NewtekOne Stock: Margin Of Safety Likely Present – Valuation Model

golfcphoto/iStock via Getty Images

I will assume that you are familiar with my four previously published articles in order to thoroughly understand this valuation:

My Valuation Method

I will take a sum-of-the-parts approach to Newtek Bank and NewtekOne’s (NASDAQ:NEWT) subsidiaries in a discounted cash flow analysis. The first part is the subsidiaries – this is shorter since it only relies on selected data from past 10-K filings. The second and much more extensive part is Newtek Bank, for which I will outline the parameters, calculations, and present some initial valuation estimates.

There are four parts of NewtekOne that I will disregard for the purposes of doing this valuation:

- Current assets and liabilities. This is a back-of-the-envelope model of NewtekOne for the purposes of a discounted cash flow analysis. I am interested in doing a DCF that continues out in the very long run, where the present amount of current assets minus current liabilities (working capital) has little bearing on the long run valuation.

- The securitization trusts and associated notes. These have smaller net interest margins – NIM – than the banking operation, and existing securitizations are currently warehoused to be run down according to their lifespans.

- The interest rates on notes outstanding – both baby bonds and notes against securitization trusts – that differ somewhat from the interest rates on Newtek Bank’s checking and savings accounts. NewtekOne is just beginning to enjoy some explosive growth, and assuming that this growth continues, the future value of the interest margin on the legacy businesses is miniscule compared to the future value of the bank.

- The outstanding securitization trusts. Again, NewtekOne is just beginning to enjoy some explosive growth, and assuming that this growth continues, the future value of the interest margin on securitization trusts is miniscule compared to the future value of the bank.

The bulk of the value at NewtekOne will be the bank and the payment processing / technology solutions subsidiaries.

NewtekOne Payment Processing & Technology Solutions Subsidiaries: Operating Income & Present Value

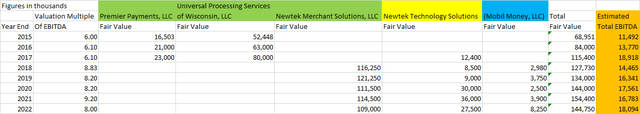

NewtekOne has many subsidiaries, the most significant of which are Newtek Merchant Solutions, Newtek Technology Solutions, and Mobil Money. Note that the former subsidiaries Premier Payments and Universal Processing Services of Wisconsin were merged into Newtek Merchant Solutions in 2018. While Mobil Money is small, it is starting to gain traction, which is why I included it here.

While Newtek operated as a BDC, its wholly owned subsidiaries were reported as controlled investments, and their fair value was calculated at a multiple of EBITDA. This multiple was reported along with the fair values in past 10-K filings, so it was possible to back-calculate an estimate the EBITDA of the combined subsidiaries.

NewtekOne Subsidiaries Valuation (Past 10-K Filings, Controlled Investments)

Taken as a whole, these three subsidiaries have operated at roughly a steady state over the past 5 years. Assuming that these subsidiaries continue to operate at the same steady state, I would estimate that they would contribute a combined $18M/year of EBITDA going forwards.

Taking a factor of 0.8 to correct EBITDA into Operating Income for businesses that are capital light and suffer little in the way of depreciation and amortization, and applying a corporate tax rate of 21%, we arrive at their contribution to future profits:

- $18M/year * 0.8 * 0.79 = $11.376M/year of after tax profit

Discounting this stream of cash flows at 10%/year to the present, we can arrive at an after tax present value of at least ~$114M for Newtek’s payment processing and technology solutions subsidiaries. Given the 24M shares outstanding, this works out to ~$4.75/share of value.

Newtek Bank Model & Valuation

For the purposes of this valuation, I will assume that NewtekOne is not constrained in its ability to grow its bank by the rate of gathering new deposits. Here’s why.

