PDO: Consequences Of The Distribution Hike And Our Outlook (NYSE:PDO)

da-kuk

This article was first released to Systematic Income subscribers and free trials on July 5.

On 1-July, in its usual start-of-month distribution press release, PIMCO announced an 8% distribution hike for the Dynamic Income Opportunities Fund (NYSE:PDO). For investors who have been following the PIMCO suite of closed-end funds (“CEFs”), this was probably not unexpected. In this article, we take a quick look at the hike and its consequences. Currently, PDO is trading at a 7.4% discount and a 10.77% current yield.

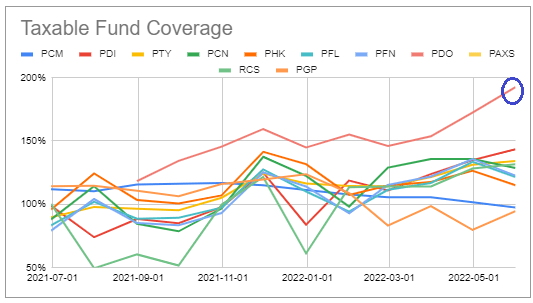

We have discussed a number of times over the last few months how comically high the distribution coverage of PDO has been this year in both absolute terms as well as relative to the PIMCO suite. The fund’s coverage has been increasing steadily and touched a ridiculous 192% in May (going by our favorite 6-month rolling figure).

Systematic Income CEF Tool

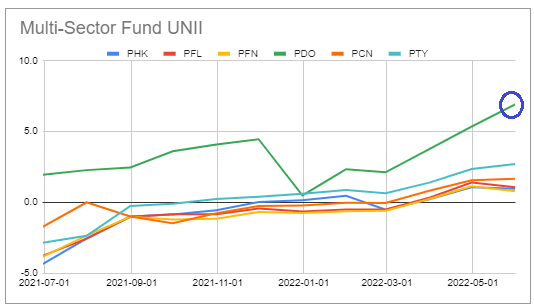

Even more interesting, perhaps, is the fund’s UNII profile which touched a normalized regular distribution equivalent of 6.9 (i.e. PDO has UNII equivalent of nearly 7 times its previous regular distribution or about 6.4x its new one). This number exceeded its previous peak right before the large special at the end of last year (which was equivalent to 5 regular monthly distributions). Given the current UNII peak is above the previous one, we wouldn’t be surprised by a similar or larger special this year even with this distribution hike.

Systematic Income CEF Tool

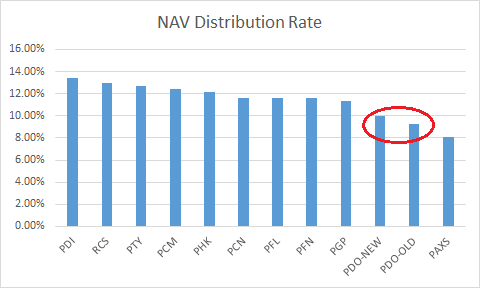

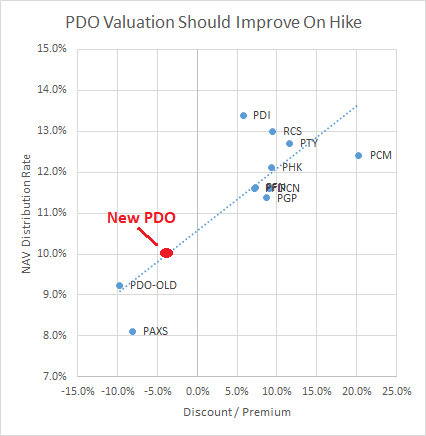

In the PIMCO taxable suite, PDO had the second lowest NAV distribution rate in the taxable suite (shown by PDO-OLD in the chart below) – above only the more recently-launched PAXS. What’s interesting is that despite a sizable hike (8% or 0.74% in absolute terms from 9.23% to 9.97% on NAV) the fund’s distribution rate remains the second lowest and 1.5% below the average rate.

Systematic Income

We expect the PDO NAV distribution rate to converge further with the rest of the suite. The bulk of this convergence we expect to come from the continued steady drop in NAV distribution rates across other funds.

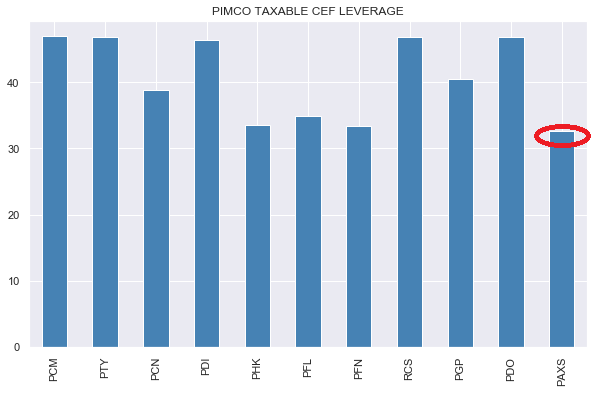

The timing of cuts is always difficult to gauge and we don’t forecast distribution changes, focusing instead on the balance of risks. The most upside in our view is for PAXS which has boosted its leverage from zero to around 33% in just a couple of months. We wouldn’t be surprised if its leverage rises further 10-15% to that of PDO.

