OneMain Holdings Stock Appears Overvalued, But It’s A Buy (NYSE:OMF)

cokada

OneMain Holdings, Inc. (NYSE:OMF) currently operates in a riskier market landscape. Despite this, OMF maintains a stable performance with its revenues and margins. Also, it holds adequate reserves to cover potential delinquencies. It can cover borrowings and dividends while keeping yields exciting. Meanwhile, the stock price remains divorced from fundamentals but reasonable.

Company Performance

The recession specter seeps into every household as interest rate hikes persist. As such, OneMain Holdings, Inc. appears more vulnerable to market headwinds. Despite this, its core operations remain robust and resilient. Its ability to withstand the blows shows it can navigate the rugged landscape.

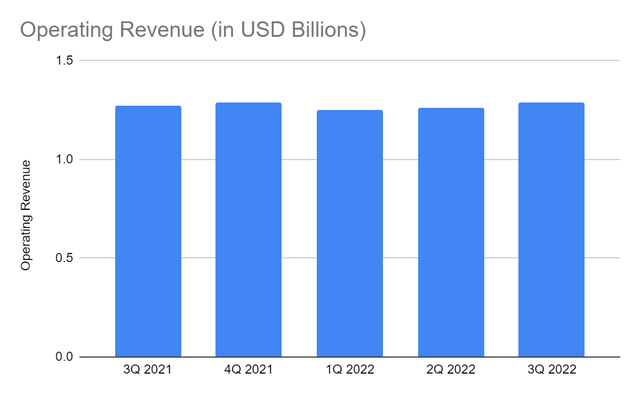

The operating revenue amounts to $1.29 billion, a 1.5% year-over-year growth. In addition, quarterly values have been stable despite recession fears. Interest income remains the primary revenue growth driver, with a 2% YoY growth. Other revenue components are also in an uptrend. It shows relative stability in all its segments. Several attributes keep driving its steady revenue growth. I will focus on the three.

Operating Revenue (MarketWatch)

First, OMF remains a personal loan and consumer finance staple. It comes mainly from personal loans with a 4% year-over-year growth. Despite the lower loan origination, higher loan volumes and interest rates offset it. Yields are lower but remain within the range of 22.6%. Managed receivables are also primary contributors, given the 7% annual increase. It leads to more returns as sales partnerships and credit cards continue to increase.

Second, OMF maintains prudent securities portfolio management and diversification. We can see it in their yields even if their fair value decreased. In essence, securities and inflation have an inverse correlation. Yet, OMF derives stable yields due to the nature of securities. Most of them are government-backed treasuries and securities. So they are more inflation-linked and flexible to economic cycles. This attribute allows them to cushion recession fears and lower valuation.

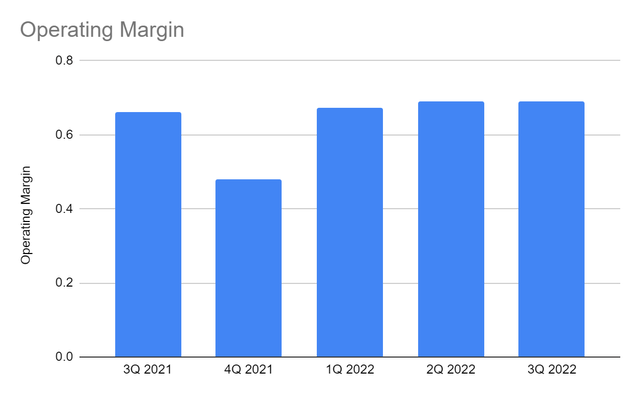

Third, OMF focuses on what it can control and improve best. Over the years, it has been investing in new products and digitalization. Its efforts remain helpful as operating expenses remain manageable. Interest expense remains lower despite the increased borrowings and interest rate hikes. Labor and other expenses remain almost unchanged, showing increased efficiency. However, provisions for credit losses are 86% higher than in the comparative quarter. While it is wise to be conservative, it erodes the viability of the company. Nevertheless, the increased revenues offset provisions. The operating margin remains impressive at 69% compared to 66% in 3Q 2021. Indeed, OMF remains viable. The attributes driving revenues and stabilizing expenses help OMF navigate the market.

Operating Margin (MarketWatch)

Potential Risks, Opportunities, And Core Competencies

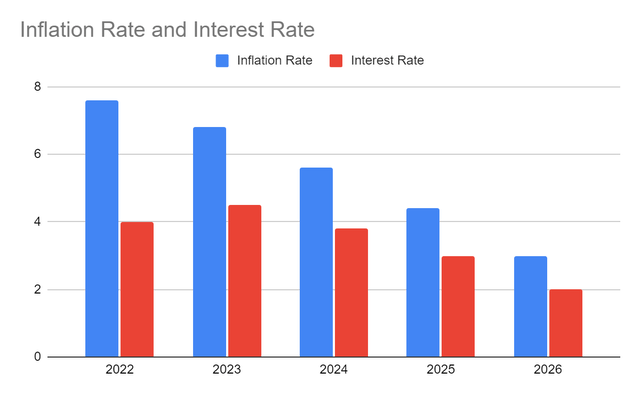

As inflation drops to 7.1%, Americans are more hopeful today. Recession fears may subside, and interest rate hikes may slow down. Despite this, these macroeconomic indicators remain elevated. I expect inflation to close at 7-8% before decreasing to 4-5% in the following years. Likewise, I still expect interest rates to increase some more. But I am optimistic about the slowing down of increments. The average interest rate may reach 4.5% before plummeting as the economy improves.

