Readers Tag 30 Prime-Buy Dividend Dogs For June

Fly_dragonfly/iStock via Getty Images

Reader Selections

Since May 2017, any dividend-paying stock mentioned in a message, e-mail, or comment to the author is fair game for a reader-favorite listing in this series of articles. Thus, it is possible that only rogues and discontinued, or dreadful, doubtful, dividend issues may appear.

Lately, readers and other contributors have questioned the intent, purpose, validity, and usefulness of my daily stock lists. Most, however, praise the effort to sort promising opportunities out of the thousands of dividend offers. After all, yield counts when searching for dividend winners.

Furthermore, my dog catching is, by method, a contrarian investing strategy and that can rub some investors the wrong way. It is most useful for new buyers; intended to guide readers to new purchases of dogs on the dips.

Most valuable to the writer, however, are those reader comments that truly catch errors in my calculations or changes in direction. Examples like the reader who missed my “safer” dividend follow-up articles because they contain dividend payout ratios. There are also those who catch flagrant-fouled stock lists not synchronized with the data charted. In January, a reader discovered a ‘Safer’ net gain chart posing as a Monthly Pay chart that even Seeking Alpha Editors missed. In February, the pending demise of my four S&P 500 Aristocrat buy suggestions caught reader attention. Every month some discover errant ticker symbols. Earlier this year, a reader asked how to identify Rogues in the ReFa/Ro list. Last month, high yields were criticized that is a sure sign of Roguishness.

In February, one reader suggested an option strategy for monthly-paying dividend stocks:

“You should identify where options are available on the Monthly dividend stocks. What I do is find mopay stocks with options, I buy and write covered calls about 6 – 12 months out. I look for a scenario where I collect the dividend and get my stock bought back at a much lower price than I pay but pocket a premium that makes up the loss. This gives me a dividend boost since my cost is lower. It’s like a guaranteed CD with little risk.”

Another reader suggested I dial back my blatant opinion that high yield equates to high risk:

“The article says “high dividends are a sure sign of high risk”.

It should be “high dividends might be a sign of high risk”.

“If a good stock/ETF/CEF with a 5% dividend drops simply because the whole market dropped, the dividend could get to 8 or 9%. I think that’s a great time to buy because the high dividend and low price makes it a low risk investment.”

Last October, readers noted my gaff alleging AT&T’s (T) impending dividend cut might happen in 2021. It was timed to coincide with the spin-off of AT&T’s Warner assets and finally happened this year. From my dogcatcher perspective, there was ample room to slice the AT&T dividend. With the T share price under $30 and a dividend yield over 7%, the T dividend was indeed cut in half and still showed a handsome attraction for new investors even as old hands abandon the ship of T.

More than one writer has decried my favoritism for low-priced stocks. They especially dislike my “ideal” stocks whose dividend returns from a $1k investment equaling or exceeding share price. A prime example is Sirius XM Holdings Inc. (SIRI), the satellite radio and pandora music catalog owner, priced now at $6.19 still passes my test (of dividends from $1k invested exceeding share price) with a forward dividend of 1.42%! A little over $1k investment now buys 162 shares, and they’ll throw the owner a dividend of $14.58, which is more than double the share price. Assuming all things remain equal, SIRI dividends alone will pay back their purchase price in 69 years (and that assumes the satellite radio and subscription music service can survive that long)!

Last month, a reader said a $13.20 dividend on a $1K investment was too small. I point out that holders of AAPL stock garner about $6.20 in dividends from $1K invested.

A year ago, one reader expressed confusion about top-ten by yield summaries concluding each article. How can one top ten group show positive returns, and another be negative? The answer is that every collection of stocks has a different dynamic. Even the “safer” survivors of the dogcatcher safety check usually favor more expensive stocks. Furthermore, a monthly shift in prices and yields can change the amount and direction of analyst-estimated projections. Finally, the analysts are guessing just like the rest of us. Mr. Market has more to say about the future than any one of us punters can imagine. The market turns on popularity and not on beauty or logic.

