Old Dominion Proves Its Excellence, Yet Headwinds Call For Patience (NASDAQ:ODFL)

ablokhin

Introduction

I never root against companies. However, I’m hoping to buy Old Dominion Freight Line (NASDAQ:ODFL) at a better price, as I wrote in a dividend-focused article published in August. In this article, we’ll discuss two things. First of all, we dive into the transportation sector, which is starting to suffer from imploding rates and high input costs. The “bullwhip” effect is in full effect. Second, we’ll dive into Old Dominion’s just-released third-quarter results, which show the company’s tremendous resilience in this economic environment. The company continues to handle input price inflation masterfully, resulting in an industry-leading operating ratio. Cash generation is strong, and the valuation is starting to get attractive.

I remain very bullish and hope for another move lower, allowing us to add the ODFL ticker to our portfolios – or expand existing positions.

Let’s look at the details!

The Macro Outlook Is Worsening

In almost all of my articles, I combine macro and actionable ideas. In this case, I am starting by discussing trucking fundamentals – after all, that’s what drives Old Dominion’s top and bottom lines. It’s also important as trucking is the backbone of the US economy.

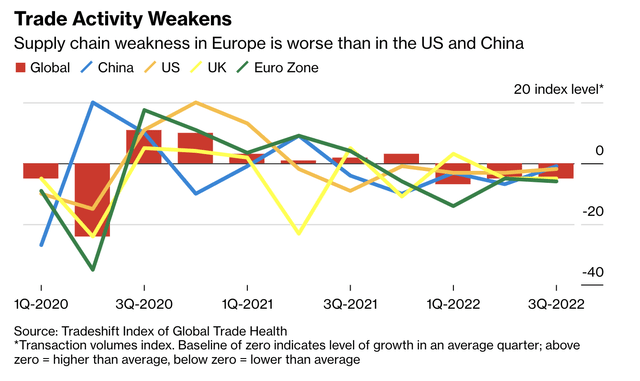

On October 24, I wrote an article focused on the transportation outlook. It basically showed that former tailwinds are now turning into headwinds. Global trade volumes have been in contraction for three consecutive quarters as the graph below shows.

Bloomberg

These developments make sense as economic growth indicators are slowing. The odds are rising that the ISM manufacturing index will fall below 50 in October, which would indicate a contraction. Regional surveys already indicate a decline toward 46, which would make a manufacturing recession a “done deal”.

