Signet Jewelers Stock: A Monopoly In Mid-Market Jewelry (NYSE:SIG)

Justin Sullivan

Investment Thesis

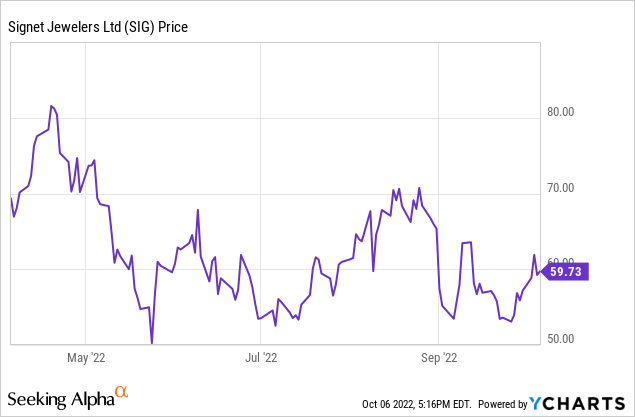

Signet Jewelers (NYSE:SIG) is home to the first, third, and fourth-largest specialty retail jewelry brands in the United States. They are almost a monopoly in the low to middle-priced jewelry business; unless you prefer to buy your engagement ring in a Vegas pawn shop. This makes it a valuable player for your portfolio. The stock has recently climbed back up to $59 and with the forecast for consumer discretionary being bleak this seems a bit pricey. Therefore, I recommend building a position at around $53 which seems to be the support level for the stock.

House of Brands

Signet Jewelers primary advantage stems from the fact that they are a beast in the lower to middle-income jewelry business. They own Jared, Kay, Zales, and seem to be on their way to acquiring every player they can. This is the best strategy for a company like Signet, and they have made their latest acquisition, Blue Nile. This acquisition strategy follows a similar path to companies like LVMH (OTCPK:LVMHF). LVMH used its muscle to make acquisitions such as Dior; Signet used its size to slowly conquer any rivals, with their most successful one being Zales. This strategy has worked phenomenally for them, as they are one of the largest conglomerates for low to middle-income jewelry.

However, another thing they can do is go international. For example, markets like India have a huge demand for jewelry due to its cultural significance, and while it may be difficult to acquire older players due to the prominence of family-owned businesses. Popular brands like Carat Lane which are newer can give Signet Jewelers a foothold in international markets. As long as, they allow these brands to continue with their specific type of jewelry and do not try to change their style.

Numbers

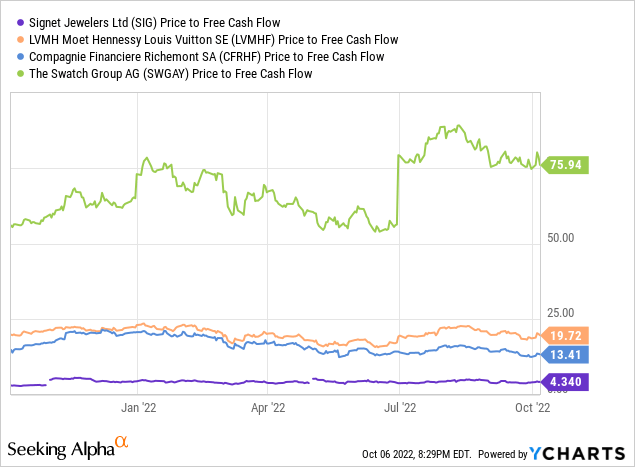

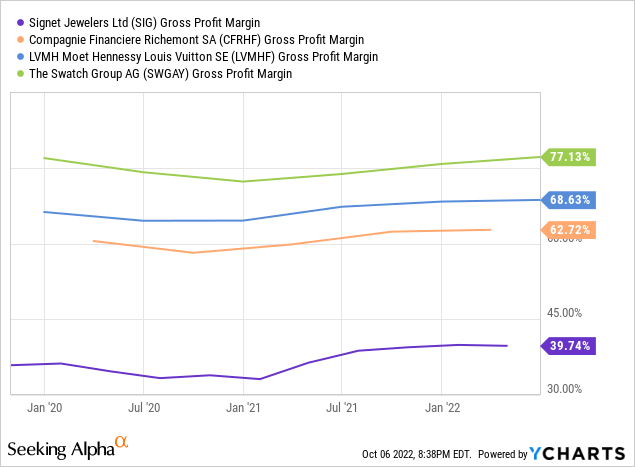

Signet’s price-to-book ratio is lower than other competitors at 2.2 and they also have a relatively low price to free cash flow at 4.3. These are very attractive metrics, however, Signet also has the lowest gross profit margin due to its lack of luxury businesses at 40% and the lowest operating margin at 11%. The valuation reflects all of these margin factors, however, the reason why I compared them to luxury jewelry retailers is there is just no competition for Signet in middle priced jewelry. They are truly a one of a kind company in this regard.

