Public Service Enterprise Group: Good Renewable Opportunities

ArtistGNDphotography

Public Service Enterprise Group Incorporated (NYSE:PEG) is the largest regulated electric and natural gas utility in the highly populated state of New Jersey. The utility sector in general has long been a favorite of more conservative investors due to its relatively stable cash flows and generally high dividend yields. Public Service Enterprise Group is no exception to this, as the stock yields 3.46% as of the time of writing, which is certainly higher than most other things in the market.

The company has much more to offer than just a high yield, though. Public Service Enterprise Group is positioned to grow its earnings at a respectable rate over the next few years and is on course to achieve net-zero carbon emissions by 2030. This net-zero carbon goal is one of the most ambitious goals in the entire utility sector, which may allow the company to appeal to the legion of investors that have been pouring money into various environmental, social, and governance (“ESG”) funds over the past few years.

Unfortunately, though, you have to pay through the nose for all these nice things, as Public Service Enterprise Group is one of the most expensive utilities in the entire sector. Overall, then, the stock might be worth watching; the company is very attractive, but it might be best to wait until the price comes down.

About Public Service Enterprise Group

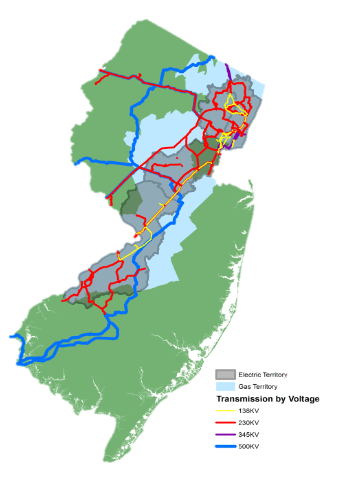

As stated in the introduction, Public Service Enterprise Group is the largest regulated electric and natural gas utility in the highly populated state of New Jersey. The company boasts 2.3 million electric and 1.9 million natural gas customers across much of the state:

Public Service Enterprise Group

Public Service Enterprise Group is entirely isolated to the state of New Jersey. Unfortunately for the company, New Jersey is not a particularly rapidly growing state. The company has only grown its electric customer base at a 0.8% rate and its natural gas customer base at a 0.7% rate over the past five years. This is unfortunate, because a growing customer base is one of the only ways that a company like this can actually grow. After all, people do not start using more electricity or natural gas just because they start making more money, so the company does not really benefit much from economic growth. Plus, its prices have to be approved by regulators, so it cannot just arbitrarily increase its prices in order to boost margins.

As such, Public Service Enterprise Group is heavily dependent on population growth in its service to increase its base of paying customers. As we can see, that has not been occurring at a particularly rapid pace. This could be a drag on its growth compared to some of the company’s peers that are located in more high-growth areas.

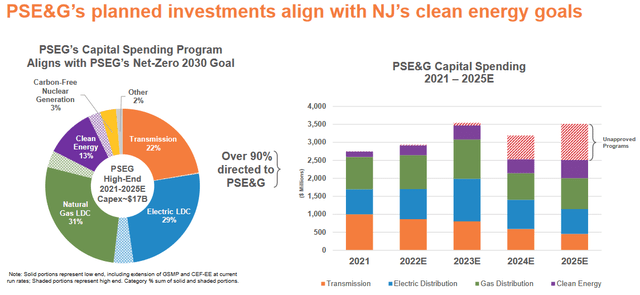

With that said, Public Service Enterprise Group does have another way to grow its earnings that is independent of population growth. That is by increasing the size of its rate base. The rate base is the value of the company’s assets upon which regulators allow Public Service Enterprise Group to earn a specified rate of return. As this rate of return is a percentage, any increase to the size of the rate base allows the company to increase the prices that it charges its customers in order to earn that allowed rate of return. The usual way that this is accomplished is for the company to invest money into upgrading, modernizing, and possibly even expanding its utility infrastructure. Public Service Enterprise Group is planning on doing exactly this, as the company intends to invest approximately $17 billion into growing its rate base over the 2021 to 2025 period:

Public Service Enterprise Group

This spending program will not increase Public Service Enterprise Group’s rate base by fully $17 billion. One reason for this is depreciation, which is constantly reducing the value of the assets that make up the company’s rate base. As a result of this, something that the company spent full price on back in 2021 will have a much smaller impact on the firm’s rate base in 2025 by the end of the program. This basically means that the company’s rate base will decline if Public Service Enterprise Group does not continually invest money into it.