The partnership with Apiture gives NewtekOne the digital and autonomous customer-facing abilities of a large bank. Potential customers are able to open accounts digitally – both online and on mobile devices. What the Apiture partnership does is give Newtek Bank access to technology that only larger banks could afford to develop in-house. This means that NewtekOne can compete on an equal footing in the same marketplaces for personal and business accounts as the larger banks.

The NewTracker app technology feeds NewtekOne a constant stream of loan application and customer prospects. The referral partner company employees download the NewTracker app on their phones, and use it to track the progress of prospects through the customer acquisition process. Put together, NewTracker and Apiture represent a digital vertical integration of the banking process, automating both the process of gathering loan applications and gathering deposits.

Indeed, recently I myself tried to open a savings account at NewtekOne but had my application cancelled. When I called in to inquire for the reason, it turned out that NewtekOne is inundated with so many new account applications that they put new account applications on hiatus so they could process the backlog of new applications. This really does show that checking and savings accounts are commodities that compete by and large on a single number: the interest rate offered.

Before we go into my model, I need to explain why I believe that a formal discounted cash flow model is necessary. NewtekOne has several factors that distinguish it from the run of the mill small bank:

- Net interest margin. Newtek’s net interest margin is north of 600 basis points, which is much larger than the 200-250 bps of a typical bank. I believe this nearly automatically means that instead of attempting to value a bank at a 1-1.5x multiple to tangible book value, we instead must assign a 2.5x – 3x multiple to NewtekOne’s tangible book value instead to account for the much wider NIM.

- Deposit gathering capabilities. As a result of NewtekOne’s much higher interest rate on loans and its Apiture partnership, it is much more capable of attracting deposits. Therefore, NewtekOne is far less constrained than typical banks by its ability to gather deposits, and so I reject the typical multiple to tangible book value approach as it may implicitly contain assumptions about deposit gathering that do not apply.

- Loan issuing abilities. As a result of NewtekOne’s Newtracker technology and numerous alliance partners, it gathers over 1,000 loan referrals each day. Fewer than 1 in 20 loan referrals actually result in a loan. NewtekOne has no shortage of loan issuance opportunities, and so I reject the typical multiple to tangible book value approach as it may implicitly contain assumptions about loan issuance opportunities that do not apply to NewtekOne.

You can download the spreadsheet directly from my Dropbox with this link. Without further ado, let’s begin with the parameters and assumed values of my model (there are fifteen):

Known Parameters

- Unguaranteed Fraction: the average fraction of an SBA loan that is unguaranteed. This is typically 25% and I believe this number is set by the SBA itself.

- Guaranteed Portion, Gain On Sale: the typical premium that the guaranteed portion of an SBA loan commands on the market relative to its principal amount. This is typically 10%, and can occasionally fluctuate from 9 – 13% depending on interest rate conditions. I take the time-averaged figure of around 10%.

- Initial quantity of deposits (millions): the latest figure for the amount of deposits present at Newtek Bank is $310 million, as of April 28, 2023.

- Corporate Tax Rate: 21%, or if written as a fraction, 0.21. This is written into the law.

Estimated Parameters

- Initial Loans Issued: This is the current state of NewtekOne and is the initial year condition for the model. The CEO Barry Sloane can be quoted on this transcript from Q4 2022 forecasting that $885M of loans will be issued in 2023.

- Fraction of Loans Charged Off Annually: NewtekOne was one of the better BDCs in terms of credit losses. The typical loan loss rate for BDCs with better and usual underwriting is about 0.5%/year. So, I will take this fraction to be 0.005, based on how I categorized NewtekOne in the past. Note that this number can be highly variable from year to year, and so this should be taken to be an expected geometric average over a period of years.

- Net Interest Margin: As of the writing of this article, Newtek issues SBA loans at a 11.25% rate of interest. Newtek offers personal savings accounts yielding 5.00% (one of the best on the market), business savings at 3.50%, and business checking at 1.00%. Since we can presume that the vast majority of Newtek’s deposits are for the personal savings accounts, I would estimate that Newtek’s mixed cost of deposits is about 4.50%. Hence, for this model, I will use 11.25% – 4.50% = 6.75% for Newtek’s Net Interest Margin. This number can be clarified by reading future 10-K filings.

