Rates Go Up, Rates Go Down, My Income Keeps Growing

Bet_Noire/iStock via Getty Images

Co-produced with Treading Softly

I love utility.

Not utilities, although I do enjoy income from many different essential service providers.

I mean real-world utility. The ability to function properly in a number of environments and complete a number of tasks effectively. Picture a Swiss Army knife, and you’re headed in the right direction.

We live in a very focused world. Everything is aimed to be specialized. We see experts on TV in countless niche areas. Everyone claims to be an expert at something, no matter how trivial it seems.

Specializing can be a high risk when investing. It’s said that once you pick up a hammer, everything looks like a nail – even if it’s not the right tool for the job. This can lead many to failure. They specialize their portfolio for certain events, situations, or a particular sector they specialize in. And if they misjudge their timing? Calamity strikes.

I want a portfolio that I can hold for decades without needing a constant shuffle. I also recognize that I’m not an expert on everything. This is why I’ve constructed HDO to be the “Swiss Army Knife” of high dividend investing. It isn’t just me, it is a team, and each member brings their own specialties and knowledge.

So when building my income portfolio and applying our Income Method, I wanted to focus on utility. A portfolio that can function as expected through various environments without major issues. Rising rates? Great. Falling rates? OK. Bull market? Woohoo! Bear market? Income keeps coming.

To achieve this, I buy investments that benefit from offsetting environments. Those that benefit from rising rates, and those that benefit when rates fall. This way, my overall portfolio is agnostic to interest rates and keeps pumping out income – which is my core goal for investing.

So today, to help you achieve a similar utility by looking at two offsetting investments when it comes to interest rates.

Let’s dive in.

Pick #1: ACRE – Yield 12.5%

Ares Commercial Credit (ACRE) is a commercial mortgage REIT that’s managed by Ares Management (ARES). Commercial mortgage REITs are benefiting directly from rising interest rates since these mortgages are floating rates. However, investor fear of how high rates might impact the real estate market has been a headwind for prices.

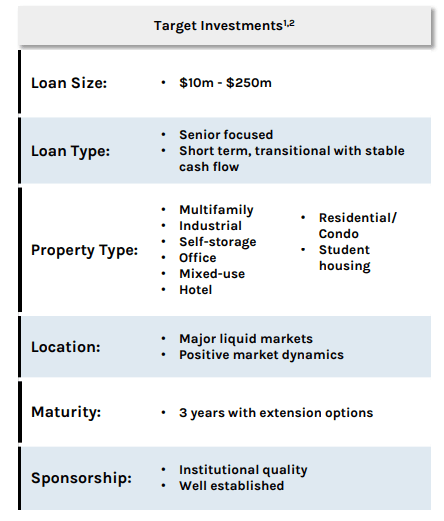

ACRE uses its connection with ARES to target “sponsored” mortgage investments. These are generally short-term mortgages, with maturity in three years with a few one-year extension options. (Source)

ACRE November 2022 Presentation

With interest rates high, this type of financing will become more attractive as borrowers will want to avoid locking in long-term fixed-rate loans at the current high rates. On the other hand, a slowdown in the commercial real estate market means there are fewer loans to originate, and the risks of defaults will rise.

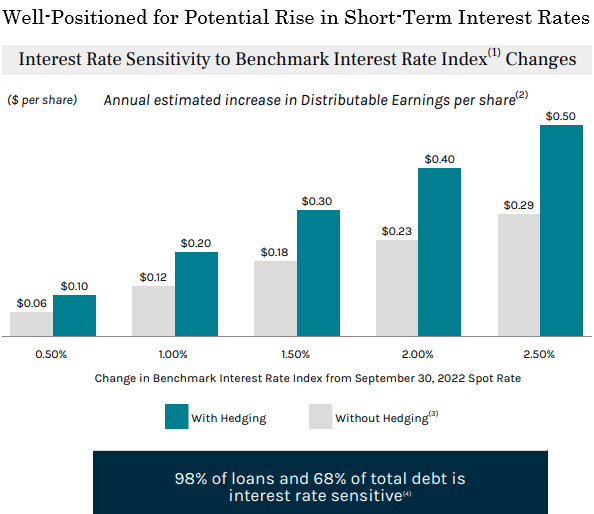

Thanks to rising interest rates, ACRE is seeing its earnings grow substantially. (Source)

ACRE Q3 2022 Earnings Presentation

This growth from existing loans will mean that ACRE has the luxury of being selective with new originations. It can allow leverage to decline and the portfolio to shrink without putting the current dividend at risk. As a result, ACRE will be able to maintain high underwriting standards and negotiate aggressively with potential borrowers.