Early last year, I learned YCharts uses the following formula to chart forward-looking dividend yields:

Yield = (last dividend paid x dividend frequency) / price

Unfortunately, that formula presumes the last dividend paid was a regularly occurring dividend. Companies paying variable dividends end up with outlandish spikes and holes by that formula. Accurate data is critical to this audience of dividend hunters I write for using YCharts data. I have suggested YCharts use a spot check against other data sources as a quality control measure. That is what I must do to verify their numbers.

My ongoing gaff confusing volatility with risk in my beta reports was detected in May 2019 and persisted until May 2020. Beta on my charts is now described as risk/volatility. [For those looking for a volatility index on these charts, beta will have to suffice.]

Finally, I am working to untangle the run-on descriptions that introduce my metrics. Such as, “Probable profit-generating trades were identified. I used estimated dividend returns from $1k invested in each of the highest yielding stocks, etc., etc…” The quest for clarity and candor continues…

Foreword

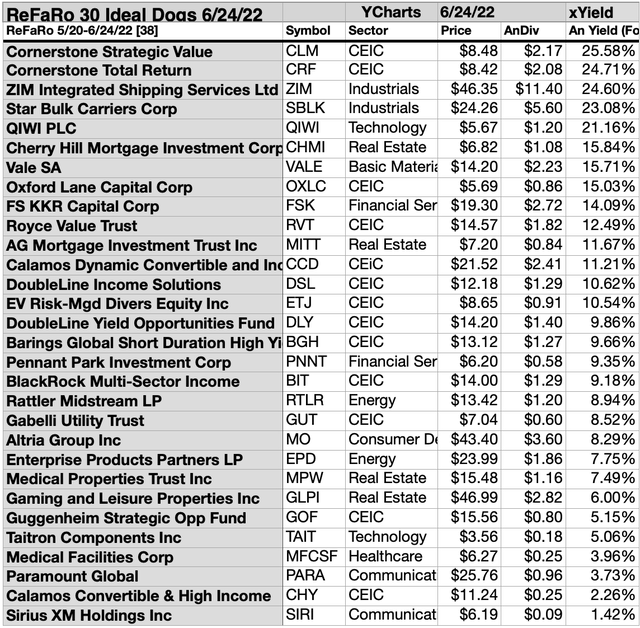

Note that this month readers mentioned thirty stocks whose dividends from a $1K investment exceeded their single share prices. These are listed below by yield:

The ReFaRo May Ideal Dividend Dogs

Above are 30 ideal candidates derived from the 38 tangible results from reader favorite & rogue equities from May 20-June 24, 2022. YCharts data for this article was collected as of 6/24/22.

