Portillo’s: Long Runway Of Growth In A Big TAM (NASDAQ:PTLO)

Yagi Studio/DigitalVision via Getty Images

Overview

Portillo’s (NASDAQ:PTLO) is currently undervalued by ~70%. I believe the market will realize PTLO’s intrinsic value when it shows that it can hit its guidance and that the high debt level will not be an issue. It should be able to continue growing units at 10%+ and same-store-sales at low single digits as guided, given it is still a relatively small player with plenty of room to grow. I believe PTLO can hit its long-term guidance and the stock price should reflect the business value overtime.

Business description

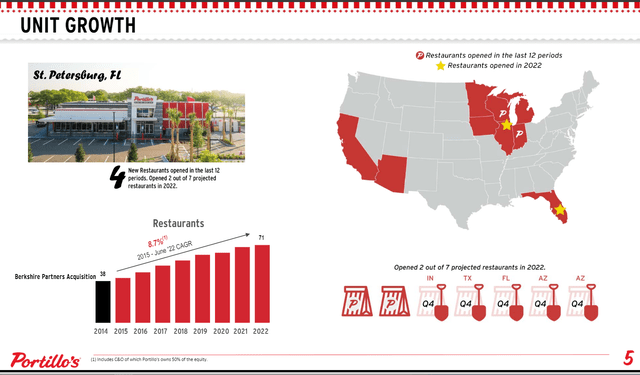

PTLO is a fast food restaurant serving traditional Chicago street food. Chicago-style hot dogs and sausages, Italian beef sandwiches, chopped salads, burgers, crinkle-cut french fries, homemade chocolate cake, and milkshakes are among the menu items. PTLO owned and operated 71 Portillo’s restaurants across nine states in the United States as of June 26, 2022.

Long runway of growth

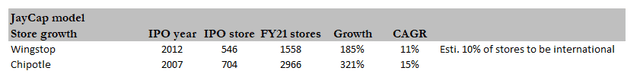

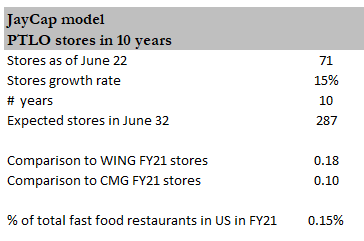

PTLO had 71 units open at the end of 2Q22 and plans to have 76 locations by FY22. Given that PTLO is still a small concept in its early stages of growth, I believe it will easily meet that target. In the United States, there are approximately ~197,000 fast food restaurants, making PTLO less than 1% of the industry. PTLO’s long-term goal is to achieve 10%+ annual unit growth and low-single-digit same-store sales, which would result in high-single to low-double-digit revenue growth. To begin with, I am confident that PTLO can continue to expand at its expected rate if executed well (as it has over the past eight years), as there are successful examples such as Wingstop (WING) and Chipotle (CMG). From a TAM standpoint, even if PTLO grows at a 15% annual rate for the next ten years, it is still only one-fifth and one-tenth of WING and CMG FY21 stores, respectively. The number of states in which PTLO currently operates is another qualitative indicator that it has plenty of room to expand. The United States is a large country, and opportunities to expand to other states could be a future growth lever. The point is that there is plenty of room for expansion.

Author’s estimates, WING filings, CMG filings Author’s estimates PTLO 2022 Investor Day

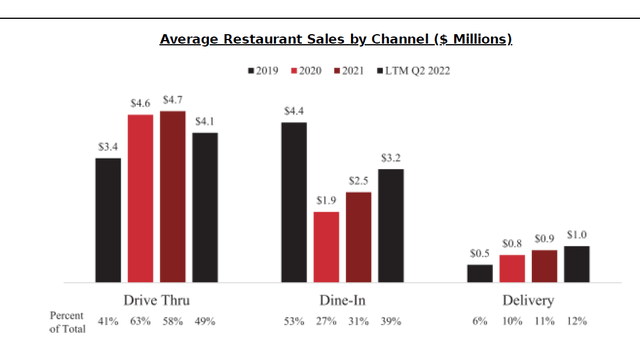

Omnichannel sales channel

PTLO restaurants are built on the premise that customers value speed, ease of use, efficiency, and the ability to make purchases through a number of different methods. Because of this, its eateries feature drive-thrus, indoor seating, curbside pickup, takeout, delivery, and even off-site catering. Drive-thru and delivery sales increased during COVID, demonstrating the success of PTLO’s strategy to quickly adjust to sales changes and train staff in preparation for possible pandemic lock-down periods. Furthermore, PTLO restaurants are placed strategically to take advantage of the drive-through culture in the United States. Nearly all PTLO restaurants are designed to accommodate large crowds, with features like double-lane drive-thrus and ample parking. I think PTLO has a good chance of keeping its success and even growing its market share because it has a lot of experience across multiple channels in an age when customers value ease of use and a wide range of ways to interact.

