Safe Bulkers Common And Preferred Stocks Should Satisfy Your Needs (NYSE:SB)

Denys Yelmanov

My Investment Thesis

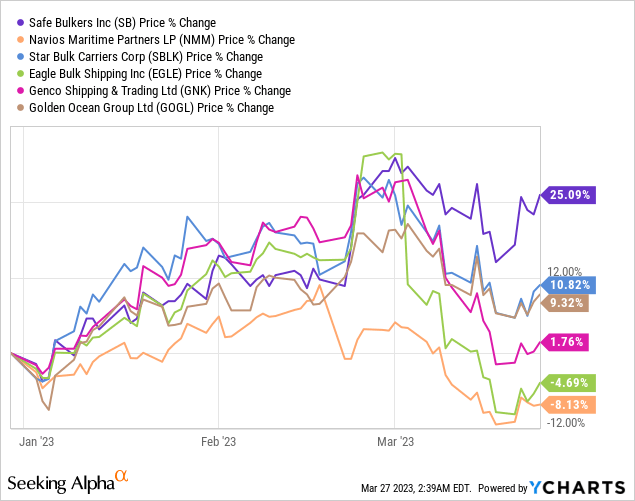

Although dry bulk shipping equities did not perform as expected so far this year, with an average YTD return of 4.27% for the major and most liquid names compared to 3.42% for the S&P 500 Index (SPX), it’s important to note that not all companies are equal. Some companies have better operational positions, more robust balance sheets, or are undervalued. The recent outperformance of Safe Bulkers, Inc. (NYSE:SB) (NYSE:SB.PD) stock is likely due to a combination of such factors, which I discuss in my today’s analysis.

Based on SB’s attractive valuation and strong financial position, I anticipate that the stock will continue to outperform, not only meeting but potentially exceeding market expectations.

My Reasoning

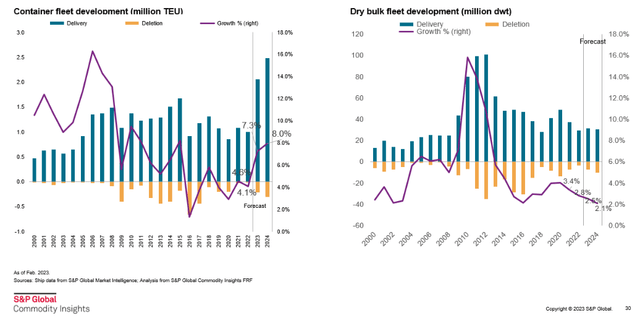

In contrast to the container shipping market, which is expected to experience a significant increase in ship supply due to a large orderbook for several years ahead, the dry bulk shipping industry is experiencing the opposite trend, currently having the smallest orderbook in recent decades.

S&P Global: Shipping market outlook—Container vs dry bulk

According to analysts at S&P Global, the demand/supply analysis for the dry bulk shipping market in the 1st half of 2023 seemed negative.

Nevertheless, their model forecasts a positive outlook for the market in the later part of the same year:

S&P Global: Shipping market outlook—Container vs dry bulk

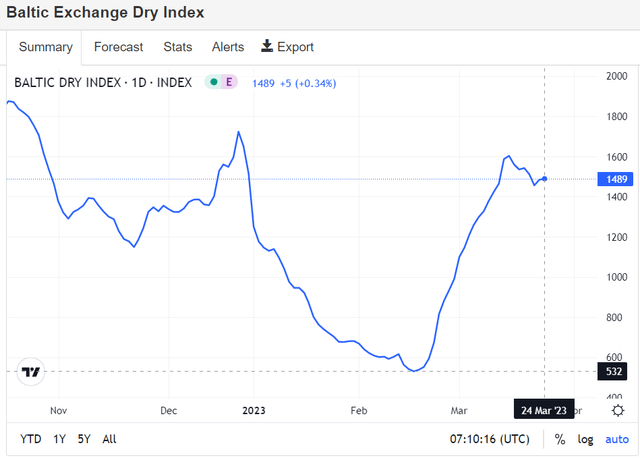

We are still in the first half of the year, but apparently, the positive momentum is already making itself felt – the Baltic Exchange Dry Index has almost tripled from the mid-February 2023 lows:

TradingEconomics: Baltic Exchange Dry Index

Earlier, Niels Rasmussen from Bimco gave his forecast for the state of the industry in FY2023. According to his calculations, China’s economic recovery, albeit without the previous high single-digit growth rates, will be able to provide a new impetus to the demand side – the gap to supply growth will only widen in 2023 and 2024, which is a bullish sign for all bulkers.