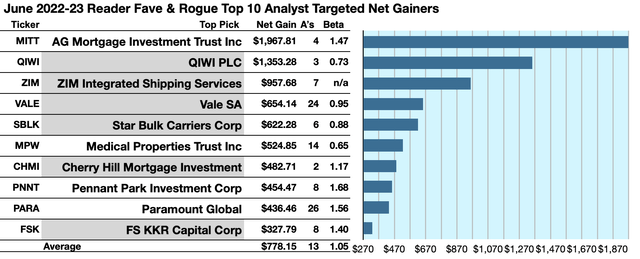

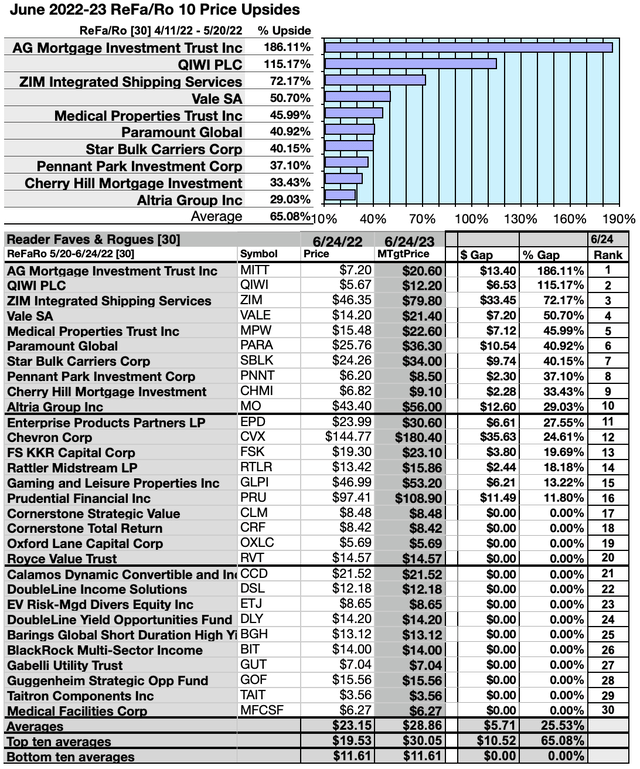

Actionable Conclusions (1-10): Brokers Augured 32.78% To 196.78% Net Gains By 10 ReFa/Ro Stocks To June 2023

Six reader-favorite top-yield stocks were verified as being among the top 10 gainers for the coming year based on analyst one-year target prices. (They are tinted gray in the chart below). Thus, this yield-based forecast for reader-fave stocks, as graded by Wall St. Wizards, was deemed 60% accurate. With those four Rogues at or near the top.

Estimated dividend returns from $1k invested in each of the highest-yielding stocks, plus the median one-year analyst target prices, as reported by YCharts, created the 2022-23 data points which identified probable profit-generating trades. (Note: one-year target prices by lone analysts were not counted.) Thus, ten probable profit-generating trades projected to June 24, 2023, were:

AG Mortgage Investment Trust, Inc. (MITT) was projected to net $1,967.00, based on the median of target price estimates from four analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 47% over the market as a whole. It’s a rogue with a dividend likely to be reduced.

QIWI plc (QIWI) netted $1353.28 based on the median of target price estimates from three analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 26% under the market as a whole. As a Russian holding, QIWI is a Rogue whose price has not varied (due to lack of trading) in three months.

ZIM Integrated Shipping Services (ZIM) netted $957.68 based on the median of target price estimates from seven analysts, plus dividends, less broker fees. A beta number was not available. A Rogue.

Vale S.A. (VALE) was projected to net $654.14, based on the median of target estimates from twenty-four analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 5% under the market as a whole. VALE is a Rogue.

Star Bulk Carriers Corp. (SBLK) was projected to net $622.28, based on the median of target price estimates from six analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 12% under the market as a whole. This is another Rogue.

Medical Properties Trust, Inc. (MPW) was projected to net $554.47 based on the median of target price estimates from fourteen analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 35% less than the market as a whole. A Fave.

Cherry Hill Mortgage Investment (CHMI) was projected to net $482.71, based on the median of target price estimates from two analysts, plus a projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 17% over the market as a whole. It’s a fave.

PennantPark Investment Corp. (PNNT) was projected to net $454.47, based on the median of target price estimates from eight analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 68% over the market as a whole. PNNT is a Rogue.

Paramount Global (PARA) was projected to net $436.46, based on the median of target price estimates from twenty-six analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 56% greater than the market as a whole. A Fave.

FS KKR Capital Corp (FSK) was projected to net $327.79 based on the median of target price estimates from eight analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 40% greater than the market as a whole. A fave.

Average net gain in dividend and price was estimated at 77.82% on $10k invested as $1k in each of these ten stocks. This gain estimate was subject to average risk/volatility 17% over the market as a whole. June 2022 top-ten gainers count seven rogues and three faves.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

The “dog” moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. So, the highest-yielding stocks in any collection have become affectionately known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

38 For the Money

Yield (dividend/price) results from YCharts.com verified by Yahoo Finance for ReFa/Ro stocks as of market closing prices 6/24/22 for 38 equities and funds revealed the actionable conclusions discussed below.

See any Dow 30 article for an explanation of the term “dogs” for stocks reported based on Michael B. O’Higgins book “Beating The Dow” (HarperCollins, 1991), now named Dogs of the Dow. O’Higgins’ system works to find bargains in any collection of dividend-paying stocks. Utilizing analysts’ price upside estimates expanded the stock universe to include popular growth equities, as desired.