Wells Fargo

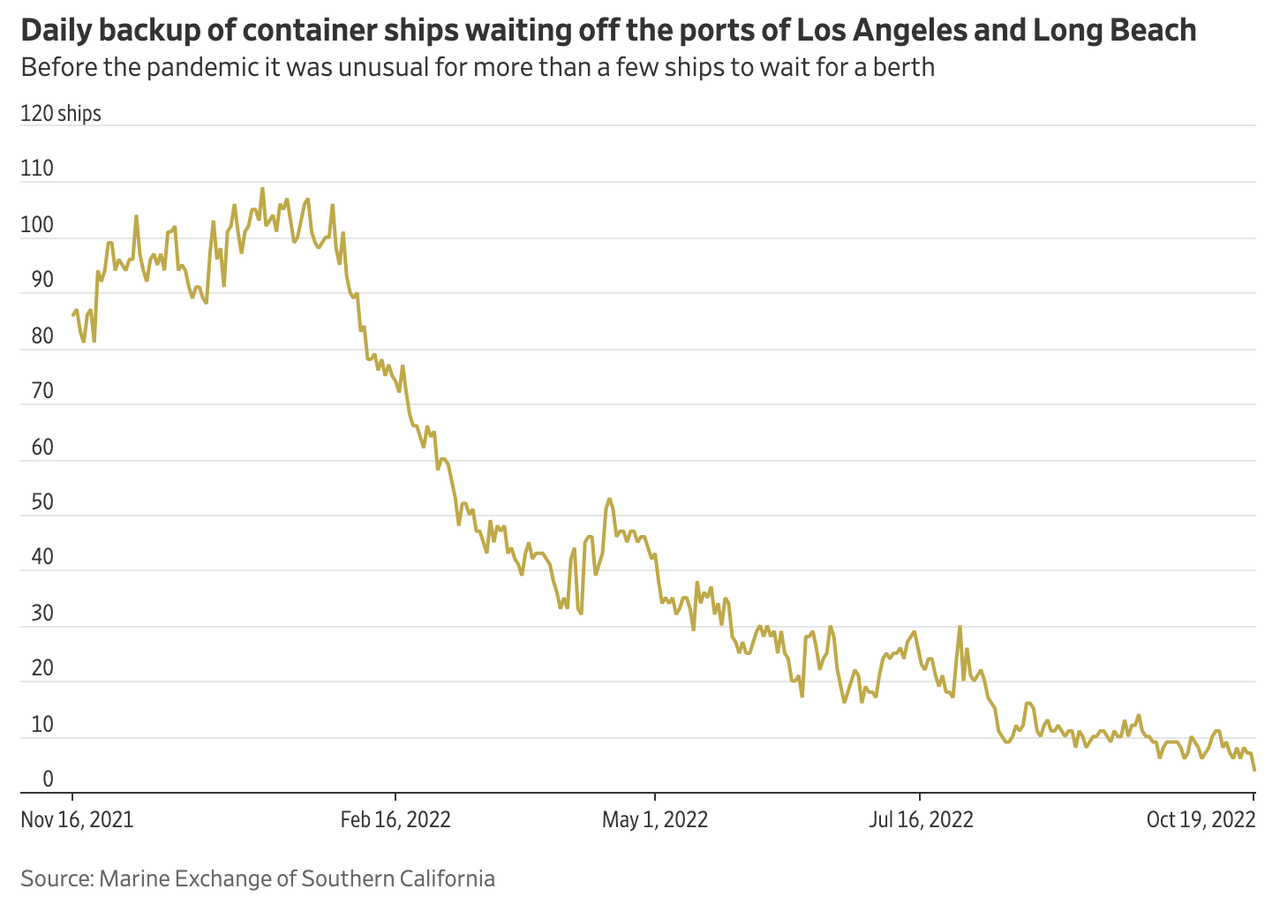

Furthermore, the chart below displays the “rebalancing” of supply and demand as the US’ largest ports in Los Angeles and Long Beach are not experiencing any backup anymore. A year ago, the ports had more than 100 ships waiting, which did a number on supply chains and put trucking companies in a good spot when it comes to pricing.

