Nutanix Stock: Looks More Appealing After Price Reset (NASDAQ:NTNX)

Sundry Photography/iStock Editorial via Getty Images

After several months of pain, a rebound fervor seems to be settling in. The best way for investors to position for a rebound, in my view, is to load up on beaten-down growth stocks that have seen their share prices deteriorate far faster than their accompanying fundamentals. Small- and mid-cap stocks reign king here, as they are the most sensitive to a sharp upside swing.

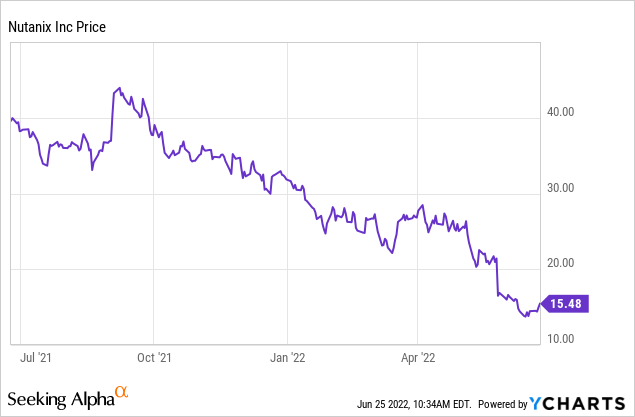

In particular, I think Nutanix (NASDAQ:NTNX) is worth a close second look. This software infrastructure provider, whose technology helps data centers run more smoothly and efficiently, has seen its share price collapse by ~50% year to date. Losses accelerated after Nutanix posted fiscal Q3 results in late May, where a guidance shortfall spooked the markets and set off a selling panic. In spite of this, I think the bottom has been reached and that this price reset represents a great buying opportunity in Nutanix.

What’s driving this low?

Let’s start with the elephant in the room: why is Nutanix trading so close to multi-year lows?

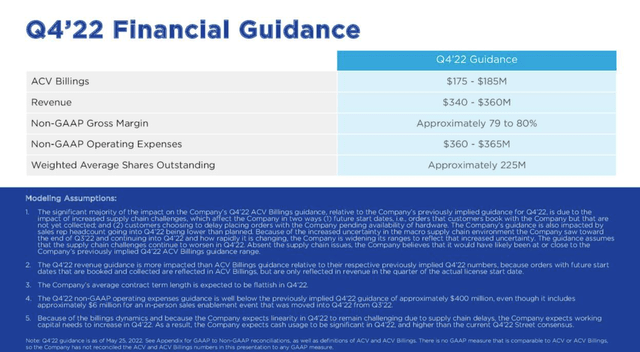

In its Q3 earnings release, Nutanix issued the following guidance for Q4:

Nutanix Q4 outlook (Nutanix Q3 earnings deck)

The $340-$360 million that the company is guiding to for the fourth quarter, representing a -13% y/y to a -7% y/y decline, is far worse than the $407.7 million (+4% y/y) in revenue that Wall Street had hoped for.

The company cited two reasons for the shortfall: one, supply chain challenges, and two, sales attrition that led to lower sales headcount at the beginning of Q4. Per CEO Rajiv Ramaswamy’s prepared remarks on the Q4 earnings call:

That said, the quarter didn’t finish as we had expected. Late in the third quarter, when we typically book a significant portion of our orders, we saw an unexpected impact from challenges that limited our upside in the quarter and affected our outlook for the fourth quarter. Increased hardware supply chain delays resulted in an increasing percentage of our orders having start dates in future quarters, or in some cases being delayed, pending availability of hardware. This affected both our billings and revenue upside in Q3, and we expect this trend to continue in Q4.

In addition, after seeing our attrition rate among sales improve for each of the prior two quarters, we saw it worsen in Q3, driving a lower than expected rep headcount entering Q4.”

Let’s take each of these problems in turn. On supply chain challenges, Nutanix is no longer a hardware vendor. However, the company noted that many of its customers prefer to time their purchase of Nutanix software alongside the server hardware that will run Nutanix. Because of third parties’ supply chain challenges, the company noted that many customers have paused their purchases until server availability.

Is this a risk for Nutanix? Yes, certainly. But it’s not an isolated problem: almost every company that produces physical products across all industries is citing supply chain challenges. The fact that Nutanix is baking in an impact for these challenges into its guidance should not merit an especially harsh punishment.