A second reason why the rate base will not grow by the full $17 billion that is being spent is that some of the new equipment that is being purchased will be replacing older equipment that will then be taken out of service and thus removed from the company’s rate base. Overall, this investment program will boost the company’s rate base from $24.5 billion today to just over $30 billion at the end of 2025. This works out to a 7.5% compound annual growth rate over the period, which is a reasonable growth rate for a company like this. Public Service Enterprise Group expects that this will translate into an earnings per share growth rate of 5% to 7% over the period. When we combine this with the company’s 3.46% current dividend yield, Public Service Enterprise Group should be able to reward its investors with a 9% to 11% total return annually from now until the end of 2025. This is a very reasonable return for a conservative utility stock.

As stated in the introduction, Public Service Enterprise Group has the goal of achieving net-zero carbon emissions by 2030. This is one of the most aggressive sustainability goals in the entire utility sector, as most companies are not expecting to achieve this goal until the 2040 to 2050 period.

Admittedly, the fact that Public Service Enterprise Group is based in New Jersey, which is one of the more progressive states in the country, may play a role in this. One of the more interesting ways in which the company is seeking to achieve this goal is by constructing a series of offshore wind farms. This is an area a few other utilities, such as Eversource Energy (ES), have explored in order to achieve their renewable goals, but admittedly we have not seen very many companies pursuing this technology. This is a bit of a shame as offshore wind farms have a number of advantages over other renewable technologies. I discussed this in a previous article. The most significant advantages that offshore wind farms have over other technologies are that winds offshore tend to be stronger and more stable than onshore winds, which helps to solve the reliability problems that plague renewables.

One of Public Service Enterprise Group’s most significant offshore wind projects is the Ocean Wind Project, which is being constructed as a joint venture with Ørsted (OTCPK:DNNGY, DOGEF). This is the first offshore wind project that was approved by the state’s regulatory authorities. It is intended to be part of the state’s efforts to reduce carbon emissions and increase the use of renewable sources of power to meet the state’s energy needs. This project would certainly accomplish this goal, as it is expected to produce 1.1 gigawatts of electricity when it is operational, which is enough to power about half a million homes. As is the case with many offshore wind projects that are being constructed in the United States, Public Service Enterprise Group is only a part-owner of the project as it purchased a 25% stake back in 2020.

This project is expected to come online in the latter half of 2024, so we might see an impact on the company’s financial performance around that time, although it is admittedly not likely that the completion of this project will have a huge impact on the company’s revenues or cash flows. It may improve the company’s attractiveness in the eyes of the managers of the various ESG funds, however. When we consider the amount of money that these funds control, any buying pressure from these funds will have a very substantial impact on the company’s stock price. Any investor should certainly appreciate this.

Fundamentals Of Electric And Natural Gas Utilities

As Public Service Enterprise Group is both an electric and a natural gas utility, it would be a good idea to have a look at the macroeconomic fundamentals of these companies. Many investors have the perception that the long-term fundamentals of electric companies are much stronger than those of natural gas utilities; indeed, many believe that natural gas utilities will soon be obsolete. This is largely due to the widely promoted concept of electrification, which many in the government and the media have hyped to a great degree. This concept refers to the conversion of things that are historically powered by fossil fuels to the use of electricity instead. The most commonly cited things that are targeted for conversion are transportation (electric vehicles) and space heating, but there are other things that can be converted as well. As space heating is the primary use of natural gas supplied by utilities, this conversion can be expected to reduce the demand for natural gas in favor of electricity. This would thus greatly increase the revenues and cash flows of electric utilities at the expense of natural gas ones.