Wall Street Journal

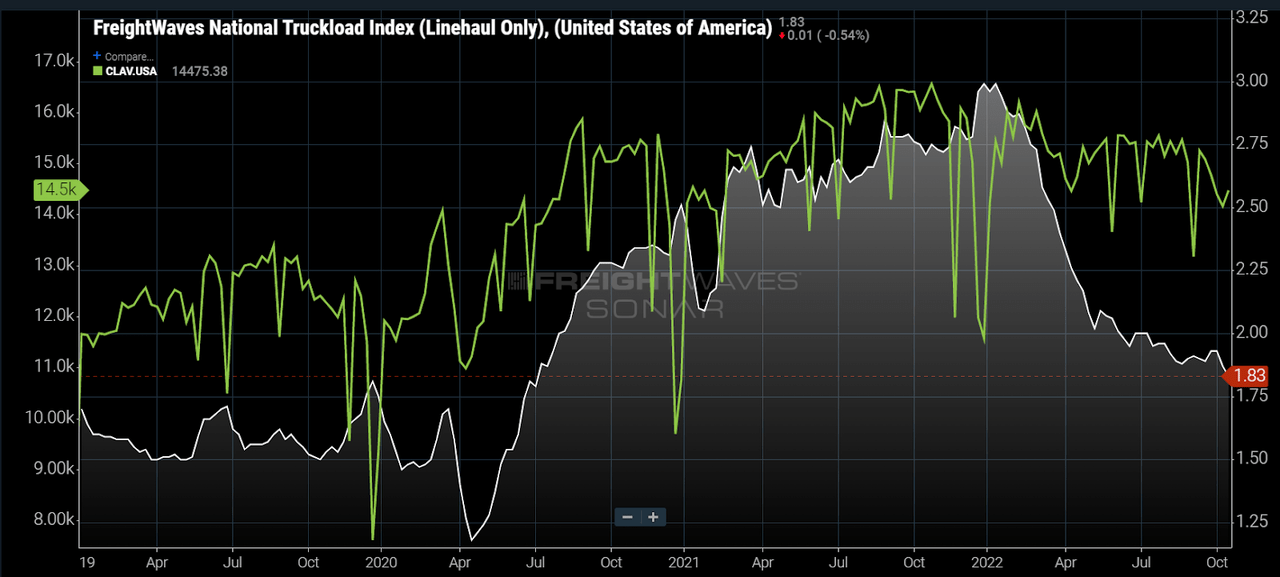

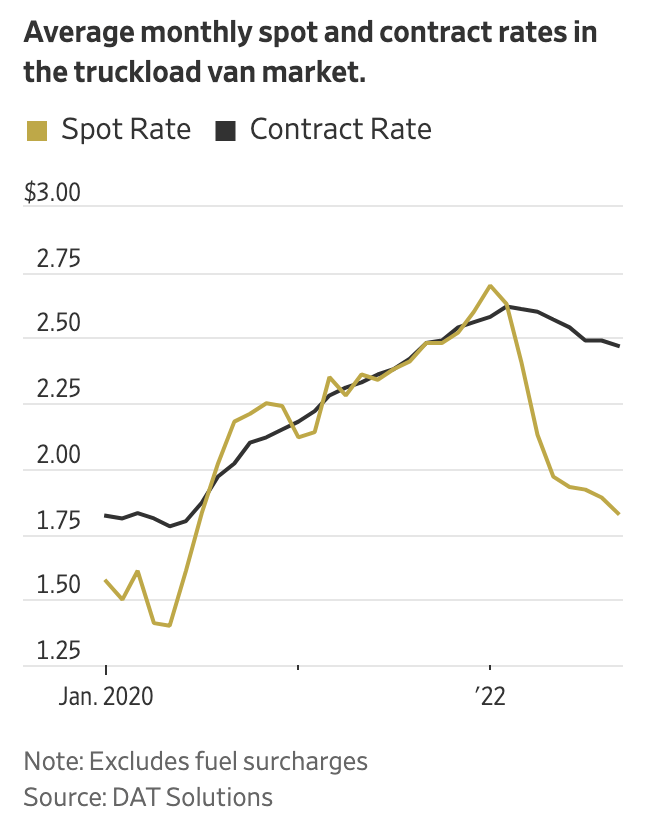

Speaking of pricing, trucking rates are falling. Truckload spot rates, excluding fuel costs, are down 37% from their January 2022 highs.

FreightWaves

Knight-Swift Transportation (KNX) is confirming these developments as it cut its annual profit forecast to $5.17, well below analyst expectations of $5.40.

Businesses are slowing their orders on concern consumer demand won’t hold up, and that means less freight to carry, especially for smaller truckers, the company said late Wednesday as it reported quarterly earnings. That’s leading to a decline in the prices transportation companies can charge, and their operating costs are still soaring, Knight-Swift said.

[…] “These muted trends have continued into October as supply chains appear to be catching up and adjusting for uncertainty in consumer demand,” Chief Executive Officer David Jackson said in a statement. “If these trends continue, we expect truckload supply to rapidly exit the market.”

In light of these developments, the question is how much more downside (risk) we are facing.

