Occidental Stock: Prime Reason Buffett Hasn’t Bought Recently (NYSE:OXY)

imaginima

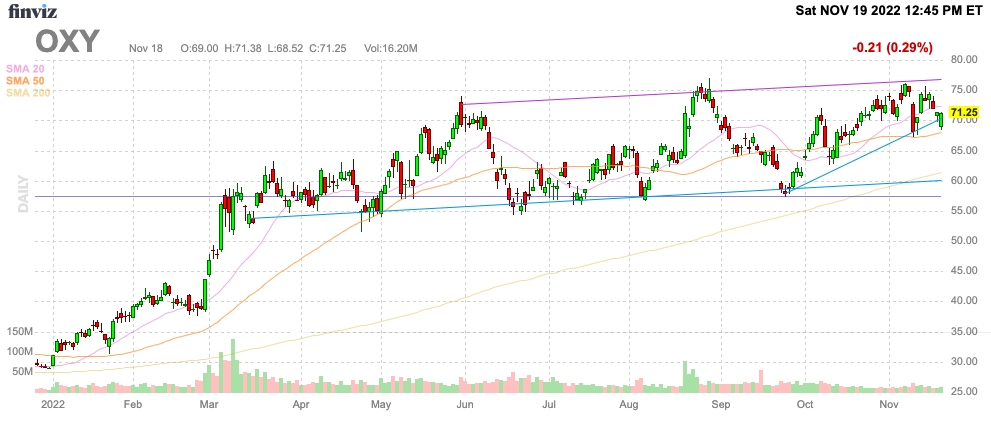

Despite all the news that Warren Buffett wants to acquire Occidental Petroleum (NYSE:OXY), his investment firm hasn’t added more shares since the last purchase at $60 on September 28. Oil fell below $80 for the first time in months in a prime example of why Buffett isn’t willing to chase Oxy higher. My investment thesis remain Bearish on the oil stock until the price falls back below $60.

Source: FinViz

Collapsing WTI Prices

Only last month, OPEC+ cut oil production targets by 2 m/bpd and the market expected oil prices to surge back above $100. Instead, WTI closed the week at $80 as China has been slow to reopen and central banks continue hiking interest rates to reduce economic growth.

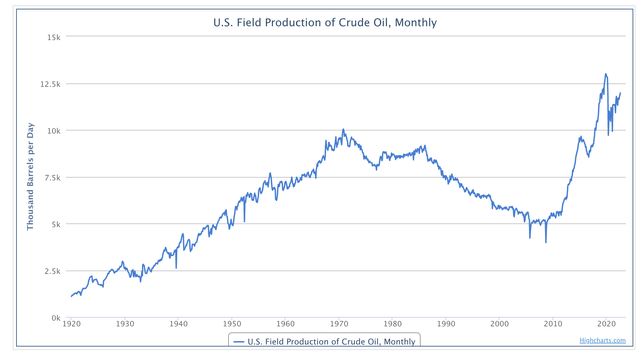

The end result is the typical cyclical weakness of an energy market where supplies are plentiful and dependent on constantly changing market dynamics. Investors bullish on energy stocks due to industry under investment and OPEC+ cutting back production need to realize on the flip side that domestic production is approaching record levels and the Republicans back in charge of Congress are likely to reverse some of the restrictions preventing record production.

For August, US oil production hit 12.0 m/bpd compared to the record high of 13.0 m/bpd back in November 2019. Investors need to crucially understand how oil is dipping below $80 due in part to the US already close to record production. In fact, US domestic production was only higher in a brief period in 2019 and early 2020.

The US is near record production levels despite an unfriendly White House causing oil production firms to not invest aggressively for growth. A government focused on US energy independence could quickly push production higher solving a lot of the price issues of the last year.

Back Down To Normal Earnings

A prime reason Buffett isn’t loading up on Oxy are the impact to financials of these lower energy prices. In Q3’22, the energy company reported the EPS dipped to $2.44, slightly missing analyst estimates despite a large revenue beat of $450 million.

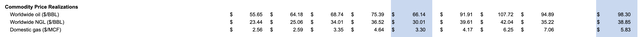

Oxy had the following realized energy prices during the quarter:

- WTI – $91.55 per barrel

- Brent – $97.59 per barrel

- Domestic Nat Gas – $7.06 per Mcf

Any investor can quickly see how WTI prices falling below $80/bbl in mid-November is problematic for Oxy. In addition, domestic nat gas prices have fallen to a still very elevated price of $6/mcf.

The energy sector isn’t going to see a scenario where higher energy prices are the likely outcome in a future where the war in Ukraine no longer exists. Russia is likely to enter a period of maximum energy production to rebuild the Russian army or pay Ukraine to rebuild the country after the destruction caused by their invasion.

Oxy earned $3.47 per share back in Q2 and these excess profits are set to disappear fast. The independent energy company only earned $2.55 per share back in 2021 when nat gas prices were regularly below $3 per Mcf due to huge supplies in the US.

The following table lists the realized quarterly prices from Q1’21 through Q3’22 with the yearly totals highlighted in blue.

Source: Occidental Q3’22 earnings release

Very notable though, the 2021 EPS was only obtained via excessive energy prices in Q4 of last year. The profits quickly disappear when oil dips below $75/bbl and domestic nat. gas falls below $4/mcf.

The news the direct air capture project in Ector County, Texas will cost ~$200 million more at $1.1 billion appeared to alarm the market. The concerning part is Oxy has plans to build up to 100 stations by 2035. The company just added $20 billion to the capex budget over the next 10+ years to complete these DAC projects.

The DAC project has immense plans for capturing carbon to help governments achieve climate goals, but the business of pulling CO2 out of the air will be a drain on profits in the short term. The project isn’t scheduled to begin operations until 2024.

Takeaway

The key investor takeaway is that Buffett isn’t willing to pay anywhere above $60 for Oxy due to the normal path to lower energy prices regardless of market expectations otherwise. Investors should’ve used the recent price above $75 to unload shares to roll back into the stock in the $50s where the valuation is much more attractive. Even at those levels, investors have to know the ultimate risk is energy prices falling back to the 2021 levels where the stock price only traded in the $20s.