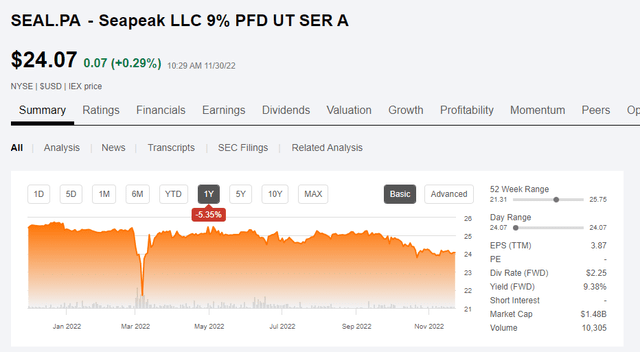

Seapeak’s Preferred Shares Offer 9-9.4% Yields With Strong Coverage Levels

Natallia Pershaj/iStock via Getty Images

Introduction

Although I’m generally not a fan of preferred shares of unlisted companies, I still own both series of Seapeak’s preferred shares, trading with (NYSE:SEAL.PA) and (NYSE:SEAL.PB) as their respective ticker symbols. When Stonepeak, a private equity player, acquired Teekay LNG Partners is committed to being transparent and the company focusing on LNG tankers continues to report its financial results in SEC filings. In a previous article, I commented I’m happy to continue to be a preferred shareholder as long as the company continues to report its financial results on a quarterly basis and as long as the financial health of Seapeak remains the priority of the private equity group.

The Q3 results were in line with the expectations

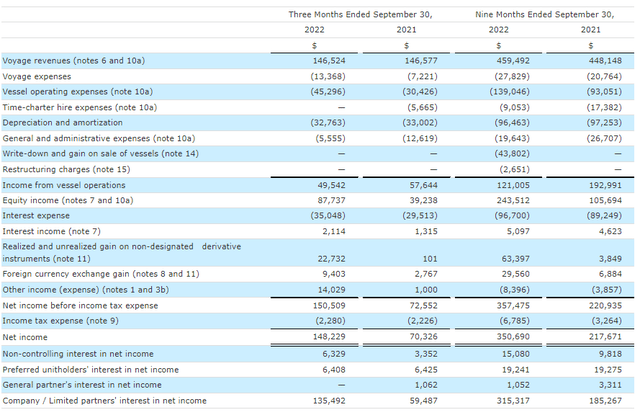

During the third quarter, Seapeak reported a total revenue of just over $146M and after deducting the voyage expenses and the vessel operating expenses, the net operating income from the pure operations was approximately $88M. After deducting the almost $33M in depreciation and amortization expenses as well as the $5.6M in G&A expenses, the net income from vessel operations was approximately $49.5M.

Seapeak’s reported pre-tax income was boosted by the almost $88M in equity income and the almost $23M profit on derivative instruments. Additionally, there was a $14M ‘other income’ and this resulted in a pre-tax income of $150M and a net income of $148.2M. Of that amount, $6.3M was attributable to non-controlling interests and an additional $6.4M was required to cover the preferred dividend payments, which means the net income attributable to the common shareholders (in casu the private equity group) was just over $135M.

There are a few elements that need additional clarification here. First of all, the equity income contains a few non-recurring elements like the sale of the Excalibur LNG vessel to Exmar, which will lease the asset to Eni (E) as part of a larger LNG-related deal.

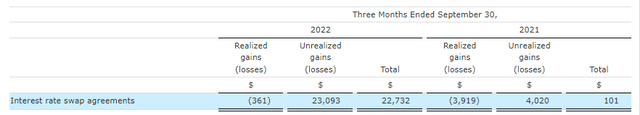

The almost $23M in derivative-related income was entirely related to the unrealized gains on interest rate swap agreements. As market interest rates are increasing, the value of the swaps increase. This is a non-cash gain and won’t show up in the cash flow statement.

And finally, a large portion of the ‘other income’ which helped to boost the pre-tax income was related to the change in credit loss provisions for the financing leases on some of the vessels. According to the footnotes to the financial statements ‘The change in the credit loss provision for the three and nine months ended September 30, 2022, primarily reflects an increase in the estimated charter-free valuations for certain types of its liquefied natural gas (or LNG) carriers at the end of their respective time-charter contracts’. This basically means Seapeak benefited from the value increase of LNG vessels thanks to the very high demand for capacity.

