Ross Stores: People Dress For Less In Times Of Low Consumer Confidence (NASDAQ:ROST)

Justin Sullivan/Getty Images News

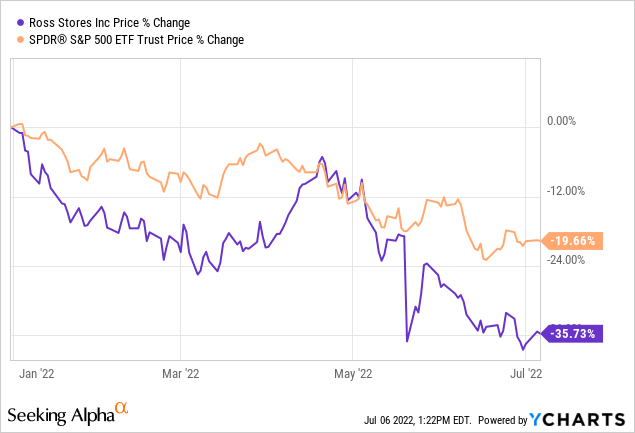

Ross Stores (NASDAQ:ROST) has lost more than 35% of its market capitalisation compared to the 20% decline of the broader market.

In our opinion, the sharp selloff was partially justified due to the relatively poor financial performance in the first quarter of the year. On the other, Ross Stores’ stock has consistently outperformed the broader market during times of low consumer confidence in the last 20 years. In this article, we will take a look at what we like and what we do not like about ROST and whether it could be an attractive investment option at the current price levels.

So let us start with recalling how the stock price has developed during times of low consumer confidence.

Consumer Confidence

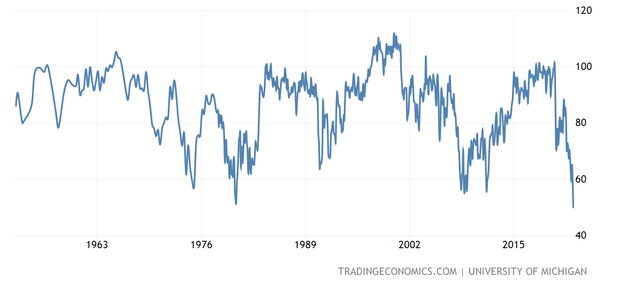

Consumer confidence is often regarded as a leading economic indicator, which can be used to gauge or forecast the near-term trend changes in the behaviour of the consumer spending.

So far, in 2022, consumer confidence has been steadily declining in the United States, falling below levels that we have seen during the 2008-2009 financial crises.

U.S. Consumer confidence (Trading Economics)

A low consumer confidence is likely to lead to a spending cut on durable, discretionary, and non-essential products. Spending on such items could be completely eliminated, delayed to a later point in time, or simply reduced by choosing lower cost alternatives.

In our opinion, Ross Stores operates off-price retail apparel and home fashion stores, it could be a good alternative for consumers looking for more affordable alternatives.

Let us take a look, how Ross has performed in the last 20 years, during times of low consumer confidence to support our hypothesis.

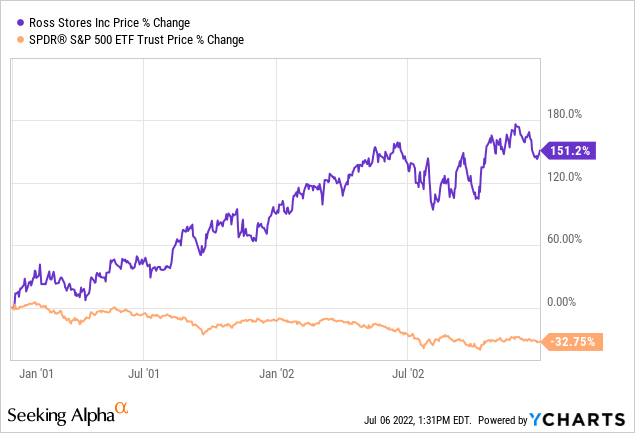

2001-2003

While the S&P 500 (SPY) has declined by more than 32%, Ross’ share price has more than doubled, gaining as much as 151% over the two year period.

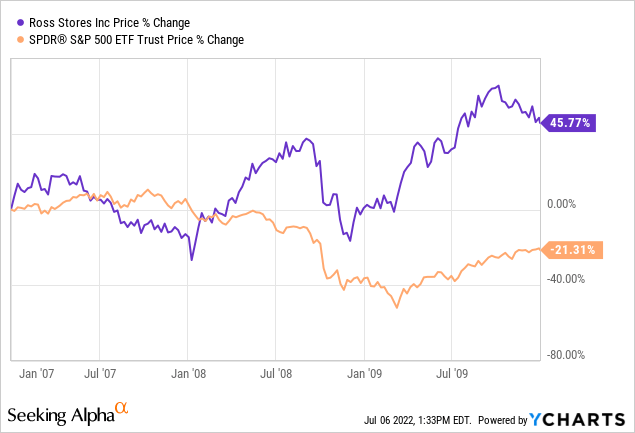

2007-2010

Between 2007 and 2010, ROST has once again significantly outperformed the broader market. Although in 2007, the stock slightly underperformed the broader market, during the years of the financial crisis it has made significant gains.