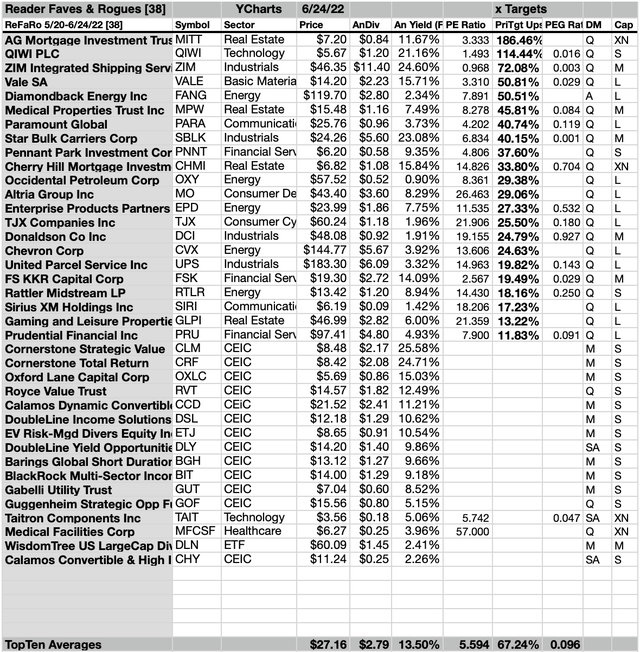

22 ReFa/Ro By Target Gains

Actionable Conclusions (11-20): ReFa/Ro Top (Rogue) Stock, MITT, Led 38 By Yield into May

The 38 ReFa/Ro sorted by yield included ten of 11 Morningstar sectors plus one exchange-traded fund [ETF], thirteen closed-end investment companies [CEICs], and no exchange-traded notes [ETNs], among the selections.

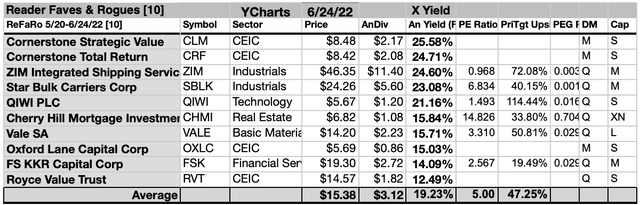

The ten top reader mentions by yield were led by one of four CEIC representatives, Cornerstone Strategic Value (CLM) [1], a rogue. The other four top rogue CEICs placed second, eighth, and tenth, Cornerstone Total Return (CRF) [2], Oxford Lane Capital (OXLC) [8], and Royce Value Trust (RVT) [10].

Then the first of two industrials representatives placed third, ZIM Integrated Shipping Services [3]. The other industrial placed fourth, Star Bulk Carriers Corp. [4].

The Russian technology rogue placed fifth, QIWI plc [5]. Then the real estate representative placed sixth, Cherry Hill Mortgage Investment Corp. [6].

Finally, a basic materials entity placed seventh, Vale S.A. [7], and the financial services member placed ninth, FS KKR Capital Corp [9], which completed the top 10 ReFa/Ro by yield as of June 24, 2022.

Actionable Conclusions: (21-30) Top 10 ReFa/Ro By Price Upsides Showed 16.62% To 114.46% Increases To June 2023

To quantify top dog rankings, analysts’ median price-target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analysts’ median price-target estimates became another tool to dig out bargains. In this list, the top stock QIWI price has dropped due to sanctions on Russian financial entities. Therefore, the analyst rankings for QIWI are frozen far from current financial realities.

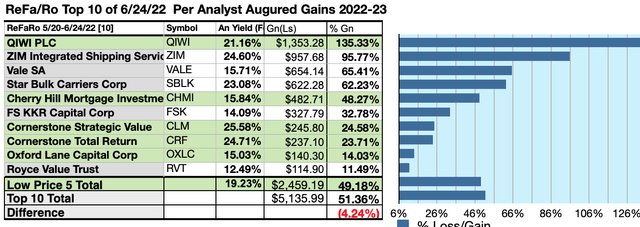

Analyst Targets Indicated A 4.24% Disadvantage For 5 Highest-Yield, Lowest-Priced Reader Favored/Rogue Stocks To June 2023

