Shutterstock: A Steady Tech Stock Still Seeing Growth (NYSE:SSTK)

Borislav/iStock via Getty Images

Overview

Shutterstock, Inc. (NYSE:SSTK) is a stock photography and video company. It monetizes its content base in several ways, including a la carte licensing and subscriptions. It also allows contributors to monetize their content via participation in its platform.

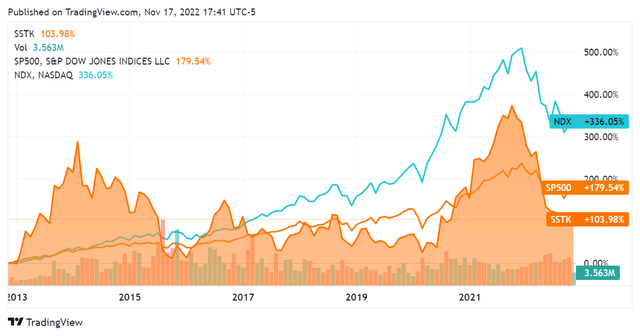

Founded in 2003, Shutterstock went public in 2012 at $14 a share. The company has underperformed both the SP500 (SP500) and NASDAQ Composite (COMP:IND) since then.

SeekingAlpha.com SSTK 11.17.22

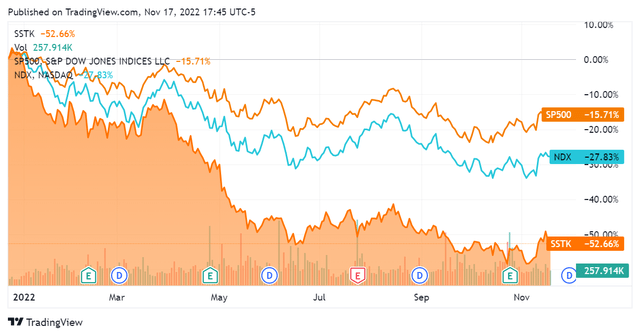

Shutterstock’s latest earnings report was decidedly mixed, with a beat of $0.11 on its non-GAAP EPS but a miss on revenue by $9.37M. While appreciating somewhat since then, the stock is still down significantly year-to-date.

SeekingAlpha.com SSTK 11.17.22

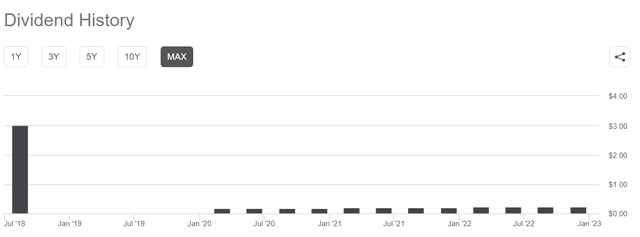

As a mature software company, Shutterstock has been paying a quarterly divided since Q1 2020, having also executed a significantly larger one-off payout in Q2 2018. This is certainly a sign of confidence in its ongoing capacity to generate profits.

SeekingAlpha.com SSTK 11.17.22

This article will review Shutterstock’s financials and determine whether it’s a stock worth owning.

Financials

Since Shutterstock has been in business for 19 years and publicly traded for the last 10, it’s sensible to review its financial performance year-by-year.

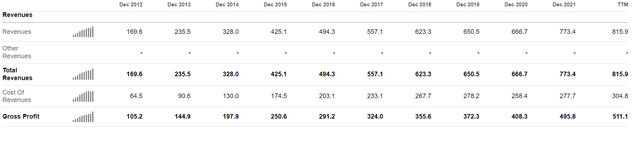

Starting with revenues, we see a consistent pattern of growth and a continuation of this on a trailing twelve months basis.

SeekingAlpha.com SSTK 11.17.22

The company appeared to experience headwinds during the 2020 pandemic year, but still achieved managed to post revenue growth of 2.5% – not spectacular, but certainly better than 0 or less than that. 2021 saw Shutterstock return to double digit YoY growth, with revenues coming in 16% higher than 2020. The trailing twelve month (“TTM”) metric indicates continued momentum on revenue growth. As should be expected with a software company, gross profit continued to grow as well.

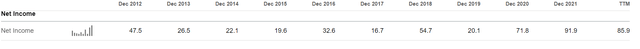

Shutterstock has seen positive net income for its entire publicly traded lifecycle. While this number has been relatively volatile, the last two years were back-to-back records for the company as to net income generation – certainly a good signal.

SeekingAlpha.com SSTK 11.17.22

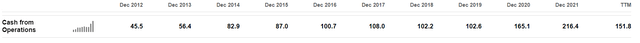

This is further buoyed by the fact that Shutterstock has had positive cash from operations throughout this entire time as well:

SeekingAlpha.com SSTK 11.17.22

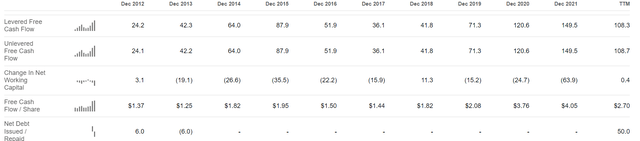

To encompass its full operating picture, we can look at the firm’s free cash flow (“FCF”), which also appears robust. Fiscal years 2020 and 2021 saw the company generate record levels of free cash flow, posting triple digit FCF back to back for the first time over the last decade:

SeekingAlpha.com SSTK 11.17.22

The TTM figure appears to have been a decrease from either of the aforementioned reporting periods, and the company took on $50M of debt during period – something that it had not done previously. As per the earnings call transcript, this came from the company’s revolver and is priced at a 4.5% interest rate. This will likely have increased 1-2% in line with the rates environment since then. Nonetheless, this will cost the firm somewhere in the realm of $3M in interest annually, which should not represent an undue burden due to the company’s ongoing $100M+ free cash flow.

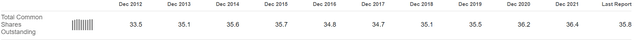

Additionally, the company has been repurchasing shares throughout this past year, decreasing its float by 2.7%. This represented the completion of a $100M buyback program that the company was executing; it was not made immediately clear if they intend to continue doing so.

SeekingAlpha.com SSTK 11.17.22

Overall the company’s financial picture looks sound, with a healthy trendline and no apparent red flags.

Conclusion

Shutterstock is again a mature software company, and it is subject to the economics of software – which are really quite good when they work. This has clearly been the case here. It is maintaining strong growth in revenues while also continuing to be a cash flow positive company.

Additionally, it seems that Shutterstock’s management has taken an interest in generating value for shareholders in particular; this is evidenced by Shutterstock’s ongoing dividend payments as well as the conclusion of its $100MM share buyback program. It seems that they have their business well under control and are at the point in their growth cycle where they can continue augmenting returns for shareholders. With a healthy base of fundamentals and this direction from management, I am calling Shutterstock’s stock a buy.