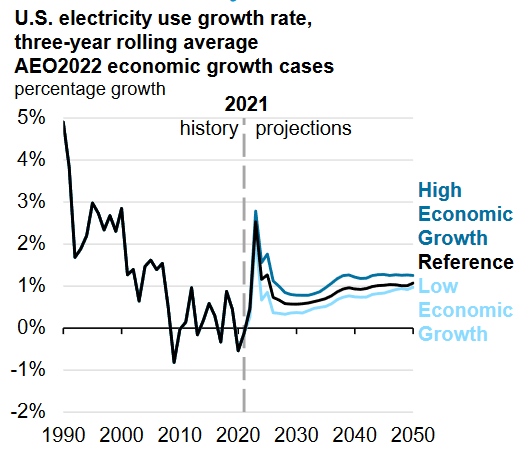

Unfortunately, the United States Energy Information Administration does not believe that this trend will play out anywhere near as strongly as its proponents do. According to the agency, the national demand for electricity will only grow at a 1% to 2% rate over the next thirty years:

EIA 2022 Annual Energy Outlook

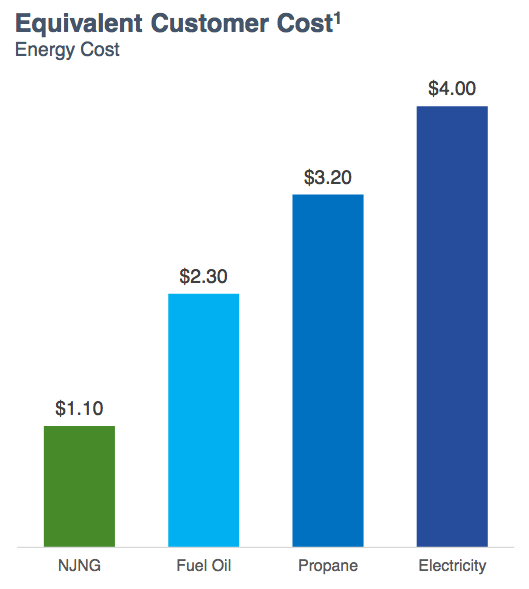

This is nowhere close to the growth rate that we would expect were wide swathes of the economy to convert from fossil fuels to electricity. In fact, I pointed out the impact of electric cars alone in a previous article. Unfortunately for the activists, there are some reasons to believe that the agency is correct about this. One of the reasons for this lies in simple economics. Electricity is much less efficient than natural gas at producing heat, which means that it is substantially more expensive to heat a building with electricity than with natural gas. According to the Energy Information Administration, it can cost nearly four times as much to heat a house with electricity as with natural gas:

New Jersey Resources/Data from EIA

It seems highly unlikely that anyone will be willing to see their heating bills increase to this degree just to reduce their consumption of natural gas. This is particularly true for people of limited means. Thus, it does not seem like natural gas utilities are going to lose the core of their businesses anytime soon, which means that the idea that natural gas utilities will become obsolete is rather far-fetched. As such, Public Service Enterprise Group does not have to worry about that part of its business going away in the near future. In addition, the company will not likely benefit to a huge degree in the near future from the widespread adoption of electric cars or electricity for space heating. The company is still likely to deliver a 5% to 7% earnings per share growth rate annually though, so it is still positioned to reward its investors even without a rapid electrification surge.

Financial Considerations

It is always important to have a look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is typically accomplished by issuing new debt to repay the maturing debt. Unfortunately, this process might cause a company’s interest expenses to increase over the rollover depending on the overall market conditions. In addition to this, a company must make regular payments on its debt if it wishes to remain solvent. Thus, a decline in cash flows might push a company into financial distress if it has too much debt. Although utilities like Public Service Enterprise Group tend to have remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector so this is still a risk that investors should consider.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is relying on debt to finance its operations as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2022, Public Service Enterprise Group had a net debt of $17.925 billion compared to 13.598 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.32. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| Public Service Enterprise Group (PEG) | 1.32 |

| The AES Corporation (AES) | 8.50 |

| Entergy Corporation (ETR) | 2.32 |

| Exelon Corporation (EXC) | 1.57 |

| FirstEnergy Corporation (FE) | 2.61 |

As we can clearly see, Public Service Enterprise Group is fairly conservative with respect to its financial structure as it is much less leveraged than its peers. This is nice to see as it means that the company should have minimal risk with respect to its debt load. Any potential investor should be able to appreciate this.

