Rithm Capital PFD ‘D’: An Update (NYSE:RITM)

Evkaz

(This article was co-produced with Hoya Capital Real Estate)

Introduction

When interest rates on CDs were basically “zero”, I started buying baby bonds and a few Preferreds to build a bond ladder in place of owning CDs, which I last reviewed at the start of 2021: 2021 Was A Tough Year For Investors Who Built A Bond Ladder. While my asset prices declined with the FOMC actions, the “being called” problem stopped.

About the same time, I reviewed the then newly issued New Residential preferred, their fourth. Two months later, at a price of $24.24, I added the PFD-D to our ladder as several of our 2026 assets were called.

The RITM Pfd “D” appeared to be the best bet when I covered it last January; that call is less clear now. With more rate increases coming, I give it a Hold today.

Reviewing the Rithm Capital Corporation

Seeking Alpha describes this mortgage REIT as:

Rithm Capital Corp. provides capital and services to the real estate and financial services sectors in the United States. Its investment portfolio comprises mortgage servicing related assets, residential securities and loans, and consumer loans. It qualifies as a real estate investment trust for federal income tax purposes. The company generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was formerly known as New Residential Investment Corp. and changed its name to Rithm Capital Corp. in August 2022. Rithm Capital Corp. was incorporated in 2011.

Source: seekingalpha.com RITM

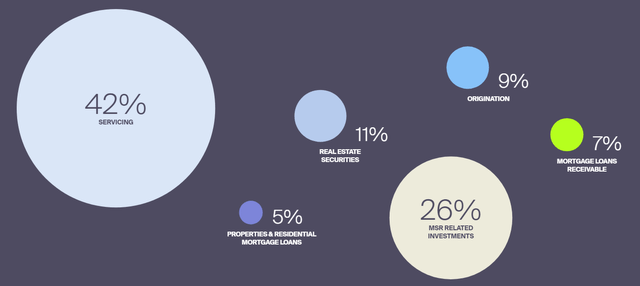

Rithm posts this bubble chart on their homepage to explain their business model.

Each segment came with a description:

- Servicing: Our servicing business operates through our performing loan servicing division and a special servicing division, Shellpoint Mortgage Servicing (“SMS”). The performing loan servicing division services performing Agency and government-insured loans. SMS services delinquent government-insured, Agency and Non-Agency loans on behalf of the owners of the underlying mortgage loans.

- MSR related: This segment includes a portion of our Mortgage Servicing Rights (“MSRs”) and our servicer advances. It also includes the activity from several wholly-owned subsidiaries or minority investments in companies that perform various services in the mortgage and real estate industries. Our subsidiary Guardian is a national provider of field services and property management services. We also made a strategic minority investment in Covius, a provider of various technology-enabled services to the mortgage and real estate industries. As of June 30, 2022, our ownership interest in Covius is 18.1%.

- Real Estate Securities: We acquire and manage a diversified portfolio of credit sensitive real estate securities, including Agency Residential Mortgage Backed Securities (“RMBS”), Non-Agency RMBS, and Call Rights. Residential mortgage-backed securities (“RMBS”) are securities created through the securitization of a pool of residential mortgage loans. We hold call rights on non-Agency residential mortgage securitizations which become exercisable once the current collateral balance reduces below a certain threshold of the original balance.

- Origination: Our origination business operates through the lending divisions of our leading mortgage companies Newrez LLC (“Newrez”), and Caliber Home Loans Inc (Caliber). Together, the companies are a top-5 non-bank mortgage lender in the country. As lenders, Newrez and Caliber provide purchase and refinance loans to consumers across all major channels including direct-to-consumer, retail / joint-venture, wholesale, and correspondent lending.

- Mortgage Load Receivable: Through our wholly owned subsidiary Genesis Capital LLC (“Genesis”), we specialize in originating and managing a portfolio of primarily short-term mortgage loans to fund single-family and multifamily real estate developers with construction, renovation and bridge loans.

- Properties and Residential Mortgage loans: We believe there are pockets of opportunity for us to invest in portfolios of non-performing and other residential mortgage loans, including performing and re-performing mortgage loans. In certain of these investments, we would expect to acquire the loans at a discount to their face amount, and we (either independently or with a servicing co-investor) would seek to resolve the loans at a substantially higher valuation.

