QuantumScape Stock: Unfavorable Risk Reward (NYSE:QS)

MF3d

Investment Thesis

Since QuantumScape (NYSE:QS) is a company that is not yet generating revenue, I think an examination is worthwhile of how quickly the company is burning cash relative to what potential there is and how high its market cap already is. Also, it’s worth looking at the competition to figure out what opportunities the company might have given all these factors.

I am not a material expert on next-gen batteries and can only evaluate the technology to a limited extent. Therefore, I refer to fundamental investing principles, and as far as the technology is concerned, I link to other sources.

The buy thesis

At the moment, without a doubt, electrification of the car industry is taking place, which is politically wanted and promoted. It seems that there will be no or hardly any internal combustion engines in a few decades. But electric cars are still in their infancy and suffer from long charging times and short range, which leads to less than optimal customer satisfaction. QuantumScape is developing solid-state batteries that promise to solve these problems. If they are successful, a billion-dollar market and probably many more opportunities than just cars await them.

Solid state-batteries

These types of batteries promise a much higher energy density, which means that the same battery weight either contributes to more range or the battery can be lighter. This also means less energy is wasted by extra weight that has to be driven around. QuantumScape claims that the battery can be charged to 80% full in 10 minutes. In addition, the battery is said to have a longer overall life and be safer, as it is non-flammable. And in the long run, even the cost is said to be lower than current lithium batteries because the material can be saved. However, this is only a theoretical long-term estimate based on mass production. According to Nikkei, the costs are estimated to be many times higher.

All these points also ensure that less scarce resources are consumed, and CO2 is emitted, which would benefit the ESG guidelines of car manufacturers. The lower weight would also make batteries possible in areas where they now seem unsuitable. In trains or airplanes, for example.

Industry Overview & Competition

According to straitsresearch.com, in 2021, the global solid-state battery market was valued at $805M. It is expected to reach a value of $13B by 2030 (CAGR of 36.4%). Of course, these are only rough estimates. However, looking at the long list of advantages, it is clear that these batteries have enormous potential. Technically mature enough, any car manufacturer would prefer these batteries.

One of the biggest dangers of investing in QS is that they are not the only ones researching solid-state batteries. On the contrary, the competition is significant and considerably better funded. According to Nikkei, Toyota (TM) is the world leader in research and also the number of patents (more than 1300). Panasonic Holdings (OTCPK:PCRFY) is second with 445 patents. QS has more than 300 patents.

And other big players like Samsung (OTCPK:SSNLF) and several other South Korean companies are also researching next-gen batteries. It’s a billion-dollar opportunity for everyone. Every company involved knows that batteries urgently need to develop further, not only in cars but also in smartphones and all other technical devices.

Toyota has 370,000 employees and generates more than $200B in revenue annually. QS employs about 600 people and generates no revenue, so it relies on financing. Toyota has been researching since the 1990s and is on its way to becoming the first car manufacturer to launch a car with a solid-state battery. This is expected to happen in the first half of this decade and will be integrated into a hybrid system. QS has been researching since 2010, and I had to look for a long time in the letters to shareholders and the investor presentation to find statements about actual market readiness. They seem to be relatively silent about this, which is not a good sign – especially compared to the quite concrete statement from Toyota.

In 2020, we showed our first single-layer cell; in 2021, we showed four- and 10-layer cells, and earlier this year we showed our first 16-layer cells. Building on this momentum, we are pleased to report we have now made our first prototype 24-layer cells and put them on test. 24-layer cells represent A-sample candidates for some automotive OEMs. While the precise definition of an A sample will vary by customer, delivering any such cell to an automotive customer is a high bar and remains one of our key goals for the year. Doing so requires that we make cells with sufficient performance and quality to meet our standards, and in sufficient quantities to complete our validation process and ship to a customer.

I have not found anything more concrete. How far it will take from this sample to real market maturity is unclear to me and can only be estimated roughly. As an investor, I don’t like such guessing games, especially when the competition is already more advanced.

Valuation & financials

The current market cap is $3.49B with about $1.27B in cash. Enterprise value is $2.33B. The company has a strategic partnership with Volkswagen (OTCPK:VWAGY), which has invested $300 million in QS. The company also has a lot of money left over from its IPO, so its funding is secure for now. Other investors include Bill Gates and the Qatar Investment Authority.