And there’s one other element I’d like to highlight. The private equity partner appears to be running a tight ship (pun intended) as the G&A expenses continue to decrease. During the third quarter, the total amount of G&A expenses had dropped to just $5.6M, which is less than half of the $12.6M spent in Q3 2021 when Seapeak was still a publicly listed company and was paying fees to Teekay.

As you notice, virtually all of the main ‘special’ contributors to the strong net income result are either non-recurring and/or non-cash. That’s a very important reason why I always want to have a look at the cash flow statement as well.

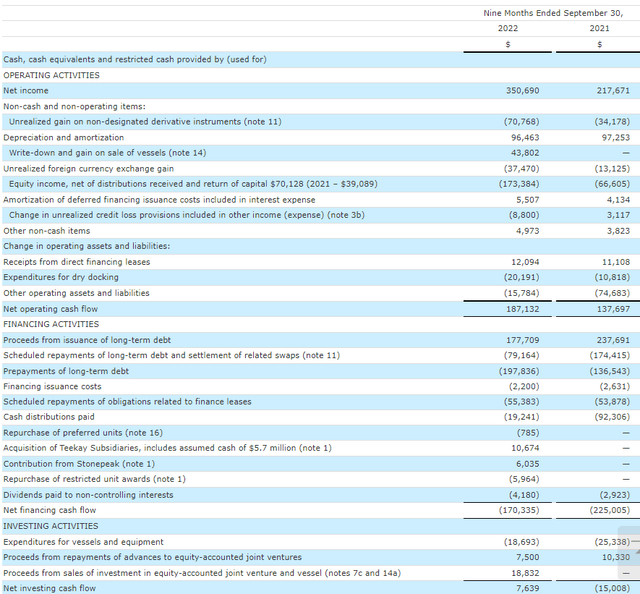

Unfortunately, Seapeak does not provide a Q3 cash flow statement, but the Q3 cash flows can easily be calculated by comparing the 9M 2022 statement with the H1 statement. As you can see below, the reported operating cash flow in the first nine months of the year was $187M and this would be $203M after adding back the changes in the working capital position and $199M after deducting the distributions to the non-controlling interests.

The cash flow statement above clearly shows the almost $71M in gains on derivatives, the $37M FX gain, and the $173M in equity income is fully deducted. The total capex excluding dry-docking payments was just $19M, resulting in a net free cash flow of $180M in the first nine months of the year and $161M after deducting the preferred dividend payments. If you would also deduct the $55M in finance leases, the net free cash flow would be $105M on an underlying basis.

As explained in a previous article, Seapeak’s H1 result came in at just $33M, which means the Q3 free cash flow was approximately $72M. This strong performance wasn’t just caused by a decent operating performance but also because of a nice cash inflow related to the equity investments ($48M in the third quarter).

The cash flow statement again clearly shows the private equity partner is running Seapeak as it should: there are no suspicious cash outflows from Seapeak to the partner, and the cash was mainly used to reduce the debt. As of the end of Q3, the total equity value (excluding the equity attributable to non-controlling interests) on the balance sheet came in at $2.19B, an increase from the $1.86B as of the end of 2021 and also an increase compared to the $2.05B as of the end of June. As a preferred shareholder of an unlisted company, that’s something I really like.

Expect the net debt to increase again in the current quarter, as Seapeak entered into an agreement with Jaccar Holdings to acquire Evergas for $244M. Evergas owns and operates two Very Large Ethane Carriers and eight LNG carriers, and all of these vessels are chartered to the well-known Ineos Group on long-term contracts, expiring between 2026 and 2030.

Investment thesis

Even if you would ignore the non-recurring items in the income statement, the preferred dividends are very well-covered. As the private equity owner of Seapeak hasn’t taken any cash out of Seapeak, the preferred shares are actually getting safer on a daily basis. At the end of last year, the total equity ranking junior to the preferred shares totalled $1.56B which already was a comfortable position to be in, but as of the end of the third quarter, the retained earnings boosted the net equity to $2.19B. After deducting the $295M in preferred equity, the total amount of common equity ranking junior to the preferred shares had increased to almost $1.9B.

We’ll see if the private equity owner ‘rewards’ itself with a cash dividend based on the full-year 2022 performance, but for now, I’m very pleased with how Stonepeak is managing Seapeak. I have a long position in both preferred shares and I see no reason to sell. Keep in mind, the A-series can be called at any given moment at Seapeak’s discretion.