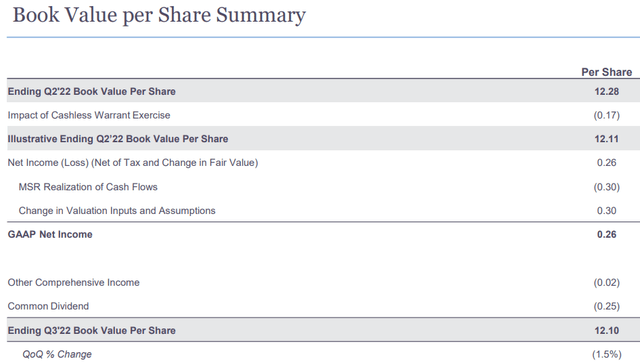

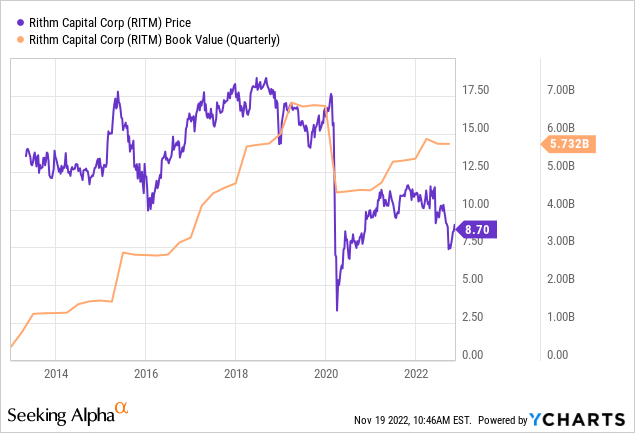

This is how the book value was effected in the latest quarter.

The common shares outstanding as of September 30, 2022 increased about 6,858,347 shares, which caused the Book Value to drop $0.17. This reflects the cashless exercise of common stock purchase warrants. The line “Change in valuation inputs and assumptions” refers to Mortgage Servicing Rights, though I did not see what assumption adjustments were made.

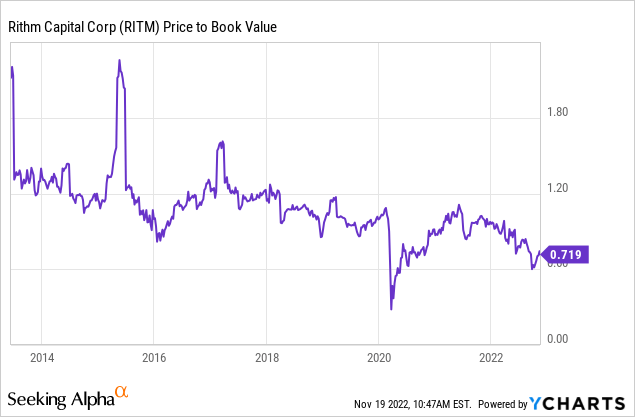

Except for the COVID crash, the Price/BV ratio is at a historically low level.

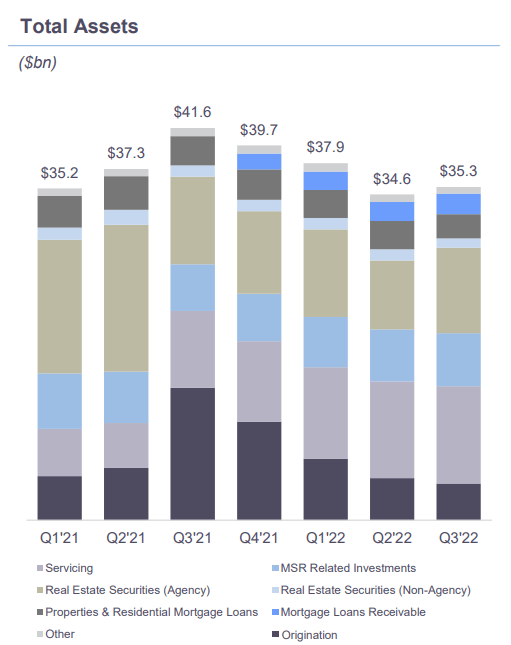

A positive sign is that for the first time since Q3’21, total assets were up QoQ.

rithmcap.com

A RITM focused article recently published goes into a deeper analysis: Rithm Capital: 11.3% Yield And The Stock Is Still A Bargain

Reviewing the RITHM PFD “D”

seekingalpha.com/symbol/RITM.PD/charting

The past year, with rising interest rates, has not been a great time to own this or most preferred stocks.

