PayPal Earnings: Market Got Its Recent Hammering Right Again (NASDAQ:PYPL)

Justin Sullivan

Thesis

We cautioned investors in our previous article not to get caught up in the summer rally for PayPal Holdings, Inc. (NASDAQ:PYPL), even as we highlighted in late June that it has likely bottomed. Instead, we gleaned that the market drew investors into an unsustainable surge with a more well-balanced valuation then.

Accordingly, PYPL has fallen nearly 20% from our previous article (Hold rating) and more than 30% to its recent November lows. Therefore, PYPL has underperformed the broad market significantly since then. As a result, the market nearly forced a complete digestion of its rally from its June lows, taking out investors astutely who chased its summer surge.

Therefore, the market has gotten it right again, as it anticipated PYPL’s momentum from its August highs wasn’t sustainable. The company highlighted further weakness for its Q4 holiday spending, as e-commerce trends worsened further as consumers crimped their discretionary spending.

However, management also highlighted that it expects to continue driving operating leverage and expects to reaccelerate its adjusted EPS growth for FY23. With PYPL’s valuation falling back to an NTM normalized P/E of 16.4x, we discuss why it’s back to undervalued zones.

While the re-test of its June lows could introduce potentially more near-term downside volatility, we are confident its significantly de-risked entry zones offer investors a much-improved reward/risk from its August highs.

Revise from Hold to Buy with a medium-term price target of $100 (implying a potential upside of 33%).

The Market Correctly Anticipated PayPal’s Weak Q4 Guidance

With PYPL down more than 30% from its August highs, it’s clear that the market correctly anticipated tepid guidance from management as PayPal headed into its Q3 earnings release. Accordingly, worsening macroeconomic weakness added more stress to the strength of Q4’s critical holiday spending forecasts.

Adobe’s (ADBE) forecasts for the holiday season in early October previewed the significant challenges facing PayPal and its e-commerce peers. It projected just 2.5% YoY growth for 2022’s online holiday sales.

Amazon’s (AMZN) recent earnings card also demonstrated that it expects a highly challenging holiday season, suggesting a significant slowdown in e-commerce spending growth. Notably, Q4’s holiday spending could be down significantly from Q2’s US e-commerce growth of 6.8% as consumers cut back their spending further.

Management also emphasized the deterioration in e-commerce trends as it exited Q3:

We saw US e-commerce growing in the low single digits in Q3 with deceleration into the close of the quarter. This trend persisted in October. On our platform as well as in third-party data, we have not seen the early start to the US online holiday season that we saw in 2021. Our guidance contemplates holiday e-commerce ramping through November. Overall, our expectations for holiday e-commerce are consistent with the recent spending forecasts from Adobe, Mastercard and Salesforce with growth in the low single digits. (PayPal FQ3’22 earnings call)

But PayPal Could Outperform The Market In FY23

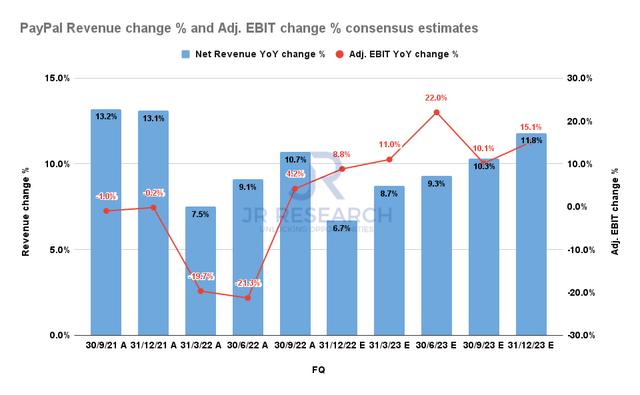

PayPal Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

We believe PayPal guided conservatively into Q4, as highlighted by management. Notably, management was astute as it provided a preview into FY23, highlighting its confidence that PayPal’s revenue and profitability could recover markedly from its FY22 malaise.

Hence, we postulate PayPal likely sandbagged its FY22 guidance, as management’s FY23 outlook suggests the company could deliver an adjusted EPS growth of 15%. It’s also expected to be much faster than the S&P 500’s (SPX) (SP500) FY23 normalized EPS growth of 5.6% (according to Refinitiv data).

As such, the consensus estimates (bullish) are also in line, as it expects PayPal to gain incremental operating leverage through FY23, as seen above.

PYPL Is Back to Undervalued Zones

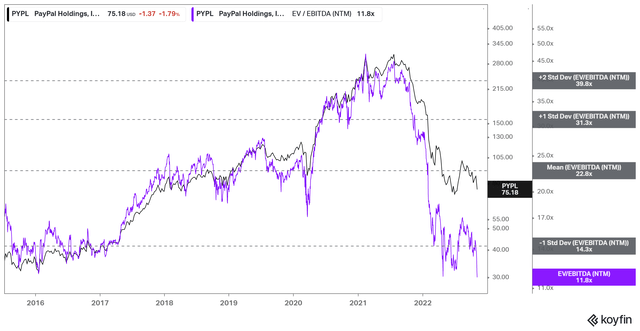

PYPL NTM EBITDA multiples valuation trend (koyfin)

Given the battering from its August highs, PYPL last traded at an NTM EBITDA of 11.8x, well below its all-time mean of 22.8x. Its NTM normalized P/E of 16.4x is also in line with the S&P 500’s forward normalized P/E of 16.2x.

Consequently, with PayPal expected to grow much faster in FY23, as highlighted by management, we believe the market could re-rate PYPL moving forward.

Hence, with PYPL’s FY23 PEG ratio of 0.93x (based on FY23 revised consensus estimates), we believe PYPL is undervalued at the current levels.

Is PYPL Stock A Buy, Sell, Or Hold?

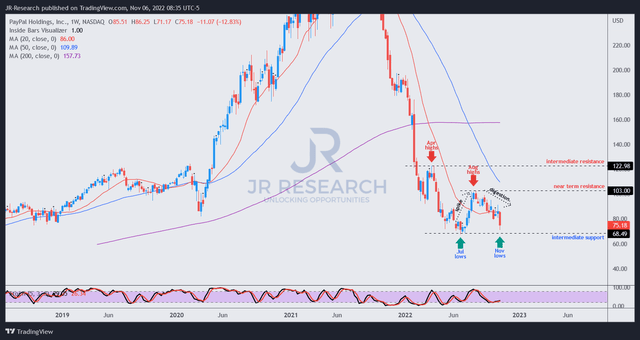

PYPL price chart (weekly) (TradingView)

We are satisfied that PYPL’s surge to its August highs has been digested meaningfully, de-risking its entry zone for investors who patiently waited for PYPL to “come back.”

While the potential for a re-test of June lows remains, we believe it should hold robustly.

Revising our rating from Hold to Buy with a PT of $100.