To be honest, interest rate hikes can also become a growth catalyst for the company. With a series of bps increments, it has already stretched further than expected. Many analysts anticipate an increase of 4.5-5%. It is way higher than the interest rates of many credit cards and lending institutions. These include OneMain Holdings. And since OneMain caters to middle-income households, the inflows of borrowers are visible.

Inflation Rate And Interest Rate (Author Estimation)

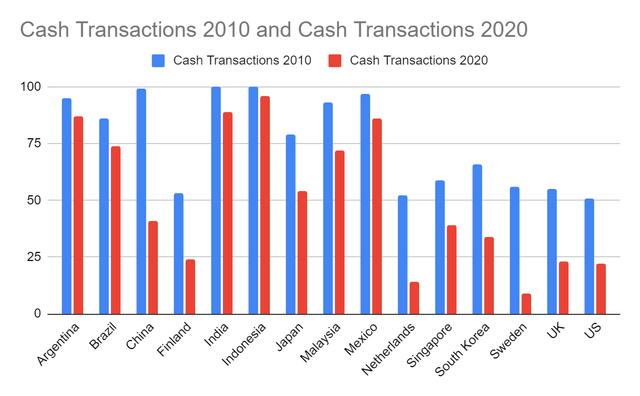

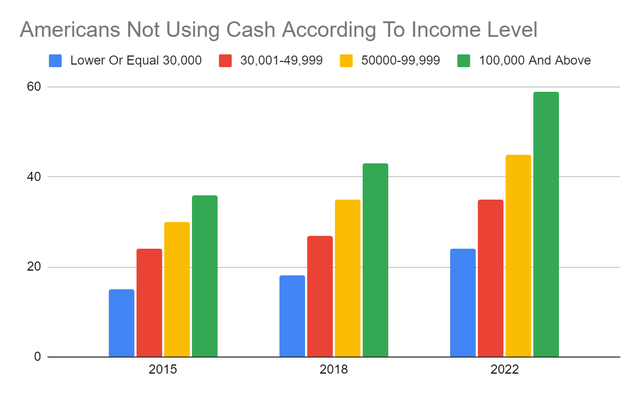

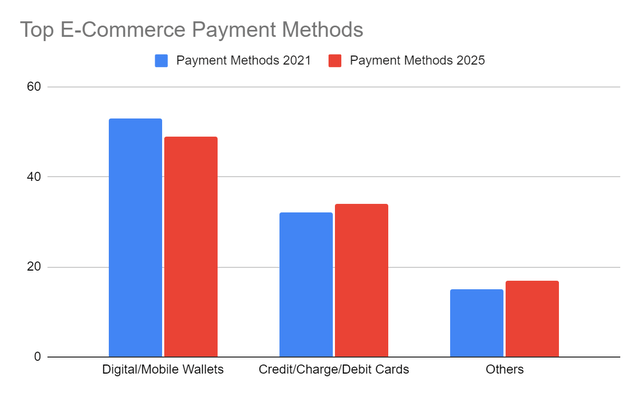

Moreover, credit cards are more of a staple today. Their usage has increased over the years and may increase further. They help make ends meet and are effective payment methods. The acceleration of digital transformation further highlights credit cards. In the US, for example, cash transactions dropped from 55% to 25% in ten years. More specifically, Americans not using cash for purchases is now 41% versus 24% in 2015. Also, there is an inverse relationship between cash usage and income levels. This factor contributes to the inflows of OMF credit card users. Other potential drivers are the rise of point-of-sale and e-commerce. Both of them project increased use of credit cards.

Cash Transactions In 2010 And 2020 (The Straits Times)

Americans Not Using Cash Based On Income Level (Pew Research Center)

Top E-Commerce Payment Methods (Statista)