And on the second piece on sales attrition: again, job transitioning is very common across industries right now. The company has a new CRO in place and has made sales hiring a top priority. While it will take time to ramp new sales reps to full productivity, I think the cheapness of Nutanix stock is sufficient compensation for the added risk.

Valuation check

At current share prices near $15, Nutanix trades at a market cap of just $3.47 billion. After we net off the $1.30 billion of cash and $1.29 billion of debt on the company’s most recent balance sheet, Nutanix’s resulting enterprise value is $3.46 billion.

For FY23 (the fiscal year for Nutanix ending in June 2023), Wall Street analysts have a consensus revenue target of $1.68 billion, representing 9% y/y growth. This puts Nutanix’s valuation at just 2.1x EV/FY23 revenue – a bargain for a company that to me, is just facing temporary hiccups and has a path to sustained growth and operating margin expansion in the year ahead.

And as a reminder for investors who are newer to this name, here are all the long-term reasons to be bullish on Nutanix:

- Enabling the hybrid cloud: Not all workloads can be moved to the cloud. These days, IT and computing are all about the cloud. But while the market is chasing after all the hot cloud stocks, the reality is that most companies – especially those in complex or highly regulated industries, or those that simply want more direct control over their data – will never entirely move their systems into the cloud. Nutanix is a champion of the “hybrid cloud” strategy, in which some of a business’s assets are in the cloud and others are in on-prem environments. For the on-prem assets, Nutanix’s hyper-converged technology ensures that customers get the same performance and agility benefits that users receive in the cloud. Most companies today employ some sort of hybrid cloud strategy – meaning Nutanix products are widely applicable to all IT departments.

- Thought leader in hyper-converged infrastructure. VMware has been chasing Nutanix’s tail ever since the company gained prominence. For multiple years in a row, the company has been recognized as the category leader by Gartner, the software industry’s leading analyst and reviewer.

- Software-first. Earlier on in Nutanix’s lifespan, the company sold server devices as its primary business, with its proprietary software overlaid as a “package solution.” Now, Nutanix sells only software. This has dramatically raised its margin profile while also making it more palatable for companies who only want to consume software to run on their own hardware.

- Executing on its new sales strategy. At the beginning of Nutanix’s fiscal 2021, the company made the earth-shaking decision to incentivize its sales staff based on ACV and not TCV. In the past, Nutanix’s account executives sold longer-term contracts and incentivized customers with bigger discounts because they were paid based on the value of the total deal. What’s important for Nutanix and for investors, however, is how much Nutanix can rake in annually and for each customer’s lifetime. So Nutanix shifted its sales compensation in line with this priority and began paying its sales teams based on ACV – and this has yielded very strong results.

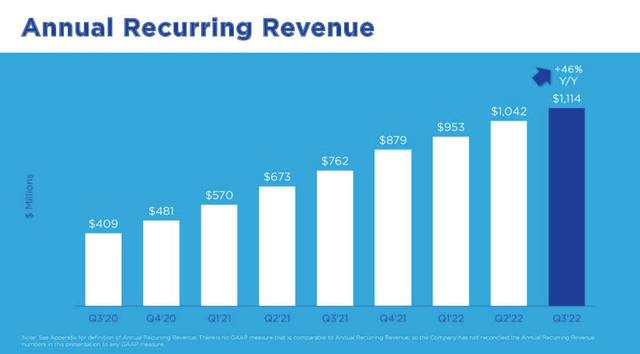

ARR growth

One last comment I’ll make here: in spite of recent bearish noise on Nutanix, the company has been very successful at driving its recurring-revenue business forward. As of the end of Q3, Nutanix’s ARR hit $1.1 billion, up 46% y/y.

Nutanix ARR growth (Nutanix Q3 earnings deck)

Management notes as well that Nutanix has been successful in getting go-to-market contributions from channel partners like Red Hat. Increased sales activity from partners will help Nutanix “plug holes” as it continues to build up its own internal sales force.

Key takeaways

I won’t argue that Nutanix has a lot of added risk after the information it doled out in Q3. It may take several quarters for supply-chain issues to dissipate and for sales headcount to get back to levels that can support Nutanix’s growth trajectory. At the same time, however, investors can’t ignore the company’s bargain-basement 2x forward revenue multiple as well as its fantastic, market-leading product that leads the hyperconverged infrastructure category. Stay long here and buy the dip.