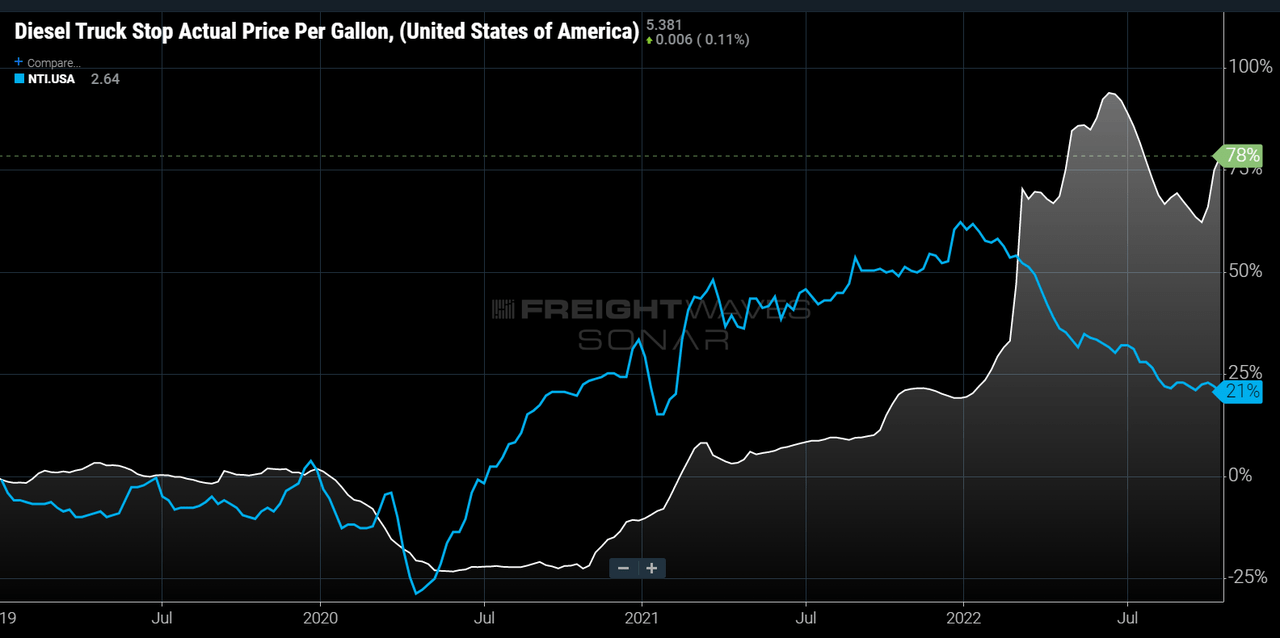

According to FreightWaves, we’re now seeing declining spot rates and rising fuel costs. These divergences are extremely rare as fuel is highly cyclical – in general.

FreightWaves

The divergence is likely based on two things.

- There was a lot of room on carrier operating margins.

- The balance between capacity supply and demand was shifting dramatically from an undersupplied market to an oversupplied one.

Since early May, the average fuel price has fluctuated but is currently about 2% higher than it was at that point. All-inclusive spot rates have fallen another 11%, but at a much slower pace. In October, the price of fuel appears to have a stronger impact on spot rates (including fuel).

