Nike Stock: Huge Earnings Beat (NYSE:NKE)

Robert Way

Article Thesis

NIKE (NYSE:NKE) reported its fiscal second quarter earnings results on Tuesday evening. The company beat estimates easily, showcasing a compelling growth rate versus the previous year’s quarter, which surprised many analysts and investors. The headwinds that the company is experiencing aren’t as impactful as previously feared, which is great news for investors. Yet, shares are far from cheap at current prices, which is why investors shouldn’t become too greedy, I believe.

What Happened?

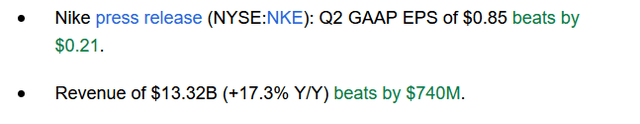

Nike’s results for its Q2 in fiscal 2023 beat estimates easily, on both lines:

Seeking Alpha

The company’s top line number came in at $13.3 billion, up by a hefty 17% year over year. That easily outpaced inflation, which is not a given for a consumer goods company such as Nike. Revenues also came in 6% higher than expected, which is a significant beat.

On the bottom line, Nike beat estimates even more widely, as earnings per share came in 33% ahead of expectations. Of course, beating profit estimates this widely is easier than beating revenue estimates this widely, as margins are harder to forecast for the analyst community. Still, the profit beat was a major feat, although investors should remember that analysts were predicting a considerable earnings per share decline versus the previous year’s period. Despite the hefty beat, earnings per share were thus up by only 2% compared to the second quarter of fiscal 2022 — which isn’t too great, especially when we consider Nike’s premium valuation and its strong top-line growth rate.

Nike’s Results: The Good Things And The Bad Things

Beating estimates easily is good, of course, all else equal. That being said, not everything in Nike’s report was good. Margins took a major hit compared to the previous year’s period, for example. Nike reported a gross profit margin of 42.9% for the quarter, which isn’t bad, but which was down 300 base points compared to the previous year’s period. Margin compression has been a theme in some of Nike’s recent earnings reports, and some other consumer discretionary companies have experienced the same thing. This pressure on margins can be explained by several factors. First, inflation and rising energy expenses make the production of the goods that Nike is selling more costly. These higher input costs can’t be passed on to consumers completely, which pressures margins. Second, Nike has, like some other retailers, seen its inventory levels increase in the recent past. In order to prevent the items that Nike holds from becoming stale, the company had to increase markdowns in order to liquidate the surplus inventory. While these markdowns can be good for sales, as they may attract additional buyers, markdowns naturally are bad for margins, as Nike generates a lower gross profit per unit that it sells.

While Nike thus had a great quarter when it comes to revenue generation, profitability wasn’t very strong, although still a lot better than many investors and analysts feared.

Looking at Nike’s inventory levels at the end of the period, we see that inventories are up by more than 40% versus one year earlier. That’s a quite large inventory increase that might indicate further markdowns in the current quarter, as Nike’s inventory levels stood at $9.3 billion at the end of the period. That’s also up close to $1 billion from one quarter earlier, thus inventories did grow on a sequential basis as well. Nike’s Q2 ended on November 30, thus the Black Friday event had already passed, and yet inventories were up on a sequential basis. End-of-year holiday shopping could allow Nike to move more merchandise than during previous quarters in the current quarter, fiscal Q3, but the inventory increase is nevertheless an item investors should keep an eye on.

Due to the gross margin hit, Nike’s gross profit was up only 10%. Operating expenses rose by a similar amount, due to factors such as increased advertising spending. The FIFA world cup likely played a role in that increased advertising spending (and it also had a positive impact on revenue generation).

Once taxes and interest expenses are accounted for, Nike’s net income was unchanged from the previous year’s period. Earnings per share were up 2% only thanks to the impact of a lower share count, which was caused by Nike’s share repurchases over the last year.