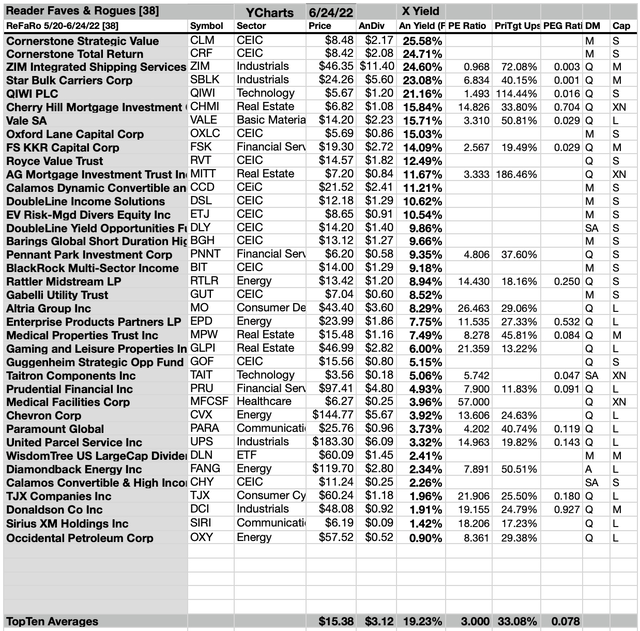

10 top ReFa/Ro were culled by yield for their monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

As noted above, top 10 ReFa/Ro selected 6/24/22, showing the highest dividend yields, represented: CEICs (4); industrials (2); technology (1); real estate (1); basic materials (1); financial services (1).

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of Top 10 Highest-Yield Reader Favorites & Rogues To (31) Deliver 49.18% Vs. (32) 51.36% Net Gains by All 10 To June 2023

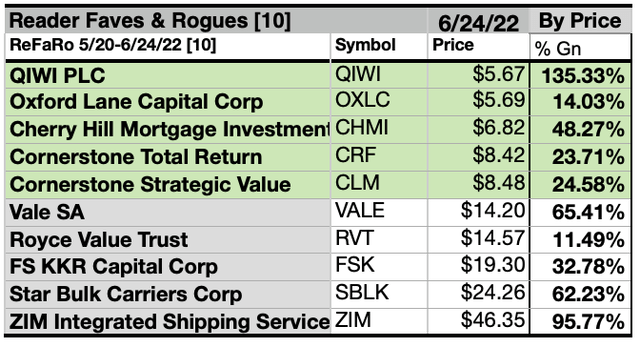

$5k invested as $1k in each of the five lowest-priced stocks in the top 10 ReFa/Ro kennel by yield were predicted by analyst one-year targets to deliver 4.24% LESS net gain than $5k invested in all 10. The very lowest-priced frozen ReFa/Ro top-yield equity, QIWI plc, was projected to deliver the best net gain of 135.33%.

The five lowest-priced ReFa/Ro top-yield dogs for June 24 were: QIWI plc; Oxford Lane Capital; Cherry Hill Mortgage Investment Corp.; Cornerstone Total Return; Cornerstone Strategic Value, with prices ranging from $5.67 to $8.48 per share.

Five higher-priced ReFa/Ro for June 24 were: Vale S.A.; Royce Value Trust; FS KKR Capital Corp; Star Bulk Carriers Corp.; ZIM Integrated Shipping Services Ltd., whose prices ranged from $14.20 to $46.35.

The distinction between five low-priced dividend dogs and the general field of 10 reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analysts’ targets added a unique element of “market sentiment” gauging upside potential.

It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The 38 equities and funds discussed in this article were submitted within comments from Seeking Alpha members noted below.

Afterword

Here is the full pack of 38 March ReFa/Ro

(Listed alphabetically by ticker symbol, the pack includes the nicknames of recommending readers.)

Note that this month, readers mentioned thirty Dogcatcher Ideal stocks that offer annual dividends from a $1K investment exceeding their single share prices.

30 Dogcatcher Ideal Dogs for June

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your FoFave/Ro dog stock purchase or sale research process. These were not recommendations.