Strong brand

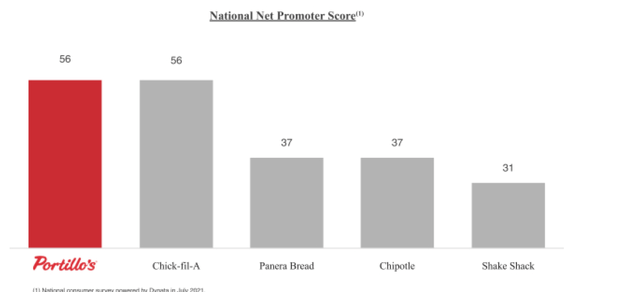

PTLO has an intangible competitive advantage that does not appear on the financial statements-brand, which some investors may overlook. After nearly 60 years in business, PTLO has established a solid reputation among its devoted clientele. The menu is diverse and can cater to a wide range of tastes, which helps its restaurants succeed in many different commercial zones. As challenging as it may be to put a precise number on the brand’s success, there are still some metrics we can use. To begin with, PTLO is supported by an active and enthusiastic online community. Socialinsider’s 2022 benchmark study for the industry found that PTLO’s Facebook posts average 26 times more engagement than the average industry brand post, and that PTLO’s Twitter (TWTR) posts average 46 times more engagement. Dynata did a nationwide survey in July 2021, and the results showed that PTLO had a higher net promoter score than a number of well-known fast-food chains (Socialinsider and Dynata data source from PTLO S-1).

Value meal insulate recession pressures

One of PTLO’s main selling points is the value it brings to its customers. The PTLO strategy prioritizes speed, multichannel accessibility, and the provision of high-quality, craveable food at low prices. PTLO’s policy is to not offer sales or promotions on their products. Its goal instead is to consistently impress its patrons with a high level of service at a fair price. As someone who enjoys fast food, I think PTLO will be able to maintain and even increase its volume during economic downturns because of its combination of craveable food (especially fast food) made with high-quality ingredients and served quickly at an affordable per-person spend of around $9.75.

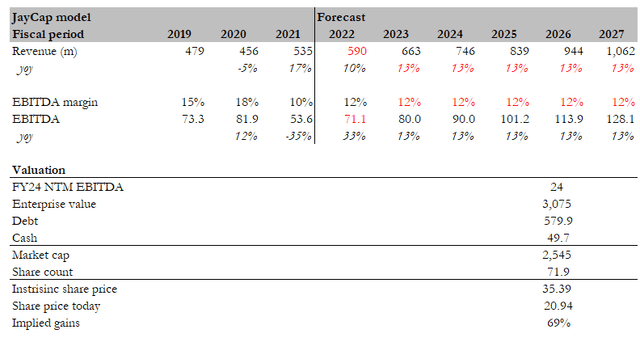

Forecast

Based on my investment thesis, I expect PTLO to continue growing its store unit count to capture a bigger share of the pie. Management is guiding to a long-term revenue target growth of high single to low double digits, which I believe is achievable given it is still a small player today. That said, my forecast is based on consensus FY22 figures and growth moving forward on the lower range of the forecast, 10% unit growth and 2.5% same-store sales growth. Margins may improve due to fixed-cost leverage, but I conservatively forecast them to remain flat from FY22.What I want to show readers here is that even at the lower range, PTLO is still an attractive investment opportunity that could generate good returns. PTLO’s valuation has been beaten down by a fair bit from 29x forward EBITIDA to 24x forward EBITDA, which is still roughly in range with competitors such as WING and CMG. Based on the above assumptions and an NTM EBITDA of 24x, I came up with an intrinsic value of $35.39. This is ~70% more than the current share price of $20.94.

Red flags

Recession

Since eating out is considered a luxury to some, PTLO could be negatively affected by changes in the U.S. economy, such as a drop in disposable personal income or a slowdown in job growth, or by changes in the restaurant industry that reduce profits at the store level, such as higher labor costs, higher food prices, or higher rent.

Change in consumer preferences

It’s difficult to foresee, but PTLO would suffer if people’s tastes in fast food shifted. In this regard, the popularity of meat substitutes made from plants is a good example.

Levered balance sheet

When compared to other fast-growing restaurants, PTLO has a higher level of debt (Net debt/EBITDA). This is not necessarily bad, but it could cause PTLO to issue equity to keep the lights on during a prolonged economic downturn.

Conclusion

PTLO is undervalued at its current share price as of the date of this writing in my opinion. PTLO is still a relatively small player in the industry, and as such, it still has a long runway to continue growing. More importantly, it has a brand that consumers love, which is very important in the food business as having top-of-mind awareness is one of the key factors that sets players apart. While there may be some short-term headwinds in terms of raw material prices, I believe that all of these will eventually normalize over time, and PTLO will be an appealing investment opportunity in retrospect.