Dividend Analysis

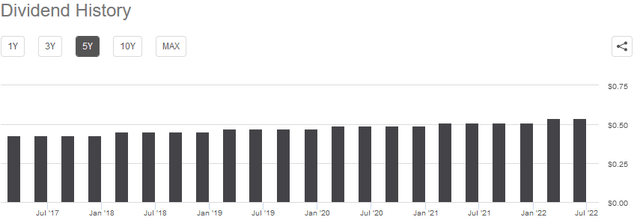

One of the reasons why investors purchase shares of utility companies is because they tend to have higher dividend yields than most other things in the market. Public Service Enterprise Group is no exception to this as the stock yields 3.46% as of the time of writing, which is quite a bit higher than the 1.55% yield of the S&P 500 index (SPY). Public Service Enterprise Group also has a history of increasing its dividend on an annual basis:

The fact that the company increases its dividend annually is very nice to see during inflationary times, such as what we are experiencing right now. This is because inflation is continually reducing the number of goods and services that we can purchase with the company’s dividend. The fact that the company is giving us greater amounts of money each year helps to offset this effect and allows us to maintain our lifestyles. As is always the case, though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be suddenly forced to reverse course and cut the dividend since that will reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we analyze a company’s ability to afford its dividend is by looking at its free cash flow. Free cash flow is the money that is generated by the firm’s ordinary operations and is left over after it pays all its bills and makes all necessary capital expenditures. This is therefore the amount that is available to do things like buy back stock, pay off debt, or pay a dividend. In the first quarter of 2022, Public Service Enterprise Group had a levered free cash flow of $2.0185 billion but only paid out $271.0 million in dividends. Obviously then the company was more than able to afford its dividend.

However, Public Service Enterprise Group usually has a much higher free cash flow in the first quarter of the year than in any other quarter. This is because of the money that is generated by its natural gas utility business unit during the winter heating season. It therefore might be a better idea to look at the company’s cash flows over the trailing twelve-month period to smooth out the impact of seasonal fluctuations. Unfortunately, here the company does not look nearly as strong as it had a negative levered free cash flow of $851.3 million over the trailing twelve-month period. This is not enough to pay any dividend, let alone the $1.044 billion that it actually paid out during the same twelve-month period.

With that said, it is not unusual for utilities to finance their capital expenditures through the issuance of debt and equity while financing the dividends using operating cash flow. This is because of the high costs of constructing and maintaining utility-grade infrastructure over a wide geographic area. In the trailing twelve-month period, Public Service Enterprise Group had an operating cash flow of $1.181 billion. This is enough to cover the $1.044 billion that the company paid out in dividends but I will admit that I am concerned about the coverage here as it looks quite tight. The company can technically afford its dividend but we will need to keep an eye on this to see if it can improve that coverage as it is too close for comfort.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of a utility like Public Service Enterprise Group, one metric that we can use to value it is the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock might be undervalued relative to its forward earnings growth and vice versa. However, there are very few stocks in today’s overheated market that have a ratio that low, particularly in the low-growth utility sector. As such, it makes more sense to compare the company’s ratio against its peers to see which one offers the most attractive relative valuation.

According to Zacks Investment Research, Public Service Enterprise Group will grow its earnings per share at a 4.57% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 3.93 at the current stock price. Here is how that compares to its peer group:

| Company | PEG Ratio |

| Public Service Enterprise Group | 3.93 |

| The AES Corporation | 1.77 |

| Entergy Corporation | 2.59 |

| Exelon Corporation | 3.14 |

| FirstEnergy Corporation | 2.42 |

Here we can see confirmation of the statement that I made in the introduction to this article. Public Service Enterprise Group looks remarkably expensive compared to its peers. This might be due to the company’s renewable credentials as companies that are very aggressive in the deployment of these technologies seem to have higher valuations than companies that are not. Either way, Public Service Enterprise Group looks rather expensive and it may make sense to see if the stock declines to a more reasonable valuation relative to its peer group before buying in.

Conclusion

In conclusion, there are certainly a few things to like about Public Service Enterprise Group. Notably, the company is positioned to deliver an attractive 9% to 11% total annual return over the next five years and it is very aggressive in the deployment of renewable generation technology. The company also has an attractive balance sheet with limited leverage. Unfortunately, it also looks very expensive, and its cash flows are barely able to cover the dividend. It might be worth considering if the price drops, but at present, it may be best to steer clear.