- Accrual Status Fraction: The fraction of loans that are in accrual status is a key number that determines the net interest income that may be derived from the net interest margin. The Q1 2023 conference call transcript and presentation (slide 15 here) may be cited to provide an approximate figure of 93% of loans in accrual state, which is the best I have and what I will use for my model. However, this is a one-time snapshot, and may not be representative of the average figure over a full business cycle.

- Efficiency Ratio: From the net interest income, salaries and benefits, as well as other non-interest costs are paid. The efficiency ratio is non-interest costs divided by total revenues. The Q1 2023 conference call transcript and presentation (slide 34 here) forecast a 50.4% efficiency ratio for Newtek Bank, which is the best data point available. Again, this does not reflect a whole business cycle, so this is just an estimate.

Conservatively Guessed Parameters

These are numbers that are my estimates based on my best judgment. They are material to the valuation, and so I will make effort in the future to ascertain these numbers more accurately and precisely.

- Fraction of Principal Paid Down Annually: as loans amortize, their principal gets paid down. This is directly linked to their time amortization period. SBA loans range from 5 to 25 years. Since the portfolio is composed of loans of a mixture of ages and amortization periods, the amount of principal paid down by all the debtors across the loan portfolio can be taken to be approximately a constant each year. I take the midpoint of 15 years for average loan amortization period, and set this parameter to 1/15, or 0.0667.

- Loan Issuance Growth Rate: NewtekOne has been a growing firm over the time it has been a BDC. From the various presentations I have read, I surmise that NewtekOne’s annual loan issuance growth rate is about 10%. In order to build in a margin of safety though, I will build in 5% into my model. This will need to be observed quarter by quarter, one year at a time, or possibly as dictated by the rate at which deposits are gathered.

- Years Until Market Saturation: NewtekOne is a rapidly growing business, and has rapidly earned more and more of the SBA loan market share. Since in business, exponential growth can’t go on forever, at some point NewtekOne will saturate the market and stop getting more of the pie. This means that the amount of time for which Newtek needs to retain earnings to help fund new loans is finite, after which Newtek does not need to continue aggressively retaining earnings. As a conservative guess, I will set this number equal to 10 years.

Parameters Decided By Management / Assumed By The Investor

- Fraction of Earnings Retained For Growth: NewtekOne is currently a very small bank, and 5-10% of the funds for the value of loans made come from company equity. This means that it is necessary for NewtekOne to aggressively retain earnings to maximize the growth rate of the business. Based on the results of Q1 2023, where net income was 46 cents/share with an accompanying 18 cents/share of dividend, I make an initial estimate that 60% of earnings are being retained for growth. However, strong deposit growth may mean that even more aggressive retaining of earnings is appropriate. We will have to just wait and see what the business outcomes are.

- Guaranteed Portion, Fraction Retained On Balance Sheet: The latest quotation I can cite from Mr. Sloane (from this transcript, see the end) is that the unguaranteed portions are retained while the guaranteed portions are sold, so for my initial valuation I will use zero for this value. However, this parameter that is within management control is incredibly consequential to the final valuation, as I will show an example of later. Note that this parameter and the previous parameter are NOT independent – in the long run, as a purely business observation, the more guaranteed portions that are retained on the balance sheet, the faster the bank grows, and the larger the fraction of earnings needed to be retained for growth.

- Discount Rate: I generally use 10%/year as my discount rate for valuations, as it is equal to the long term return of the US stock market – the implicit assumption is that we are choosing between investing in NewtekOne if its valuation is above market price, or investing in a market cap weighted overall market index fund otherwise, like SPY.

