94.5% as of the end of the third quarter. Also encouraging, tenants are paying overall higher lease rates, with base minimum rent per square foot rising by 1.7% YoY to $54.80.

Importantly, SPG is on track to reclaim its pre-pandemic dividend rate of $2.00 per quarter, as it just raised its dividend by 2.9% sequentially to $1.80. This also represents a 9% YoY increase and the new dividend rate is well covered by a 61% payout ratio, based on FFO per share of $2.97 during the third quarter.

In the meantime, SPG maintains a strong A- rated balance sheet that’s supported by a safe net debt to EBITDA ratio of 5.7x and a very strong fixed charge coverage ratio of over 5x. It also has plenty of financial flexibility, with $8.6 billion of liquidity.

Looking forward, SPG should benefit from continued international expansion, as it recently opened its 10th premium outlet in Japan, and began construction on a substantial expansion in Busan, South Korea, all while maintaining a significant number of new leases in it pipeline. All in all, it appears that retail is thriving under SPG, and the CEO David Simon had this to support this thesis during the recent conference call:

And I need not remind you, when physical retail was closed in COVID, all the naysayers saying that physical retail was gone forever. However, brick and mortar is strong — brick and mortar retail are strong and ecommerce is flat lining. And importantly, over this period of time, we have paid out billions in dividends to shareholders, as we have become stronger and more profitable.

And why do I bring this up constantly? Well, because hopefully, this will put an end to the so-called negative mall narrative as you can’t pay those dividends without a strong underlying business.

Lastly, SPG remains cheap at the current price of $118 with a forward P/FFO of 10.2, sitting well below its normal P/FFO of 15.8 over the past decade. I see strong potential for the valuation gap to close over time, and investors get paid a well-covered and growing dividend in the meantime.

Investor Takeaway

Simon Property Group is well-positioned for future growth, as it continues to benefit from a strong recovery in retail activity and from its international expansion plans. Moreover, it’s able to pay a growing dividend that’s well covered by FFO. Lastly, SPG remains undervalued compared to historical valuations, resulting in significant upside potential in the near to medium term.