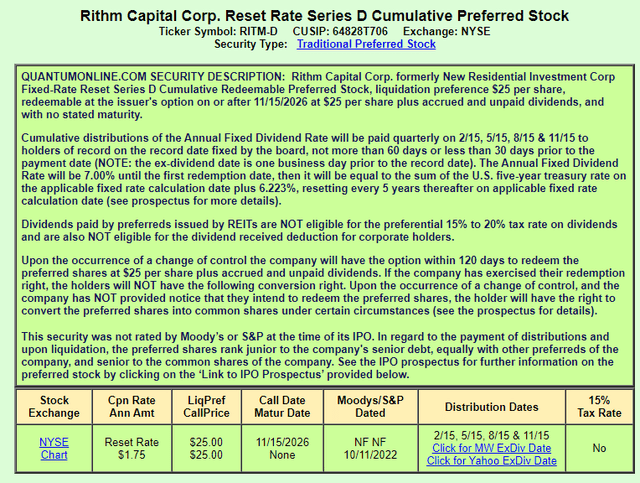

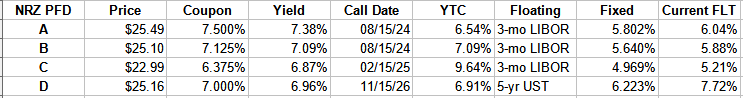

Pulling out the important facts about Rithm Capital Corp. 7% RT REST PFD D (NYSE:RITM.PD), we see that:

- The fixed coupon of 7.00% is good until the first call date: 11/15/26. Payments are made quarterly using the F/M/A/N cycle.

- The floating rate is then reset every 5 years using the following formula: UST 5-Yr rate + 6.223%. The current 5Y rate is near 4%, meaning the floating rate is above the current fixed rate. The 5Y UST rate was below 1.5% this time last year, before the FOMC started fighting inflation.

- Since RITM is classified as a REIT, any payments do not qualify for the special dividend tax rates.

- As with most issues, there is a special redemption feature if the company experiences a change-in-control.

For more detailed information the IPO Prospectus is available. One important data point for Preferred holders is how much equity covers their holdings. For all four preferreds, I calculate the coverage ratio at 450%.

Comparing Preferreds

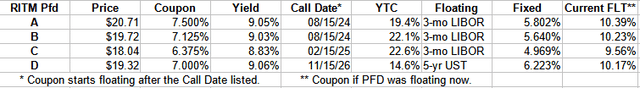

I will start by showing where all four stood in January of 2022.

Author’s YTC XLS

This what ten months of price declines and rate increases did to them.

In summary:

- Current yields have a smaller spread but YTC spreads are wider.

- “D” trails the other three in YTC although its current yield is both the highest (slightly) and longest by over 1.5 to 2.25 years.

- The estimated floating rate based on current data no longer clearly favors “D”.

Portfolio strategy

Even with inflation over 8%, today’s buyers/holders are earning above that at the current prices these preferreds trade at. The YOC is locked in for new buyers. The coupons are still above CDs and not that much below inflation, which appears to be weakening as the FOMC continues to bring it down.

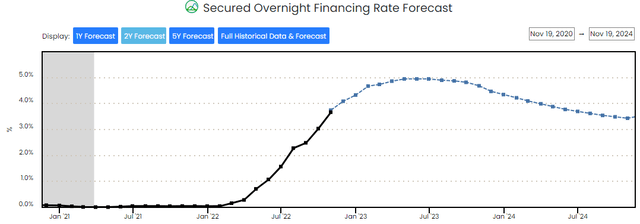

I take the YTC lightly as there is no guarantee that any will be called. The projected cost post-floating makes it attractive if new issues would not be required or if RITM’s financial condition would permit new issues at a lower coupon. I found this forecast for the SOFR rate, which is replacing LIBOR and covers the life span of two of the preferreds and most of the third.

econforecasting.com/forecast-sofr

They are forecasting rates to peak next summer and remain above today’s level until mid-2024. The 5-year UST forecasted curve mirrors SOFR’s. If correct, buyers should wait until next summer to initiate or add to their positions in most fixed income assets. It also tells me that preferreds with low coupons that float would be less likely to be called and replaced by a higher fixed but lower floating rate ones. The point being, do not be a buyer today expecting a high probability of getting $25 on the call date. What the past year has shown is, even without being called, these issues could sell for more than the current prices if interest rates and/or recession fears abate.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research – including reports that are never published elsewhere – across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.