Shopify Stock: Time For A Pause – No Margin Of Safety Here (NYSE:SHOP)

Antagain/E+ via Getty Images

Investment Thesis

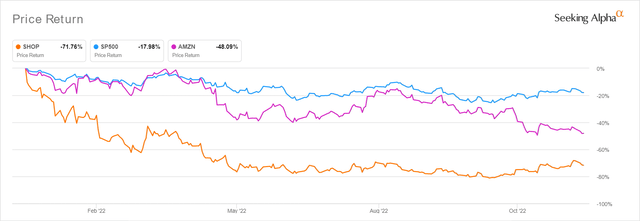

SHOP YTD Stock Price

The overvaluation is a given, since the Shopify Inc. (NYSE:SHOP) stock has enjoyed a notable 62.88% rally from its 52 weeks low of $23.63 in October 2022. Furthermore, if we were to gauge a moderate price target based on its FY2026 EPS of $0.65 and a P/E valuation of 60x, we would arrive at $39. Otherwise, an ambitious target of $56.17 instead, based on Amazon’s (AMZN) 5Y P/E mean of 86.43x. Thereby, indicating the minimal margin of safety for those who add at current levels, similar to consensus estimates’ price target of $43.25 with a 12.37% upside.

With the November labor market report and service industry report proving overly bullish against Powell’s previous dovish statement, we reckon that there will be more uncertainties in the short term, depending on the November CPI reports released by 13 December. The optimism surrounding a 50 basis point hike may not be sufficient to counter the raised terminal rates to over 6% indeed. Thereby, pointing to more chances for loading up at the low $20s.

Combined with SHOP’s declining market share in the US from 33% in August to 25% by mid-November and globally from 23% to 22%, it seems that one will need quite a bit of convincing to take on the stock at these inflated valuations. Patience first.

SHOP’s FQ4’22 Performance Will Be Critical In Proving Its Forward Profitability

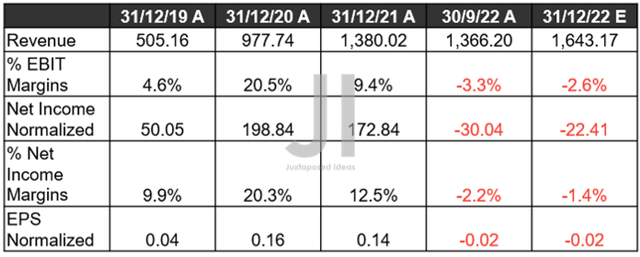

SHOP Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

Despite the peak recessionary fears then, SHOP delivered an excellent FQ3’22 earnings call, beating consensus estimates by a wide margin. Combined with the upbeat October CPI report, Thanksgiving festivities, and record-breaking Black Friday Cyber Monday sales, it is no wonder that market analysts are expecting the company to further deliver exceptional FQ4’22 earnings, despite the tougher YoY comparison. Revenues are expected to hit $1.64B with EPS of -$0.02 by the next quarter, indicating excellent YoY growth of 19.1% though a notable decline of -116.2%, respectively.

The natural decline in SHOP’s profitability is to be expected, due to the impact of rising inflationary pressure on its gross margins in FQ3’22 by -2.1 percentage points QoQ and -5.7 points YoY. The company has also been incurring additional operating expenses by 43.28% YoY. However, these are already notably decelerating QoQ attributed to the 10% job cuts thus far, leading to one-time severance costs reflected in the latest quarter. We expect things to improve further over the next few quarters, thereby, explaining market analysts’ optimistic projection of -2.6% in EBIT margins by FQ4’22.

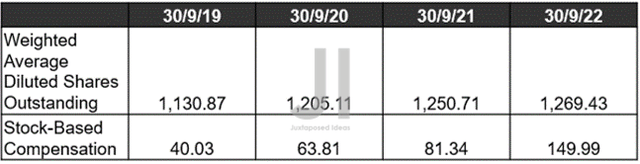

SHOP Share Count & Share-Based Compensation ( in million $ )

Part of these operating expenses is attributed to SHOP’s growing Stock-Based Compensation [SBC] expenses of $505.71M over the last twelve months [LTM], expanding sequentially by 68.84%. Though this has also contributed to the growth in its share count, 1.49% YoY remains inconsequential for now. Furthermore, these efforts are particularly encouraging, since Shopify Fulfillment Network was built upon its previous acquisition, Deliverr, along with employing the right talent for the company’s strategic growth. Sustained profitability will come soon enough, once SHOP hits the critical inflection point.

