Shiseido: Business Transformation Complete; Awaiting China Recovery (SSDOF)

Vincent_St_Thomas/iStock Editorial via Getty Images

Investment thesis

Shiseido (OTCPK:SSDOY) has remodeled its business portfolio and experiencing improving business conditions in the core Japanese market as well as in EMEA. China remains an uncertain market but conditions are stabilizing – although a full-blown recovery will still take time, we believe Shiseido is positioned well to benefit. We rate the shares as a buy.

Quick primer

Founded in 1872, Shiseido is a Japanese cosmetics and personal care products company. Key brands include SHISEIDO, clé de peau beauté, NARS, and Drunk Elephant. The two core markets are Japan and China, with total Asian sales making up over 60% of FY12/2022 total sales.

During FY12/2022 the company streamlined its business portfolio, selling off the Personal Care business (mass market skincare and shampoo products) and three overseas-focused brands (bareMinerals, BUXOM, and Laura Mercier) to private equity firms, and terminating a global license agreement with Dolce&Gabbana. Shiseido is aiming to re-focus as a high-end skincare business. It has most recently disposed of its Professional products business.

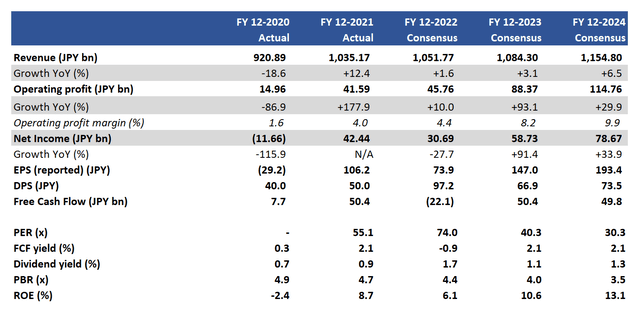

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

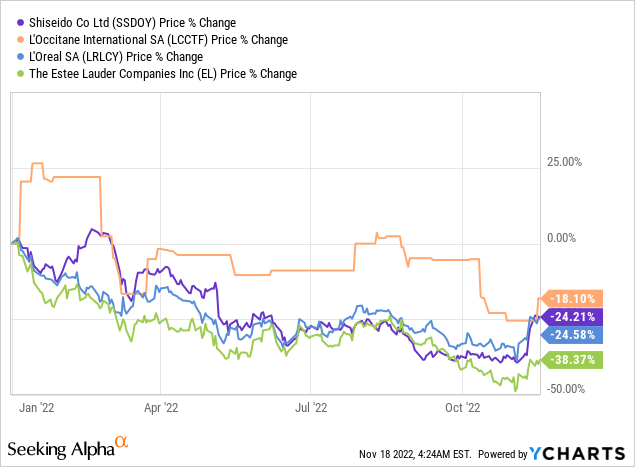

Shiseido’s shares have outperformed YTD key global player Estee Lauder (EL), on par with L’Oreal (OTCPK:LRLCY) and slightly lagging L’Occitane (OTCPK:LCCTF). In this piece, we want to revisit our view from June 2021, and see whether after this price correction the shares are worth investing in.

China’s recovery remains a work in progress

Earlier in spring 2022, the outlook for the company was negative with China sales falling 14% YoY with persistent lockdowns, together with Japan’s slow market recovery. As Shiseido’s core geographic markets dragged, this was reflected in the share price performance.

Q3 FY12/2022 results highlighted that although China remained the weakest region, the decline in sales YoY fell back to -2% YoY (page 6), with management stating that sell-through was firm resulting in market share gains. Japan made a comeback with sales recovering 9% YoY, driven by demand for all price range products as well as department stores (but still with limited inbound tourist business). EMEA continued to see strong momentum. Per brands, the key Q1-3 FY12/2022 sales growth drivers were clé de peau beauté and NARS (page 5).

Shiseido needs the China market to normalize, as lockdowns continue to play havoc with consumer behavior. Whilst the company focuses on driving demand through both online and offline promotions as well as personalized services. Q3 FY12/2022 sales saw some positive metrics for consumer purchases for its premium products, but concerns persist over inventory adjustments and Chinese consumers focusing on making savings.

Our view is that China will maintain a more stringent lockdown policy compared to the rest of the world, and consequently doing business in the region will mean more speed bumps to come. However, the general direction is one of a very gradual recovery, which is a positive for Shiseido in the longer term given its strong market position.

Current efforts to drive change at Shiseido have been overseen by CEO Masahiko Uotani who was appointed in 2014. In November 2022 it was announced that the company is overhauling its management team, with Uotani becoming chairman and CEO, and current China-region CEO Kentaro Fujiwara becoming president and COO. This change hints at Shiseido’s unerring focus on the region.

Business transformation yielding some results

Despite disruption from major asset disposals in the business, it was positive to see that there is already evidence to suggest that the business portfolio is improving. The cost of goods sold ratio for Q1-3 FY3/2023 fell from 25.5% in the previous year to 24.8% (for like-for-like sales) (page 14), due to an improving sales mix and lower inventory write-offs. This is a significant positive given cost inflation with higher raw materials and logistics costs.

Q1-3 FY12/2022 results overall were firm, with JPY36 billion/USD250 million operating profit showing a 90% run-rate versus company FY guidance of JPY40 billion/USD275 million. The official reasoning is the need to book restructuring costs during Q4 FY12/2022. However, it would appear that the company will perform ahead of guidance (which is already reflected in consensus estimates).

The company’s strategic shift to focus on skincare products appears sensible, given it can focus on its core competitive product. However, it would appear that a full recovery in Japan and China into FY12/2023 will have to be the key earnings driver, as opposed to immediate major benefits from the improving sales mix.

Valuation

On consensus forecasts (see Key financials table above), the shares are trading on PER FY12/2023 40.3x, on a free cash flow yield of 2.1%. These valuations are not particularly low, although the PER multiple is significantly lower than the 5-year historic average of 60x.

Risks

Upside risk comes from an accelerating recovery in the China market, driven by lockdowns being loosened. Although not expected in the next year, a return of Chinese tourists to Japan will be a major positive catalyst.

Downside risk comes from China’s recovery decelerating as more lockdowns are implemented in key cities. The cost-of-living crisis could tone down demand in the Travel Retail business (duty-free shops) which has performed strongly in Q1-3 FY12/2022.

Conclusion

Shiseido has executed its business portfolio reshuffle, and the sales mix is improving. The Japanese market is recovering, with the core China market showing some signs of improvement. The company needs sales volume to recover to return to pre-pandemic levels of profitability, but this process will take more time given the company’s reliance on Chinese consumers. A full-blown recovery may take longer than market expectations, but with limited downside risk, we rate the shares a buy.