Capital expenditures for this year will be lower than initially assumed, but are expected to increase next year. At this cash burn rate, financing should be secured for another 3-4 years. The lower capital expenditures could indicate problems with the development. At least I find it very remarkable that the expenditures are reduced so much, but are expected to be shifted to the next year

While we reiterate our cash opex guidance of $225M to $275M for FY’22, we now estimate our capital expenditures to be between $175M and $225M for FY’22 (versus our prior guidance of $325M to $375M) as the drivers of lower Q2 spend also impact full year capex projections. We believe most of the reduction in our forecasted 2022 capex spend will now be pushed into 2023.

QS Seeking Alpha news

Share dilution and insider selling

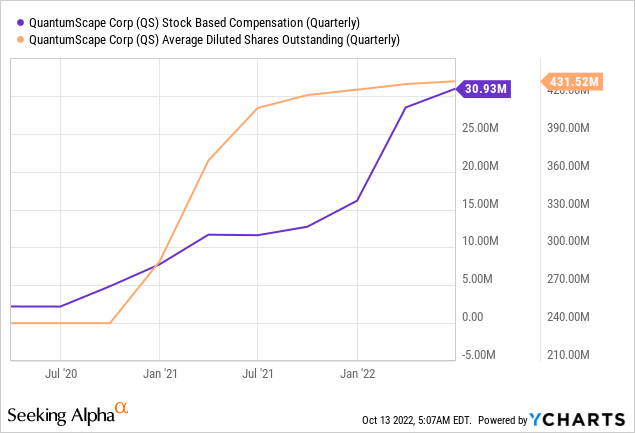

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. The share count has almost doubled since the IPO in August 2020. Given that the company still has cash reserves, share dilution should not be too severe in the near future. However, stock-based compensation for employees has risen sharply in the last year, certainly also because the number of employees has tripled since the IPO.

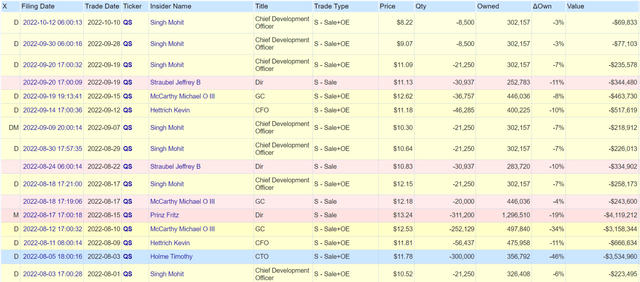

More concerning, in my opinion, is insider selling. Below is a screenshot of what has happened since August 1, 2022. Lots of options, but not only. There are also some sales where employees have sold double-digit percentages of their shares. Roughly combined, these sales are worth about $15M, which is about 0.5% of the market cap. I think that is quite substantial, especially considering that these are just the numbers since the beginning of August.

Shorting could be dangerous

Even if the stock is not a good long candidate, in my view, that does not mean that it is automatically a good short. The more than 300 patents could be very valuable for other companies, and that makes the company a potential takeover candidate. You also have to keep in mind that with a story like this, a single announcement about a research breakthrough, for example, is enough to send the share price skyrocketing.

Conclusion

As an investor, finding the next big thing, or at least one of the market leaders in future technology, is very difficult. Most of the time, several companies are researching simultaneously, and we never know precisely what these researches look like behind closed doors. In investor presentations, everything always looks terrific. But let’s not deceive ourselves, investor presentations are more like advertising brochures, and the real challenges are not mentioned. Especially small companies, competing against financially stronger competitors, have a tough time.

With QS, I don’t know why I should invest. In theory, the solid-state battery sounds excellent, but there is no real roadmap for when the whole thing will be ready, and the company will earn money. Given this uncertainty for several years to come, I think the market capitalization is too high. Although Volkswagen supports the company, you can be sure that Volkswagen will not only rely on QS but will buy the battery from whoever has the best battery on offer. Of course, QS could become a very successful company, but I consider the risk-reward ratio unfavorable.