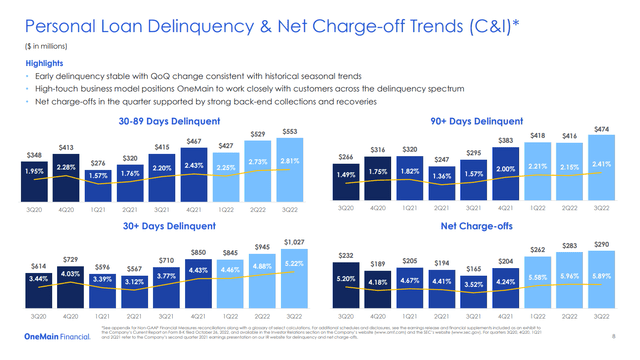

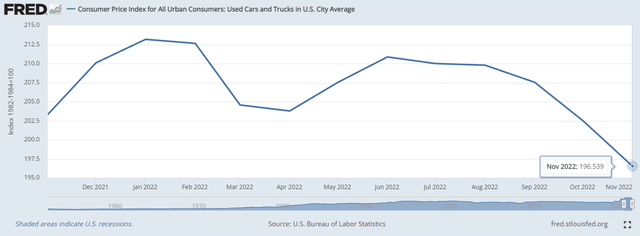

Despite these opportunities and growth avenues, OMF must recognize recession fears. Delinquencies and charge-offs are on the rise. They can pull down loan quality and viability. While provisions are a conservative approach to growth, OMF must be more careful. Also, unsecured loans comprise a considerable portion of personal and credit card loans. Even collateralized loans face risks. Used car prices have been cooling down recently. These may not compensate for delinquencies if prices continue to decrease. Thankfully, the unemployment rate is still a far cry from the Great Recession. In addition, the US government has been extending financial relief to the unemployed. Consumers and borrowers still have good purchasing and borrowing power.

Loan Delinquency And Charge Offs (3Q Investor Presentation) Average Used Car/Truck Prices (ST. LOUIS FED )

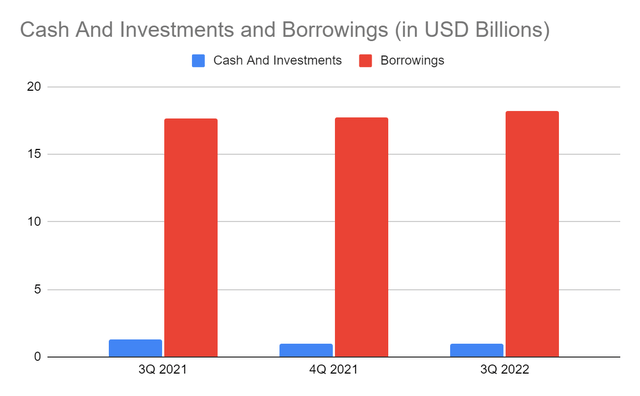

Amidst the market mix, OMF remains a durable company. Its Balance Sheet is well-positioned against economic downturns. It maintains adequate reserves to cover potential defaults and delinquencies. Cash levels and short-term investments are stable at $1.02. Borrowings are higher but within the lower end of the risk spectrum. The net leverage of 5.6x is the same as in 2Q 2022. It is higher than the ideal range of 3.5-4.5x. Even so, it is a massive improvement from pre-pandemic levels at 7-8x. The banking capacity amounts to $7 billion. Overall, it shows adequacy to hedge risks and sustain the operating capacity.

Cash And Investments And Borrowings (MarketWatch)

Stock Price

The stock price of OneMain Holdings, Inc. lost almost half of its value after the continued downtrend. Although there has been a rebound in the last two months, it remains lower. At $36.5, the stock price has already been cut by 21% from the starting price. Despite this, price metrics do not show undervaluation. The price-earnings multiple of 4.8x shows that the stock price is affordable. If we multiply it by NASDAQ EPS estimates of $7.25, the target price will be $34.51. My estimation is more optimistic at $7.41, so the target price is higher at $35.55. Either way, the estimation suggests that the stock price is still reasonable.

Meanwhile, dividend payments of OMF are consistent with special dividends. Yields are enticing at 10.29%. It is way better than the S&P 400 average of 1.22%. Also, payments remain well-covered, given the dividend payout ratio of 62%. To assess the stock price better, we will use the DCF Model.

FCFF $908,000,000

Cash $1,020,000,000

Borrowings $18,200,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 122,211,896

Stock Price $36.5

Derived Value $38.04

The derived value does not adhere to the price-earnings multiple. It shows potential undervaluation with an upside of 4% in the next 12-18 months. Investors may still consider it an entry point to make a position.

Bottomline

OneMain Holdings, Inc. faces mixed market risks and opportunities. Risks are present as delinquencies and non-performing loans increase. Even so, it remains well-positioned against recessionary headwinds. Its steady revenue growth and stable margins are proof of financial stability. Also, the stellar Balance Sheet is one of the main cornerstones. It has adequate reserves to cushion risks, sustain the business, and cover borrowings. Dividends remain well-covered and consistent with enticing yields.

Meanwhile, the stock price is still in a downtrend. My estimates show different target prices, although they agree it is still reasonable. Either way, it is worth the risk. Yes, there is more to a stock than dividends. But if yields are 10%, then it’s worth the try. The company can also sustain it as cash reserves and banking capacity improve. Weighing risks and opportunities, OneMain Holdings, Inc. could have been a strong buy. But given the current market condition, I rate it as a buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!