BIMCO: dry bulk shipping market overview [author’s notes]

BIMCO reports, that dry bulk supply is expected to increase by about 1-2% in FY2023 and by another 0.5-1.5% in FY2024, while demand growth is predicted at 1.5-2.5% and 1-2%, respectively.

Long-term demand growth for dry bulk shipping is linked to the GDP growth of the markets they serve, but it’s also crucial to consider the demand structure. Safe Bulkers’ latest IR presentation revealed that the demand for grains and coal is projected to increase by 3% and 2% in FY2023, respectively. These are the primary materials that Safe Bulkers carries in its 44 vessels, along with iron ore.

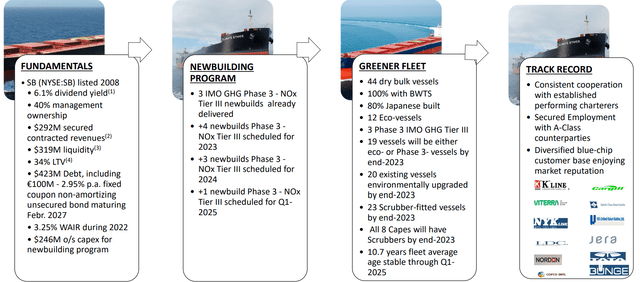

With 100% of their 44 dry bulk vessels equipped with Ballast Water Treatment Systems [BWTS], and 80% of the vessels being Japanese-built [read – more energy efficient], the company is already making strides toward a greener fleet. SB has 12 Eco-vessels, with 3 of them meeting the Phase 3 IMO GHG Tier III standards. By the end of 2023, 19 vessels will be either eco- or Phase 3- vessels, and 20 existing vessels will have undergone environmental upgrades. Furthermore, 23 vessels will have Scrubbers fitted, and all 8 Capes will have Scrubbers by the end of 2023:

In this way, SB protects itself and its stakeholders from much of the operational risk that can occur in less well-prepared firms.

On the financial side of the business, I am particularly struck by the fact that SB has $123 million in cash on hand – well above average compared to most other peers:

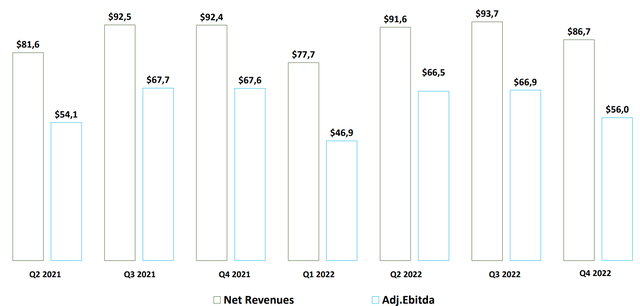

The years 2021-2022 proved to be a roller coaster ride for the industry, but despite the ups and downs, the company’s net revenue and adjusted EBITDA figures have remained fairly stable during this period:

As of February 10, 2023, SB had 50% of its revenue contracted for FY2023 – it already has contracts for 26% and 15% of revenues for FY2024 and FY2025, respectively. In my opinion, this positions SB quite favorably for a recovery in demand – a significant portion of the company’s fleet will be contracted against a backdrop of higher demand growth and lower supply – see Niels Rasmussen’s chart above. Against the background of limited supply growth, charter rates will adjust to the existing reality and should therefore be higher than today.

At this point, I would like to draw your attention to valuation and what the market expects from a company in the context of its industry:

Author’s calculations, Seeking Alpha data

We can pay special attention to the EPS growth rates for FY2024 and the implied price-to-earnings ratio for the corresponding year. You can argue for hours about what is fair and what is not in valuing these companies, but there will be little disagreement on one point – the opportunity cost. Take Star Bulk Carriers (SBLK) and Eagle Bulk Shipping (EGLE), for example, which Wall Street analysts forecast to grow earnings per share by 12.57% and 10.99% in FY2024 [respectively, YoY]. That’s up just 3.06% and 1.48%, respectively, from SB’s growth rate. At the same time, SB’s P/E ratio [FY2024] is 43% and 58% lower than those two peers, respectively. In my opinion, this is too large a discount for a 1-3% difference in EPS growth.

