Rio Tinto: Cooling Property Markets, Uncertain Zero-COVID Policy (NYSE:RIO)

Pyrosky

Investment Thesis

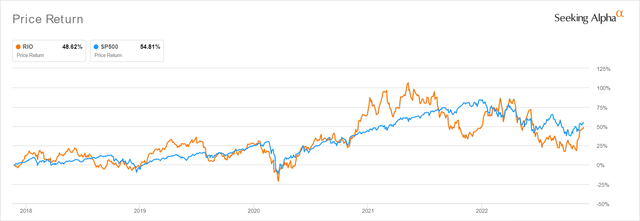

RIO 5Y Stock Price

Considering China’s progressive stimulus worth $146B and potential reopening post-Zero Covid Policy, it is no wonder that the Rio Tinto Group (NYSE:RIO) stock has rallied by 24.74% over the past few weeks, significantly aided by the upbeat October CPI reports. Therefore, we may see higher iron ore imports by H2’22, since the country consumed 1.12B tons of the material in 2021, accounting for 43.07% of the global production then. Furthermore, 75.8% of analysts are now projecting that the Feds will pivot early with a 50 basis points hike, as seen by the Bank of Canada’s recent moderation. Assuming so, we may see this tsunami of confidence lifting all boats moderately from 14 December onwards.

On the other hand, depending on how the situation develops, we doubt that this optimism is sustainable over the next few weeks (or months). Most notably, Apple (AAPL) is reportedly having trouble securing workers for the Zhengzhou factory in China, due to the overly strict quarantine protocols and, consequently, triggering violent riots delaying production. This is despite the supposed ‘targeted and precise’ approach from Beijing and local authorities alike, in an attempt to minimize the impact on economic growth. The resulting worker unrest has contributed to global delays in the iPhone 14 deliveries, since four in five iPhones are assembled there. Thereby, triggering more suspicions amongst the watching international audience.

There is no telling when President Xi Jin Ping will finally relent on its hardline approach, since the latter continues to hinder the recovery of domestic property and labor sectors. The Chinese leader has previously clamped down on speculative frenzies and caused an ongoing property crisis, as prices continue to fall drastically since June 2021. It still remains to be seen, if the recent $30B stimulus is able to revive the highly indebted developers. With the housing market in a deep crisis and limited catalysts for recovery, China’s reopening progress and iron ore appetite remain dangerously uncertain.

RIO Faces Margin Headwinds With Uncertain Prospects Ahead

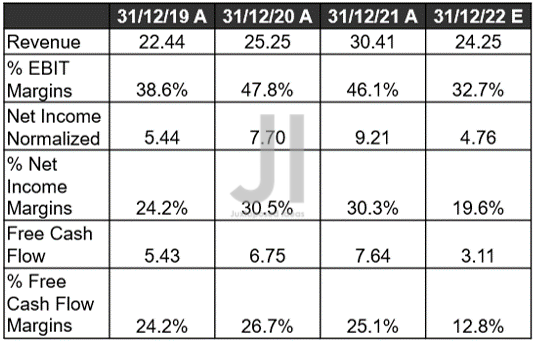

RIO Revenue, Net Income ( in billion $ ) %, EBIT %, and FCF %

S&P Capital IQ

For its upcoming earnings call in February 2023, RIO is expected to report revenues of $24.25B with EBIT margins of 32.7%, indicating a drastic decline of -20.25% and -13.4 percentage points YoY, respectively. With its profitability also potentially affected by -48.31% and -10.7 percentage points YoY, the company’s Free Cash Flow generation may be tragically halved to $3.11B then. Therefore, it is no wonder that the stock has also previously hit rock bottom with a -36.88% plunge from previous peak optimism levels of $84 in March 2022.

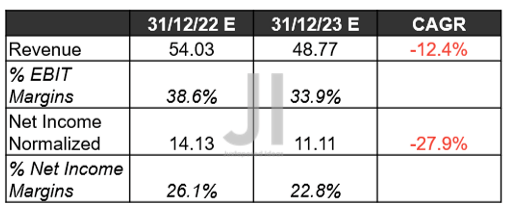

RIO Projected Revenue, Net Income ( in billion $ ) %

S&P Capital IQ

Due to the normalization of iron ore prices, RIO is expected to report a notable -9.73% drop in top-line growth for FY2023, significantly worsened by peak recessionary fears. Its projected EBIT margins of 33.9% also represent another underperformance against pre-pandemic levels of 39%. Thereby, also impacting its profitability by -21.37% YoY, with naturally declining margins to 22.8%, against FY2019 levels of 24%.