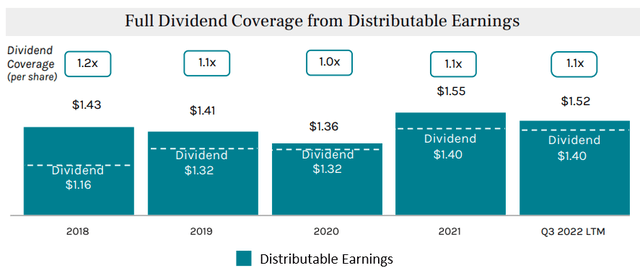

ACRE has been easily covering its dividend.

ACRE Q3 2022 Earnings Presentation

As we go into 2023, ACRE will continue to see the tailwinds of higher interest rates driving earnings higher.

The market is focused on the risk and is already pricing in a 10%+ discount to book value. Meanwhile, ACRE’s earnings are rising, and it has the ability to remain conservative with its underwriting.

Frequently, the market’s fear outweighs the actual risks, providing an opportunity for income investors like us to buy at cheap prices.

Pick 2: DX – Yield 11.9%

Dynex Capital, Inc. (DX)

Among the collateral damage of rising interest rates is “Agency mortgage-backed securities.” Agency MBS are bundles of mortgages that are guaranteed by the “agencies” Fannie Mae or Freddie Mac. If a borrower defaults, the agency buys the mortgage back at par value, absorbing the loss.

As a result, agency MBS has minimal credit risk. Like U.S. Treasuries, you know the day you buy it that you will receive the par value eventually. Agency MBS has frequently been seen as a competitive alternative to Treasury Bonds and is one of the most liquid bond markets in the world behind U.S. Treasuries. Most mortgages in the U.S. are “agency” mortgages and end up in agency MBS. The system was created with the goal of ensuring that “average” Americans could qualify for a mortgage and that there would be plenty of capital available to fund those mortgages.

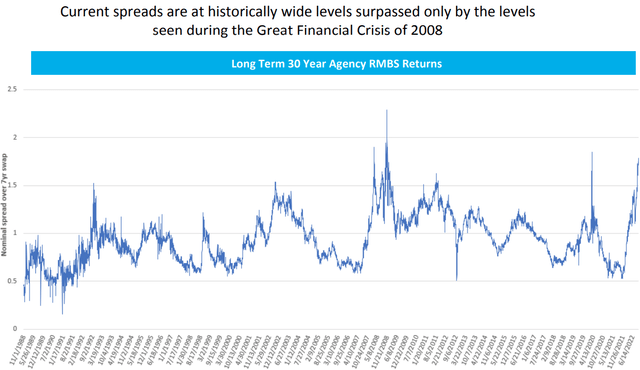

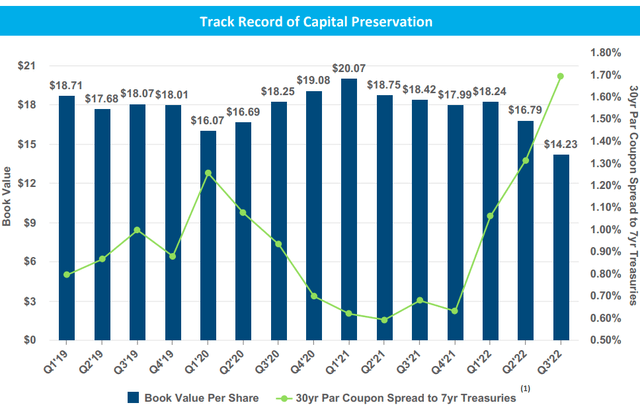

However, agency MBS prices have fallen significantly in 2022. Much more quickly than U.S. Treasury prices have. Historically, agency MBS has traded very similarly to Treasuries. The “spread” or difference between 30-year MBS coupons and Treasuries has been fairly stable. Only spiking up significantly in times of recession. Here is a look at the 30-year MBS vs. the 7-year Treasury swap rate: Source

