Senseonics Holdings Stock: 2023 Will Be The Make Or Break Year

supersizer/iStock via Getty Images

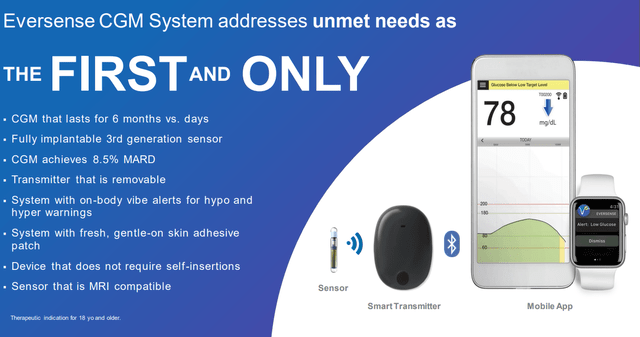

Senseonics Holdings Inc (NYSE:SENS) develops medical devices for the diabetes market. Its “Eversense” implantable continuous glucose monitoring (CGM) systems are recognized as offering several advantages compared to traditional wearable glucose monitors and blood meters. Even as the core technology has been FDA-approved since 2018, the commercialization strategy has been slow to ramp up following disruptions during the pandemic. Indeed, shares of SENS are down more than 50% this year amid overall weak financial results.

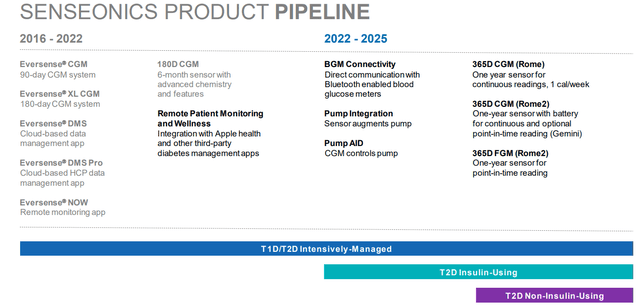

That being said, the outlook is for stronger growth as insurance reimbursement coverage expands for the latest 6-month CGM implant device available now. Senseonics is also moving forward with clinical trials for a 1-year version of Eversense along with a product pipeline for a next-generation implant incorporating more advanced features.

We believe 2023 will be a critical year for the company to make some real progress with sales and prove the business is viable. This is a highly speculative stock but the attraction here is the significant opportunity to capture share from some of the more established and larger CGM leaders as part of the long-term bullish case.

source: company IR

SENS Key Metrics

The company reported its Q3 earnings on November 8th with revenue of $4.6 million, up 31% year-over-year from $3.5 million in the period last year. The story here was the early success momentum in the transition to the 180-day “Eversense E3” which was FDA-approved back in Q1. U.S. sales more than tripled to $1.9 million while sales outside the U.S. were down by 7% to $2.7 million reflecting a later approval of E3 in Europe only in June with the commercial launch just getting underway.

The gross profit reached $0.8 million reversing a gross loss of -$1.2 million in the period last year. Still, the focus continues to be on growth, evidenced by a jump in R&D to $11 million in support of its new product development and spending on clinical trials. The company ended the quarter with $163 million in cash, and equivalents against $103.3 million in total debt.

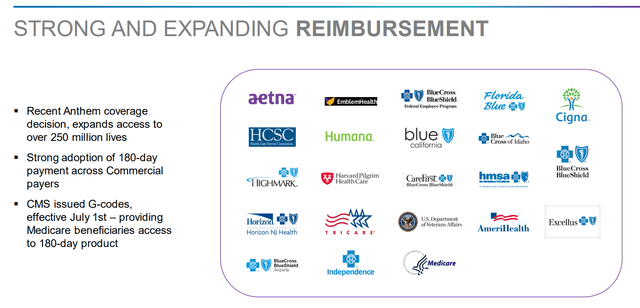

The latest update is that E3 is now available globally. In the U.S., E3 received a positive coverage decision from Blue Cross Blue Shield of Florida health insurance association, which added over five million covered lives as potential Eversense CGM patients. Insurance codes within the 2023 Medicare Physicians’ fee schedule were also updated to account for the longer 6-month platform. Keep in mind that Senseonics products are marketed by the company’s exclusive distributor “Ascensia Diabetes Care“.

