Petco Health And Wellness Company: Still A Great Prospect (NASDAQ:WOOF)

JHVEPhoto

Any good pet owner will treat their pets like their family. This means taking proper care of them by making sure that they have the food they need, the toys they enjoy, and even the healthcare offerings that you would want for your children. One company dedicated to providing health and wellness offerings like veterinary care, grooming, and pet training, to nearly 1,500 pet care centers across the US, Mexico, and Puerto Rico, is Petco Health and Wellness Company (NASDAQ:WOOF). Fundamentally speaking, financial performance achieved by the company has been quite mixed recently. Revenue continues to climb, but profits have fallen compared to the same time last year. Investors have also been skittish because management has decreased guidance across the board. This also seems to point to even more downward revisions in the future. While I understand the market’s concern, I do also think that the downside the company experienced has been worse than warranted. This is especially true if management ends up being right when it comes to current guidance for the 2022 fiscal year.

Petco’s shares – not man’s best friend

Back in late May of this year, I wrote an article that took a rather bullish stance on Petco. I was particularly impressed with how the company had grown in prior years and I also found myself appreciative of the guidance that management offered covering the 2022 fiscal year. At the end of the day, I concluded that so long as guidance was met or exceeded, that the company would offer some upside potential for investors. This led me to rate the company a ‘buy’, reflecting my belief at the time that it would generate performance that would exceed with a broader market would for the foreseeable future. Unfortunately, things have not gone exactly as planned. While the S&P 500 has dropped by 7.2%, shares of Petco have experienced downside of 28.8%.

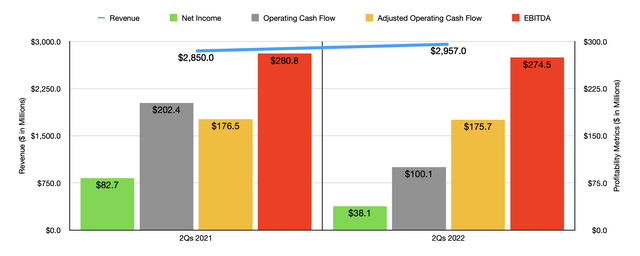

In truth, some of this downside was likely warranted. But at the same time, I do think that the market has overreacted based on the guidance provided by management. For instance, let’s start with revenue. For the first half of the 2022 fiscal year, sales came in at $2.96 billion. That’s 3.8% higher than the $2.85 billion the company generated the same time one year earlier. The key driver behind this increase in sales was a 4.4% increase in comparable sales data. This increase was driven by a 13.7% rise in consumables sales and by a 19.7% increase in revenue associated with services and other activities. On the services and other side of the equation, the company benefited from an increase in the company’s veterinary hospital business, with the number of locations rising by 50 from 150 to 200 over the past year. Supplies and companion animal sales, meanwhile, dropped by 9.2% year-over-year. The company also saw its online sales climb by 10.2% over the past year, which to me is a great sign. At the same time, however, the company was negatively impacted by a reduction in the total pet care centers that it had in operation at the end of the latest quarter. That number came in at 1,428, down from the 1,451 the company had just one year earlier.

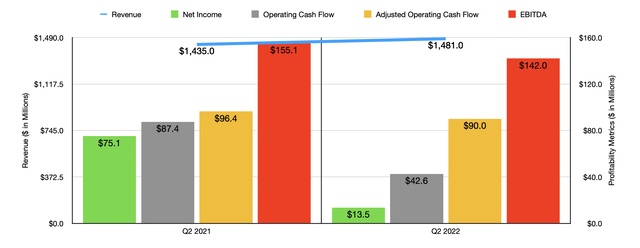

Although revenue increased nicely, profits for the company plummeted, with net income dropping from $82.7 million in the first half of 2021 to $38.1 million the same time this year. The company suffered here from a number of factors, including a reduction in its gross profit margin from 42% to 40.7% as a result of a change in product mix. Higher interest expense also affected the company, as did A significant change in other non-operating items. This particular category saw a swing of $55.11 million year over year, driven entirely by a swing in fair value associated with its investment in Rover Group, Inc. Other profitability metrics for the company also worsened, with operating cash flow dropping from $202.4 million to $100.1 million. But if we adjust for changes in working capital, it remained almost flat, dipping from $387 million to $386.7 million. And over that same window of time, we also saw EBITDA dip slightly, going from $280.8 million to $274.5 million. As you can see in the chart above, results in the second quarter of the 2022 fiscal year relative to the same time of 2021 were very similar to what the company saw in the first half of the year as a whole. At the very least, we aren’t seeing a deterioration in revenue or a significant decline in cash flows in this admittedly turbulent market.

For the long haul, management is also making some interesting moves. For instance, in late August of this year, the company unveiled its decision to extend its health and wellness plan to all species of pets, ranging from birds, to reptiles, to fish, and more. The company is also making significant investments in its product line, such as its announcement in late August of the expansion of its popular WholeHearted Pet foods to include human-grade fresh food for dogs. And in June, the company unveiled its new small town and rural retail test concept that is supposed to be tailored to the health and wellness of not only traditional pets, but also farm animals.

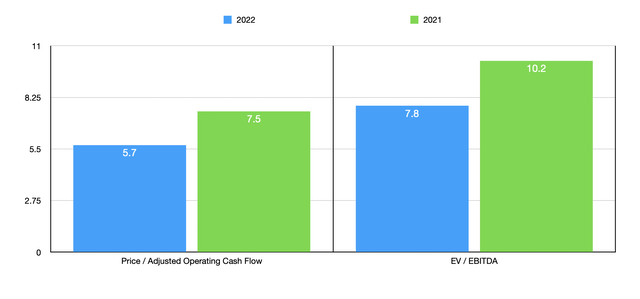

Sales this year are now forecasted to be between $5.975 billion and $6.05 billion. Previously, management guided sales to be between $6.15 billion and $6.25 billion. Although the company has experienced some pain on the bottom line this year, management remains hopeful about what the rest of the year will look like. Currently, the firm expects EBITDA to be between $580 million and $595 million. Although this is lower than the prior expected range of between $630 million and $645 million, it would be above the $448.9 million generated in 2021. Adjusted earnings per share should be between $0.77 and $0.81. Although this is down from me $0.97 per share to $1 per share previously anticipated, it would still translate to net income of $210 million. That stacks up nicely against the $164.4 million reported for 2021. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA is forecasted to, we should anticipate a reading there of $538.4 million. As part of my analysis, I compared Petco to five similar companies. On a price to operating cash flow basis, these companies ranged from a low of 15 to a high of 6,321. And using the EV to EBITDA approach, the range was between 11.4 and 698.7. In both cases, our prospect was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Petco Health and Wellness Company | 7.5 | 10.2 |

| Chewy (CHWY) | 73.7 | 387.0 |

| Freshpet (FRPT) | 6,321.0 | 698.7 |

| Central Garden & Pet Co. (CENT) | 15.0 | 11.4 |

| PetMed Express (PETS) | 18.2 | 14.1 |

| PetIQ (PETQ) | 27.3 | 20.2 |

Takeaway

The data right now suggests to me that Petco is going through something of a difficult time from a profit and cash flow perspective. On top of that, investors are likely worried that the guidance management has provided will be revised lower again. After all, one of the first things people are likely to cut back on during times of economic uncertainty is the amount of money they spend on their pets. Having said that, shares do look very affordable at this time and could still be undervalued even if the fundamental condition of the company comes up short. Add on top of that management’s still-rosy guidance, and I do believe that the ‘buy’ rating I gave the company previously is warranted.