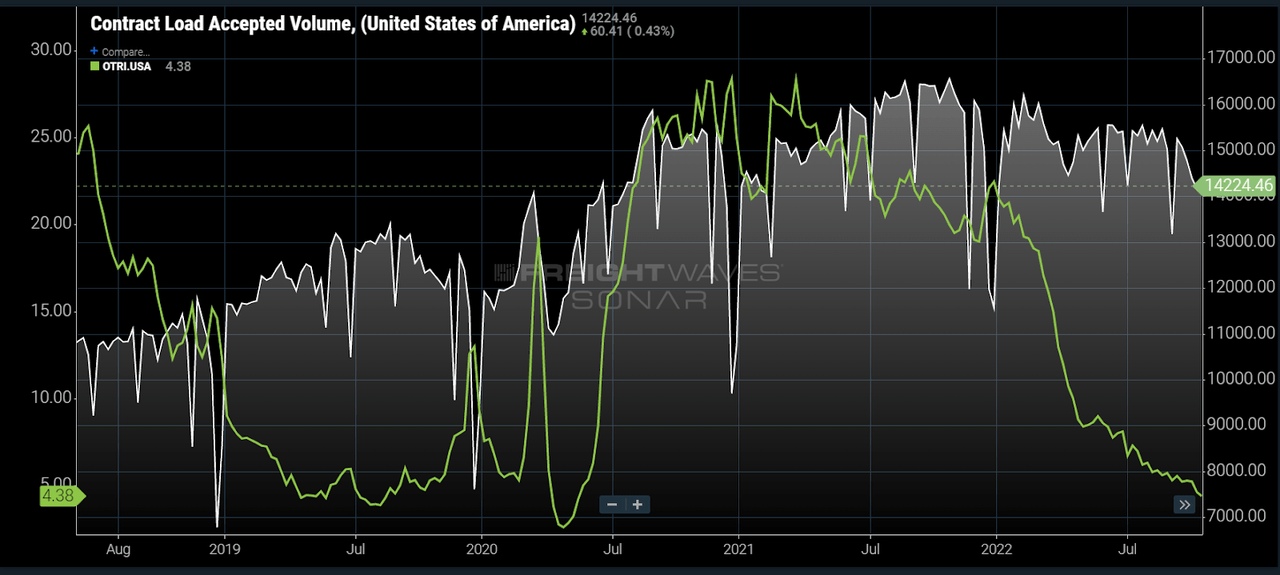

The problem is the demand side. Accepted tender volumes are now 11% lower on a year-on-year basis. Accepted tenders, as displayed in the chart below, are representative of load volumes being moved under contracted rates.

FreightWaves

Essentially, what this means is that carriers accept more loads under contract rates because they have less optionality and network disruption. A decline in contract load accepted volumes suggests that aggregate demand is falling.

The following chart confirms this (apologies for its huge size). While rates, in general, are falling, spot rates are massively underperforming contract rates as excess demand is gone.

Wall Street Journal

Based on this background, all eyes are on the last two months of this year, which is usually peak season for truckers. The peak season for trucking and rail (intermodal) is usually October through December 15.

Ocean container peak season has ended at the end of September, which means that the outlook for trucking companies isn’t much better – after all, they are just one step further down the supply chain.

In light of these developments and extreme weakness in the consumer space due to high inventories and depressed consumer sentiment, trucking companies are now dependent on retailers, which are often in a bad spot given the aforementioned consumer weakness and high inventories.

According to FreightWaves:

In the context of understanding the trucking calendar and sharp decline in container volumes, the slowdown makes sense. Retail has an outsized impact on the fourth quarter trucking market. Even in a good year, construction, agriculture, and beverage volumes slow down in the fourth quarter significantly. Retail becomes king.

Retailers have nearly all of the products they need in their distribution networks for the holidays (and then some), which means that there won’t be a lot of freight demand as we head into the last two months of the year.

In recent quarters, retailers have talked about how much inventory they are carrying. This holiday season, they will be focused on burning that inventory down – potentially through aggressive discounting and promotions.

With all of this being said, let’s dive into Old Dominion Freight Line.

Old Dominion Freight – Defying Weakness?