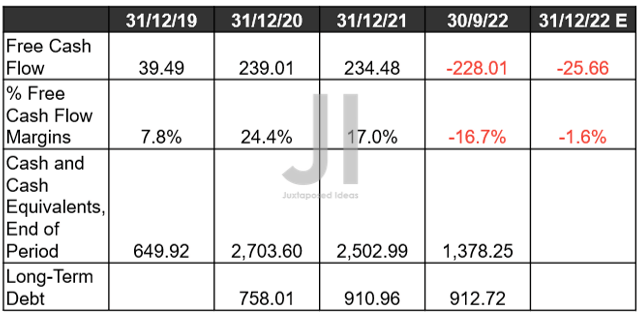

SHOP Cash/ Equivalents, FCF ( in million $ ) %, and Debt

S&P Capital IQ

In addition, market analysts are already projecting SHOP’s improved Free Cash Flow [FCF] generation by FQ4’22, with -$25.66M and margins of -1.6%. Thereby, indicating massive improvements QoQ. In the meantime, we are not concerned about its liquidity through 2023, no matter the soft landing or recession, since the company continues to boast cash and equivalents of $1.37B in the latest quarter.

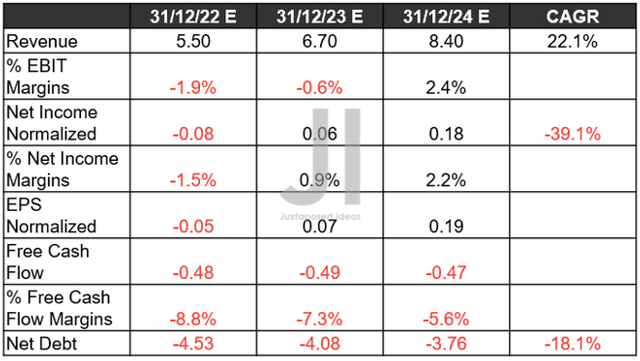

SHOP Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, FCF %, and Debt

Over the next three years, SHOP is expected to report a notable deceleration in revenue growth at a CAGR of 22.1%, compared to pre-pandemic levels of 59.4% and hyper-pandemic levels of 70.8%. Nonetheless, investors must also note the potential return to profitability by 2023, due to the management’s efforts in improving customer acquisition costs while streamlining operating expenses at the same time.

In the meantime, we do not expect to see SHOP report positive FCF generation through 2024 yet, since the company is still aggressively expanding its Shopify Fulfillment Network. Market analysts expect the company to more than triple its Capex to $396M in 2023 and $415M in 2024, compared to the $125M guided for 2022. However, we expect this strategy to eventually be top and bottom lines accretive, thereby, fulfilling the company’s goal of building an end-to-end logistics platform for the next hundred years of e-commerce. No harm, since its net debts are expected to remain stable at these levels as well.

In the meantime, we encourage you to read our previous article on SHOP, which would help you better understand its position and market opportunities.

So, Is SHOP Stock A Buy, Sell, Or Hold?

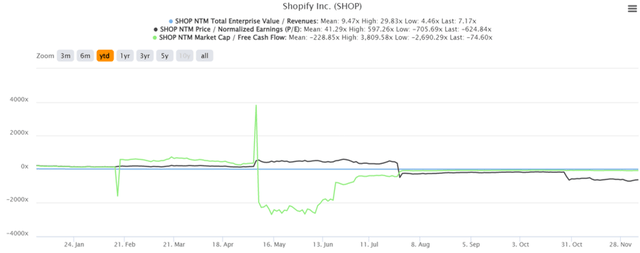

SHOP YTD EV/Revenue and P/E Valuations

SHOP is currently trading at an EV/NTM Revenue of 7.17x, NTM P/E of -624.84x, and NTM Market Cap/ FCF of -74.60x, lower than its obviously hyper-inflated 5Y mean of 21.85x, 609.77x, and -290.93x, respectively. Otherwise, still massively overvalued based on its YTD mean P/E of 41.29x. It is evident that these numbers still look crazily inflated, despite the worsening macroeconomics and the 98% probability of recession in 2023.

While it is not unreasonable to assume that SHOP may eventually surpass AMZN in valuations, the former will need to prove itself by delivering sustained profitability first. Even the latter’s stock prices continue to be depressed at $88.42 at the time of writing, despite the supposed price target of $364.06 against its FY2026 EPS of $5.94 and NTM P/E of 61.29x.

Therefore, we prefer to revise our rating on the SHOP stock as a Hold for now, due to the massive uncertainty in the market. There is no point in chasing this rally, since things will likely remain volatile over the next few months.