Now that we’ve introduced all the parameters, I’ll briefly describe how my spreadsheet calculation works, from left to right. In a given year, new loans are issued. Some portion of the guaranteed loan portions are immediately sold to realize their market premium. The rest of the loans are retained on the balance sheet. All loan assets have matching deposits, and the net interest income and loan chargeoffs for the year are computed. Subtract the loan chargeoffs from the (before chargeoff) loan balance to get the year end loan balance, and compute the after tax distributable cash flow. Some of this is retained for growth, the rest is paid out as dividend. The series of dividends are discounted back to the present and summed to arrive at a final valuation.

For as long as the market has not been saturated, this growth funded by earnings retainment continues. Once the market has been saturated, earnings are no longer retained, and all distributable cash are paid out as dividends.

The formulas are in the spreadsheet to examine, if you wish to.

Plugging all of the above parameter values into the model, I arrive at a valuation of Newtek Bank of $554.98M. Summing this with the $114M value of the subsidiary payment processing and technology companies, I arrive at a valuation of NEWT equal to $668.98M.

This is roughly equal to NewtekOne’s market cap while it was still a BDC with a ~10% dividend yield. For perspective, at a share count of 24.5M, it works out to about $27/share. Current prices are about $12/share. At this point, I can say this:

Subject to verification of parameters that are still unclear, it is likely that at current market prices, shares of NewtekOne possess a very significant margin of safety.

Sensitivity Analysis Of Parameters On The Valuation

I will discuss a few parameters which I deem the most important or consequential to valuation.

Guaranteed Loan Portion, Fraction Retained On Balance Sheet: this is most consequential. Changing just this parameter, if NewtekOne retains 0%, 25%, or 50% of the guaranteed loan portions on the balance sheet, the value of Newtek bank is $554.98M, $755.52M, or $956.06M. The reason is hopefully easy to see: we are trading off a one-time realization of a market premium for a long-term net interest income, as well as accelerated growth of the bank. Given that this one number can potentially change the valuation of NewtekOne by a factor of 2, this is an important business decision to be made, either out of discretion or the unwillingness to turn away new deposits and wanting to put them to work.

Fraction Of Principal Paid Down Annually: this is an observable number at the level of the business, where the accuracy to which we know this number has some impact on the accuracy of a valuation. Changing just this parameter, if the average amortization period of loans is 10 years, 15 years, or 20 years, then the fraction is 0.10, 0.0667, or 0.05, and the valuation of Newtek Bank is $491.14M, $554.98M, or $597.45M. The longer the amortization period of the loans, the larger the principal outstanding in the bank’s assets. This parameter is relevant in terms of assessing the size of the margin of safety.

Loan Issuance Annual Growth Rate: this is a number that we assume about the future for the purpose of computing a valuation. Since the future is unobservable and uncertain, for the sake of having a margin of safety we would want to err on the side of making lower estimates. Changing only this parameter, at annual growth rates of 0%, 5%, 10%, or 15%, the valuation of Newtek Bank is $404.83M, $554.98M, $767.05M, or $1063.53M. I chose 5% knowing that NewtekOne is currently growing.

Concluding Remarks

Having built the model, it is possible to plug in any number we want into it and ogle at the output – but ultimately, the quality of the output depends on the quality of the inputs.

There are four parameters whose values remain to be ascertained with more accuracy either by inquiring or by recording the numbers reported in the future:

- Fraction of Principal Paid Down Annually (or, average amortization period)

- Fraction of Loans Charged Off Annually

- Accrual Status Fraction

- Efficiency Ratio

There are two parameters that are forward-looking, where if we want to pick values for them we need to be cognizant of the need to build in a margin of safety:

- Loan Issuance Annual Growth Rate

- Years Until Market Saturation

There are two more parameters that are interlinked, which are at the discretion of management or may be influenced by deposit growth. For modeling purposes these need to be observed in the future:

- Fraction of Earnings Retained For Growth

- Guaranteed Loan Portion, Fraction Retained On Balance Sheet

Just to reiterate a previous conclusion: Subject to verification of parameters that are still unclear, it is likely that at current market prices, shares of NewtekOne possess a very significant margin of safety.

I hope to hear from you in the comments if you have any feedback or questions!