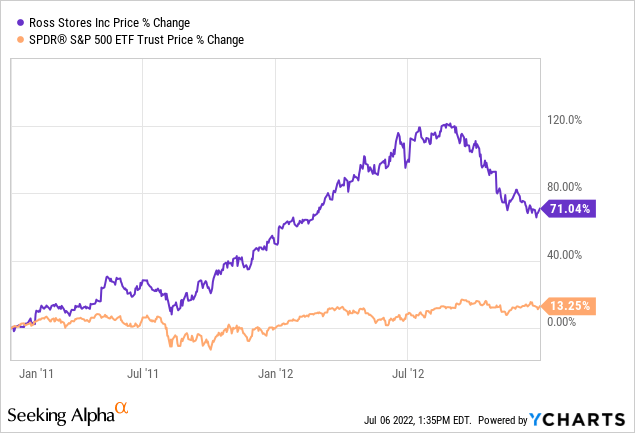

2011-2013

Last, between 2011 and 2013, the firm has gained as much as 71%, in contract to the 13% gain of the broader market.

All in all, the firm has performed significantly better than the broader market during all three highlighted periods. In our opinion, discount retailers in general are well-positioned to outperform the broader market during times of low confidence.

The question is, can ROST repeat its past performance once again?

To figure it out, let us look at the first quarter financial results.

First quarter financial results

In the first quarter, comparable store sales were down by as much as 7%. Demand has been lower for this quarter than a year ago, due to two primary reasons:

1.) Government stimulus created elevated demand in 2021

2.) Easing of COVID-19 restrictions in 2021 also lead to higher demand

These positive effects have largely disappeared by 2022. The firm has also had to adjust their sales forecast downwards for 2022 to capture the most recent observations.

Not only the sales performance of the firm was disappointing, but also the margin contraction.

Operating margin has declined to 10.8%, from the more than 14% in the year ago quarter. As many other firms, ROST is also hurt by the elevated freight and wage costs.

The elevated freight costs are a result of the extraordinarily high oil and gas prices, partially driven by the ongoing geopolitical conflict in the Eastern European region. To ease the situation, OPEC+ has earlier signalled its willingness to increase oil output by a larger than planned amount in July and August, which may have driven the decline in oil prices in the first week of July. Despite this decline in oil prices, we remain cautious as the geopolitical tension may create further volatility in the energy prices in the months ahead. Due to the high uncertainty, we believe that oil and gas prices are likely to remain elevated compared to 2021 price levels for the rest of the year.

Due to this outlook, we do not recommend starting a new position in ROST. First, we would like to see the macroeconomic headwinds ease.

Although the firm had a challenging start in 2022, it can still appear to be an attractive choice for a large group of investors.

One reason is: dividend.

Dividend

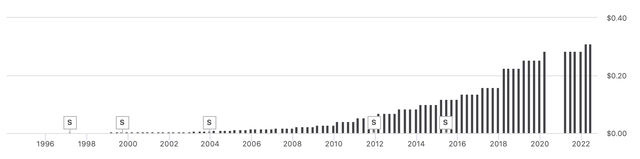

ROST has demonstrated over the years that they are committed to return value to their shareholders in the form of dividend payments.

The firm has been paying out dividend for the last 28 years consecutively, however they have paid only one quarterly dividend in 2020, due to the pandemic.

The cut of the dividend in 2020, in our view, is actually positive. We like when the management recognises that the dividend is not sustainable and is not afraid to make the decision of cutting or reducing the payouts.

Currently, the firm pays a quarterly dividend of $0.31 per share, which corresponds to a yield of about 1.7%. The Dividend Payout Ratio (TTM) (GAAP) is 26.5%, which appears to be sustainable, despite the potential sales decline. This figure is also in line with the sector median of the consumer discretionary sector.

For these reasons, we believe that ROST could be an attractive addition to a dividend investor’s portfolio.

Valuation

Despite the more than 35% share price decrease in 2022, we believe that the stock is still overvalued, based on a set of traditional price multiples. In terms of price to earnings ratio, EV-to-EBITDA and price to cash flow, the firm seems to be trading at a significant premium compared to the median of the consumer discretionary sector.

In our opinion, such a high valuation is not justified, due to the poor first quarter performance and the highly uncertain macroeconomic environment. We would like to see the stock price come down to the low 60s to consider it attractive from a valuation standpoint.

Key takeaways

ROST had a challenging first quarter in 2022 with sales declining and margins contracting.

The stock has a strong track record of outperforming the broader market during times of low consumer confidence in the last 20 years.

Despite the sharp price drop year to date, and the attractive historic performance, we believe that the stock at the current price levels remains overvalued.

Investors looking for a safe and sustainable dividend, may consider adding ROST to their portfolios.

Currently we rate ROST as “hold”, due to the high valuation and uncertain macroeconomic environment.