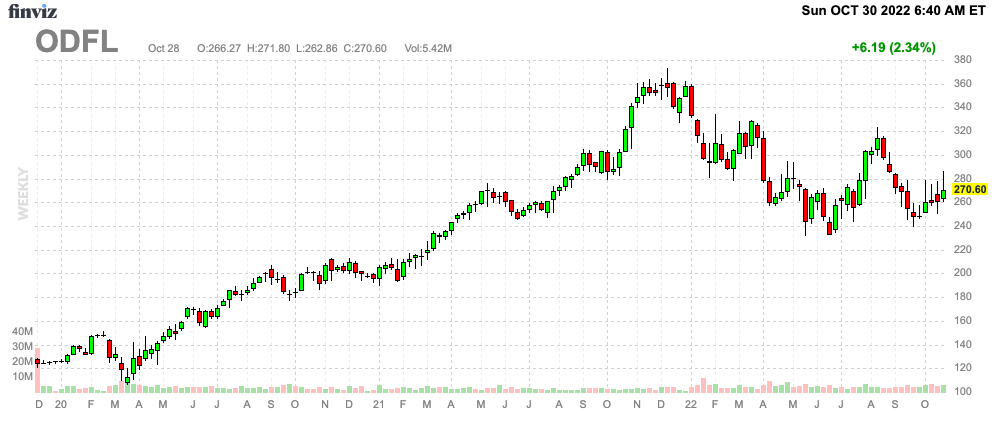

ODFL shares are down roughly 24% since the start of the year. That’s surprisingly strong as it just barely underperforms the S&P 500 – at a time when growth and (related) trucking rates are plummeting. Hence, I have not bought the stock as I really want to buy it between $220 and $240 as I discussed in my dividend-focused article, mentioned in the introduction.

FINVIZ

What makes this less-than-truckload (“LTL”) company so powerful is its ability to thrive in strong economic times, and do relatively well when others are struggling in downturns.

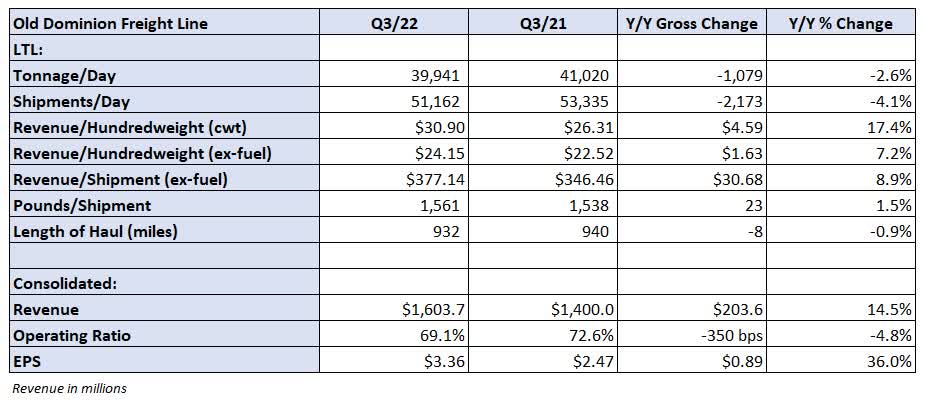

In 3Q22, the company grew its revenue by 14.3% to $1.6 billion, missing estimates by a mere $20 million. This paved the way to $3.36 in GAAP EPS, $0.28 higher than expected.

These numbers include a one-time expense reduction of $15.8 million, or $0.11 per share, tied to the employment transition of the executive chairman.

With that said, looking at the table below, we see a number of things that are interesting – and important – to point out. First of all, the company shipped less tonnage per day. Tonnage per day was down 2.6%. Total shipments per day fell by 4.1%.

FreightWaves

These numbers make sense given the decline in freight demand.

The good news is that the company is operating more efficiently, while it also benefits from higher pricing. Tonnage and shipments per day both exclude pricing. When looking at the revenue per “unit”, the company saw an increase of 17.4%.

Even excluding fuel, revenue per hundredweight is up 7.2%. Total freight per shipment increased by 1.5%, which somewhat helped to ease the pressure from rising costs.

Speaking of rising costs, the operating ratio, one of the most important ratios in the transportation world, declined by 350 basis points from an already low 72.6% in 3Q21. This ratio measures how much it costs as a percentage of total revenues to operate the company. The lower the better. This improvement happened despite an increase of 300 basis points (as a percentage of total sales) in operating supplies and expenses like fuel, and spare parts (maintenance).

An operating ratio below 70% is absolutely impressive. Note that most major Class I railroads are now dealing with operating ratios close to 60%. Trucking is way more labor and material intensive. A lot of ODFL peers are somewhere between 80% and 90% with weaker companies struggling to break even.

Maintaining this kind of profitability allows the company to gain an increasing competitive advantage over its peers.

According to the company:

Investments in our fleet and technologies have helped us improve our operating efficiency and customer service, while the significant investments in our service center network generally support our growth. We have expanded the capacity of our service center network by over 50% in the past 10 years while doubling our market share, and we believe further investments will be necessary to ensure that our network is never a limiting factor to our growth.