Signet had a disappointing quarter in terms of revenue growth, since revenue was down 2% compared to Q2 of last year. Additionally, real disposable personal income has been sitting at depressed levels since January. Due to these economic headwinds, consumer discretionary is usually the first one on the chopping block. Therefore, Signet is looking to face a rough couple of quarters in terms of revenue growth. However, the reason why I believe this is short-term is disposable income is still higher than it was in 2019 and disposable income has also stabilized at the $15 trillion mark.

Real Disposable Personal Income (St. Louis FRED)

(Source: https://fred.stlouisfed.org/series/DSPIC96)

The stock could go below $53, however, I do believe much of the bad news is already priced in and there seems to be a lot of support at the $53 level. This leads me to believe that there are very few people willing to sell below this point.

In terms of balance sheet, Signet has an excellent debt to EBITDA ratio at 0.194, and they spend about 28% of revenue on SG&A. LVMH spends about 40% of revenue on SG&A, so this is considerably lower, however, I wonder if SG&A spending is considerably lower because of lower marketing spend. In that case, they should maybe increase spend to be about 30-33% of revenue, especially in this increased competitive environment.

Low End v. Luxury

Signet Jewelers mentioned in their most recent earnings call that “…jewelry price points below $500, are seeing steep decline, with price points below $1,000 also being negatively impacted. Conversely, higher price point items are showing more strength and this is reflected in the fastest jewelry growth being luxury price tiers…” (Earnings Call Transcript). In this current retail environment with recessionary fears out and about, it makes sense why lower-priced merchandise is suffering, especially since jewelry is a consumer discretionary purchase. However, it does bring up the interesting point that it may be high time for Signet to pay more attention to luxury jewelry. When LVMH bought Tiffany, it was LVMH’s play into high-end jewelry, which would’ve taken them years to develop on their own. Signet Jewelers should also push more into high-end jewelry in the way that Capri Holdings did with Versace. They could buy Elizabeth Gage or other high-end brands. In the Earnings Call they mentioned that, “At the top end of the market, Jared grew total revenue by 44% in Fiscal 2022, with its fastest growth reflected in products over $3,000” (Earnings Call Transcript). They are already seeing fast growth rates in high-end, so expanding their high-end collections is in their best interest. Long-term the lower-priced jewelry business is durable, however, these troubles may persist for the next year.

Technical Indicators

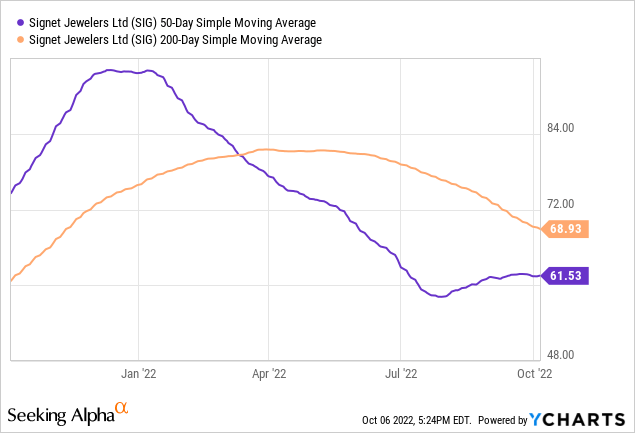

The most common bottom in price is around $53 if you are using the 6-month price chart. This is the ideal buy target for this stock. The stock is currently priced at $59 which makes this around an 11% drop. The stock has been trading horizontally since the six-month low of $50 back in May of this year. The possibility of going back to $50 is lower, but the stock has already touched $53 nearly four times in the last six months. Additionally, the 50-day SMA has been finally turning up around August and the 200-day SMA has been turning down, leading to the idea that the 50-day SMA will soon cross the 200-day moving average, which is a bullish sign. The 52-week high of this stock is $111 and while the likelihood of the stock price doubling in today’s grittier retail environment is low, the choppiness of the market lends itself to a possible 15-20% gain within the next year if purchased at $53.

Conclusion

Signet Jewelers is an excellent stock for your portfolio because of its sheer prowess in the low to middle-end jewelry space. The stock price currently sits at $59 and could reach $53 within the next few weeks. The current retail environment is choppy, but Signet’s size makes it ideal to weather the storm.