For the rest of 2022, management is targeting full-year revenue in a range between $15.0 to $17.0 million, which is narrower compared to the prior guidance of $14.0 to $18.0 million. Considering $10.8 million in revenue year-to-date, the estimate here implies Q4 sales above $5 million which is an acceleration from Q3. Even as the top end of the estimate was pulled lower, the understanding is that ramp-up should continue into 2023 particularly considering the expanded insurance coverage.

source: company IR

Is SENS a Good Investment?

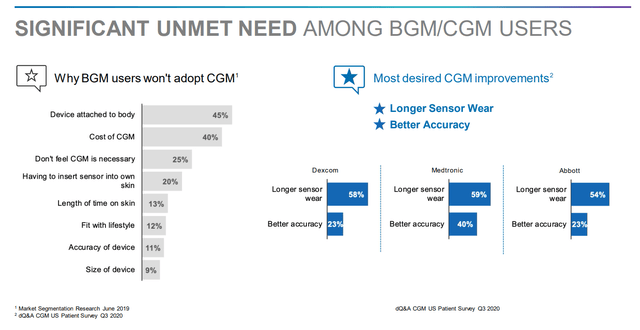

What we like about Senseonics as an investment opportunity is the transformative positioning of its CGM systems. The product is real and there’s a strong case to be made that many diabetes patients can benefit from the implantable device compared to alternative solutions.

Currently, the CGM market is dominated by players like Medtronic Inc (MDT), Abbott Laboratories (ABT), and DexCom Inc (DXCM) where the glucose monitor sensor is attached to the body via a small micro-needle, which typically needs to be calibrated daily and replaced weekly. The option to get a 6-month minimally invasive implant through the Senseonics device simply adds convenience to the regular diabetic care process.

The goal is to capture both new CGM users and dissatisfied patients from the competitors. This is a market estimated to represent more than $8 billion annually. The ability of Senseonics to just capture a fraction of those revenues globally highlights the upside potential for the company that is just getting started.

source: company IR

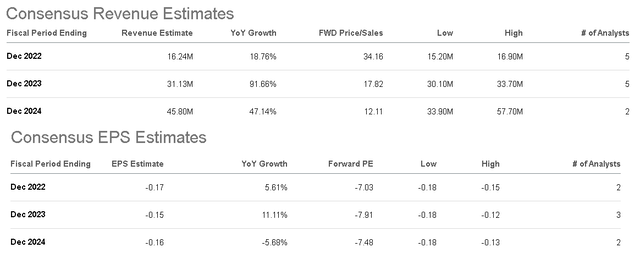

From the management guidance of 2022 revenue of around $16 million, the consensus is for sales to accelerate and nearly double next year towards $31 million and reach $46 million by 2024. Our take is that if the response from patients is strong, there is likely an upside to the top line as part of the bullish case for the stock.

The bigger question is how or when the company will be able to translate that sales trend into stronger profitability, which is not expected for the foreseeable future. This of course is a weakness in the outlook that should keep shares volatile.

source: company IR

In terms of the 365-day “one-year” sensor currently in a pivotal trial, we expect this to eventually be approved considering the safety of the 180-day version has been established. The impact of the longer indication is to further add to the attraction of the device which could also lead to another boost in growth as current users transition to the new style.

What’s interesting are the next steps for Senseonics in terms of its product pipeline. A next-generation implant that features a wireless integration with insulin pumps as a multi-way transmitter would be a game changer. Functionality in third-party health monitoring apps like “Apple Health” would also be another selling point.

source: company IR

SENS Stock Price Forecast

With a current market cap of around $550 million, the setup here is that SENS is trading at a sales multiple above 35x. The objectively pricey valuation despite recurring losses means many of the positives in the outlook have already been incorporated into the stock price.

Senseonics will need to prove it can successfully execute a commercialization strategy while also demonstrating some progress in improving financials. As sales of the 180-day E3 ramp up, the focus will begin shifting toward questions like margin potential and cash flow trends.

We rate SENS as a hold, balancing our positive view of the product and its potential against what are lingering financial uncertainties. The stock has been forming a base of technical support around $1.20 over the last month but has also traded as high as $2.44 back in August highlighting the extreme trading range. Investors should expect this type of volatility to continue.

The main risk is that sales underperform based on slower-than-expected market adoption. While liquidity is stable in the near term, we wouldn’t be surprised by the need for a capital raise into next year, which could be dilutive to current shareholders. On the upside, any update on the 365-day CGM trials or new product development could work as a bullish catalyst for the stock.