It is apparent that Mr. Market is more bearish than we thought, since RIO’s operations may further suffer from cyclical cost inflation and elevated energy costs in the short term.

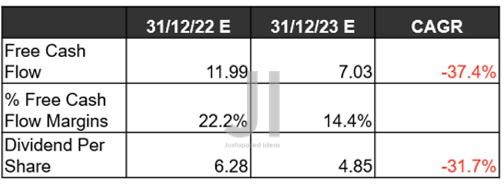

RIO Projected FCF ( in billion $ ) % and Dividends

S&P Capital IQ

It is no wonder then, that RIO chose to cut dividends to $2.67 for H1’22, comprising 50% of earnings against H1’21 levels of 75%. The management’s prudent call has allowed for a healthier balance sheet, with cash and equivalents of $11.4B by the end of last quarter. However, market analysts are also relatively optimistic that the company will revert to its previous stance by H2’22. This is due to the projected $3.61 payout then, indicating an excellent annual yield of 11.41% for those who had entered at the mid $50s. We are more realistic with in-line payouts $2.67, unfortunately.

Furthermore, we expect to see more headwinds to RIO’s stock performance, since its FCF margins are expected to further deteriorate to 14.4% by FY2023, against FY2019 levels of 21.8% and FY2021 of 28.3%. Thereby, also impacting its projected dividends payout next year, with a potential YoY cut of -22.77% then.

On the other hand, market analysts also expect RIO to continue paying down debt, as it did in the past few quarters. By the latest quarter, the company has successfully paid off -$2.13B of its long-term debts since H2’20, while expected to further deleverage by -$1.5B through FY2023. Furthermore, investors need not worry, since the weighted average maturity is estimated at ten years, with the nearest one due by 2024 at $1.5B. Thereby, securing the company’s immediate liquidity through the uncertain economic conditions ahead.

So, Is RIO Stock A Buy, Sell, or Hold?

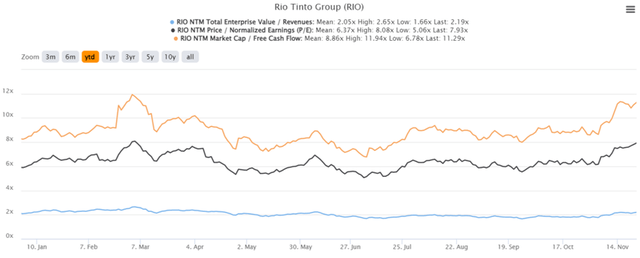

RIO YTD EV/Revenue and P/E Valuations

RIO is currently trading at an EV/NTM Revenue of 2.19x, NTM P/E of 7.93x, and NTM Market Cap/ FCF of 11.29x, relatively inflated near its YTD highs of 2.65x, 8.08x, and 11.94x, respectively. Nonetheless, we have to admit these levels are still somewhat reasonable compared to its 5Y means of 2.44x, 8.57x, and 10.86x, respectively. In that case, investors who do not mind the smaller margin of safety may still nibble at a price target of approximately mid $50s to $60s. Portfolios should naturally be sized appropriately, in the event of volatility as well.

Iron Ore Prices

Trading Economics

For now, iron ore spot prices have also temporarily lifted from $73.62 to $98 per tonne at the time of writing, nearer to pre-pandemic highs in 2019. However, bulls would likely still be discouraged by the massive difference of -18.30% from recent highs in August 2022 or a catastrophic -56% plunge since the peak in May 2021. In the short term, we expect demand and prices to remain stunted until property markets boom again globally. Things are unlikely to improve, due to the cooling property markets in the US & uncertain Zero Covid Policy in China. Ouch, since both countries comprise 73.61% of RIO’s revenues in FY2021.

Another word of warning, since the Feds may not pivot this early, due to the raised terminal rates of over 6%. Assuming so, we may see another bottom re-test, as seen in July and September 2022. As a result, conservative investors may want to wait for more clarity before adding RIO to their portfolio. There is no point chasing this rally.