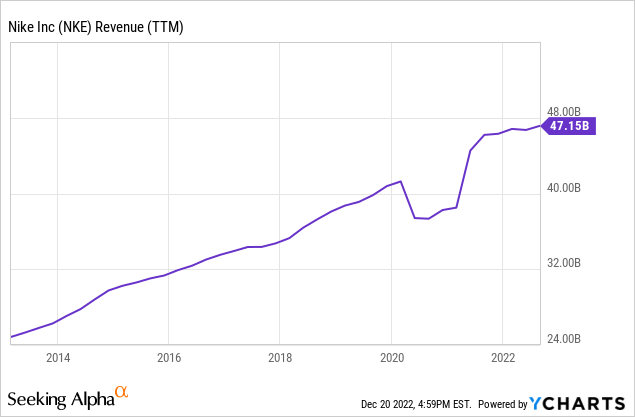

Nike is seen as a growth stock by many, and when we look at its revenue performance, that absolutely makes sense:

Over the last decade, revenue almost doubled, which is a strong result for an established and large consumer goods company such as Nike. Unfortunately, profit growth has been more uneven, and recently it has been far from encouraging. The good news is that Nike might see stronger profit growth in the coming years. If Nike were to grow its revenue meaningfully in the coming years as well, and if Nike manages to get its gross margin up to previous levels over time, then profits would grow meaningfully. If Nike had been able to keep its gross margin in the previous year’s period, its net income would have grown by 24% year over year, and its earnings per share would have grown by 26%. After all, operating expenses rose at a slower pace compared to revenues, which results in tailwinds from operating leverage, all else equal. Unfortunately, this was offset by gross margin compression in Nike’s Q2, but if Nike manages to stop said gross margin compression, operating leverage starts to work in its favor, and net profit and earnings per share could climb meaningfully. Whether Nike manages to grow its gross margins in the near term is uncertain, however. It’s possible that gross margins remain at a sub-par level for the foreseeable future, as inventory levels remain high.

Nike’s Valuation Is A Little High

Nike’s results were a lot better than feared, but that does not automatically make shares a buy. Analysts are currently predicting that Nike will earn $2.98 this year. When we add the profit beat for Q2, $0.21, we get to $3.29 in EPS in fiscal 2023. Rounding that up to $3.30 gets us to earnings multiple of 31.2 at current prices. When we calculate with the current after-hours share price of $111, the earnings multiple is even higher, at 33.6.

While one can definitely argue that this is warranted for a company growing its revenue at a high-teens range, others might say that earnings multiple north of 30 is far too high for a company that is growing its earnings per share at a low-single-digit rate.

Even when we look beyond the current fiscal year, to Fiscal 2024, which ends in May 2024, or around one and a half years from now, the earnings multiple is still far from low, at 27.2, based on a current consensus EPS estimate of $3.80.

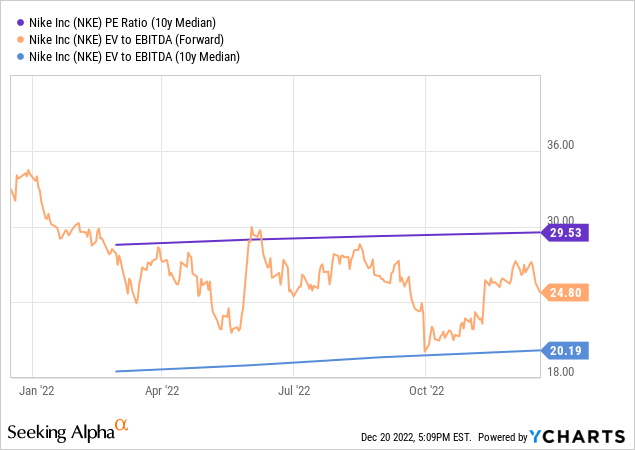

Looking at Nike’s historical valuation, shares look moderately overvalued today:

The 10-year median earnings multiple is 29.5, thus shares trade at a 6% premium right now (not accounting for the after-hours share price increase). Looking at the enterprise value to EBITDA multiple, Nike is 23% overvalued right now, relative to the 10-year norm. Averaging the two metrics gets us to a ~15% overvaluation — that’s not dramatic, but it indicates that Nike is not a great value today. When we account for the fact that interest rates are way higher than they used to be over the last decade, which should result in lower equity valuations, all else equal, the current valuation does not seem attractive. A recession in calendar year 2023 could also pressure Nike and its results, as consumers might cut back on spending cash on high-priced, non-necessary consumer goods. Due to an above-average valuation and some near-term uncertainties, I thus believe that Nike is not an attractive investment at current prices.

Takeaway

Nike has reported earnings results that were way better than feared. Still, earnings per share were up only slightly, as the analyst community had expected a big earnings drop.

Margin headwinds are an issue, and since inventory levels remain high, it’s unclear whether that headwind will cease in the near term. A possible recession in 2023 could also become an issue for Nike.

Since shares are trading at a moderate premium relative to the historical valuation norm, I do not deem Nike especially attractive at current prices, despite the surprisingly large earnings beat.