The picture is perfectly complemented by management’s recent decision to increase the share buyback program. This news seems to have gone unnoticed but suggests that new contractual revenues due to charter rates could now translate into higher EPS than currently priced in [thanks to the lower denominator].

Your Takeaway

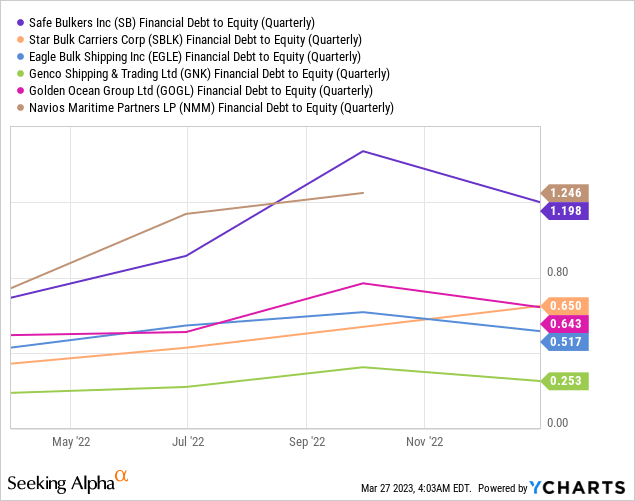

Of course, my bullish thesis is not without flaws. SB has the highest debt level among its direct competitors [Navios Maritime Partners (NMM) is not the one], which increases the company’s risk profile and could explain its too-cheap valuation:

In addition, SB will have to spend a total of $246.2 million in capital expenditures in the coming years, which may lead to a sharp decline in profitability against the backdrop of a possible deterioration in the industry.

Despite these risks, I tend to believe that SB is trading at too large a discount to its peers at current levels. The company’s EPS estimates for FY2024 and FY2025 seem too conservative, and it does not get a higher multiple for a smaller decline in EPS this year either. SB is just too cheap to ignore here.

For those who want to make a relatively safe bet on this company, I recommend paying attention to its preferred shares. I wrote about Safe Bulkers PERP PFD SER D back in September 2021 – as time has shown, this recommendation would have resulted in a loss but would have been almost 2x better than the market represented by SPX:

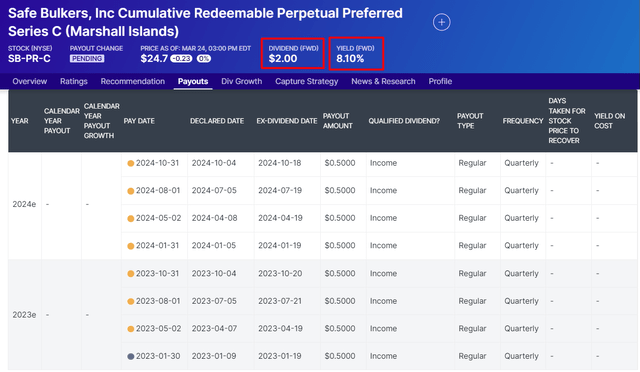

The company’s preferred stock looks quite stable, with quarterly distributions and an annualized FWD yield of 8.1%:

From dividend.com

At the same time, these payments cost the company less than 5% of free cash flow, which makes this instrument quite cheap for SB and thus reliable for income-seeking investors.

Safe Bulkers’ IR materials [author’s notes]![Safe Bulkers' IR materials [author's notes]](https://static.seekingalpha.com/uploads/2023/3/27/53838465-16799101636008348.png)

I expect yields on this instrument to fall as the Fed adjusts its tightening policy. The cycle of high-interest rates amid the problems of the U.S. banking system seems to be short-lived now – as soon as the interest rate falls, fixed-income instruments [and preferred stocks] will become more expensive.

Once again, Safe Bulkers proves that it has everything to satisfy investors – both value-oriented and income-seeking. In SB stocks [different types of them] everyone can find what they are looking for, and at the same time, one is unlikely to overpay for it.