The leverage mandate of (PAXS) is the typical 50% version which leaves it a lot of room for further borrowings. The only PIMCO taxable funds that choose to run leverage well below 50% are either those holding auction-rate preferreds, e.g., (PCN), (PHK), (PFL), (PFN), or (PGP) which is a very high-beta fund due to its equity allocation which, simply, can’t afford to run leverage anywhere near 50%. Since PAXS doesn’t fit into these two buckets we suspect its leverage will keep growing which will likely result in a distribution hike down the line just as it did for PDO.

Systematic Income

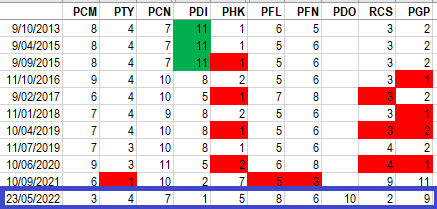

In terms of downside risks we continue to see risks for (PDI) and (RCS) as the following chart shows (higher numbers = more downside risk). See our previously published framework for assessing downside risk in PIMCO distribution cuts here. The red highlights indicate funds when the distribution was cut the following month and green when they were increased. Note that the red cells correlate well with lower numbers.

Systematic Income

The second impact of the distribution hike is that we expect PDO valuation to improve. Many CEF investors are well aware that NAV distribution rates play a significant role in driving the valuation of a given fund. The relationship is not particularly strong for the PIMCO funds as it’s also driven by the large differential in fund fees, but it’s not non-existent.

We use the discounts the day prior to the hike announcement and show the pre-hike PDO as PDO-OLD in the chart with the red dot being the fair-value post-hike PDO according to the trendline with a discount of around 4%. The point here isn’t that PDO has to trade at a discount of 4% but rather that the valuation differential between it and the rest of the suite should converge by around 5% or so relative to its pre-hike level.

Systematic Income

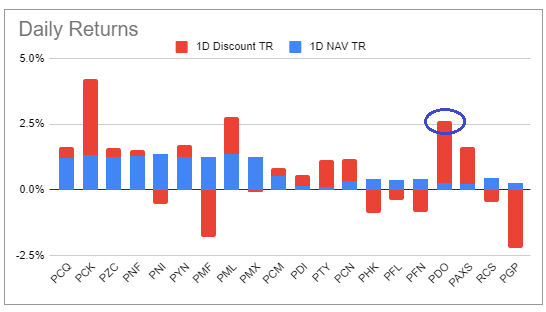

The bulk of this move was already made on Friday, with PDO outperforming strongly (i.e., its valuation outperforming the taxable suite by 3.2%) as the information was released prior to market close.

Systematic Income CEF Tool

Takeaways

Overall, we continue to favor PDO within the broader PIMCO taxable suite and continue to hold it in our High Income Portfolio.

Our previous reasons for tilting to PDO were 1) more attractive valuation in the suite – offering a valuation margin of safety, 2) term structure – offering a potential performance tailwind if the fund terminates / holds a tender offer, 3) relative distribution safety.

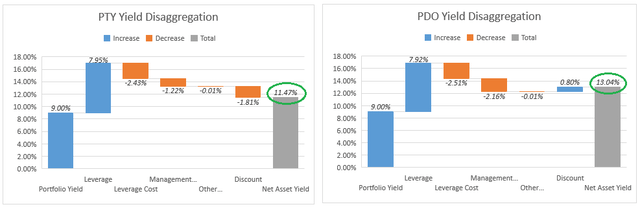

These factors are still in play, however, we would also add the fact that with a high level of underlying asset yields (e.g., high-yield corporate bonds trading near a yield of 9%), its wide discount more than makes up for its higher management fee – something we discussed in more detail in our previous PIMCO update. A yield disaggregation chart relative to PTY shows how this works.

Many investors have commented that they consider PDO uninvestable given its performance since its IPO. In our view, the fund has performed pretty much as intended given the broader market environment. If we do a simple back-of-the-envelope performance estimate of its portfolio using benchmark ETFs we get to an unleveraged weighted-average total return of -12% year-to-date. Once we take into account the fund’s leverage we get to a figure of -21.9%. The fund’s actual performance year-to-date in total NAV terms is -17.5%, so, if anything, the fund has done better than expected.

We can also compare the fund’s performance relative to PTY which is often treated as the “best” fund in the PIMCO taxable suite. PTY has delivered a total NAV return of -16.6% this year – besting PDO by 0.9%. That’s certainly something but it’s not all that impressive. PTY has also underperformed in total price terms, however, owing to the deflation in its still-high premium.

Clearly, the recent experience has been painful for PDO and we don’t expect it to retrace its NAV drop all the way anytime soon, if ever. However, the ability of PIMCO to deliver alpha over time as well as the attractive value on offer in income markets makes PDO a decent hold for more aggressive income investors.