The company consistently invests between 10% to 15% of its revenues in CapEx, regardless of the macro environment. This has allowed the company to have available capacity in the past two years, allowing customers to find a reliable place for transportation needs in a very tight market. It helped to grow its customer base and market share.

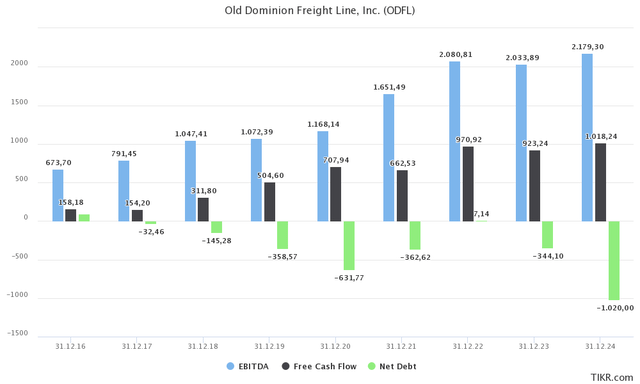

Between 2016 and 2024E, the company is growing EBITDA by 15.8% per year. Free cash flow is growing by 26.2% per year. Not only is this resulting in increased availability of funds for investments in new capabilities, but it is also causing net debt to rapidly fall. It is hard to compete with that.

TIKR

In 3Q22, operating cash flow was roughly $514 million, pushing the YTD result to $1.3 billion. This allowed the company to buy back $345 million worth of shares and distribute $33.4 million in dividends, which also shows where the company’s cash distribution priorities are (buybacks).

Moreover, demand remains good. The company has seen no attrition in the company’s account base. Management also saw normal seasonal trends return in October, for the first time since February.

Needless to say, the company is not seeing a positive growth catalyst, which makes sense given the macro background.

Valuation

The valuation is a bit of an issue and the reason I’m looking for a better entry.

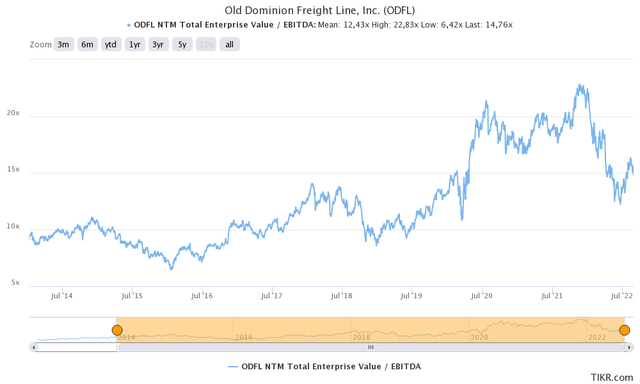

Old Dominion is trading at 14.2x 2023E EBITDA of $2.1 billion. That’s based on its $29.9 billion enterprise value. That value is below its $30.2 billion market cap as I incorporated 2023E net debt of -$300 million (negative net debt).

TIKR

This valuation isn’t extremely elevated, but it’s above levels that I would be comfortable with when making ODFL a part of my long-term portfolio.

Given deteriorating macro fundamentals, I’m looking to buy ODFL between $220-$240, which I believe would provide us with a better risk/reward.

Takeaway

The economy continues to deteriorate. The last quarter is looking to be extremely tough for trucking companies – both truckload and LTL. Spot rates are plummeting as shipping demand has faded. Low consumer sentiment and high inventory levels are a toxic mix for both pricing and overall shipping demand.

I expect this to continue going into 2023.

However, while ODFL is seeing growth fade, it continues to benefit from its ability to deal with input costs and use pricing and higher operating efficiencies to offset some weaknesses in volumes.

The company continues to benefit from high investments in its network, allowing it to service customers when it matters most while offering competitive prices. Now, the company benefits from high customer loyalty, pricing power, and every single benefit that comes with high free cash flow generation.

Unfortunately, due to the macro situation and the company’s valuation, I will remain on the sidelines a bit longer, looking for an entry below $240.

(Dis)agree? Let me know in the comments!