Dynex Q3-2022 Earnings Report

Note that since this slide was created, this spread continued climbing over 2008 levels. We can see that historically, these spikes up have been very brief. The higher the spike, the lower the “book value” is for agency mREITs, but the higher the cash flow on new investments will be. The spike in 2008 and the persistence of above-average spreads through 2012 is the reason for what we would call “the golden years” for agency mREITs. Dividends were sky-high, share prices were high, and total returns skyrocketed.

We have talked a lot about AGNC Investment (AGNC) and Annaly Capital (NLY) as options in the agency mREIT space. One frequent question we are asked is why they are “down so much” since 2012. Well, the chart is your answer. Spreads declined and spent most of the decade materially lower than they were in 2008-2012. That spread is how these mREITs make money. So when profitability is down for the better part of a decade, it shouldn’t be a surprise that prices fall too. Hence why we didn’t own any agency mREITs until 2019, under the belief that spreads would widen. They did, but a bit more dramatically than anticipated due to COVID!

So here we are today, with spreads at all-time highs for agency mREITs. Agency MBS prices have fallen from rising Treasury rates and also have been helped along by the Federal Reserve – the largest buyer of agency MBS for over a decade – stopping all purchases. Agency MBS prices are low, and the spread between MBS and Treasuries is near an all-time high. Historically, this mix has led to great returns for agency mREITs which buy MBS using significant leverage and also short U.S. Treasuries to hedge.

AGNC and NLY are both very large mREITs. Which is a positive for stability. DX is an alternative option that is much smaller. While AGNC and NLY have portfolios well north of $50 billion, DX’s entire portfolio is slightly over $6 billion. With the liquidity of the agency MBS market, DX is capable of buying or selling its entire portfolio within weeks. In fact, in March 2020, DX did make significant adjustments to their portfolio.

That unpredictability is a benefit and a risk. The benefit is clear. DX can be far more nimble than its larger peers. The risk is that shareholders don’t get advance notice. Management can shift the entire portfolio, and you will see the results in quarterly earnings. This flexibility is only a positive to the extent that management makes wise decisions.

Dynex Q3-2022 Earnings Report

Through the COVID crisis and this year’s headwinds, management made excellent decisions, outperforming peers.

We believe that the agency MBS sector will likely take off as soon as the downward pressure is relieved. Like a spring that is being compressed, the rebound is getting stronger the more it is pushed down.

For those who wish to add exposure to this sector, DX is a great option. Its small size is a risk, but management has proven an ability to navigate troubled waters and use its small size to its advantage.

Shutterstock

Conclusion

With ACRE and DX, we have two investments with frequently divergent paths when it comes to interest rate sensitivity. Both are set up to provide strong income in the long term due to superior management teams. While DX is well positioned to benefit from rising MBS values, it will truly explode in benefits when rates fall in the future. ACRE benefits from every single rate hike, enjoying their income rising and thus ours as it travels through their balance sheet and income statement.

This is one way to create a portfolio designed for income and utility. I can be agnostic toward interest rates by having investments that benefit from opposite environments.

Some will doubtlessly enjoy dancing back and forth, claiming outsized returns when they dance correctly to the tune, but few can do so repeatedly over the long term. That’s why they disappear or reset their portfolios after stumbling and falling.

I don’t want that for income investors. I want a portfolio that’s reliable, low effort, and provides excellent income – so I focus on buying, holding, and enjoying my dividends.

Could I potentially squeeze in more returns from the song and dance? Probably.

Is that what I want to spend my time doing? Squeezing pennies out of benjamins instead of enjoying my day-to-day life? No.

I want to go out and enjoy a trip to Alaska, a skiing trip to Alberta, or a visit to Iceland. I want my portfolio to be like a Swiss Army knife – excellent in all situations without needless specialization.

That’s the beauty of income investing.